This week's roundup:

- In Focus: Proposed Rule on the CY 2026 Medicare PFS Emphasizes Value-Based Care and Alternative Payment Models

- In Focus: CY 2026 Medicare Hospital OPPS Proposed Rule Encourages Site of Service Shifts and Data Collection for Use in Rate Setting

- Florida to Propose MMA Section 1115 Demonstration Home Health Aide Amendment to Close Gaps in Services for Medically Fragile Children

- Maine Expands Hospital Charity Care Amid Looming Federal Medicaid Cuts

- Maryland Seeks Vendor Information on Artificial Intelligence, Other Technological Solutions to Improve Medicaid, Replace Legacy MMIS

- Montana Releases Draft 1115 Demonstration for Medicaid Expansion Work Requirements

- Nevada Establishes PACE Effective July 1

- CMS Reaffirms Statutory Limits on Medicaid Demonstrations, Workforce Initiatives

- CMS Targets Duplicate Medicaid Enrollment Under New Integrity Initiatives

- Marketplace Plans Seek 15 Percent Premium Hikes

In Focus

Proposed Rule on the CY 2026 Medicare PFS Emphasizes Value-Based Care and Alternative Payment Models

This week, our first In Focus reviews the Centers for Medicare & Medicaid Services (CMS) proposed rule for the calendar year (CY) 2026 Medicare Physician Fee Schedule (PFS), released on July 14, 2025. The proposal echoes many of the administration’s priorities and would substantially change how physicians are paid for their services, focusing on value-based payment strategies, efficiency adjustments, conversion factors, technology coding, and MSSP eligibility.

This In Focus is the second in our series covering recent Medicare-related announcements. [Last week, we discussed CMS Innovation Center updates.]

Emphasis on Value-Based, Hospital-Based Care

The CY 2026 Medicare PFS proposed rule reflects the administration’s prioritization of value-based care, chronic care management, new payment strategies for evolving models of care delivery, and support for technology-based services. Provisions in the proposed rule also are intended to reduce costs through reimbursement rate changes, better access to behavioral health services, and facilitated advanced primary care management (APCM).

The proposal recognizes the additional complexity of providing primary care in the home and other residential environments by proposing to allow billing of an add-on code to trigger additional payment for home-based visits. CMS also proposes to delete separate coding and payment for social determinants of health (SDOH) risk assessments (established in 2024) and will begin referring to SDOH as “upstream driver(s).”

Emphasis on Efficiency and Lower Practice Expenses

Proposed changes include an “efficiency adjustment,” which would reduce the physician work relative value unit (RVU) based on the assumption that as clinicians gain experience and technology advances, procedures become more efficient. CMS also proposes to rebalance clinician reimbursement for expenses to recognize that hospital-based physicians incur fewer costs than physicians in private or group practices and that the number of physicians practicing in hospitals has increased significantly, leaving far fewer physicians in freestanding offices. As a result, CMS estimates specialists who furnish care in hospital settings will experience double-digit cuts in reimbursement on average, whereas those practicing in freestanding (non-facility) settings will generally receive increases, though the impact on any individual clinician or practice will depend on the mix of services provided.

CMS continues to evaluate potential payment reform for global surgical packages and is studying the real-world division of work between surgeons and providers of postoperative care, as CMS findings suggest only a fraction of post-discharge visits included in valuation are furnished.

Positive PFS Conversion Factor Update

All providers/suppliers paid for services under the PFS will benefit from positive statutory updates to the conversion factor, with slightly higher increases going to clinicians who meet certain eligibility requirements for participating in an Advanced Alternative Payment Model (APM) under the Quality Payment Program (QPP). Specifically, two conversion factors would be available in CY 2026. Under the proposed rule, services furnished by providers who participate in qualifying Advanced APMs would be paid based on a conversion factor of $33.5875, representing a 3.84 percent increase (or $1.2410) from the 2025 amount of $32.3465. Services furnished by providers who do not participate in a qualifying AAPM are proposed to be paid based on a conversion factor of $33.4209, representing an increase of 3.32 percent (or $1.0744) from CY 2025.

Both conversion factors reflect the 2.50 percent overall update required by statute, a 0.55 percent budget neutrality adjustment to account for RVU changes, and an updated factor of 0.75 percent for qualified APMs or 0.25 percent for non-qualifying APMs. CY 2026 is the final year in which eligible clinicians can receive an additional APM incentive. Qualifying clinicians will get a one-time payment of 1.88 percent of their paid claims for covered professional services based on performance from two years earlier.

Evolving Coding and Payment for Technology-Based Services

CMS continues to expand coding and payment for technology-based services, including a proposal for the use of digital mental health treatment (DMHT) devices used in conjunction with an ongoing treatment plan of care for attention deficit hyperactivity disorder (ADHD). The agency recognizes that behavioral health conditions are common chronic diseases and that the field of digital therapeutics is evolving.

CMS requests comments on the use of devices for treating symptoms of gastrointestinal conditions, sleep disturbance for psychiatric conditions, and symptoms of fibromyalgia, as well as to aid in the diagnosis of autism spectrum disorder. The agency also seeks input on a broader set of digital tools that could be used to encourage a healthy lifestyle. Through comment requests, CMS suggests that it might consider payment for digital tools that do not require Food and Drug Administration clearance in future years.

While CMS allows PFS payment of Software as a Service (SaaS) and artificial intelligence (AI) applications in certain circumstances, it also solicits comments on how to establish stable and consistent reimbursement for these technologies and asks how they can be used in the management of chronic diseases and primary care services.

Telehealth-Related Flexibilities

CMS proposes to streamline the process for adding codes to the telehealth list and making other adjustments to supervision and frequency of billing requirements for codes on the list.

Medicare Diabetes Prevention Program

CMS proposes several changes to the Medicare Diabetes Prevention Program (MDPP), which was expanded in 2018 under the CMS Innovation Center authority to increase beneficiary participation and to align with the Centers for Disease Control and Prevention program standards. These proposed changes include the addition and codification of more virtual flexibilities including asynchronous delivery of services, technical changes to the collection of data, and payment changes to reflect these new requirements.

Medicare Shared Savings Program

The proposed rule comprises several provisions to modify eligibility requirements for certain tracks of the program, revisions to the quality performance standards and reporting requirements, and other changes to improve the operations of the program. The Medicare Shared Savings Program (MSSP) now has more than 477 ACO participants, furnishing care to 11.2 million Medicare beneficiaries.

Drugs and Biological Products Incident-to Physician Services

The proposed rule addresses reimbursement for drugs paid incident-to a physician’s service, including policies related to the Inflation Reduction Act provisions, continued implementation of discarded units refund requirements, changes and clarifications to Average Sales Price (ASP) reporting, and payment for procurement of tissue required to manufacture cell-based gene therapies.

Citing a nearly 40-fold increase in spending for skin substitute products from 2019 to 2024, CMS proposes major changes for reimbursement of skin substitutes that would pay for most of these products as supplies incident-to physician services, rather than as Part B drugs. CMS estimates that these modifications would result in significant savings. If finalized, these proposals will take effect at the same time as CMS launches a new model in six geographic areas to test clinical review for certain services, including skin substitutes, in fee-for-service Medicare to achieve the WISeR (Waste and Inappropriate Service Reduction) Model.

Requests for Information

CMS included multiple requests for information in the CY 2026 proposed rule. The agency seeks stakeholder feedback on how the fee schedule can be used to better account for indirect practice expenses (PEs) costs in facility settings, integration of preventive services into APCM bundles, and use of motivational interviewing and health coaching to improve chronic disease prevention and management.

On the QPP, CMS seeks input on advancing digital quality measurement, refining MIPS (Merit-Based Incentive Payment System) Value Pathways (MVPs) through core elements, procedural code alignment, and well-being and nutrition measures. The agency also requests comments on improving public health and prescription drug monitoring reporting and strengthening data quality and performance thresholds across Medicare’s quality programs.

Contact an HMA Medicare Expert Today

Health Management Associates, Inc. (HMA), policy and rate setting experts are analyzing the details and impacts in the proposed rule and will provide additional updates to key Medicare policies as they become available. Our team can help support stakeholder development of policy and data-oriented comments on this rule, due September 12, 2025, and on any other Medicare policy topic of interest. Contact Amy Bassano, Rachel Kramer, or Kevin Kirby to discuss your priorities and approach.

CY 2026 Medicare Hospital OPPS Proposed Rule Encourages Site of Service Shifts and Data Collection for Use in Rate Setting

Our second In Focus reviews the policy changes in the Centers for Medicare & Medicaid Services (CMS) for the calendar year (CY) 2026 Medicare Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) Payment System Proposed Rule (CMS-1834-P). This OPPS proposed rule, released January 15, 2025, includes several important policy revisions that will alter hospital margins and change administrative procedures beginning as soon as January 1, 2026.

Key Provisions in the CY 2026 Hospital OPPS and ASC Proposed Rule

For CY 2026, CMS proposes to make critical modifications to several hospital outpatient and ASC payment policies, which hospitals and other stakeholders will need to quickly adopt. We highlight and interpret the following seven proposed policies that may be among the most impactful for Medicare beneficiaries, hospitals and health systems, payers, and manufacturers:

- Proposed updates for OPPS and ASC payment rates are consistent with proposed inpatient rates.

- The phased elimination of the inpatient-only (IPO) list will cause services to shift to the outpatient setting.

- Expansion of the ASC covered procedures list will cause services to shift from the outpatient to ASC setting.

- Site-neutral payment to drug administration services will be expanded to all off-campus provider-based departments.

- Medicare Advantage data will be used to set weights for inpatient Medicare Severity Diagnosis Related Groups (MS-DRGs).

- 340B payment recovery will intensify to recover funds more quickly.

- A new survey will be conducted to gather data on the amount hospitals pay for drugs used in the hospital outpatient department.

Stakeholder comments on the OPPS and ASC Proposed Rule are due to CMS by September 13, 2025.

What the Seven Provisions Mean

1. The proposed payment update for OPPS and ASC rates is consistent with proposed inpatient rates.

Proposed Rule: Overall CMS’s CY 2026 Medicare OPPS and ASC Proposed Rule will increase 2025 payments to acute care hospitals by 2.4 percent in 2026, amounting to an estimated $4 billion increase in payments. This update is based on a hospital market basket increase of 3.2 percent and a 0.8 percent reduction for total factor productivity.

HMA Analysis: CMS’s 2.4 percent increase results from the estimated rate of increase in the cost of a standard basket of hospital goods, the hospital market basket. CMS estimates that total payments to OPPS and ASC providers (including beneficiary cost sharing and estimated changes in enrollment, utilization, and case mix) for CY 2026 will increase by roughly $8.1 billion and $480 million, respectively, from CY 2025 payment levels. The proposed outpatient and ASC rates are consistent with the proposed inpatient payment update for 2026.

2. Phased elimination of the IPO list to cause movement of cases from inpatient to outpatient setting.

Proposed Rule: CMS has long maintained a list of procedures and services that must be provided on an inpatient basis and are excluded from the OPPS. In the CY 2021 final rule, CMS finalized a proposal to eliminate the IPO list over three years, beginning with nearly 300 procedures. CMS noted various changes in technology and chose to defer to the clinical judgment of physicians which procedures can be safely performed in the hospital outpatient department based on the circumstances of individual patients. When the Biden Administration entered office in 2022, CMS halted the process of eliminating the inpatient-only list and reinstituted five criteria it had previously used to determine whether a procedure should be removed from the IPO list.

Under the Trump Administration, CMS now proposes to again eliminate the IPO list over a three- year period. For 2026, CMS proposes to eliminate 285 mostly musculoskeletal services from the IPO list. Across the next two rulemaking cycles CMS will eliminate the remaining services from the IPO list and the agency is requesting stakeholder input regarding which services should be eliminated from the IPO list in CY 2027.

HMA Analysis: If finalized, the policy to eliminate the IPO list is likely to spur a migration of many cases from the inpatient setting to the hospital outpatient setting. Many of these cases are likely to be surgical short-stay cases. Given that the proposed policy would defer largely to clinical judgment to determine which procedures are performed in the outpatient setting, we anticipate a degree of variability by hospital in how this policy plays out. We anticipate hospital revenues will decline because of this policy, as certain inpatient payment adjustments are inapplicable to the outpatient setting. We do not anticipate a cost sharing impact on patients due to policies that protect them from higher outpatient cost sharing. Because the Medicare IPO list has served as a foundation for many site of service coverage decisions, we anticipate payers will respond to this policy by encouraging more rapid migration of cases to the outpatient setting, which is likely to result in lower Medicare spending.

3. Expansion of the ASC covered procedures list will cause services to shift from the outpatient to ASC setting.

Proposed Rule: CMS proposes to add 547 services to the ASC covered procedures list.

HMA Analysis: CMS’s proposal to add 547 services to the ASC CPL enables greater fluidity of site of service for providers in deciding where to conduct procedures. Among these 547 services are 276 musculoskeletal services that are also proposed for removal from the OPPS IPO list. While state regulations concerning which procedures can be conducted in ASCs may affect which cases are eventually conducted in the ASC setting, CMS’s plan to expand the ASC CPL may enable some musculoskeletal services to move directly from the inpatient setting to the ASC setting in 2026. We anticipate that the expansion of the ASC CPL may result in lower revenues for hospitals as cases move from the inpatient or outpatient setting to the ASC. This shift may also result in lower Medicare spending.

4. Expansion of the site-neutral policy to drug administration services furnished in all outpatient provider-based departments.

Proposed Rule: Under the Bipartisan Budget Act of 2015, CMS is required to implement site-neutral payments for off-campus provider-based departments (PBDs). This legislation exempted PBDs (also known as “excepted PBDs”) established as of the date of enactment. The policy has generally paid affected services at 40 percent of the OPPS rate. The agency presents the results of its own analyses, showing growth in drug administration services in the OPPS even as the number of fee-for-service beneficiaries has decreased. CMS concludes that “the differential in our payment rates has created a payment incentive that had led to unnecessary growth for the services in the drug administration” payment rates.

CMS proposes to apply the Medicare Physician Fee Schedule (PFS) payment adjustment to drug administration payments for services performed at excepted off-campus PBDs, which will be the same reimbursement rates available to non-excepted PBDs. This adjustment is proposed to be made in a non-budget-neutral manner. CMS also asks for comments on whether the PFS adjuster should be applied to other services. CMS also issues a request for information (RFI) on the potential to expand site-neutral payments for clinic visits to include on campus clinic visit services and a second RFI seeking information on the possibility of adjusting OPPS payments for services “predominantly performed” in the ASC or physician’s office setting

HMA Analysis: CMS estimates this policy will yield $280 million in savings to Medicare for 2026, which will translate into commensurate revenue reductions for the hospital industry. Although CMS proposes to exempt rural sole community hospitals from this policy, other types of safety net providers may also seek an exemption.

5. The use of Medicare Advantage data to set weights for inpatient MS-DRGs.

Proposed Rule: CMS proposes to require hospitals to submit to CMS Medicare Advantage payment information through their annual hospital cost reports for later use in setting Medicare inpatient PPS payment rates. As a part of this proposal CMS will require hospitals to include in their annual cost report submissions to CMS their median negotiated payer-specific Medicare Advantage charges by individual MS-DRG. CMS proposes to begin collecting these data in the 2026 cost reporting period, and to use these data to set MS-DRG relative weights beginning in FY 2029. CMS asserts that the agency intends to make these changes to reduce its reliance on the hospital chargemaster for setting rates for inpatient services and instead create a market-based approach to rate setting.

HMA Analysis: The first Trump Administration proposed a nearly identical policy in the CY 2021 rulemaking cycle. Like the IPO list history, this proposed policy was not implemented in the CY 2022 rulemaking cycle when the Biden Administration was in place. If implemented for 2026, the reporting of negotiated charge data will add administrative complexity to hospitals’ cost reporting processes. It is unclear whether the use of these data in the IPPS rate setting process will increase or decrease payment rates. Therefore, it is unclear how this policy might affect hospital revenue or Medicare spending.

6. Increase the pace of 340B payment recovery from hospitals to recover funds more quickly.

Proposed Rule: CMS proposes to change its policy for recovering past overpayments resulting from the budget neutrality adjustments accompanying prior cuts to reimbursement for 340B drugs. The 340B recoupment process was scheduled to begin in 2026 by reducing the hospital outpatient conversion factor by 0.5 percent annually until $7.8 billion in payments were recovered. CMS forecasted this would occur annually for 16 years; however, the CY 2026 OPPS proposed rule calls for reducing the outpatient conversion factor by 2 percent over the span of six years.

HMA Analysis: If implemented, CMS’s proposed 340B recovery policy will result in a payment reduction to hospitals of $1.1 billion in 2026. We anticipate the scale of this impact will continue during the subsequent five years that the policy is in place. We expect that hospital opposition to this proposed change will be significant.

7. New survey to gather data on the amount hospitals pay for drugs used in the hospital outpatient department.

Proposed Rule: CMS announced its intent to conduct a new survey to gather information from hospitals about the amount they pay for drugs used in the outpatient setting. The survey of drug acquisition costs will apply to specified covered outpatient drugs (SCODs) and “drugs and biologicals that CMS historically treats as SCODs.” The survey will begin at the end of 2025 and end in early 2026. CMS has stated that it intends for these survey results to “inform policy making” beginning with the 2027 rulemaking cycle.

HMA Analysis: The data collected through this survey effort could be used to set payment rates for Part B drugs or to inform 340B payment policy, but how exactly these data would be used is unclear. CMS noted that an adequate response rate will be necessary and asks for input on how to interpret nonresponses, such as assuming that non-responding hospitals have very low drug costs and therefore payment for drugs and biologics could be packaged with other services. CMS also noted that other sources of drug data could include the Federal Supply Schedule (FSS) or other benchmarks or different markups to ASP data.

HMA’s Medicare Practice Group Can Help

The Health Management Associates, Inc. (HMA), Medicare Practice Group monitors federal regulatory and legislative developments in the hospital space and assesses the impact on hospitals, life science companies, payers, and other stakeholders. Our experts interpret and model hospital payment policies and assist clients in developing CMS comment letters and long-term strategic plans. Our team replicates CMS payment methodologies and model alternative policies using the most current Medicare fee-for-service and Medicare Advantage (100 percent) claims data. We also support clients with DRG reassignment requests, New Technology Add-on Payment (NTAP) applications, and analyses of CMS Innovation Center alternative payment models.

For more information or questions about the policies described below, please contact Zach Gaumer, Amy Bassano, Kevin Kirby, or Clare Mamerow.

HMA Roundup

Florida

Florida to Propose MMA Section 1115 Demonstration Home Health Aide Amendment to Close Gaps in Services for Medically Fragile Children. The Florida Agency for Health Care Administration (AHCA) announced on July 18, 2025, that it will be submitting a request to the Centers for Medicare & Medicaid Services (CMS) to amend its Managed Medical Assistance (MMA) Section 1115 demonstration. The proposed amendment, called the “Family Home Health Aide (FHHA) Services Program,” seeks to implement an income disregard and expand the home health aide workforce to add more eligible provider types with the intent of closing gaps in health services for Medicaid-eligible medically fragile children. AHCA will accept public comments through August 16, 2025. The MMA demonstration is authorized through January 30, 2030.

Maine

Maine Expands Hospital Charity Care Amid Looming Federal Medicaid Cuts. News Center Maine reported on July 20, 2025, that Maine has enacted a new law expanding eligibility for hospital charity care by raising the income threshold from 150 percent to 200 percent of the federal poverty level (FPL) and capping cost-sharing for those earning up to 400 percent FPL. The law simplifies the application process and broadens eligibility to all state residents, aiming to ease the burden of medical debt. However, hospitals warn that the policy combined with federal Medicaid cuts expected to remove 34,000 Mainers from coverage could significantly increase uncompensated care costs and strain an already fragile system, where some facilities are already cutting services and staff.

Maryland

Maryland Seeks Vendor Information on Artificial Intelligence, Other Technological Solutions to Improve Medicaid, Replace Legacy MMIS. The Maryland Department of Health released on July 18, 2025, a request for information regarding artificial intelligence (AI), AI agent, specialized large language model, and robotic process automation to improve Medicaid and public health operations by potentially replacing the state’s legacy Medicaid Management Information System (MMIS) and enhancing IT operations. The agency is seeking responses that show specific use cases that show possible technological solutions with the goal of reducing costs, improving efficiency, and ensuring compliance with state and federal laws. Responses are due August 6, 2025.

Montana

Montana Releases Draft 1115 Demonstration for Medicaid Expansion Work Requirements. The Montana Department of Public Health and Human Services (DPHHS) released on July 18, 2025, a draft Section 1115 Health and Economic Livelihood Partnership (HELP) demonstration request, which would authorize community engagement requirements for certain Medicaid expansion adults. The proposed five-year demonstration would apply to non-exempt individuals ages 19–55 and is expected to affect up to 25,000 people. Individuals must complete 80 hours per month of qualifying activities or risk suspension. The application includes exemptions and good-cause provisions for individuals who are medically frail, pregnant, in treatment for substance use disorder, caring for a dependent with a disability, experiencing a crisis, or facing other hardships that prevent compliance. Public comments are open through August 20, 2025.

Nevada

Nevada Establishes PACE Effective July 1. Modern Healthcare reported on July 16, 2025, that Nevada has approved the Program for All-Inclusive Care for the Elderly (PACE), which provides home and community-based services to older adults and aims to keep people out of skilled nursing facilities and living at home. Senate Bill 207 requires the Nevada Department of Health and Human Services (DHHS) to establish PACE and requires the Community Advocate within the Aging and Disability Services Division to provide assistance for the program. The new law went into effect July 1, 2025.

National

CMS Reaffirms Statutory Limits on Medicaid Demonstrations, Workforce Initiatives. The Centers for Medicare & Medicaid Services (CMS) announced on July 17, 2025, a policy shift to reinforce Medicaid and the Children’s Health Insurance Program (CHIP) program integrity by phasing out Section 1115 waiver demonstrations that allow extended continuous eligibility and Medicaid workforce initiatives. CMS stated it will no longer approve or extend waivers that permit individuals to remain enrolled despite losing eligibility or that use Medicaid funds for job training programs, citing sustainability concerns and over $1 billion in federal commitments to date. The agency will allow existing initiatives to expire but future demonstration approvals will be limited to initiatives with clear health outcomes, cost-effectiveness, and accountability.

CMS Targets Duplicate Medicaid Enrollment Under New Integrity Initiatives. The Centers for Medicare & Medicaid Services (CMS) announced on July 17, 2025, that it is implementing three initiatives to reduce duplicative enrollment in Medicaid, CHIP, and subsidized Marketplace coverage, with estimated savings of up to $14 billion annually. A CMS analysis of 2024 data found that 2.8 million individuals were either enrolled in Medicaid or CHIP in more than one state or simultaneously enrolled in Medicaid/CHIP and a subsidized ACA Exchange plan. To address this, CMS will:

- Provide states with lists of individuals enrolled in Medicaid/CHIP in multiple states and request redeterminations of eligibility.

- Notify individuals dually enrolled in Medicaid/CHIP and a subsidized federally facilitated Exchange (FFE) plan. If duplicative enrollment is not resolved within 30 days, subsidies will be discontinued.

- Coordinate with state-based Exchanges (SBEs) to verify and resolve dual enrollment using similar processes.

CMS will issue further guidance in August and expects states to make good-faith efforts to complete eligibility checks by late fall. These efforts are supported by new enforcement tools included in the One Big, Beautiful Bill Act.

Marketplace Plans Seek 15 Percent Premium Hikes. KFF Health News reported on July 18, 2025, that Affordable Care Act (ACA) Marketplace health plans are requesting median increase of 15 percent for 2026 due to rising medical costs and policy changes under the Trump administration. Without action from Congress, individuals earning above 400 percent of the federal poverty level would no longer qualify for subsidies—raising average premium costs by over 75 percent and potentially doubling premiums in some areas. Insurers warn that enrollment could drop by as much as 57 percent, leading to a sicker risk pool and further destabilizing the market.

Industry News

Humana Files New Medicare Advantage Star Rating Lawsuit in Federal Court. Reuters reported on July 21, 2025, that Humana has filed a new lawsuit in federal court over its 2025 Medicare Advantage star rating. The company previously filed a lawsuit over the rating, but a judge dismissed the case in July 2025 after finding that Humana had not exhausted all out-of-court options to challenge the ratings. In the new lawsuit, Humana claims it has gone through the administrative appeals process in recent months and now has standing to sue.

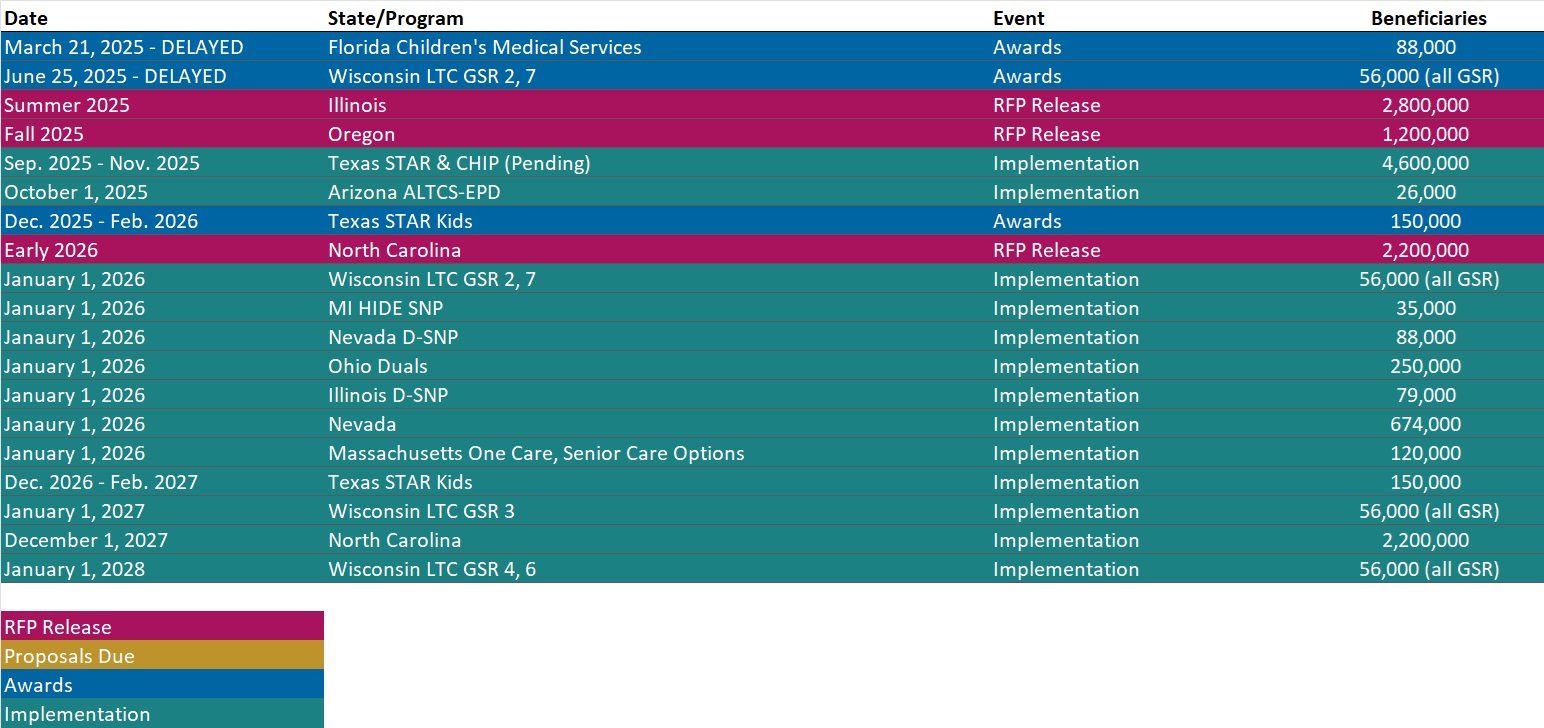

RFP Calendar

Actuaries Corner

Medicaid Cuts Could Have ‘Far-Reaching’ Healthcare, Economic Impacts: Study. Coverage losses linked to the massive tax and policy law could drive up excess deaths and preventable hospitalizations by 2034, according to the study. Editor’s Note: Among the most contentious provisions in the sweeping “One Big Beautiful Bill” signed earlier this month is a $1 trillion cut to federal Medicaid funding. The study warns these cuts could lead to 1.6 million people annually delaying care due to cost, and nearly 1.9 million instances of medication nonadherence—contributing to a rise in preventable hospitalizations and excess deaths by 2034. If Medicaid coverage losses exceed current projections, the consequences could be even more dire.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Conference

Adapting for Success in a Changing Healthcare Landscape

Navigating the New Federal Policy Shifts? Get Grounded with Timely Workshops at the HMA National Conference

As Medicaid work requirements, new Medicare models, and the evolving federal policy landscape reshape healthcare, it’s more important than ever to adapt quickly and effectively. At the HMA National Conference in New Orleans, join us for expert-led sessions that directly address these issues—offering practical insights and actionable strategies you can put to work. With this year’s workshops, you’ll find the firm footing you need—starting with a broad overview of the trends and forces reshaping Medicare, Medicaid, digital health, and behavioral health, and then diving deep into real-world use cases, operational strategies, and peer-driven solutions. The main stage sessions and workshops are designed to give you both the context and the concrete tools to navigate uncertainty with confidence—and prepare you to lead change in your organization.

Early bird pricing ends July 31, 2025.

HMA Podcast

Ready or Not: Implementing Strategy Amid Massive Healthcare Disruption. Rebecca Nielsen and Alex Rich, co-leaders of HMA’s Strategy and Transformation practice, have been supporting healthcare strategies in an ever-changing environment defined by constant disruption from AI, shifting regulatory policies, and financial strain. With so much change in the air now, many strategic plans are outdated before they ever get implemented. In this episode of Vital Viewpoints on Healthcare, they expose the blind spots that sabotage even the most well-crafted strategies and offer a grounded look at what actually works when change is the only constant. They unpack the challenge of the 5-year strategic plan and the risk of trying to do everything at once, explaining why real-time information sharing may be your most overlooked leadership tool. If your organization is struggling to turn strategy into action, this is the clarity you’ve been waiting for. Listen Here

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- Updated HMA Medicaid Databook

- Updated Section 1115 Medicaid Demonstration Inventory

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

- Updated Minnesota, Montana, and Nebraska Overviews

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].