This week's roundup:

- In Focus: CMS Provider Tax Guidance Places New Pressures on Medicaid Budgets

- In Focus: State Medicaid Programs Face New Challenges: Findings from the 2025 Medicaid Budget Survey

- Colorado Governor’s Proposed Budget Plan Includes Major Medicaid Cuts Amid Growing Deficits

- Louisiana Names Seth J. Gold as Medicaid Director

- Michigan Releases Healthy Kids Dental Program RFP

- Nebraska Submits Section 1115 SUD Demonstration Amendment

- South Carolina Medicaid to No Longer Cover Weight Loss Medication in January 2026

- Medica to Acquire UCare’s Medicaid, Marketplace Businesses

- MVP Health Care to Acquire Independent Health

In Focus

CMS Provider Tax Guidance Places New Pressures on Medicaid Budgets

The Centers for Medicare & Medicaid Services (CMS) issued a letter on November 14, 2025, which provides preliminary guidance on healthcare-related taxes affected by Sections 71115 and 71117 of the Budget Reconciliation Act of 2025 (OBBBA, P.L. 119-21)—the portion of the legislation that focuses on new limitations on provider assessments.

Although this letter does not change federal regulations, it signals an important policy shift that will affect how states fund their Medicaid programs. CMS is working to incorporate these interpretations into rulemaking through the federal notice and comment process.

Health Management Associates (HMA) reviewed the letter specific to these provisions and in the context of other policy and financing changes that are affecting the Medicaid program. This article highlights key clarifications in the letter, the impact of the preliminary guidance on states, and the potential for the guidance to shape Medicaid budgets, financing strategies, and future policy reforms.

Guidance Clarifies the Meaning of “Enacted” and “Imposes”

OBBBA prohibits states from establishing new provider taxes after July 4, 2025. Existing provider taxes may be grandfathered if they meet specific criteria, but most taxes in expansion states—except those on nursing and intermediate care facilities—will be phased down starting October 1, 2027. To qualify for grandfathering, a tax must be both “enacted” and “imposed” by July 4, 2025, as defined by CMS.

CMS interprets enacted and imposed in the following way.

- Enacted: CMS defines enacted based on two components. First, the state or local government must have completed the legislative process to authorize the tax by July 4, 2025. Second, any necessary tax waiver of the broad-based and uniformity requirements must be approved no later than July 4, 2025. This interpretation will present challenges for some states as any pending tax waiver requests and approvals issued after July 4, 2025, will not qualify for grandfathering.

- Imposed: In addition to the enacted requirements, a state must have been actively collecting revenue for the new tax as of July 4, 2025. CMS does appear to allow for instances in which a state’s routine collection and billing practices require the tax be paid on a delayed schedule—a common practice across states.

CMS may continue to approve pending state proposals for new and revised tax structures; however, with the approvals, CMS is also notifying states that any tax structure that is ineligible for grandfathering must be revised by October 1, 2026, to comply with Section 71115 of the OBBBA.

Guidance Sets Preliminary Timeline for Compliance with New Broad-based and Uniformity Requirements in Section 71117

The OBBBA and a separately proposed rule published in May 2025 provide CMS with additional flexibility to tighten requirements for waivers that allow states to impose provider taxes that are not broad-based and uniform (i.e., the tax is levied on providers in a class at a common rate). CMS believes states have used a strategy to pass the prescribed statistical test for these waivers while shifting a disproportionate share of tax burden to high Medicaid providers.

The November 14 letter also includes a preliminary timeline for states to restructure their taxes to comply with the new requirements related to waivers of the broad-based and uniformity tests.

- MCO taxes: States that levy a higher tax rate on Medicaid managed care organizations (MCOs) than on other MCOs must submit a revised tax structure applicable to the state fiscal year (SFY) starting in calendar year (CY) 2026.

- Taxes on all other provider types: States with a similar tax structure on another provider class would need comply by the conclusion of the SFY, ending in CY 2028.

CMS notes that the preliminary timeline for the MCO taxes is the minimum transition period, and the final rule may allow for a transition period of up to three fiscal years.

What It Means for States

All states except Alaska rely on one or more provider tax(es) to fund their Medicaid programs. These additional limitations on the uses of provider taxes—including those now in place—will put a significant strain on state budgets, beginning as early as October 1, 2026. States may need to reduce provider reimbursement and/or enrollee benefits to address these losses.

States and providers should start planning for the changes in revenue now. Strategic planning for provider tax sustainability and close monitoring of upcoming CMS rulemaking are essential.

Connect with Us

The potential impact will vary by state, and each tax structure should be individually assessed to fully understand the implications of this new guidance. HMA has designed, developed, and helped implement provider taxes across the country and is uniquely positioned to support states, MCOs, and providers as they navigate the evolving landscape.

For details about the federal guidance and considerations for your organization, contact Mary Goddeeris.

State Medicaid Programs Face New Challenges: Findings from the 2025 Medicaid Budget Survey

KFF and Health Management Associates (HMA), on November 13, 2025, released the annual Medicaid Budget Survey, A View of Medicaid Today and a Look Ahead: Balancing Access, Budgets and Upcoming Changes Results from an Annual Medicaid Budget Survey for State Fiscal Years 2025 and 2026. Now in its 25th year, this report offers a window into the evolving landscape of state Medicaid policy, financing, and operations across the United States. The survey was conducted in collaboration with the National Association of Medicaid Directors (NAMD), with 48 states providing survey responses by October 2025.

Released before the NAMD 2025 Fall Conference, Medicaid directors’ insights and the challenges, priorities, and innovations shaping Medicaid programs in fiscal years (FYs) 2025 and 2026 will figure prominently at this event. A team of HMA experts will be in attendance and available to address new developments and opportunities in state Medicaid policy and financing.

Key Trends and Challenges

Fiscal Pressures and Budget Uncertainty

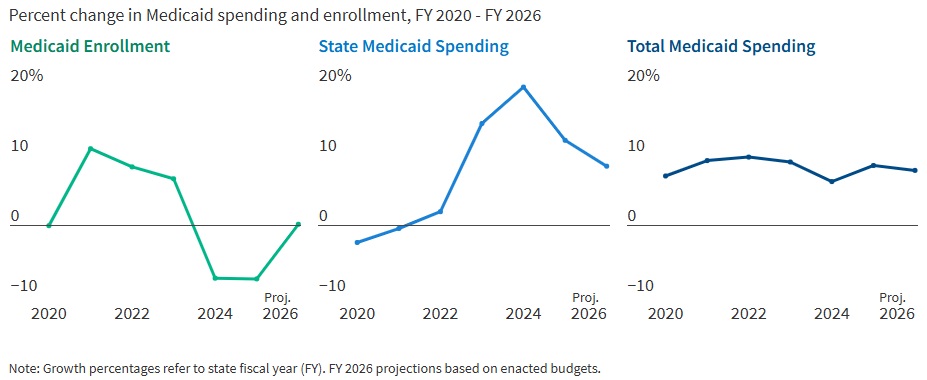

States are entering FY 2026 with slower revenue growth and rising healthcare costs. In FY 2025, Medicaid enrollment dropped by 7.6 percent as pandemic-era continuous coverage policies ended, but spending continued to climb. In fact, total Medicaid spending grew 8.6 percent in FY 2025 and is projected to rise another 7.9 percent in FY 2026. State Medicaid spending growth is expected to slow from 12.2 percent in FY 2025 to 8.5 percent in FY 2026. Nearly two-thirds of Medicaid directors, however, thought the odds of a Medicaid budget shortfall in FY 2026 was “50-50,” “likely,” or “almost certain.” Cost drivers include increases in provider rates, higher acuity enrollees, greater long-term care and behavioral health utilization, and rising pharmacy costs, especially for specialty drugs.

Figure 1. Medicaid Spending and Enrollment Trends Since the COVID-19 Pandemic Began

Federal Policy Changes and Provider Taxes

States are preparing for major federal policy changes under the 2025 budget reconciliation law (OBBBA), which will reduce federal Medicaid funding and impose new eligibility requirements. On November 14, 2025, the Centers for Medicare & Medicaid Services issued guidance regarding the OBBBA’s restrictions on states’ ability to use healthcare-related provider taxes to finance Medicaid programs (see CMS Provider Tax Guidance Places New Pressures on Medicaid Budgets). States are now generally prohibited from enacting new provider taxes or increasing existing ones after July 4, 2025, and must comply with new rules by the end of FY 2026 or FY 2028, depending on the tax type. In particular, beginning in federal FY 2028, the OBBBA gradually reduces the safe harbor provider tax limit for states that have adopted the ACA Medicaid expansion by 0.5 percent annually until the safe harbor limit reaches 3.5 percent of net patient revenues in federal FY 2032. These changes will reduce states’ flexibility to use provider taxes as a source of non-federal Medicaid funding, potentially leading to budget gaps and reductions in provider payments if lost revenue cannot be replaced.

Policy Changes and Priorities

Managing Risk in Managed Care Programs

A total of 46 states operate some form of managed care, and capitated managed care remains the predominant delivery system for Medicaid in most states. Most states that contract with capitated managed care organizations (MCOs) reported imposing a minimum medical loss ratio (MLR) requirement, requiring remittance payments when an MCO falls short of the minimum MLR requirement, and using risk corridors to manage financial risk and ensure value. States are also grappling with the growing use of artificial intelligence, particularly in the context of managed care prior authorization. Early policies focus on transparency, oversight, and ensuring human review to address concerns about bias, inappropriate denials, and privacy risks.

An Uptick in Provider Rate Reductions and Provider Tax Restrictions on the Horizon

Most states implemented fee-for-service rate increases for at least one provider category in FY 2025 and FY 2026. The number of increases is slowing, however, and there was an increase in states reporting provider rate restrictions compared with previous years. States continue to target rate increases for nursing facilities and home and community-based services more than other provider types.

Provider taxes remain a key source of the non-federal share of Medicaid funding, with all states except Alaska having at least one tax. These taxes accounted for a median 18 percent of states’ FY 2026 non-federal Medicaid financing, but new federal restrictions enacted in the OBBBA will limit states’ ability to use or expand these taxes going forward. As of July 1, 2025, 31 Medicaid expansion states reported having a non-exempt provider tax greater than the 3.5 percent of net patient revenues and therefore subject to the OBBBA’s phase down requirement.

Strong Benefit Enhancements and Scrutiny of Prescription Drugs

New Medicaid benefits and benefit enhancements continued to outpace benefit cuts and limitations. In all, 37 states reported new or enhanced benefits in FY 2025, and 36 plan to add or enhance benefits in FY 2026. More specifically, states reported expanding services across the behavioral health care continuum and for prenatal, delivery, and postpartum services. Most states reported at least one new or expanded initiative to contain prescription drug costs, including participation in the Centers for Medicare & Medicaid Services (CMS) Cell and Gene Therapy Access Model. State responses also reflected a waning interest in expanding Medicaid coverage for costly obesity drugs (GLP-1s), with some states restricting coverage because of budget pressures.

Challenges and Priorities

Many states are confronting more difficult fiscal conditions while also preparing for future fiscal uncertainty driven, in part, by the OBBBA. Medicaid leaders also expressed concern about the complexity of implementing new federal requirements, including work requirements and more frequent eligibility determinations. At the same time, state Medicaid leaders reported that they continue to pursue a variety of program priorities to expand access, especially to behavioral health and long-term care services, implement initiatives targeting specific populations (e.g., people who are pregnant, justice-involved, and at risk of homelessness), reform and strengthen delivery systems, modernize IT systems and infrastructure, and expand program integrity efforts.

Connect with Us

States face a challenging fiscal environment as they balance cost containment, quality, and access in their Medicaid programs. The combination of rising healthcare costs, new federal restrictions on provider taxes, and anticipated funding reductions will require states to make decisions about coverage, benefits, and provider payments. Nonetheless, states remain committed to maintaining quality and access for Medicaid beneficiaries, using available resources, and pursuing innovative approaches to care delivery.

For more information about the key takeaways from the KFF report and HMA’s Medicaid solutions, contact Kathy Gifford or Carrie Rosenzweig.

HMA Roundup

Colorado

Colorado Governor’s Proposed Budget Plan Includes Major Medicaid Cuts Amid Growing Deficits. Denver 7 ABC reported on November 13, 2025, that Colorado Governor Jared Polis presented his fiscal year 2026-27 budget proposal to lawmakers, outlining significant Medicaid cuts to address the state’s large budget deficit driven by revenue losses tied to federal policy changes under OBBBA. The plan includes more than $79 million in reductions to the Department of Health Care Policy and Financing and an additional $537 million in cuts initiated through executive action. Lawmakers raised concerns that the reductions could harm vulnerable populations and shift more people into higher-cost institutional care. The final impact remains uncertain as the Joint Budget Committee continues the budget process heading into early 2026.

Louisiana

Louisiana Names Seth J. Gold as Medicaid Director. CenLANow/Louisiana Reporter reported on November 14, 2025, that the Louisiana Department of Health has named Seth J. Gold as the state Medicaid director. Gold previously served as a professional staff member for the U.S. House Committee on Energy and Commerce.

Michigan

Michigan Releases Healthy Kids Dental Program RFP. The Michigan Department of Health and Human Services (MDHHS) released on November 18, 2025, a request for proposals (RFP) for the Healthy Kids Dental Program. The program serves 955,000 children statewide and provides services such as X-rays, cleanings, fillings, and extractions. Proposals are due January 12, 2026. New contracts will run from October 1, 2026, through September 2031, with up to 3 additional renewal years. The state has identified seven goals for the contract rebid, including promoting good oral health practices, promoting a patient-centered approach, increasing dental providers participating, increasing access, designing and implementing best practices in dental care health shortage areas, collaborating with community organizations, and increasing education and dental service usage. The current incumbent is Delta Dental.

Nebraska

Nebraska Submits Section 1115 SUD Demonstration Amendment. The Centers for Medicare & Medicaid Services (CMS) announced on November 14, 2025, that Nebraska has submitted an amendment request for its Section 1115 Substance Use Disorder (SUD) Program Demonstration. The amendment seeks to expand federal financial participation to cover short-term inpatient and residential treatment in Institutions for Mental Diseases for individuals with serious mental illness or serious emotional disturbance, and to add medical respite services for adults experiencing homelessness or housing instability. Nebraska is requesting approval for these changes beginning in 2026 as part of its broader effort to strengthen behavioral health treatment capacity and improve care access for high-need Medicaid populations. The public comment period will be open through December 14, 2025.

South Carolina

South Carolina Medicaid to No Longer Cover Weight Loss Medication in January 2026. The South Carolina Daily Gazette reported on November 17, 2025, that the South Carolina Medicaid program will end coverage of weight loss drugs for obesity, beginning January 2026. The state first began to cover GLP-1s for obesity November 2024, but expenditures for coverage of the medication for weight loss exceeded budgeted estimates. In the last fiscal year, state expenditures for the medications were $2.3 million, while federal expenditures were $5.5 million. South Carolina will continue to cover the medications for patients with Type 2 diabetes.

Industry News

Medica to Acquire UCare’s Medicaid, Marketplace Businesses. Medica and UCare announced on November 17, 2025, that Medica will acquire UCare’s Medicaid and Marketplace businesses. Lisa Erickson will continue to serve as Medica’s president and chief executive. The transaction is anticipated to close in the first quarter of 2026.

MVP Health Care to Acquire Independent Health. New York-based health plan MVP Health Care announced on November 18, 2025, that it will acquire Independent Health, subject to regulatory approval. Combined, the plans will serve nearly one million members with $7 billion in annual revenue. Terms were not disclosed.

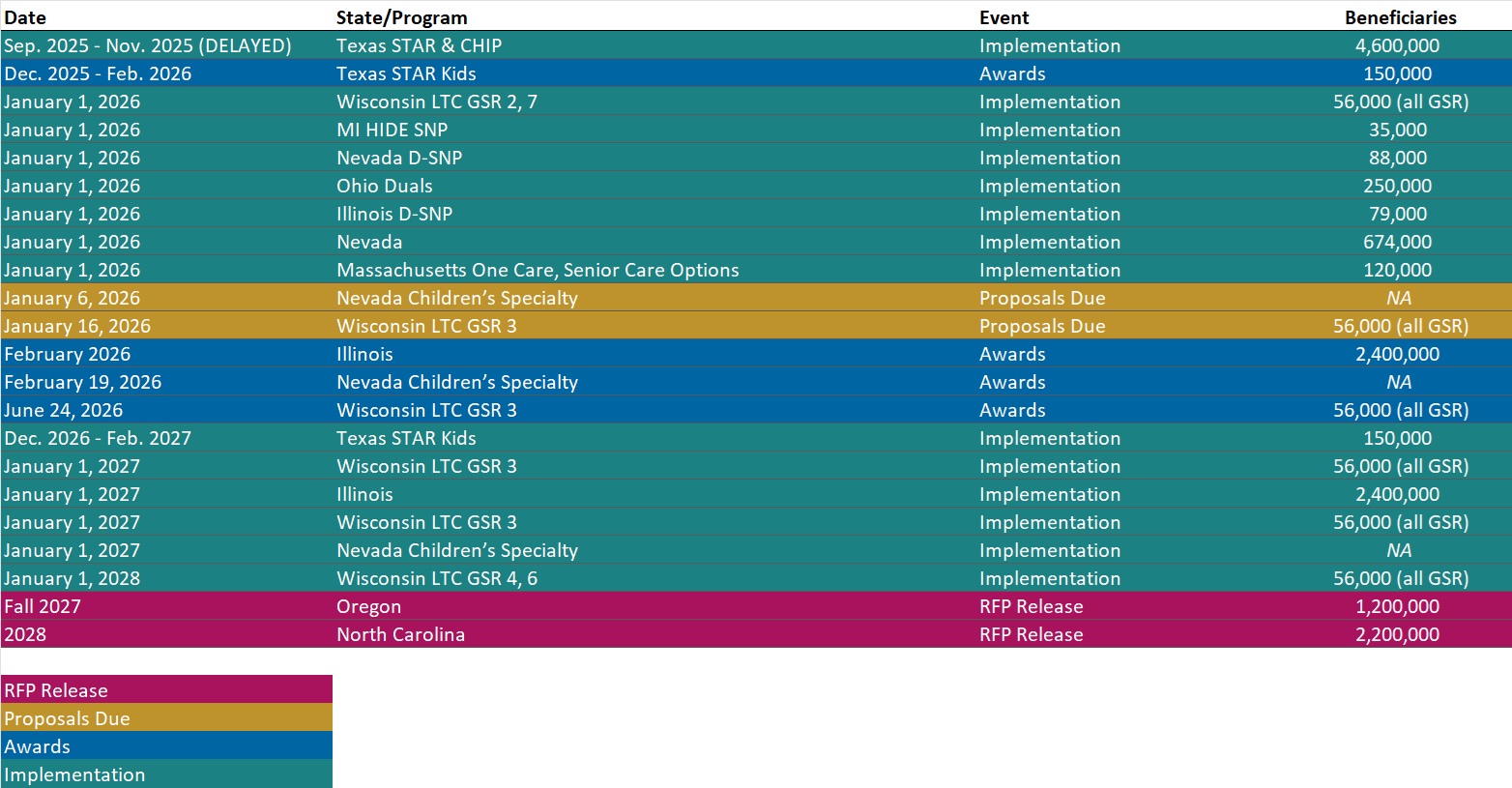

RFP Calendar

Actuaries Corner

Historic Government Shutdown Ends, Leaving ACA Subsidies in Limbo. The longest government shutdown in history came to an November 12, after President Donald Trump signed a stopgap spending bill. Editor’s Note: Washington is moving to restart government operations, but Democrats leave without their key win of securing a long-term extension of enhanced ACA tax credits set to lapse at the end of 2025. Senate Republicans have only agreed to hold a vote before year’s end, offering no assurance the subsidies will continue and resulting in mounting uncertainty heading into the 2026 coverage year.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Webinars

Value Based Care Advisory Services: HMA and Wakely Put Analysis into Action. Thursday, November 20, 2025, 1 PM ET. Join experts from HMA and Wakely for an inside look at how our teams help organizations navigate and thrive in the value-based landscape. This session will highlight case studies and recent work that demonstrate a comprehensive advisory solution for any value-based entity. Attendees will gain a deeper understanding of how integrated insights across strategy, analytics, and implementation can drive measurable results in value-based care. Register Here

Redefining Revenue: Building Financial Resilience in an Era of Policy and Payment Change. Thursday, December 11, 2025, 1 PM ET. As healthcare organizations face sweeping shifts in Medicaid funding, workforce costs, and payer expectations, leaders must think beyond short-term cuts and find sustainable ways to protect access, quality, and mission. Join HMA experts Jose Robles, Juan Montanez, and Kristina Ramos-Callan for a timely discussion on how hospitals, health systems, and providers can reimagine revenue strategy for the next decade. Register Here

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- New HMAIS RHTP Application Tracker

- Updated Medicaid Managed Care Procurement Tracking

- Updated Section 1115 Medicaid Demonstration Inventory

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

- Updated Wisconsin State Overview

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].