On February 11, 2026, the Congressional Budget Office (CBO) released The Budget and Economic Outlook: 2026 to 2036 report. The publication, which represents the first time CBO has released Medicare and Medicaid spending baseline projections since January 2025, reflects the impact of the 2025 Budget Reconciliation Act (P.L. 119-21, OBBBA), recent changes to Medicare reimbursement for skin substitute products, and the latest Medicare Part D and Medicare Advantage bids.

CBO’s baseline serves many functions, including serving as the official “scorekeeping” benchmark used for cost estimates of proposed legislation under consideration in Congress.

Changes to CBO’s Medicaid Baseline

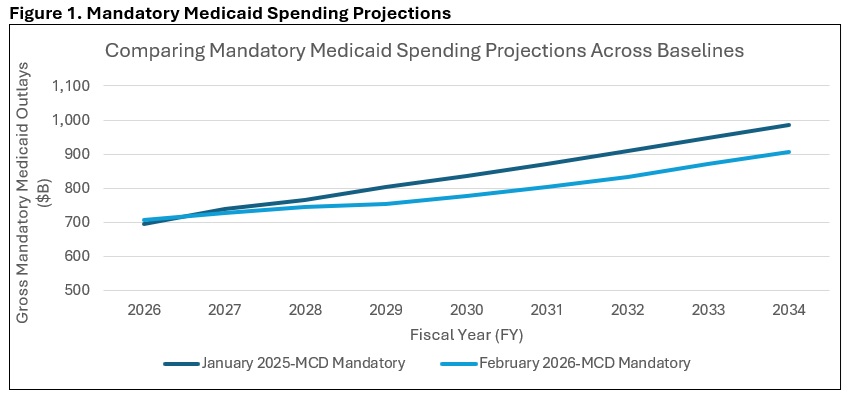

CBO decreased its projections of 2026–2035 Medicaid mandatory outlays by approximately $514 million from its January 2025 baseline update. The main driver of that reduction is the impact of the Medicaid provisions in the 2025 Budget Reconciliation Act, which CBO expects will reduce total Medicaid enrollment by 13.1 million people in 2035. The drop in Medicaid spending from the OBBBA-related enrollment reductions was partially offset by technical changes CBO made to the Medicaid baseline.

Medicaid costs per enrollee grew by 16 percent in 2025, which was more than CBO had anticipated. The agency attributes the cost per enrollee growth to a reported decrease in the average health status of Medicaid enrollees following the end of the COVID-era continuous eligibility policy.

CBO anticipates that payment rates for Medicaid managed care plans will begin to rise in 2026 because of this decrease in the average health status of enrollees, and the agency has updated the Medicaid baseline accordingly (see Figure 1).

Changes to CBO’s Medicare Baseline

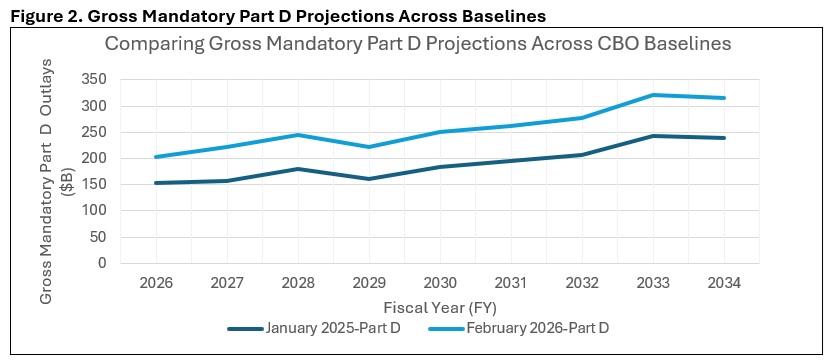

Compared with its January 2025 baseline, CBO increased its projections of Medicare’s 2026–2035 mandatory outlays by about $1 trillion (roughly $942 billion, by Health Management Associates (HMA) calculations). The main driver of that increase came from CBO’s updates to its Medicare Part D spending projections, which were increased to reflect higher than expected 2026 bids from private insurance plans that administer the Part D benefit. According to their 2026 bids, Part D plans anticipate a 35 percent increase in their annual per enrollee costs in 2026—a trend that CBO was not expecting and wants to study further. Part D spending per beneficiary in 2035 is now projected to exceed $4,000, up from less than $3,000 in the January 2025 baseline (See Figure 2).

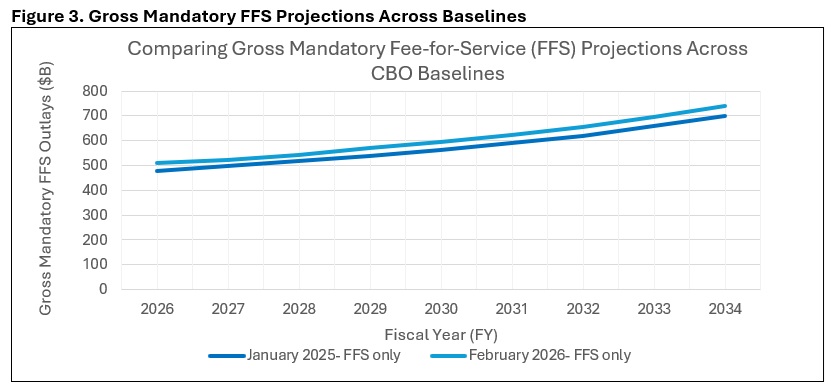

The agency’s Medicare Part A fee-for-service (FFS) spending projection increase was the result of larger than expected increases in 2025 enrollment and per enrollee spending. Those trends were also seen in Medicare Part B FFS but were partially offset by the Centers for Medicare & Medicaid Services’s (CMS) recent reimbursement changes to skin substitute products. Overall, CBO estimates that the skin substitute reform issued in CMS’s Medicare Physician Fee Schedule (MPFS) and Outpatient Prospective Payment System (OPPS) CY 2026 final rules will save $245 billion over the 2026–2035 period, including the effects on the Medicare Advantage (MA) program (see Figure 3).

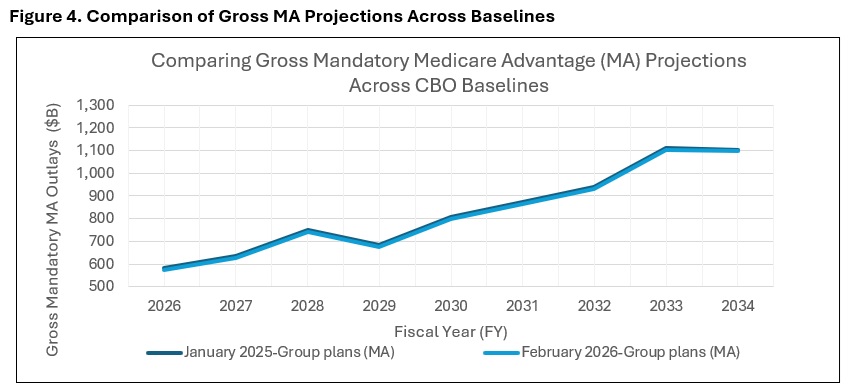

Finally, CBO reduced its spending projections for MA compared to the January 2025 baseline. This change was made to reflect lower-than-expected Medicare Advantage enrollment in 2025, although the spending implications of lower enrollment were partially offset by higher-than-expected bids in 2026 by providers of MA plans (see Figure 4).

Contact an HMA Expert Today

Interested in understanding how CBO’s latest baseline update affects the federal budgetary implications of certain Medicare or Medicaid policy topics or proposals? Contact our experts, Mark Desmaris and Rachel Matthews, to learn more about HMA’s “CBO-style” federal budgetary scoring work, which relies on The Moran Company’s long-standing methodology. [1]

Beyond federal budget scoring, HMA is working with states, health plans, and providers to assess how changes in enrollee health status are affecting utilization, costs, and payment rates—and what those trends may mean for Medicaid and MA organizations and providers. Our teams support states in evaluating managed care rate setting and program design, help Medicaid and MA plans anticipate risk and bid implications, and assist providers in understanding how changes in patient acuity could affect care delivery, contracting, and financial performance.

[1]Specifically, we apply our understanding of CBO precedents to predict how CBO will likely evaluate the budgetary impact of the legislation in question. We use our best judgment to adopt the assumptions CBO would tend to use, with the understanding that any variance in the assumptions CBO ultimately adopts could cause our estimate to differ from theirs.