KFF and Health Management Associates (HMA), on November 13, 2025, released the annual Medicaid Budget Survey, A View of Medicaid Today and a Look Ahead: Balancing Access, Budgets and Upcoming Changes Results from an Annual Medicaid Budget Survey for State Fiscal Years 2025 and 2026. Now in its 25th year, this report offers a window into the evolving landscape of state Medicaid policy, financing, and operations across the United States. The survey was conducted in collaboration with the National Association of Medicaid Directors (NAMD), with 48 states providing survey responses by October 2025.

Released before the NAMD 2025 Fall Conference, Medicaid directors’ insights and the challenges, priorities, and innovations shaping Medicaid programs in fiscal years (FYs) 2025 and 2026 will figure prominently at this event. A team of HMA experts will be in attendance and available to address new developments and opportunities in state Medicaid policy and financing.

Key Trends and Challenges

Fiscal Pressures and Budget Uncertainty

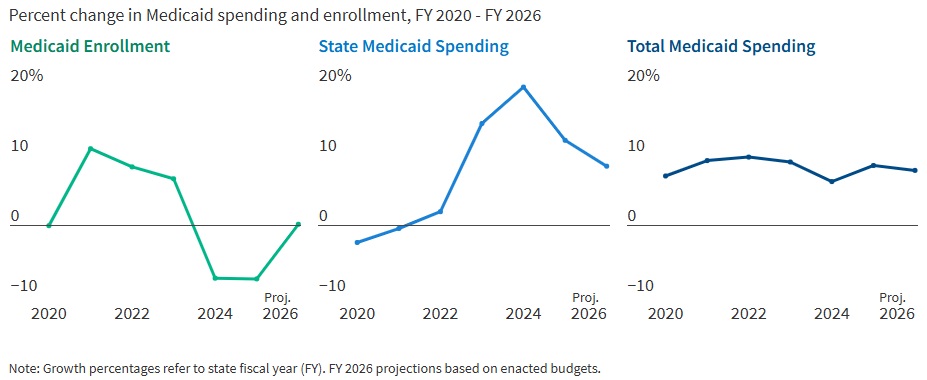

States are entering FY 2026 with slower revenue growth and rising healthcare costs. In FY 2025, Medicaid enrollment dropped by 7.6 percent as pandemic-era continuous coverage policies ended, but spending continued to climb. In fact, total Medicaid spending grew 8.6 percent in FY 2025 and is projected to rise another 7.9 percent in FY 2026. State Medicaid spending growth is expected to slow from 12.2 percent in FY 2025 to 8.5 percent in FY 2026. Nearly two-thirds of Medicaid directors, however, thought the odds of a Medicaid budget shortfall in FY 2026 was “50-50,” “likely,” or “almost certain.” Cost drivers include increases in provider rates, higher acuity enrollees, greater long-term care and behavioral health utilization, and rising pharmacy costs, especially for specialty drugs.

Figure 1. Medicaid Spending and Enrollment Trends Since the COVID-19 Pandemic Began

Federal Policy Changes and Provider Taxes

States are preparing for major federal policy changes under the 2025 budget reconciliation law (OBBBA), which will reduce federal Medicaid funding and impose new eligibility requirements. On November 14, 2025, the Centers for Medicare & Medicaid Services issued guidance regarding the OBBBA’s restrictions on states’ ability to use healthcare-related provider taxes to finance Medicaid programs (see CMS Provider Tax Guidance Places New Pressures on Medicaid Budgets). States are now generally prohibited from enacting new provider taxes or increasing existing ones after July 4, 2025, and must comply with new rules by the end of FY 2026 or FY 2028, depending on the tax type. In particular, beginning in federal FY 2028, the OBBBA gradually reduces the safe harbor provider tax limit for states that have adopted the ACA Medicaid expansion by 0.5 percent annually until the safe harbor limit reaches 3.5 percent of net patient revenues in federal FY 2032. These changes will reduce states’ flexibility to use provider taxes as a source of non-federal Medicaid funding, potentially leading to budget gaps and reductions in provider payments if lost revenue cannot be replaced.

Policy Changes and Priorities

Managing Risk in Managed Care Programs

A total of 46 states operate some form of managed care, and capitated managed care remains the predominant delivery system for Medicaid in most states. Most states that contract with capitated managed care organizations (MCOs) reported imposing a minimum medical loss ratio (MLR) requirement, requiring remittance payments when an MCO falls short of the minimum MLR requirement, and using risk corridors to manage financial risk and ensure value. States are also grappling with the growing use of artificial intelligence, particularly in the context of managed care prior authorization. Early policies focus on transparency, oversight, and ensuring human review to address concerns about bias, inappropriate denials, and privacy risks.

An Uptick in Provider Rate Reductions and Provider Tax Restrictions on the Horizon

Most states implemented fee-for-service rate increases for at least one provider category in FY 2025 and FY 2026. The number of increases is slowing, however, and there was an increase in states reporting provider rate restrictions compared with previous years. States continue to target rate increases for nursing facilities and home and community-based services more than other provider types.

Provider taxes remain a key source of the non-federal share of Medicaid funding, with all states except Alaska having at least one tax. These taxes accounted for a median 18 percent of states’ FY 2026 non-federal Medicaid financing, but new federal restrictions enacted in the OBBBA will limit states’ ability to use or expand these taxes going forward. As of July 1, 2025, 31 Medicaid expansion states reported having a non-exempt provider tax greater than the 3.5 percent of net patient revenues and therefore subject to the OBBBA’s phase down requirement.

Strong Benefit Enhancements and Scrutiny of Prescription Drugs

New Medicaid benefits and benefit enhancements continued to outpace benefit cuts and limitations. In all, 37 states reported new or enhanced benefits in FY 2025, and 36 plan to add or enhance benefits in FY 2026. More specifically, states reported expanding services across the behavioral health care continuum and for prenatal, delivery, and postpartum services. Most states reported at least one new or expanded initiative to contain prescription drug costs, including participation in the Centers for Medicare & Medicaid Services (CMS) Cell and Gene Therapy Access Model. State responses also reflected a waning interest in expanding Medicaid coverage for costly obesity drugs (GLP-1s), with some states restricting coverage because of budget pressures.

Challenges and Priorities

Many states are confronting more difficult fiscal conditions while also preparing for future fiscal uncertainty driven, in part, by the OBBBA. Medicaid leaders also expressed concern about the complexity of implementing new federal requirements, including work requirements and more frequent eligibility determinations. At the same time, state Medicaid leaders reported that they continue to pursue a variety of program priorities to expand access, especially to behavioral health and long-term care services, implement initiatives targeting specific populations (e.g., people who are pregnant, justice-involved, and at risk of homelessness), reform and strengthen delivery systems, modernize IT systems and infrastructure, and expand program integrity efforts.

Connect with Us

States face a challenging fiscal environment as they balance cost containment, quality, and access in their Medicaid programs. The combination of rising healthcare costs, new federal restrictions on provider taxes, and anticipated funding reductions will require states to make decisions about coverage, benefits, and provider payments. Nonetheless, states remain committed to maintaining quality and access for Medicaid beneficiaries, using available resources, and pursuing innovative approaches to care delivery.

For more information about the key takeaways from the KFF report and HMA’s Medicaid solutions, contact our experts below.

Keep up to date with the

HMA Weekly Roundup.

We deliver timely, expert-driven updates to help you stay informed and ahead of the curve.