This week, our In Focus section shares highlights and key takeaways from the 20th annual Medicaid Budget Survey conducted by The Kaiser Family Foundation (KFF) and Health Management Associates (HMA). Survey results were released on October 14, 2020, in two new reports: State Medicaid Programs Respond to Meet COVID-19 Challenges: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2020 and 2021 and Medicaid Enrollment & Spending Growth: FY 2020 & 2021. The reports were prepared by Kathleen Gifford, Aimee Lashbrook, and Sarah Barth from HMA and by Elizabeth Hinton, Robin Rudowitz, Madeline Guth, and Lina Stolyar from the Kaiser Family Foundation. The survey was conducted in collaboration with the National Association of Medicaid Directors.

This survey reports on trends in Medicaid spending, enrollment, and policy initiatives for FY 2020 and FY 2021, highlighting COVID-19 policy planned for implementation in FY 2021. The conclusions are based on information provided by the nation’s state Medicaid Directors.

Key Report Highlights

In the following sections, we highlight a few of the major findings from the reports. This is a fraction of what is covered in the 50-state survey reports, which include significant detail and findings on policy changes and initiatives related to eligibility and enrollment, managed care, long-term services and supports (LTSS), provider payment rates, and covered benefits (including prescription drug policies). The reports also look at the key issues and challenges now facing Medicaid programs.

Medicaid Enrollment and Spending Growth

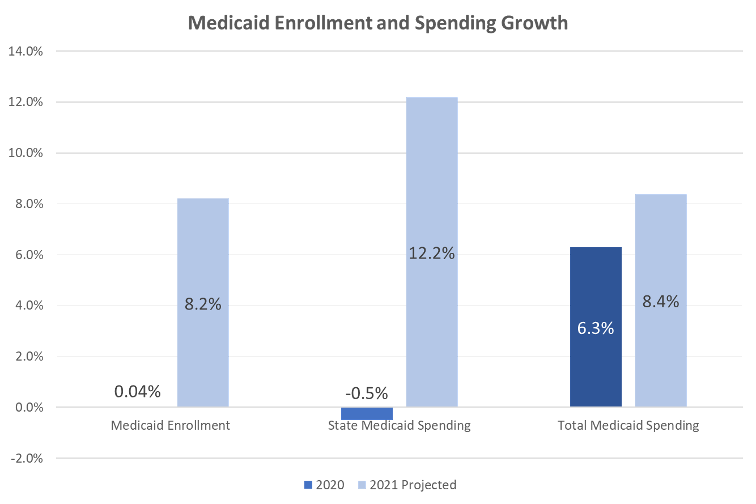

The COVID-19 public health crisis created significant implications for Medicaid. The Families First Coronavirus Response Act (FFCRA) authorized a 6.2 percentage point increase in the federal match rate, or Federal Medical Assistance Percentage (FMAP), retroactive to January 1, 2020, and until the Public Health Emergency (PHE) ends, available if states meet certain “maintenance of eligibility” (MOE) requirements. Although enrollment was flat in FY 2020, states expect Medicaid enrollment to rise 8.2 percent in FY 2021, attributed to the MOE requirements and to the economic downturn that started late in FY 2020. Enrollment peaked in FY 2015 because of the Affordable Care Act and has decreased up until the pandemic.

In FY 2019, total Medicaid spending was nearly $604 billion with 64.4 percent paid by the federal government and 35.6 percent financed by states. Total Medicaid spending growth was 6.3 percent in FY 2020 and is anticipated to be 8.4 percent in FY 2021 because of enrollment upticks. Meanwhile, the projections on state spending do not provide a clear picture. At the time of the survey, states assumed enhanced federal funding would expire by December 2020. However, it is now slated to expire at the end of March 2021. As a result, states predicted state Medicaid spending would decline in FY 2020 (-0.5 percent) and then sharply increase in FY 2021 (12.2 percent). For FY 2021, nearly all states expect enrollment increases to grow total Medicaid expenditures, with additional upward pressure coming from spending on LTSS and provider rate changes. Most states said that federal relief is being used to support costs related to the increased Medicaid enrollment and to address general Medicaid budget shortfalls. Additionally, two-thirds of states reported fiscal relief is also being used to mitigate provider rate and/or benefit cuts. States are unsure about the duration of the PHE and the enhanced FMAP, whether Congress will consider additional fiscal relief, and the outcome of the elections.

Figure 1 – Medicaid Enrollment and Spending Growth, FY 2020 and FY 2021 (Projected)

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by Health Management Associates, October 2020.

Medicaid Eligibility Standard Changes

- As part of the response to the COVID-19 pandemic, some states utilized Medicaid emergency authorities to adopt policies to help individuals obtain and maintain Medicaid coverage.

- Five states reported plans to continue COVID-19 related changes to eligibility and enrollment policies after the PHE ends, while most states remain unsure.

- Ten states reported expanding enrollment assistance or member call center capacity during the PHE.

- Idaho, Nebraska, and Utah implemented Medicaid expansions in 2020.

- Missouri and Oklahoma will implement expansions in FY 2022.

- Six states reported plans to implement more narrow eligibility expansions.

- South Carolina will increase the income limit for parent/caretaker relative enrollees from 67 percent to 100 percent of the federal poverty level (FPL) and will provide coverage with an enrollment cap for a new Targeted Adult group. Both expansions of eligibility are contingent on compliance with a work requirement.

- Georgia and New Jersey, pending waiver approval, plan to expand coverage for postpartum women to six months. Indiana reported plans to extend postpartum coverage to one year beginning in FY 2022.

- California is expanding income eligibility for the optional aged, blind, and disabled (ABD) population from 100 percent to 138 percent FPL.

- New Hampshire reported plans to implement its “Medicaid for Employed Older Adults with Disabilities” program, which will expand Medicaid buy-in coverage for working people with disabilities to include those ages 65 and older with incomes up to 250 percent FPL.

- Louisiana is expanding HCBS waiver coverage for children with significant disabilities without regard to household income and assets for children who live at home but would otherwise qualify for institutional placement in a hospital, skilled nursing facility, or intermediate care facility for individuals with intellectual disabilities.

- Two states reported planned eligibility restrictions in FY 2021 after the PHE. Missouri reported that scheduled premium increases would go forward after the PHE ended and Montana reported plans to implement a community engagement/work requirement and premium changes for expansion adults, pending CMS approval of the state’s Section 1115 waiver renewal.

- Two states reported non-emergency plans to simplify enrollment processes in FY 2021. Montana reported plans to implement an auto-renewal process for non-MAGI eligibility groups and Virginia reported plans to expand ex parte auto-renewals when individuals experience changes.

- Five states (Arizona, Massachusetts, Vermont, Virginia, Washington) reported plans to continue COVID-19 emergency changes related to eligibility and enrollment policies beyond the PHE period.

- Twelve states reported that the continuation of emergency eligibility and enrollment policies remained undetermined.

Provider Rates & Taxes

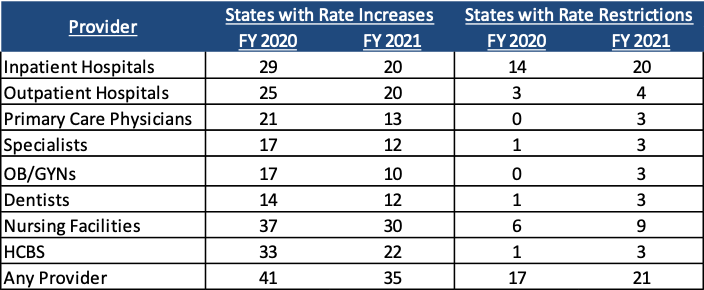

- Forty-one states implemented fee-for-service (FFS) rate increases for at least one category of provider relative to rate restrictions in FY 2020, while 17 states reported implementing rate restrictions in FY 2020. For FY 2021, 35 states planned rate increases, while 21 planned rate restrictions.

- Three states (Colorado, Nevada, and Wyoming) cut provider rates across all or nearly all provider categories, while some other states have indicated rate freezes or reductions were likely.

- More than half of reporting states (24) indicated that one or more payment changes made in FY 2020 or FY 2021 were related in whole or in part to COVID-19.

Figure 2 – Provider Rate Changes Implemented in FY 2020 and Adopted for FY 2021

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by HMA, October 2020.

- Only one state (Arizona) reported the addition of a new provider tax in FY 2021. Few states reported making significant changes to the provider tax structure in FY 2021.

- Nearly half of states reported that federal provider relief funds under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Paycheck Protection Program and Health Care Enhancement Act were not adequate for Medicaid providers.

Delivery Systems

- A total of 40 states (including DC) contract with risk-based managed care organizations (MCOs) to serve their Medicaid enrollees. Thirty-three states reported that 75 percent or more of their Medicaid beneficiaries were enrolled in MCOs.

- Sixty-nine percent of Medicaid beneficiaries are enrolled in an MCO.

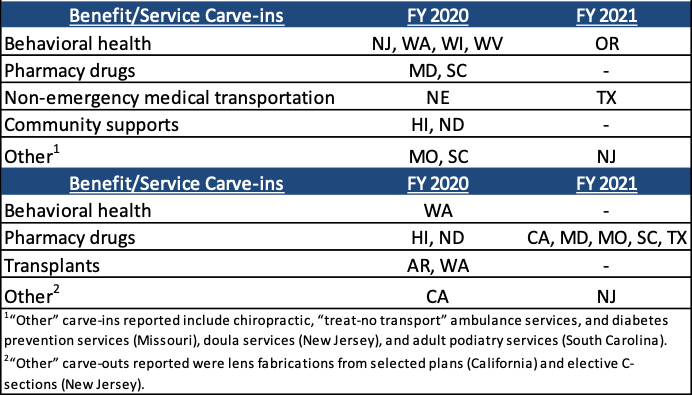

- Twelve states in FY 2020 and seven in FY 2021 reported notable changes in the benefits and services covered under their MCO contracts.

Figure 3 – MCO-Covered Benefit/Service Changes, FY 2020 and FY 2021

(n = 32 MCO states)

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by HMA, October 2020.

- Twelve MCO states (of 31 responding) indicated plans to adjust FY 2021 MCO contracts or rates in response to both COVID-related depressed utilization and unanticipated treatment costs.

- Sixteen states reported plans to make payment adjustments to FY 2021 MCO contracts or rates in response to COVID-19 related depressed utilization while 14 states reported plans to make payment adjustments in response to unanticipated COVID-19 related testing and treatment costs.

- Fourteen MCO states (of 32 responding) reported implementing directed payments to selected provider types in response to the COVID-19 pandemic.

- MCO states reported a variety of other MCO policy changes implemented to respond to the COVID-19 pandemic, including requirements to lift prior authorization requirements, waive cost sharing requirements, relax certain provider credentialing requirements, expand telehealth, in addition to other changes.

- Nearly two-thirds (27 states) reported implementation, expansion, or reform of a program or initiative to address Medicaid enrollees’ social determinants of health (SDOH) in response to COVID-19.

Long-Term Services & Supports

- As of July 1, 2019, 27 states reported having a capitated managed long-term services and supports (MLTSS) program. Two states (Alabama and Washington) reported having a managed fee-for-service MLTSS model while the remaining 25 states covered LTSS through one or more of the following types of capitated managed care arrangements: Medicaid MCO covering Medicaid acute care and LTSS; prepaid health plans (PHP) covering only Medicaid LTSS; MCO arrangement for dual eligible beneficiaries covering Medicaid and Medicare acute care and Medicaid LTSS services in a single, financially aligned contract under the federal Financial Alignment Initiative (FAI).

- Six states reported changes to their MLTSS programs in FY 2020 or FY 2021.

- Idaho, Massachusetts, and Pennsylvania expanded MLTSS to new geographic regions.

- Arizona, Massachusetts, and New Jersey carved in additional benefits/services.

- Wisconsin carved out benefits/services.

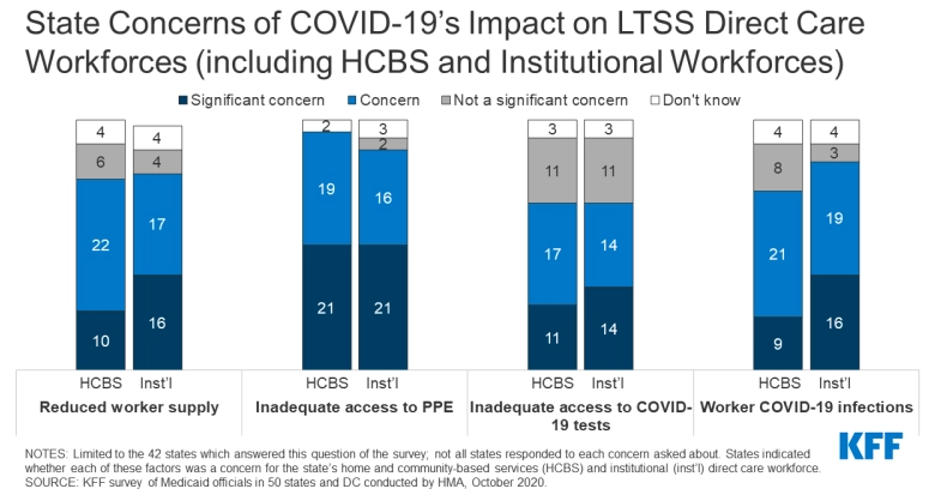

- The majority of states reported concerns about the pandemic’s impact on the LTSS direct care workforce, with similar issues across HCBS and institutional settings.

Figure 4 – State Concerns of COVID-19’s Impact on LTSS Direct Care Workforces (including HCBS and Institutional Workforces)

- Some states plan to retain a variety of LTSS policy changes adopted in response to COVID-19 after the PHE period ends.

- Twenty-one states reported plans to retain telehealth or remote provision of HCBS services.

- Six states (Connecticut, Minnesota, North Carolina, North Dakota, Oklahoma, and Oregon) cited continued remote delivery of assessments, reassessments, and case management.

- Five states (Florida, New Hampshire, North Dakota, Oregon, and Washington) reported an intent to keep changes made to LTSS provider enrollment and training processes including simplification, modified qualifications, and recruitment techniques.

- Three states (Connecticut, Maine, and North Dakota) reported plans to continue allowing family members to provide certain services.

Benefits, Cost-Sharing, and Telehealth

- The number of states reporting new benefits and benefit enhancements continues to significantly outpace the number of states reporting benefit cuts and restrictions. The COVID-19 pandemic has shifted state priorities for Medicaid benefits and cost-sharing, with states utilizing Medicaid emergency authorities to adopt new benefits, adjust existing benefits, and/or waive prior authorization requirements. Specifically, many states focused on expanding telehealth access for Medicaid beneficiaries.

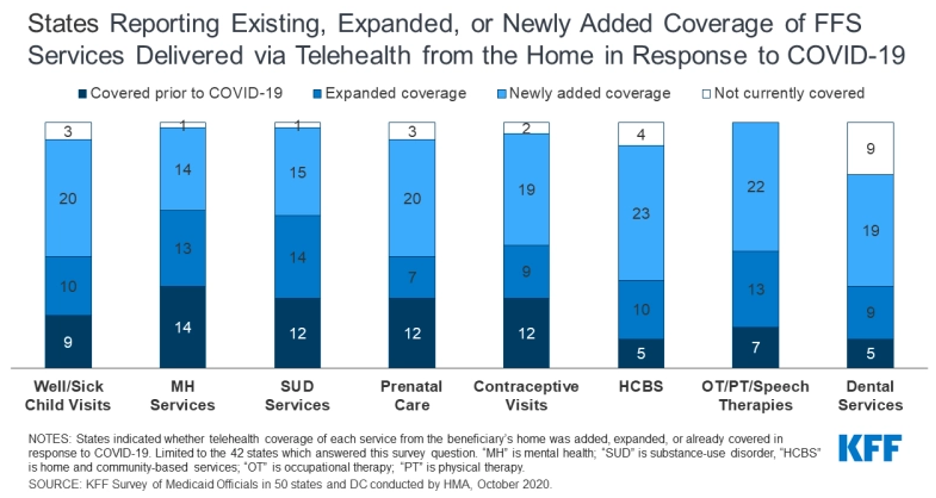

- Most states report covering a range of FFS services delivered via telehealth when the originating site is the beneficiary’s home. Many of these services were added or expanded in response to COVID-19.

Figure 5 – States Reporting Existing, Expanded, or Newly Added Coverage of FFS Services Delivered via Telehealth from the Home in Response to COVID-19

- Approximately half of states report plans to extend newly added/expanded FFS telehealth coverage when the beneficiary’s home is the originating site beyond the PHE period.

- Fifteen states intend to extend other benefit and cost-sharing changes adopted during the PHE period, many of which are pharmacy changes.

- Twelve states plan to make benefit or cost-sharing changes that are not related to the COVID-19 pandemic in FY 2021.

- Seven states (Alaska, California, Hawaii, Idaho, Montana, Texas, and Wisconsin) are adding or expanding benefits, including expanded home and community-based services (HCBS), behavioral health (BH) services, and SUD services.

- Two states are eliminating or restricting benefits. Alaska is adding prior authorization requirements for benefits that include non-preventive dental, vision, and therapies. Wyoming is removing its chiropractic benefit for all individuals, limiting some HCBS services, and reducing its adult vision and dental benefits.

- Four states (Colorado, Idaho, Michigan, and South Dakota) will be implementing new or expanded co-payments for a variety of services, or other cost-sharing.

- Two states (California and Massachusetts) will be eliminating or reducing certain co-payments in FY 2021.

Pharmacy Cost Containment Actions

- Thirty-three states reported newly implementing or expanding upon at least one initiative to contain costs in the area of prescription drugs in FY 2021.

- Twenty-three states will implement new pharmacy cost containment policies in FY 2021.

- Eleven states will expand their preferred drug list (PDL).

- Three states (Kentucky, Massachusetts, and Michigan) will adopt a uniform PDL in FY 2021 and North Carolina plans to use a uniform PDL for FFS and managed care when it implements managed care in FY 2022.

- California plans to carve the prescription drug benefit out of managed care organization (MCO) contracts.

- Three states (Iowa, Maryland, and South Carolina) reported newly carving out certain high cost drugs.

- North Dakota implemented a pharmacy carve out in FY 2020 and Nevada plans to carve out the prescription drug benefit effective in FY 2023, when MCO contracts are renewed.

Looking Ahead: Perspectives of Medicaid Directors

The COVID-19 pandemic created signficant challenges for states. Nearly all the Medicaid Directors identified significant adverse economic and state budgetary impacts driven by the pandemic. States reported that dealing with Medicaid budgets is one of the biggest challenges in the coming year. Nine states indicated that the economic negative impacts were likely to exceed those of the Great Recession and nine states reported expecting future Medicaid budget reductions. Many states reported the need for ongoing or greater fiscal relief as well as the need to strengthen the provider relief program for Medicaid-dependent providers. States noted that delivery system and payment reforms are a key priority. The November 2020 elections will also have significant implications on federal Medicaid policies.