This week, our In Focus reviews a New York State Health Foundation-commissioned report titled, “An Assessment of the New York Health Act: A Single-Payer Option for New York State.” The study, conducted by the RAND Corporation, analyzes a proposal that would establish a single-payer system in New York. The proposal, known as the New York Health Act (NYH Act), was developed by New York Assembly Health Committee Chair Richard Gottfried. It was passed by the Assembly several years in a row, but has never been brought to a vote in the Senate. The New York State Health Foundation commissioned the study to provide an independent, rigorous, and credible analysis of the proposal to understand the near-term and longer-term impact of the single-payer proposal. The study assesses how the plan would affect health care coverage and costs in the state.

According to the legislation, A.4738 (2018), the NYH plan would provide health care coverage to all residents of New York State. Health benefits under the NYH plan would be comprehensive, including all acute care benefits covered by Medicare, Medicaid, Child Health Plus, and those mandated under the Affordable Care Act (ACA). The plan does not include coverage for long-term care (LTC), although it includes the provision that those benefits could be added at a later time. Under the plan there are no out-of-pocket costs, including deductibles and co-payments.

The program would be financed through a new trust that combines funds from the federal government representing current federal financing for health programs, current state funding for health care programs, and revenues from two new progressively graduated state taxes: a payroll tax paid jointly by employers (80 percent) and employees (20 percent), and a tax on income not subject to the payroll tax, such as interest, dividends, and capital gains. Substantial new tax revenue would be required to finance the program. Even after redirecting all existing federal and state outlays for health to the NYH plan, additional tax revenue to finance the program would total $139.2 billion in 2022, and $210.1 billion by 2031. Since the NYH legislation does not describe a taxation structure, RAND modeled a possible graduated tax schedule to fully fund the plan. Under the base case scenario, payroll tax rates would range from 6 to 18 percent, and non-payroll tax rates would range from 6 to 19 percent.

The plan would have significant redistributive effects. Because the plan is financed through tax payments rather than through premiums and out-of-pocket payments, payments for health care would decline substantially among lower-income residents and rise substantially among highest-income residents. Under the base case, on average, people with incomes below the 90th percentile would pay less, while the highest-income households would pay more. They estimate that in 2022, those with household compensation below the 75th percentile would pay $3,000 less per person; those in the 75th – 90th percentile would pay $1,500 less per person; those in the 90th – 95th percentile would see health care payments increase by $1,700 per person, and for those in the top 5th percentile (where household compensation averages $1,255,700), health care payments would increase by $50,200 per person.

RAND developed a microsimulation modeling approach to estimate the plan’s effects on key outcomes and compare them with outcomes under the status quo for three future years: 2022, 2026, and 2031. The report concludes that New York could expand coverage without substantial increases in overall health care spending. The model estimates that demand for hospital care would increase around ten percent, and demand for physician services would increase around 15 percent. By restraining the growth of provider payment rates, however, increases in utilization of health care services would be offset by decreases in provider payment rates and as well as reductions in overall administrative costs.

Any simulation model is driven by assumptions, and the report clearly articulates the assumptions that drive its conclusions.

- Federal waivers for Medicaid, Medicare and ACA requirements are approved.

- All residents of New York State have insurance coverage from the NYH plan.

- NYH does not cover long-term care, but Medicaid- and Medicare-eligible enrollees would continue to be eligible for nursing home and home health services under waiver arrangements.

- The ACA continues without the individual mandate penalty.

- Provider payment rates in NYH in 2022 would be similar to the dollar-weighted average payment rate across all payers in the status quo, and grow at a rate equal to payment rate growth in public health care programs like Medicare and Medicaid.

- The administrative rate in NYH would be 6 percent of spending for health care services.

The report notes that assumptions about provider payment rates are particularly important for estimating the health care cost under the NYHA. While moving to an all-payer average would reduce payment for services currently billed to commercial payers, the change would increase payment for current Medicaid services. Medicare payment rates are similar to the all-payer average rates.

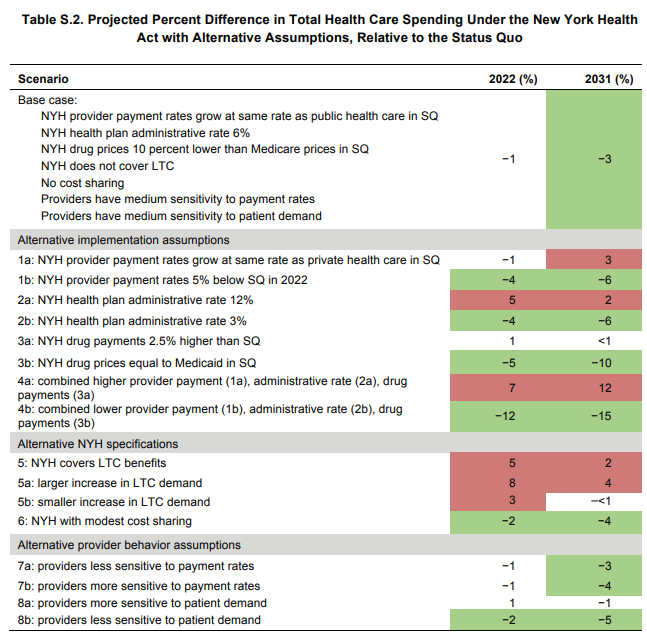

In addition to provider rates, the model’s estimated effects depend heavily on assumptions about administrative costs and drug prices, meaning that the state’s willingness and ability to negotiate or set drug prices and generate administrative efficiencies are critical to reducing health care spending. The estimates also depend heavily on the design of the tax schedule and individual behavior in response to new taxes. The report notes that NYH could be threatened if some wealthy individuals leave the state to avoid paying the higher taxes. The table below show the projected difference in health care spending under alternative assumptions, relative to the status quo.

Source: RAND Corporation

*Note: SQ is Status Quo.

The analysis has already generated strong responses. Prior to its release, CMS administrator Seema Verma had indicated that the Trump administration was unlikely to approve single-payer waivers. As reported in Becker’s Hospital Review, in a July 25 speech Verma stated “It doesn’t make sense for us to waste time on something that’s not going to work.” According to Becker’s Hospital Review, Ms. Verma said the current administration believes Medicare for All, or a single-payer system, is unaffordable and limits choice for patients.

Two powerful health industry associations in New York, the Greater New York Hospital Association and the Healthcare Association of New York State, raised concerns about the high cost of the proposal, the elimination of commercial insurance, and the impact on academic teaching hospitals due to a loss of revenue currently generated through commercial payers.

The New York Health Plan Association came out strongly against the proposal, saying that government-run health care would lead to massive tax increases and less consumer choice.

Those concerns were echoed by the state Conference of Blue Cross and Blue Shield Plans, which noted that the study’s assumptions were “aspirational if not unrealistic.”

If you’d like to learn more, please contact HMA Principal Denise Soffel at [email protected].