This week, our In Focus provides an analysis of 2022 Medicare Advantage (MA) Star Ratings, including a look at how regulatory changes during the COVID-19 pandemic resulted in a record number of Medicare plans receiving historically high scores. HMA Managing Director Anthony Davis and Principal Sarah Owens rely on data from the Centers for Medicare & Medicaid Services (CMS) to take a deep dive into ratings for nearly 500 Medicare plans serving 26.8 million members.

2022 and Historical Star Ratings by the Numbers

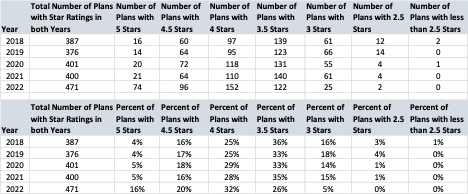

MA plans have seen that recent Star Rating results have tipped a record number of plans into the highest rated categories of four and five stars for the CMS Medicare Stars program. This should result in billions of dollars in payments to plans in 2023, representing the highest payout in the program’s history. The chart below shows how unusual the 2022 Star Ratings are from a historical perspective:

Source: The Centers for Medicare & Medicaid Services; HMA

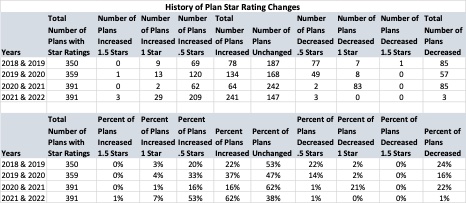

In 2022, a staggering 62 percent of plans showed an increase in their overall Star Rating performance. This is not consistent with previous years which saw much more even and consistent changes in the program. Further, less than one percent of plans decreased on their overall Star Ratings. The chart below further breaks down a historical look at Star Ratings changes within each of the individual Star Ratings:

Source: The Centers for Medicare & Medicaid Services; HMA

As the chart above shows, there were more 5-Star Plans in 2022 than 3-Star Plans. Including current membership, there were almost three times as many members in 5-Star Plans than in 2.5-, 3-, and 3.5-Star Plans combined. Since Star Rating bonus payments are calculated and paid out based upon a plan’s current membership, 5-Star Plans have a tremendous motivation to increase their enrollment, which they are allowed to do throughout the year.

Here is what 2022 overall Star Ratings look like when both contract and membership numbers are applied:

| Stars | Number of Contracts | September 2021 Enrollment |

| 2.5 | 2 | 8,605 |

| 3 | 25 | 481,789 |

| 3.5 | 122 | 2,264,885 |

| 4 | 152 | 7,990,652 |

| 4.5 | 96 | 8,881,463 |

| 5 | 74 | 7,120,244 |

| Not Applicable* | 69 | 41,377 |

| Not enough data available | 156 | 492,763 |

| Plan too new to be measured | 151 | 273,505 |

| Grand Total | 847 | 27,555,283 |

*Not Applicable are plans that have a Part C but no corresponding Part D. There were 6 plans in this category and half of these plans had 5 Star Ratings for Part C. The 5-Star Plans represented over 80% of the enrollment in these plans.

Source: The Centers for Medicare & Medicaid Services; HMA

The Impact of the COVID-19 Pandemic

So how did we go from a pandemic with some of the lowest preventative care being rendered in the country’s history to these kinds of performance levels? As reported in past HMA articles, CMS relaxed some of the Star Rating measures to accommodate MA health plans’ need to focus on the pandemic. The goals were laudable as CMS clearly wanted MA plans to focus on member care during the uncertain times of the public health crisis. It was also clear that Star Ratings would be impacted by disruptions to care. For example, ophthalmology and optometry practices were forced to close for a good portion of 2020 in many states, affecting access to care and measures such as diabetic eye exams. CMS acknowledged this trend and gave plans some leeway in what they would be required to report for HEDIS quality measures. This set an artificial “floor” as plans could select the most advantageous measure results from the current or past calendar year for both their HEDIS and CAHPS measures, which made up nearly 40 percent of the overall score. Most plans were already at four and five on operational measures, so the overall impact was to raise the Star Ratings for most plans across the country by a significant margin.

The impact of the COVID-19 measure relaxation was an overall rise in Star Ratings unlike any in the past. This represents a great opportunity for plans to take advantage of the bonus dollars and invest in their future, which conversely has the potential to lead to some of the lowest pay outs of the program on record.

What Does All This Mean to MA Plans?

While 2022 Star Ratings provide plans with opportunities to invest in further quality improvements, it is important to recognize that this year is an anomaly and that preparation for upcoming changes is vital. Plans need to be prepared for the future as the CMS Star system not only corrects from COVID, but also adds a host of new catalysts. These changes have the potential to take plans from the highest quality bonus payments on record in 2022, to the lowest in 2023. While we do not yet have the CMS 2023 Advance Announcement, CMS acknowledged last year that changes are required to reduce fluctuation and provide more stability. In the 2022 Announcement and subsequent Federal Register posting, CMS predicted that these changes would cut $4.1 billion in future years. These changes will impact all plans, and given the impact of the 2022 Star Ratings, the $4.1 billion is likely to adjust upward. The following are significant changes that should be noted and plans should be planning for despite the strong performance this year:

- Tukey Outlier Distribution: This change will reduce variation in the cut points by removing outlier plans from the cut point calculations, thus raising cut points on several HEDIS measures across the board;

- COVID Correction: While we wait for the CMS Advance Announcement for more COVID clarifications on Stars, a correction of the market and roll back of the current guidance will results in a return to similar performance levels from 2021, including significant loss in 4- and 5-Star Plans;

- CAHPS Weighting: As CAHPS scores go from two times to four times weighting, plans will need to develop significant infrastructure around member experience. These scores are often the lowest performing by health plans and will now be the highest weighted in the overall Medicare Stars score;

- 2025 Digital Measure: As indicated by the recent NCQA proposal to move colorectal cancer screening to an Electronic Clinical Data Systems (ECDS) measure with no chart review component, there is a constant push towards digital measurement. With CMS setting a commitment to be “fully digital” by 2025, plans can expect to see much of the gains they have made because of hybrid medical record review taken away in core measures.

MA plans looking to keep their newly acquired or historical 4- and 5-Star Ratings will need to start a quality planning process aimed at significant investments in new models and programs that address value-based programs differently. It is critical that while a well-deserved “deep breath” is in order, plans should not allow themselves to be lulled into a false sense of security and continue pushing forward harder than ever on quality improvement programs.

For questions, please contact Anthony Davis or Sarah Owens.