This week, our In Focus section section highlights some of the key findings of the Spring 2019 Fiscal Survey of States, released this month by the National Association of State Budget Officers (NASBO). The association conducted surveys of state budget officers in all 50 states from March through May 2019. The findings in the report focus on the key determinants of state fiscal health, highlighting data and state-by-state budget actions by area of spending. Below we summarize the major takeaway points from the report, as well as highlight key findings on Medicaid-specific and other health care budget items.

Overall Budget Environment Takeaways

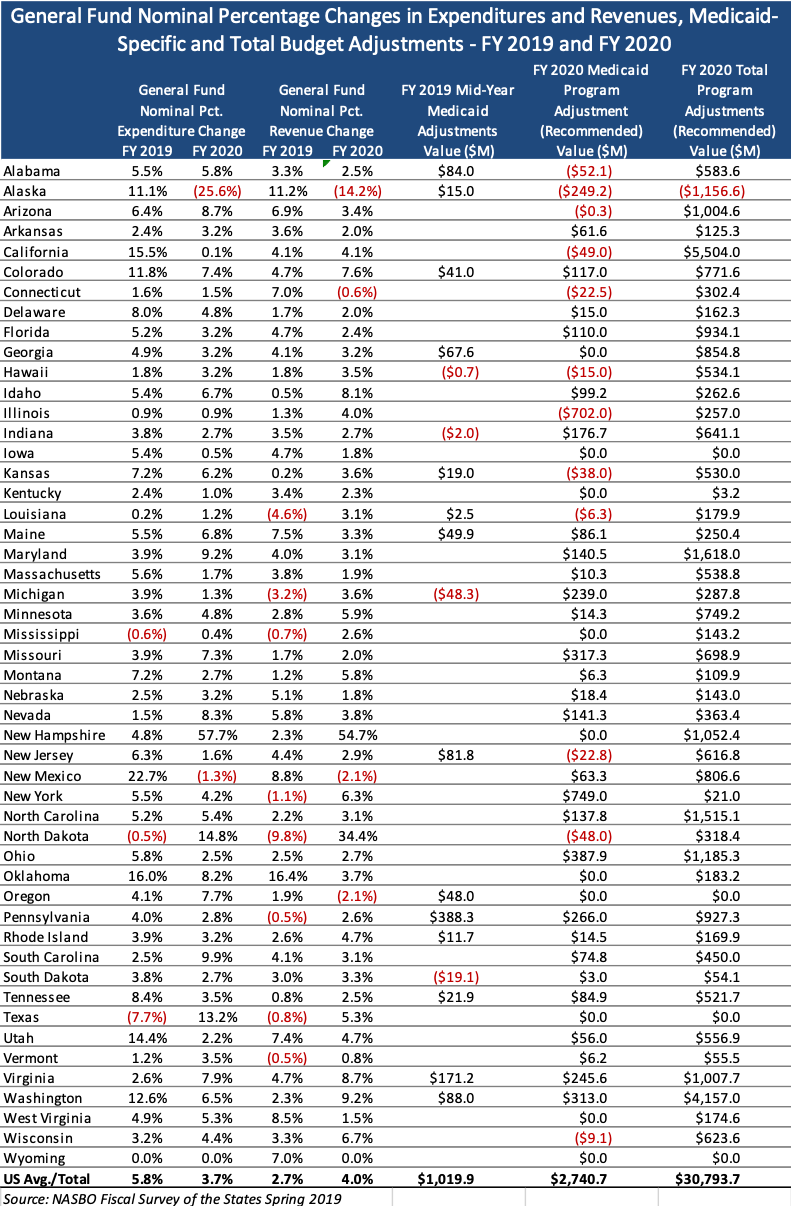

Based on NASBO’s survey and evaluation of state governors’ recommended budgets, in general, states are approaching fiscal 2019 with budget surpluses from the prior fiscal year, largely due to an uptick in personal income tax collections. Medicaid spending continues to be a major driver of state budget actions. Medicaid spending is expected to grow 4 percent in fiscal 2020, with state funds increasing 3.1 percent and federal funds 4.5 percent.

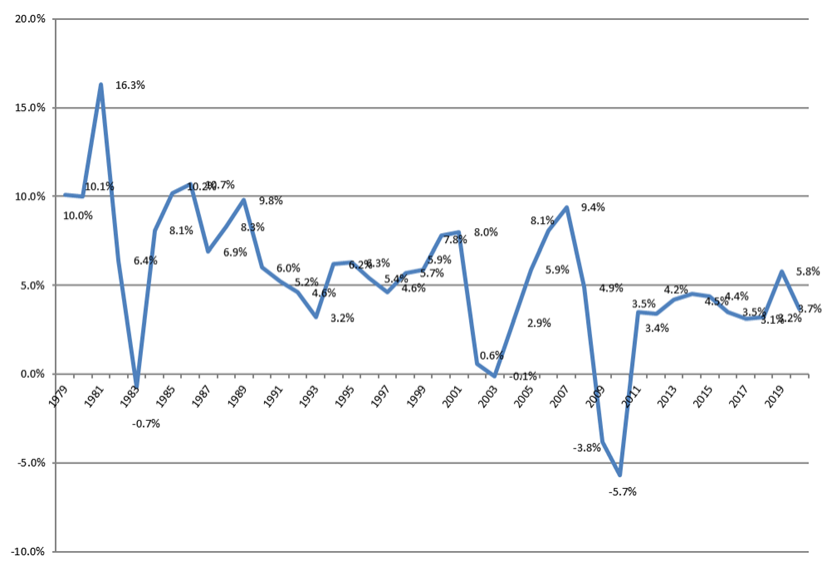

For state budgets overall, 12 states reported general fund (GF) revenues below budget projections for fiscal 2019, with only three making mid-year budget reductions. Twenty-one states made mid-year spending increases. Governors’ budget proposals for fiscal 2020 amount to overall general fund spending growth of 3.7 percent. In all:

- Three states are projecting flat or negative budget growth;

- 28 states are projecting budget growth between 0 and 5 percent;

- 16 states are projecting budget growth between 5 and 10 percent; and

- Three states anticipate budget growth above 10 percent.

Figure 1 – State Nominal Annual Budget Increases, FY 1979 to FY 2020

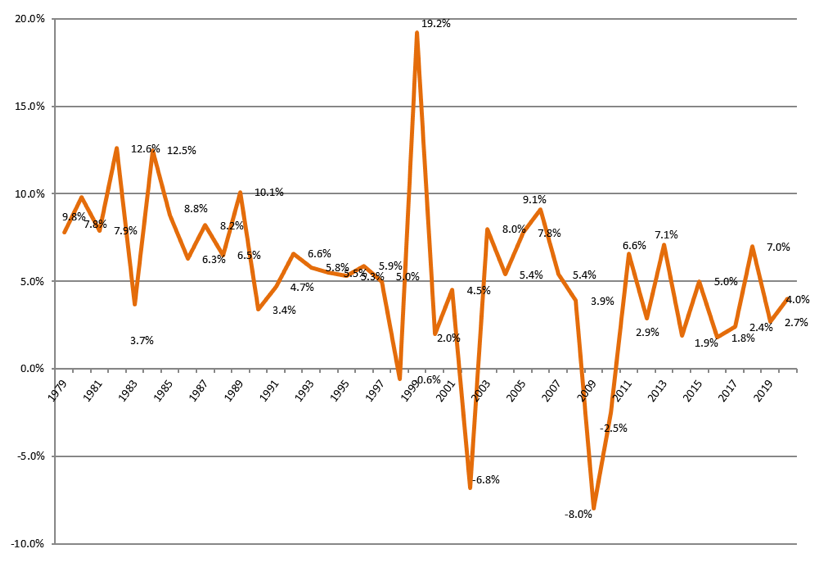

On the revenue side, fiscal 2020 is projecting slightly better than fiscal 2019, with only five states projecting negative revenue growth (compared with eight in fiscal 2019). Proposed FY 2020 budgets assume general fund collections from sales tax to grow 4.8 percent, along with 4.2 percent growth in personal income tax revenue, and 4.0 percent growth in corporate income tax revenues.

Figure 2 – State Nominal Annual Revenue Increases, FY 1979 to FY 2020

Medicaid-Specific Budget Environment

In fiscal 2018, Medicaid made up the single largest portion of total state expenditures at 29.7 percent. States project overall Medicaid expenditures to grow at 5.3 percent in fiscal 2019, compared to a growth of 5.2 percent to $587.3 billion in fiscal 2018. Governors’ recommended budgets for fiscal 2020 predict Medicaid spending to increase 4.0 percent.

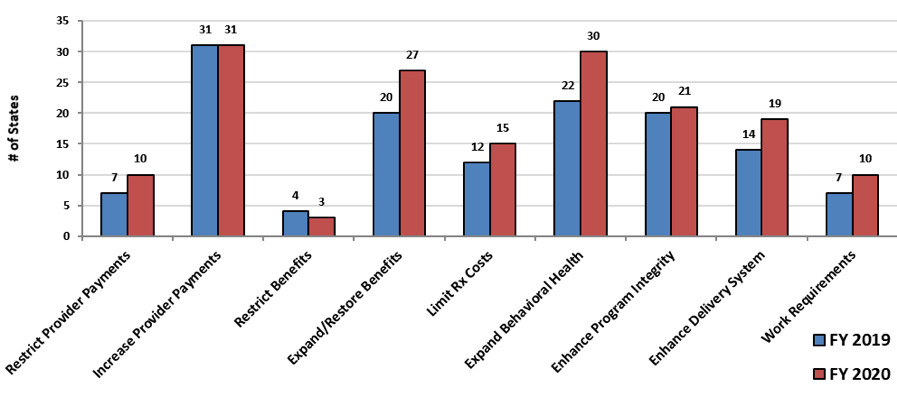

Proposed fiscal 2020 budgets show 31 states planning to increase provider payments (same as fiscal 2019), 30 states planning to expand access to behavioral health services (compared to 22 in fiscal 2019), and 27 states planning to expand or restore benefits (20 in fiscal 2019). Additionally, 21 states are proposing to enhance program integrity and 15 states to reduce prescription drug spending.

Figure 3 – FY 2019 & Proposed FY 2020 Budgetary Actions Related to Medicaid

A total of 36 states and the District of Columbia have expanded Medicaid, as of May 2019. Expansion is planned to be implemented in an additional three states in fiscal 2020 as a result of 2018 ballot initiatives. In fiscal 2018, 31 states reported spending a total of $85 billion on expansion, of which $10.4 billion represented state funds. Meanwhile, for fiscal 2019, Medicaid expansion expenditures in 33 states are expected to be a total of $91.2 billion, with $11.4 billion in state funds.

Table 4 – Selected State Data from NASBO Report – FY 2019 to FY 2020

Link to NASBO Fiscal Survey of States, Spring 2019

https://www.nasbo.org/mainsite/reports-data/fiscal-survey-of-states