This week, our In Focus section reviews the Utah Medicaid Section 1115 Demonstration Waiver amendment Fallback Plan, released for public comment on September 27, 2019. The Fallback Plan would raise Utah’s Medicaid expansion income limit to 138 percent of the federal poverty level (FPL)[1]. Voters in the state passed full Medicaid expansion through a ballot initiative in 2018, however, the state only enacted partial expansion through a waiver. The Fallback Plan looks to fully expand Medicaid, while also implementing certain provisions, including work requirements and premiums.

Background

The Centers for Medicare & Medicaid Services (CMS) approved Utah’s Medicaid expansion waiver, called the Bridge Plan, on March 29, 2019. Effective April 1, 2019, parents and adults without dependent children earning up to 100 percent of the FPL became eligible. Of the 70,000 to 90,000 individuals eligible, more than 34,000 are receiving coverage through a fee-for-service delivery system.

On July 31, 2019, Utah submitted a new Section 1115 waiver, called the Per Capita Cap Plan, which would raise eligibility to 138 percent FPL with the following provisions: work requirement, enrollment cap, up to 12-month continuous eligibility, employer-sponsored insurance enrollment, lock-out for intentional program violation provision, and a per capita cap.

If the Per Capita Cap Plan does not receive CMS approval by January 1, 2020, Utah will need to submit the Fallback Plan to CMS by March 15, 2020. However, if neither waiver is approved by July 1, 2020, the state will need to enact the full Medicaid expansion State Plan, as passed by the ballot initiative in 2018, which raises eligibility to 138 percent FPL without any of the provisions.

Fallback Plan

Utah released the Fallback Plan amendment for public comment from September 27, 2019 through October 27, 2019. It will raise Utah’s Medicaid expansion to 138 percent FPL through a 90/10 percent federal/state funding match. Currently under the Bridge Plan, the federal government pays for 70 percent, with the state paying 30 percent. The provisions that it includes are effectively similar to those in the Per Capita Cap Plan, with the exception of a per capita cap. These include:

Currently Approved by CMS under the Bridge Plan

- Self Sufficiency Requirement/Work Requirements

The work requirements under the Fallback Plan were already approved for the current expansion program, effective January 1, 2020. Individuals will need to work 30 hours a week. Exemptions include individuals who are age 60 or older, pregnant, physically or mentally unable to work, parent/caregivers for a child under six, caregivers for a person with a disability, members of a tribe, participating in a substance use disorder treatment program, receiving unemployment, enrolled at least halftime in school, in a refugee employment service, Family Employment Program (FEP) recipients, and beneficiaries exempt from SNAP/TANF employment requirements.

- Enrollment Limits

Enrollment limits will remain the same as those under the current plan.

- Employer-Sponsored Insurance (ESI) Reimbursement

Individuals who are eligible for the Adult Expansion demonstration group, and have access to ESI, must purchase their ESI plan. The state will then reimburse the health insurance premium.

- Early and Periodic Screening, Diagnostic, and Treatment (EPSDT)

The state has authority to waive EPSDT for adults age 19 and 20 years old in the Adult Expansion and Targeted Adult Populations.

New Demonstration Waiver Requests

- Income Limit Increase for Adult Expansion Eligibility

The waiver would increase eligibility to 138 percent FPL for the Adult Expansion group.

- Lock-Out Due to Intentional Program Violation (IPV)

The state would apply a six-month period of ineligibility to an individual who commits an IPV. This includes making false statements, misrepresenting facts, violating program regulations, posing as someone else, and other actions.

- Housing Related Services and Supports (HRSS)

The state would provide HRSS to the targeted adult population who may be experiencing homelessness, housing, food, or transportation insecurity, or interpersonal violence and trauma. This may include tenancy support services (projected 5,000 individuals), community transition services (projected 5,000 individuals), and supportive living/housing services (projected 1,000 individuals).

- Not Allow Presumptive Eligibility Determined by a Hospital

The state would not allow presumptive eligibility determined by a hospital. Instead, the state would need to complete a full determination of eligibility before enrolling the individual.

- Targeted Adult Medicaid Eligibility Definitions

The state would expand its eligibility criteria definitions for the three Targeted Adult subgroups.

- Flexibility to Make Changes through the State Administrative Rulemaking Process

The state would have the authority to make the following changes:

- Begin enrollment the first of the month after application for Adult Expansion beneficiaries with income over 100 percent FPL (prospective enrollment)

- Not allow retroactive eligibility for Adult Expansion beneficiaries with income over 100 percent FPL

- Change the benefit package for Adult Expansion and Targeted Adult demonstration groups (excluding medically frail) to the State’s non-traditional benefit package

- Exempt certain groups from the ESI requirement

- Suspend housing supports

- Make enrollment in an integrated plan or other managed care plan mandatory or optional for different adult expansion groups

- Open or suspend enrollment for each population group within Targeted Adult Medicaid

The state is also proposing to implement monthly premiums for individuals in the Adult Expansion population who have household income above 100 percent FPL. Single individuals will need to pay $20 per month and married couples will need to pay $30. A $25 copayment for non-emergency use of the emergency department would also be required.

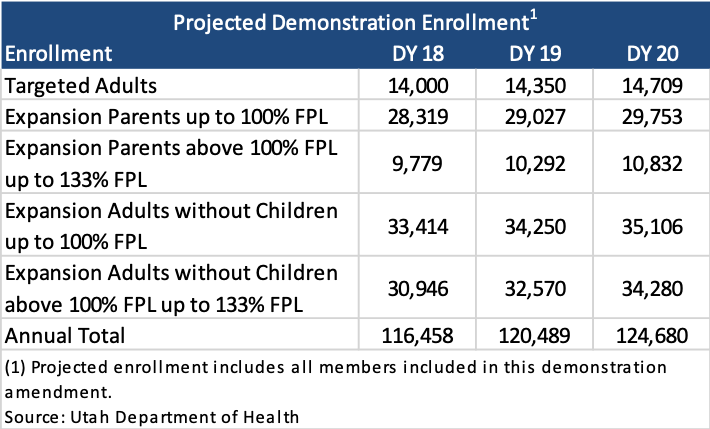

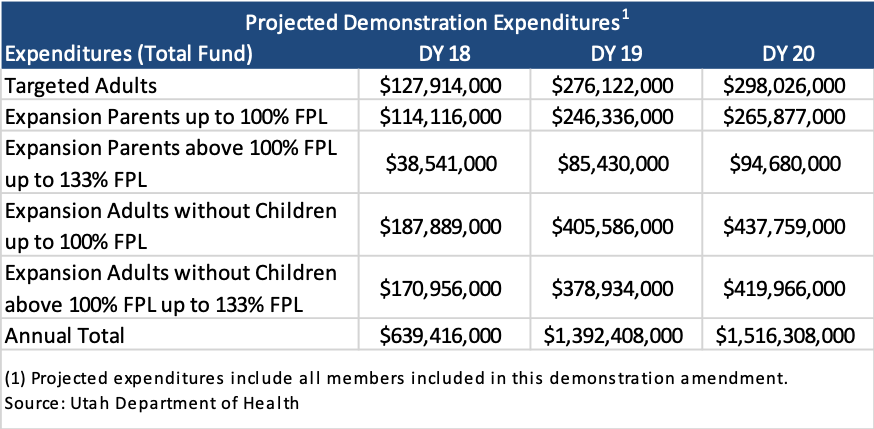

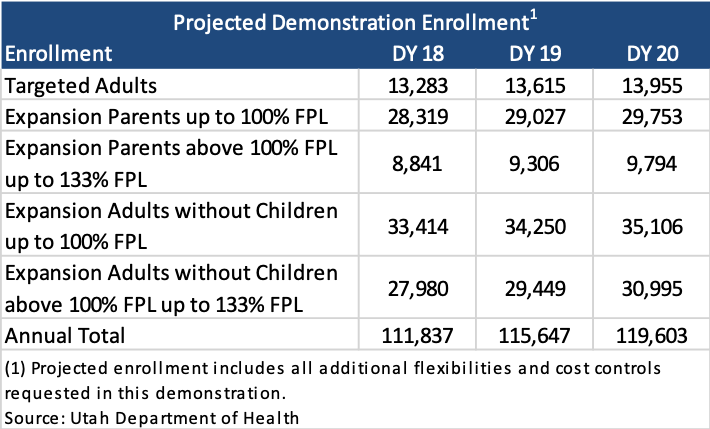

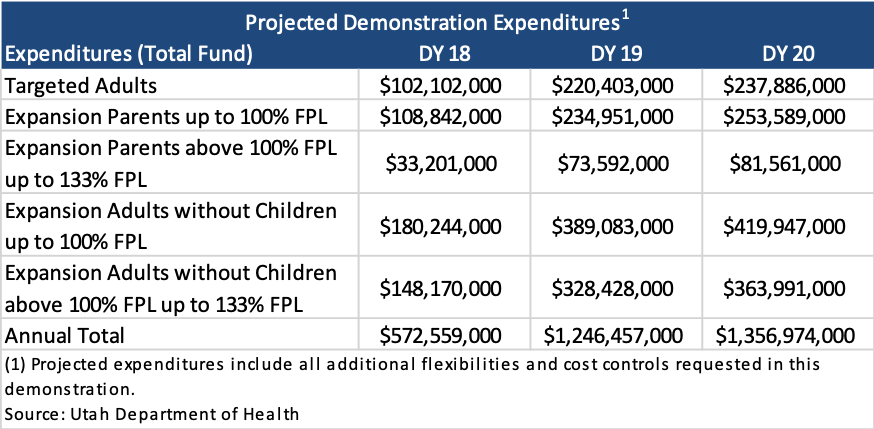

Projected Enrollment and Expenditures

The following tables show projected enrollment and expenditures for members included in this demonstration. Demonstration Year (DY) 18 reflects the anticipated average enrollment January 2020 through June 2020.

The following tables show projected enrollment and expenditures that include all additional flexibilities and cost controls requested in this demonstration.

Utah Medicaid Section 1115 Demonstration Waiver amendment Fallback Plan

[1] While the Fallback Plan cites that eligibility will be increased to 133 percent FPL, other sources on the Utah Department of Health list eligibility as 138 percent FPL. https://medicaid.utah.gov/1115-waiver

Please also see comparison chart: https://medicaid.utah.gov/Documents/pdfs/Adult%20Expansion%20Comparison%20Chart_FINAL.pdf