Weekly Roundup -

December 3, 2025

Smart. Strategic. Essential.

Unmatched Healthcare Insights from HMA,

Leavitt Partners & Wakely.

Featured:

Webinar Replay – Redefining Revenue: Building Financial Resilience in an Era of Policy and Payment Change

ACCESS WEBINARMassHealth Signals Continuity Mixed with Uncertainty as 1115 Waiver Renewal Process Begins

READ BLOGTrending: In Focus

Five Key Takeaways from the 2025 National Association of Medicaid Directors (NAMD) Conference

At the National Association of Medicaid Directors (NAMD) 2025 Fall Conference, planned federal health policy changes dominated conversations among attendees, including state Medicaid directors, health plans, and providers. With major changes on the horizon for Medicaid and Affordable Care Act (ACA) Marketplace programs, stakeholders are preparing for transition and transformation in 2026.

A team from Health Management Associates (HMA) attended the conference and returned with valuable insights on the emerging opportunities, state-specific priorities for 2026 and beyond, and early strategies to address and mitigate the challenges ahead. Among the topics discussed were the Rural Health Transformation Program (RHTP), Medicaid eligibility and community engagement policy changes, drug costs and financing, upstream drivers of health, and data infrastructure.

Five major takeaways about the work state Medicaid agencies, health plans, providers, and industry partners will focus on in the year ahead were as follows.

1. Medicaid leaders are preparing for new eligibility and community engagement policies under tight timelines.

The 2025 budget reconciliation act (P.L. 119-21, OBBBA) requires certain adults ages 19–64 enrolled in Medicaid to complete at least 80 hours per month of community engagement (CE) to maintain coverage. Exemptions to the CE requirement apply to people with disabilities, pregnant individuals, and caregivers. States must now develop processes and information systems that track and verify compliance with CE requirements, manage exemptions, and support members through this policy change.

Medicaid CE and other new eligibility requirements, including more frequent eligibility checks, were a frequent topic of discussion throughout the event. Implementation of these requirements is a major operational lift with significant program integrity implications. State leaders discussed the tight timelines, resource constraints, and the need to coordinate across agencies, health plans, and providers. They are already planning to mitigate the risk of coverage losses for at-risk populations and to minimize administrative burden for all stakeholders. The urgency and complexity of these changes underscore the need for strategic planning and cross-sector collaboration.

2. Coordinated communication and stakeholder engagement remain critical.

States are increasingly relying on multiple forms of communication and feedback channels to engage stakeholders, including Medicaid members. Clear, timely communication is essential to ensure people understand their options and know what they need to do and when to do it. Medicaid leaders described the value of embedding vital eligibility information into workflows at all levels and applying lessons from the COVID-19 public health emergency unwind to new outreach and education initiatives.

Several states emphasized the effectiveness of convening all stakeholders to ensure unified messaging. Other common themes included the importance of plain-language materials, hands-on support through case managers and navigators, and engaging providers to integrate new eligibility and work-related requirements into their workflows, as policies evolve.

3. States are eager to begin implementing initiatives in their rural health transformation plans.

Medicaid leaders are actively discussing their RHTP applications with CMS, preparing to move quickly once awards are announced. Many states are focused on enhancing existing efforts, while others are preparing to invest in systems, technology, and organizations that will better integrate rural providers into the broader healthcare system, including Medicaid.

Federal and state leaders and their partners discussed the opportunity for RHTP funding to strengthen rural health infrastructure, workforce development, education, and outreach—especially in underserved areas. States are positioning themselves to leverage these funds to address persistent disparities and improve access to care for rural populations.

4. States are seeking to balance cost and access to GLP-1s and other prescription drugs.

Federal and state leaders extolled the benefits of new and innovative prescription drug products and therapies, including GLP-1s. Centers for Medicare & Medicaid Services (CMS) Administrator Dr. Mehmet Oz highlighted the administration’s announcements about drug pricing, including the new GENEROUS (GENErating cost Reductions fOr US Medicaid) model, which is focused on drug costs in the Medicaid program. These discussions reinforced CMS’s focus on new drug pricing models and the importance of involving Medicaid experts in these nuanced development and implementation conversations.

Attendees gained a deeper appreciation for the administration’s intent to have GLP-1s and other therapies play a significant role in addressing chronic disease, including obesity. State Medicaid agencies—and their Medicaid managed care plans and partners—should plan to inform discussions about coverage and financing of these novel products as well as for cell and gene therapies. The intersection of innovation, affordability, and access will remain a central challenge.

5. Medicaid agencies are working on multiple technology interoperability and quality initiatives.

Although Medicaid eligibility policy changes and CE requirements drew significant attention, many discussions also focused on other upcoming deadlines, including:

- New federal interoperability and prior authorization rules that go into effect in 2027

- State implementation of Medicaid and CHIP Quality Rating System requirements before the end of 2028

- The transition to digital quality measurement (dQM) by 2030

Medicaid agencies are collaborating with managed care and provider organizations to understand the operational, clinical, and technical dimensions of these initiatives.

Connect with Us

HMA’s expert consultants provide advanced policy, technical, and operational support, and can help your organization navigate and succeed in the evolving regulatory landscape. Our team brings deep experience and practical solutions to help clients anticipate challenges, leverage opportunities, and achieve their program goals. For more information or technical assistance on these and other emerging Medicaid priorities, contact the HMA’s featured experts Beth Kidder and Kathleen Nolan.

CMS’s 2027 Medicare Advantage Proposed Rule Focuses on Outcomes and Competition

On November 28, 2025, the Centers for Medicare & Medicaid Services (CMS) released the Contract Year 2027 Policy and Technical Changes to the Medicare Advantage Program and Medicare Prescription Drug Benefit Program. Each annual rulemaking cycle offers CMS an opportunity to recalibrate program priorities.

This proposed rule offers a road map for CMS’s vision for Medicare Advantage (MA) and Part D. Signaling how CMS leadership intends to shape the MA and Part D programs beyond 2027—prioritizing outcomes, streamlining operations, and inviting dialogue on modernization—the proposed rule reflects a strategic imprint on the program’s trajectory. The deadline to submit comments is January 26, 2026.

Given CMS’s goal of modernizing MA and Part D, plans, providers, and advocates should engage early to inform final policies. Health Management Associates (HMA) policy and actuarial experts, including Wakely and Leavitt Partners (both HMA companies), are analyzing and modeling the effect of the proposed changes. This article highlights some of the major policy updates that require near-term planning by states, Medicare Advantage plans, providers who serve MA beneficiaries, and their partners.

Key Themes in the Proposed Rule

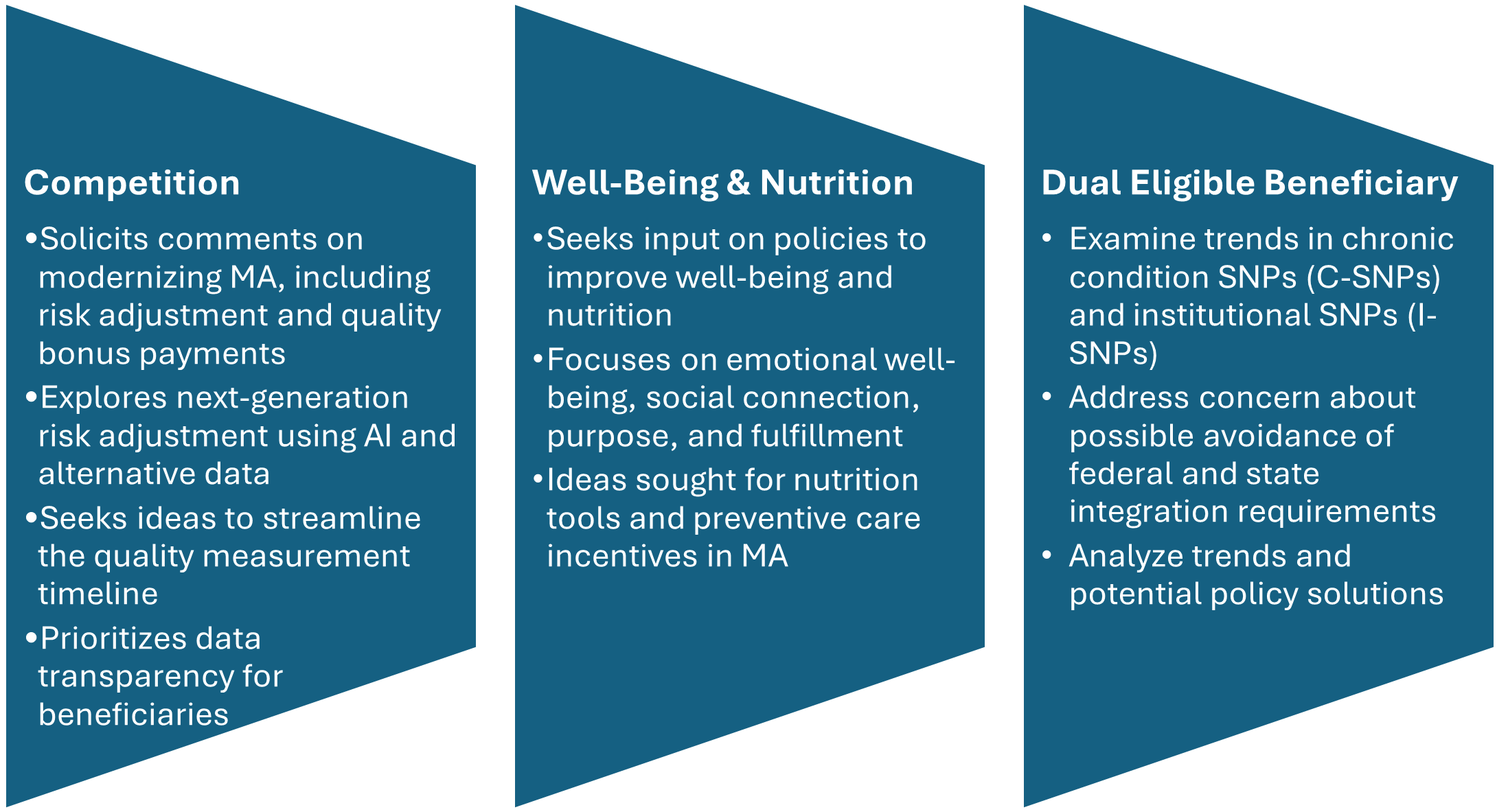

Requests for Information

CMS includes three significant requests for information (RFIs) and highlights additional opportunities to provide input on approaches to reduce administrative burden throughout the program. CMS’s modernization RFI focuses on financing and other strategies to support beneficiaries with plan selection. In addition, CMS seeks input on emerging trends in MA special needs plans (SNPs), citing concerns about rapid growth and potential program integrity issues. Consistent with the departmentwide priorities, the RFI also delves into potential strategies for plans to address nutrition and wellness benefits for MA enrollees.

Figure 1. RFIs Signaling New Policy Directions

Star Ratings Overhaul: Refocusing on Outcomes and Experience

CMS proposes significant changes to the Star Ratings system, which influences plan bonuses and consumer choice. The changes increase the focus on clinical care, outcomes, and patient experience of care measures where performance is not topped out and align with universal foundation of measures.

- Health Equity Index Rollback: Rather than implement the previously planned Excellent Health Outcomes for All reward (formerly Health Equity Index) for 2027, the agency will continue using the historical reward factor that incentivizes consistently high performance across all measures.

- Measure Streamlining: Twelve process-heavy or administrative measures will be removed.

- Behavioral Health: A new measure for depression screening and follow-up will be introduced for the 2027 measurement year, with integration into Star Ratings by 2029.

Why It Matters: Removing these measures continues the shift away from administrative compliance, easing burden while strengthening quality incentives.

Medicare and Medicaid Dual Eligible SNPs and Integration

CMS is proposing several changes to improve how Medicare Advantage plans serve people who qualify for both Medicare and Medicaid (dual-eligible beneficiaries):

- Starting in calendar year (CY) 2027, CMS proposes to allow D-SNPs and I-SNPs two opportunities to change to their model of care (MOC)—the framework for how they coordinate care. These windows would be January 1 through March 31 and October 1 through December 31.

- When beneficiaries are automatically moved (i.e., passively enrolled) from one integrated D-SNP to another, CMS will no longer require the new plan’s provider network to closely match the old plan’s network. Instead, the new plan must ensure that all incoming members receive uninterrupted care for at least 120 days (up from 90 days), helping prevent gaps in treatment.

- In states where dually eligible individuals are explicitly carved out from or not required to enroll in Medicaid managed care, CMS proposes to let highly integrated dual eligible special needs plan (HIDE SNP) continue to enroll full-benefit, dual-eligible (FBDE) individuals in the same service area, even if those individuals are in Medicaid fee-for-service. This change is intended to maintain coverage and simplify enrollment for these beneficiaries.

Why It Matters: While the proposed changes revise broader policies, the updates could have significant effects on D-SNP and MA integration. These changes also could shape states’ decisions regarding their integration policies. Plans should continue to monitor these developments.

Other Notable Changes

CMS proposes a new special enrollment period (SEP) for beneficiaries when their providers leave a plan’s network, eliminating the requirement that CMS deem the change “significant.” The intent of this change is to preserve continuity of care and ease the burden of beneficiaries switching plans. In addition, CMS plans to codify SEP policies for greater consistency.

The proposed rule also calls for the following:

- Codifying multiyear changes stemming from the Inflation Reduction Act, including elimination of the coverage gap phase

- Lowering annual out-of-pocket thresholds and removal of cost sharing in catastrophic coverage

- Transitioning to the Manufacturer Discount Program and updating true out-of-pocket (TrOOP) calculations

- Clarifying specialty-tier drugs and subsidy structures

As a result, plans will have updated financial responsibilities.

Connect With Us

As CMS sets a new course for Medicare Advantage and Part D, organizations face both opportunities and challenges in adapting to these changes. HMA brings deep expertise in Medicare policy, actuarial modeling, and operational strategy. Our team—including experts from Wakely and Leavitt Partners—can help plans, providers, and stakeholders interpret the proposed rule, assess its impact, and develop actionable strategies for compliance and competitive positioning.

Whether you need data-driven analysis, scenario modeling, or hands-on support preparing for implementation, HMA is ready to partner with you to navigate the evolving Medicare landscape and achieve your goals. Contact Amy Bassano and Julie Faulhaber to discuss your questions and how HMA can help.

Federal Policy News

Fueled By Leavitt Partners Weekly Health Intelligence

CMMI Introduces Digital Technology Payment Model

On December 2, 2025, the Centers for Medicare and Medicaid Innovation (CMMI) introduced the Advancing Chronic Care with Effective, Scalable Solutions (ACCESS) model, which will reimburse providers for using telehealth and other digital technology such as wearables and mobile apps. ACCESS is a voluntary model for Medicare Part B organizations managing patients with qualified chronic conditions. Full payments will be tied to achieving certain health outcome measures. Applications for participation in the model are due April 1, 2026, and the model will begin July 1, 2026.

ARPA-H Director Outlines Priorities and Initiatives to Address Health Crises

On November 24, newly appointed ARPA-H Director Dr. Alicia Jackson released a statement outlining the agency’s strategic priorities and recent initiatives to address major health crises. In her message, Dr. Jackson highlighted efforts initiated during her first month, including distributed biomanufacturing of genetic medicines, automated cyber patches for hospitals, as well as new tools to improve maternal health. Additionally, she reiterated ARPA-H’s mission to fund projects considered too complex or high-risk for traditional funding, citing goals such as 3D printing organs on demand and eliminating osteoarthritis through self-healing joints. Finally, Dr. Jackson called for researchers and companies to engage with the agency through upcoming Proposers’ Days and open program manager positions. Interested organizations can find more information on how to engage with ARPA-H and see current funding opportunities on ARPA-H’s website.

SUPPORT Act Reauthorization Advances

The newly signed SUPPORT for Patients and Communities Reauthorization Act of 2025 renews and expands federal efforts to address the U.S. overdose and substance use crisis by authorizing billions of dollars—pending future appropriations—for prevention, treatment, recovery, and mental health services. The law strengthens access to evidence-based care by funding state, tribal, and local programs; expands naloxone availability for first responders; supports stable transitional housing and workforce reintegration through the CAREER Act; and directs federal agencies to improve telemedicine prescribing for controlled substances to reach underserved communities. It also reinforces research and clinical workforce development as overdose deaths, driven largely by synthetic opioids such as fentanyl, remain a major public health concern despite recent declines. (Articles here, here, and here. Press release here.)

Ready to talk about your organization's challenges?

Schedule a ConsultationState Policy News

Arizona

Arizona to Modernize, Streamline Medicaid Enterprise System. Arizona Health Care Cost Containment System (AHCCCS) announced on November 25, 2025, that it is advancing a multi-year initiative to modernize the Medicaid Enterprise System to improve technology, streamline processes, strengthen security, and enhance communication with providers and partners. Planned improvements in 2026 include migration to a secure cloud platform, upgrades to the Electronic Data Interchange system for faster data exchange, expanded program integrity and auditing tools to improve payment accuracy and fraud detection, and a new centralized Customer Service System enabling providers to update information, track requests, and communicate more easily. These efforts are expected to reduce administrative burdens, accelerate claims processing, and improve data transparency. AHCCCS is also evaluating Medicaid operational impacts from OBBBA, including work requirements and eligibility verification changes, and will provide further guidance.

Idaho

Idaho Issues Medicaid Managed Care Transition RFI. The Idaho Department of Health and Welfare (DHW) released on November 21, 2025, a request for information (RFI) regarding its upcoming transition to comprehensive Medicaid managed care. The RFI welcomes feedback from Medicaid members, providers, managed care organizations (MCOs), and pharmacy benefit managers on their priorities while DHW drafts up new MCO contracts. Idaho’s goals for the procurement are controlling costs to support program sustainability, enhancing the quality of member care and outcomes, improving program efficiency and performance, supporting provider stability and increasing access, and promoting Idaho First values by increasing economic investment and jobs in the state. Responses are due December 31, 2025.

Iowa

Iowa Receives Temporary Extension for 1115 Wellness Plan Demonstration. The Centers for Medicare & Medicaid Services announced on December 1, 2025, that it has approved a temporary extension and amendment of Iowa’s section 1115 Iowa Wellness Plan (IWP) demonstration, extending federal authority through December 31, 2026. As part of this action, CMS confirmed that the state’s non-emergency medical transportation (NEMT) waiver will sunset on December 31, 2026, and will not be included in any future extensions. CMS cited evidence that eliminating NEMT can negatively affect access to care and referenced current federal law requiring transportation benefits. Iowa must continue monitoring and reporting beneficiary access impacts during the extension period.

Louisiana

Louisiana Approves One-Year Extension of Medicaid Managed Care Contracts. The Louisiana Illuminator reported on November 25, 2025, that Louisiana lawmakers have signed off on extending Louisiana’s six Medicaid managed care contracts by one year through 2026. The contracts, which are held by CVS Health/Aetna Better Health of Louisiana, AmeriHealth Caritas Louisiana, Elevance/Healthy Blue, Humana Healthy Horizons, Centene/Louisiana Healthcare Connections, and UnitedHealthcare Community Plan, are worth $17 billion total. The average per member per month payments are rising from $514 to $563, but the Louisiana Department of Health will withhold three percent of the money paid out to contractors until the end of the year, when it is determined whether the plans provided adequate services to patients.

New Mexico

New Mexico Solicits Public Input to Strengthen Behavioral Health Services. The New Mexico Health Care Authority reported that it is seeking feedback on how to improve services for individuals with serious mental illness, severe emotional disturbance, substance use disorder, and brain injuries. Responses will help inform a Behavioral Health Assessment and Feasibility Study report expected in January 2026. Three virtual listening sessions will be held for different stakeholder groups: providers and managed care plans on December 9; individuals, family members, and caregivers on December 10; and Tribal partners on December 11. Public comments will also be accepted through December 11.

North Carolina

North Carolina Launches Medicaid Plan for Children, Youth in the Child Welfare System. The Wake Weekly reported on December 1, 2025, that North Carolina has launched the Children and Families Specialty Plan, called Healthy Blue Care Together, a new statewide Medicaid health plan designed to provide coordinated physical and behavioral health services for children, youth, and young adults currently or formerly involved in the child welfare system. Implemented in partnership with Blue Cross and Blue Shield of North Carolina, the plan went live December 1 and automatically enrolled about 32,000 eligible individuals, offering comprehensive benefits including mental health services, long-term supports, and help addressing social needs such as housing and transportation.

Private Market News

Fueled By Wakely Consulting Group

Breakthrough Deal Reshapes U.S.–U.K. Pharmaceutical Pricing

On December 1, the Trump Administration announced an agreement in principle on pharmaceutical pricing as part of the broader United States-United Kingdom Economic Prosperity Deal (EPD) first announced earlier this year. Under the agreement, according to the Office of the United States Trade Representative (USTR), the U.K. has committed to “increase the net price it pays for new medicines by 25%,” as well as to reduce various repayment and rebate rates owed by pharmaceutical firms under the Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG) “or other rebate schemes.” In exchange, the Trump Administration has committed to provide exemptions for U.K.-origin medications, ingredients, and medical technologies from Section 232 tariffs, as well as to “refrain from targeting U.K. pharmaceutical pricing practices” under any future Section 301 investigations during President Trump’s term.

In a statement, HHS Secretary Robert F. Kennedy, Jr. described the agreement as addressing the “long-standing imbalances” in U.S.-U.K. trade, while Medicare Director Chris Klomp, who is credited as a lead negotiator in the agreement, noted other recent agreements between the Administration and pharmaceutical companies to provide most-favored-nation (MFN) drug pricing.

Labcorp Acquires Community Health Systems Lab Assets

Modern Healthcare reported on December 2, 2025, that Labcorp has acquired select Community Health Systems (CHS) ambulatory outreach lab assets for $194 million. The acquisition affects CHS patient service centers, in-office phlebotomy facilities, and hospitals across 13 states.

Our Insights

Fueled By Experts Across Our HMA Companies

Health Management Associates

Webinar: Redefining Revenue: Building Financial Resilience in an Era of Policy and Payment Change

As healthcare organizations face sweeping shifts in Medicaid funding, workforce costs, and payer expectations, leaders must think beyond short-term cuts and find sustainable ways to protect access, quality, and mission. Join HMA experts for a timely discussion on how hospitals, health systems, and providers can reimagine revenue strategy for the next decade.

Podcast: The Power of Alliances: Finding Consensus in Healthcare Policy

Eric Marshall, principal at Leavitt Partners, an HMA company, shares how collaboration, not competition, is the way to move healthcare policy forward in a polarized environment. In this episode of Vital Viewpoints on Healthcare, he discusses how multi-sector alliances are advancing solutions to common pain points that too often impede progress on issues like drug pricing, supply chain security, and rural health access. Drawing on years of experience bringing stakeholders together, Eric explains why consensus-building is essential to creating durable, effective policy solutions and how trust, persistence, and shared purpose can overcome even the deepest divides in Washington and beyond.

Wakely

The $245 Question: How New GLP-1 Pricing Could Transform Medicare Part D

The Trump Administration’s November 2025 announcement outlines a major proposal to reduce Medicare Part D prices for select GLP-1 medications to $245 per month and cap patient cost sharing at $50 per month. The proposal also signals a potential expansion of Medicare coverage beyond diabetes and cardiovascular disease to include obesity and related comorbidities. If implemented as early as 2026, these changes would substantially shift both the cost structure and utilization of GLP-1 therapies. The report summarizes what is known to date, highlights remaining regulatory questions, and explains how these changes intersect with prior Medicare drug price negotiation timelines.

Using an analysis of 2024 Part D plan data, 2026 bids, and a range of utilization and rebate scenarios, the paper finds that impacts on beneficiaries and plans will vary significantly. Most Part D members—those enrolled in copay-based benefit designs—may see no change or even higher annual cost sharing due to Part D adjudication rules, while members paying coinsurance would likely see savings. For plans, net liability could decline modestly or rise by several dollars PMPM depending on rebate levels, utilization growth from expanded access, and plan design. Given the uncertainty surrounding timing, eligibility criteria, and CMS implementation, plans should begin modeling potential impacts and preparing contingencies for 2026.

Leavitt Partners

Making Medicare Sustainable: A Guide to Policy Options for Congress and the Administration

Leavitt Partners released a Medicare policy guide that provides an accessible overview of several major policy concepts that have circulated in Medicare reform conversations in recent years. With debate mounting over the future of Medicare, it is imperative that policymakers first understand these core policy proposals–including site neutral payments, competitive bidding in Medicare Advantage, and others–at a high level before engaging in more detailed reform discussions.

Serving as a useful primer, this guide synthesizes the leading Medicare policy options and the key decision points within those frameworks. It is designed to help lawmakers, staff, and stakeholders rapidly familiarize themselves within the landscape of reform ideas, so that they are better positioned to engage in more productive discussions about the program’s future.

RFP Calendar

RFP Calendar

| Date | State/Program | Event | Beneficiaries |

|---|---|---|---|

| Date: DELAYED | State/Program: Texas STAR & CHIP | Event: Implementation | Beneficiaries: 4,600,000 |

| Date: December 2025 - February 2026 | State/Program: Texas STAR Kids | Event: Awards | Beneficiaries: 150,000 |

| Date: January 1, 2026 | State/Program: Wisconsin LTC GSR 2,7 | Event: Implementation | Beneficiaries: 56,000 (all GSR) |

| Date: January 1, 2026 | State/Program: Michigan HIDE SNP | Event: Implementation | Beneficiaries: 35,000 |

| Date: January 1, 2026 | State/Program: Nevada D-SNP | Event: Implementation | Beneficiaries: 88,000 |

| Date: January 1, 2026 | State/Program: Ohio Duals | Event: Implementation | Beneficiaries: 250,000 |

| Date: January 1, 2026 | State/Program: Illinois D-SNP | Event: Implementation | Beneficiaries: 79,000 |

| Date: January 1, 2026 | State/Program: Nevada | Event: Implementation | Beneficiaries: 674,000 |

| Date: January 1, 2026 | State/Program: Massachusetts One Care, Senior Care Options | Event: Implementation | Beneficiaries: 120,000 |

| Date: January 6, 2026 | State/Program: Nevada Children's Specialty | Event: Proposals Due | Beneficiaries: NA |

| Date: January 16, 2026 | State/Program: Wisconsin LTC GSR 3 | Event: Proposals Due | Beneficiaries: 56,000 (all GSR) |

| Date: February 2026 | State/Program: Illinois | Event: Awards | Beneficiaries: 2,400,000 |

| Date: February 19, 2026 | State/Program: Nevada Children's Specialty | Event: Awards | Beneficiaries: NA |

| Date: June 24, 2026 | State/Program: Wisconsin LTC GSR 3 | Event: Awards | Beneficiaries: 56,000 (all GSR) |

| Date: December 2026 - February 2027 | State/Program: Texas STAR Kids | Event: Implementation | Beneficiaries: 150,000 |

| Date: January 1, 2027 | State/Program: Illinois | Event: Implementation | Beneficiaries: 2,400,000 |

| Date: January 1, 2027 | State/Program: Nevada Children's Specialty | Event: Implementation | Beneficiaries: NA |

| Date: January 1, 2027 | State/Program: Wisconsin LTC GSR 3 | Event: Implementation | Beneficiaries: 56,000 (all GSR) |

| Date: January 1, 2028 | State/Program: Wisconsin LTC GSR 4,6 | Event: Implementation | Beneficiaries: 56,000 (all GSR) |

| Date: Fall 2027 | State/Program: Oregon | Event: RFP Release | Beneficiaries: 1,200,000 |

| Date: 2028 | State/Program: North Carolina | Event: RFP Release | Beneficiaries: 2,200,000 |