This week's roundup:

- In Focus: Navigating the Post-Subsidy Cliff—Mitigating Premium Increases After Enhanced ACA Subsidies Expire

- HMA Conference: Important Insights, Facilitated Introductions, Real Impact

- Arizona Terminates ALTCS-EPD Procurement, Plans New RFP Release in Fall 2026

- Colorado Governor Balances Budget with $79 Million in Medicaid Cuts

- Georgia Receives Temporary Extension for Pathways to Coverage Demonstration

- North Carolina Medicaid Funding Stalls, Cuts Set for October 1

- Ohio Releases First Comprehensive Maternal Care Program Performance Results

- Centene to Expand D-SNP Offerings Statewide in Four States in 2026

- Aetna to Expand Clinical Collaboration Program to 10 Hospitals for Improving MA Care Coordination

In Focus

Navigating the Post-Subsidy Cliff—Mitigating Premium Increases After Enhanced ACA Subsidies Expire

As the end of 2025 approaches, the future of enhanced premium subsidies for Affordable Care Act (ACA) Marketplace coverage remains uncertain. These subsidies, extended by the Inflation Reduction Act (IRA), are set to expire December 31, 2025. Without congressional action, millions of Americans will face a sudden and significant increase in out-of-pocket premium costs, reintroducing the “subsidy cliff” and raising the percentage of income that they will need to direct toward health insurance premiums. More than 16 million consumers who now receive subsidies will be affected, making this a critical issue for policymakers, payers, and consumers.

A new white paper from Wakely, an HMA Company, offers a timely and detailed analysis of the potential impacts and strategic considerations for stakeholders navigating this uncertain terrain.

How ACA Subsidies Are Calculated: The Mechanics Behind Premiums

The white paper explains that advance premium tax credits (APTCs) are designed to cap a household’s health insurance premium contribution at a specific percentage of income. The calculation is based on household income, size, the cost of the benchmark Second Lowest Cost Silver Plan (SLCSP), and age. The expiration of enhanced subsidies will revert contribution percentages to higher levels, increasing costs for all income brackets.

Premium Shock: Quantifying the Impact of Subsidy Expiration

Wakely’s analysis shows that the expiration of enhanced subsidies will result in a substantial increase in monthly premium contributions. For example, a hypothetical single 40-year-old at 150 percent of the federal poverty level (FPL) will see monthly premiums jump from $0 to $81.97 in order to keep the same plan.

Mitigation Strategy: Buying Down to the Lowest Cost Silver Plan

Consumers may offset part of the premium increase by switching from the SLCSP to the Lowest Cost Silver Plan (LCSP). The difference in premiums between these two plans translates directly into monthly savings, independent of income. In Raleigh, NC, a hypothetical 40-year-old could save $53.03 per month by buying down, mitigating about two-thirds of the premium shock. For older consumers, the savings are even greater; however, in highly competitive markets like Charlotte, NC, the premium gap—and the savings—will be much smaller, offsetting only a modest portion of the increase.

Consumer Savings

After applying the buy-down strategy, the net premium increase for a hypothetical single 40-year-old at 150 percent of the FPL in Raleigh will be $28.94 per month rather than $81.97 without mitigation. Depending on age and location, consumers can offset 37‒100 percent of the premium increase in less competitive markets, but only 7‒28 percent in highly competitive ones.

Market Dynamics: Why Local Competition Matters

The effectiveness of mitigation strategies depends on local market dynamics and competition. In markets with fewer carriers and larger premium gaps, consumers have greater opportunities to offset premium increases. In competitive markets, options are more limited. The paper notes that the 2026 landscape may shift due to carrier exits and price changes, underscoring the need for ongoing monitoring and adaptive strategies.

Recommendations for Payers, Regulators, and Brokers

- Payers should consider product design strategies that create meaningful premium gaps between Silver plans, where actuarially justified, to maximize consumer savings.

- Regulators can collaborate with insurers to support these strategies and, in state-based Marketplaces, may play an active role in limiting Silver offerings that erode premium gaps.

- Brokers and Carriers may want to market Bronze plans as a last-resort coverage option, as some consumers can access Bronze plans for free, which is preferable to going uninsured.

Connect with Us

Wakely is experienced in all facets of the healthcare industry—from carriers to providers to government agencies. Wakely actuarial and policy experts continually monitor and analyze potential changes to inform healthcare organization strategies and advance effective solutions to propel their success.

For questions about this analysis or to discuss strategies for navigating the post-subsidy cliff, contact Karan Rustagi.

HMA Conference: Important Insights, Facilitated Introductions, Real Impact

As states and organizations across the country are navigating tight budgets and difficult decisions, Health Management Associates (HMA) recognizes the challenge and is committed to supporting leaders and teams who are driving change. That’s why we’re offering a special discount code: FLASH25 for this year’s HMA National Conference. We want to make it easier for you to gain important insights, be inspired by innovations changing the healthcare landscape, and connect with other healthcare leaders Oct. 14-16, in New Orleans, LA.

Why Attend the HMA National Conference?

This is not just another industry event. The HMA National Conference brings together an unmatched group of thought leaders, decision makers, experienced administrators, and innovators from across the health policy, government, community, and industry sectors. In today’s environment, it is more important than ever to get out to events, build your network, and engage with the people who are shaping the future of health care.

What makes the HMA event different?

- Networking that Matters: This is your opportunity to connect with peers and leaders who understand the challenges you are facing and can offer practical solutions and inspiration. HMA experts are there to facilitate introductions and make the connections that are not possible at other meetings.

- Unparalleled Caliber of Attendees: You will not find this mix of roles and expertise anywhere else. Our attendees include those developing and championing policy, investing in infrastructure, leading growth initiatives, process efficiency leaders, and those advancing value and access across the continuum—from physical and behavioral health to the social determinants of health.

- Comprehensive Agenda: The conference agenda is designed to tackle the most pressing issues, including policy and budget reprioritization, infrastructure investments, optimizing digital health technology and AI, consumer empowerment, process efficiency, and strategies to improve value and access to services. We have powerhouse speakers lined-up to challenge and inspire you.

Acknowledging Budget Realities

HMA understands the financial pressures facing organizations and agencies across the health care sector. Our work with clients and partners gives us a unique perspective on the tough choices leaders are making every day. That’s why we want to help make participation at the 2025 HMA National Conference possible. Use code FLASH25 for a 25% discount on registration—because we believe that investing in your professional growth and connections is more important than ever.

Join Us

Whether you’re focused on policy, operations, IT, consumer engagement, or strategy and growth, the HMA National Conference is the place to find the people, ideas, and strategies that will help you tackle today’s challenges and prepare for tomorrow’s opportunities. For more information about the event contact Andrea Maresca.

HMA Roundup

Arizona

AZ Terminates ALTCS-EPD Procurement, Plans New RFP Release in Fall 2026. The Arizona Health Care Cost Containment System (AHCCCS) announced on September 18, 2025, that it has terminated the procurement for its Arizona Long-Term Care System – Elderly and Physically Disabled (ALTCS-EPD) program. The procurement had initially been awarded in December 2023 to UnitedHealthcare Community Plan and Centene/Arizona Complete Health Complete Care Plan, but the awards were later rescinded. AHCCCS then re-awarded contracts under a settlement agreement to UnitedHealthcare, Banner-University Family Care, Mercy Care, and Centene in May 2025. The agency will no longer pursue these contracts and now intends to release a new ALTCS-EPD procurement in Fall 2026. RFP documents, including proposals and protests, can be found here.

Colorado

Colorado Governor Balances Budget with $79 Million in Medicaid Cuts. The Denver Post reported on September 22, 2025, that Colorado Governor Jared Polis closed a $249 million budget gap, with about $79 million coming from Medicaid. The largest share of those reductions rolls back most of a planned 1.6 percent provider rate increase, leaving only about a 0.4 percent net increase for the year. Other savings include stricter prior authorization for certain services and program rollbacks. Hospitals, dentists, and other providers say the changes will strain access to care, especially with additional Medicaid funding reductions anticipated under federal H.R. 1 in future years. State officials emphasized that the cuts were necessary to balance the budget after automatic revenue losses tied to federal tax law changes.

Georgia

Georgia Receives Temporary Extension for Pathways to Coverage Demonstration. The Centers for Medicare & Medicaid Services (CMS) announced on September 23, 2025, that it has approved a temporary extension of Georgia’s Section 1115 “Pathways to Coverage” demonstration, the state’s Medicaid expansion program with work requirements, through December 31, 2026. The amendment expands qualifying activities to include Supplemental Nutrition Assistance Program (SNAP) Able-Bodied Adults Without Dependents compliance and caregiving for a child under age 6, while shifting beneficiary reporting from monthly to annual. It also eliminates previously authorized premiums and Member Rewards Accounts and aligns copayments with the state’s Medicaid plan. Coverage will now begin on the first day of the application month rather than providing retroactive coverage. CMS noted enrollment remains below projections at about 7,463 as of May 2025.

North Carolina

North Carolina Medicaid Funding Stalls, Cuts Set for October 1. WUNC reported on September 23, 2025, that North Carolina’s General Assembly adjourned without addressing the state’s Medicaid funding shortfall, triggering provider reimbursement cuts and loss of coverage for new weight-loss drugs beginning October 1. While both chambers agreed to allocate an additional $173.6 million for Medicaid, negotiations broke down over whether to tie the funding to $103.5 million for a new children’s hospital. As a result, the House and Senate failed to approve funding. Governor Josh Stein warned the stalemate could result in the loss of more than $1 billion in healthcare funding, and the Department of Health and Human Services has stated the cuts are required to keep the program in balance.

Ohio

Ohio Releases First Comprehensive Maternal Care Program Performance Results. The Ohio Department of Medicaid (ODM) released on September 23, 2025, performance results for the state’s Comprehensive Maternal Care (CMC) program, covering the first performance year which began in January 2023. There were 77 practices from 24 different organizations enrolled in CMC, which served almost 36,000 mothers. CMC is a statewide Medicaid community-based program that provides support for obstetrical practices to develop community connections by creating financial opportunities for maternal care providers to address patient and family needs across the entire cycle of childbearing. ODM distributed $4.2 million in per member per month payments during program year 2023 to the participating providers that met at least 50 percent of the program’s quality measures, which include hepatitis B/HIV screening, TDAP vaccination, tobacco cessation support, postpartum care, and maternal primary care visits. Going forward, ODM is considering an expansion of the program and aims to increase maternal mental health screenings, improve access to reliable medical transportation, encourage postpartum primary care visits, and enhance the overall care experience. In program year 2025, 129 practices from 52 entities are participating, serving approximately 49,000 people across 35 counties.

Industry News

Centene to Expand D-SNP Offerings Statewide in Four States in 2026. Health Payer Specialist reported on September 24, 2025 that in 2026, Centene’s WellCare will offer Medicare Advantage Dual Eligible Special Needs Plans (D-SNPs) in nearly every county in four out of five of the largest D-SNP states: Florida, New York, Pennsylvania, and Texas. In California, the other largest D-SNP state, Centene operates D-SNP plans but not in large coastal and northern rural areas. Centene and other large plans are locking in D-SNP membership as part of a strategy under the current rules that allow beneficiaries to be enrolled in separate Medicare and Medicaid plans. In 2027, beneficiaries will need to be enrolled under a single plan.

Aetna to Expand Clinical Collaboration Program to 10 Hospitals for Improving MA Care Coordination. Fierce Healthcare reported on September 22, 2025, that Aetna is expanding the Aetna Clinical Collaboration Program which aims to leverage hospital partnerships to improve Medicare Advantage (MA) outcomes by reducing hospital readmissions and emergency visits. The program rolled out earlier this year. Aetna is currently working with AdventHealth Shawnee Mission, Houston Methodist and WakeMed Health & Hospitals, and expects to implement the program into 10 hospitals by the end of 2025. Through the program, nurses are placed in each partner hospital to help assist with MA members’ transitions from the hospital to other types of care, such as skilled nursing facilities or at-home care.

RFP Calendar

Actuaries Corner

Medicare Prior Authorization Pilot Raises Concerns Among Providers. The additional red tape could save money, but may harm patient access and quality of care. Stakeholders are urging the CMS to increase transparency and hold participants accountable.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Podcast

Is the ACA Marketplace Built to Survive Another Decade of Change? Michelle Anderson, director and senior consulting actuary at Wakely, an HMA Company, joins Vital Viewpoints on Healthcare to unpack the state of the Affordable Care Act (ACA) marketplace. From the market’s volatile beginnings to today’s uncertainty around subsidies, Michelle shares how insurers, states, and consumers have adapted and what challenges lie ahead. We explore the forces shaping affordability, coverage options, and consumer behavior, as well as the critical policy decisions that could redefine the individual market in 2026 and beyond. Listen Here

HMA Webinars

Beyond Bundles: Preparing Hospitals for Success in TEAM and the Next Generation of Value-Based Models. Tuesday, September 30, 2025, 12 PM ET. Hospitals and health systems are under growing pressure to succeed in new value-based models that demand both operational transformation and strategic alignment. In this webinar, advisors from Health Management Associates, Wakely, an HMA Company and Nixon Peabody will break down the latest regulatory and contractual developments, explore lessons learned from the Comprehensive Care for Joint Replacement (CJR) model, and discuss how organizations can prepare for upcoming opportunities.

Speakers will share practical insights on:

- The regulatory, operational, and actuarial considerations hospitals must navigate

- Key takeaways from bundled payment initiatives like CJR

- How to leverage data and design strategies to build partnerships that position organizations for success in new Medicare models

This session is designed for hospital executives, provider organizations, payers, and policy leaders seeking to better understand how emerging value-based models will shape the future of care delivery and payment.

Beyond the Bill: How Pair Team and MCOs Are Meeting Community Needs Under HR 1. Thursday, October 2, 2025, 1 PM ET.

As Medicaid evolves under HR 1, Managed Care Organizations face increasing pressure to meet new engagement requirements while ensuring vulnerable communities don’t fall through the cracks. This shifting landscape demands scalable, innovative care models that go beyond compliance – focusing instead on meaningful connections, coordinated support, and whole-person care.

In this session, Jami Snyder, former HHSC Commissioner of TX and Medicaid Director of AZ, joins Neil Batlivala, CEO and Co-Founder of Pair Team, and Dr. Nate Favini, Chief Medical & Strategy Officer, to explore how Pair Team and its MCO partners are meeting this moment. Learn how their model combines technology, care coordination, and community-based partnerships to engage hard-to-reach members and address social drivers of health. You’ll hear real-world examples of how payers and partners can come together in smarter, more connected ways. By aligning efforts and building trust, they can drive better outcomes and create stronger community connections for the people who need support the most.

Medicaid 1115 Justice Involved Reentry Demonstration Opportunities: Engaging Key Stakeholders. Wednesday, October 22, 2025, 12 PM ET. This webinar will explore how states, local agencies, and community organizations can maximize Medicaid’s new 1115 demonstration authority to improve reentry outcomes for justice-involved individuals. Presenters will discuss practical strategies for assessing health and social needs, building strong collaborations with community providers, and implementing effective Medicaid enrollment processes. Attendees will gain insights into designing and operationalizing reentry programs that promote continuity of care, reduce recidivism, and support successful community reintegration. This session is ideal for State Medicaid agencies, carceral facilities, correctional healthcare companies, health plans, community-based organizations, and federally qualified health centers.

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- New Medicaid Managed Care Enrollment for Nearly 300 Plans in 41 States, Plus Ownership, Updated 2Q25

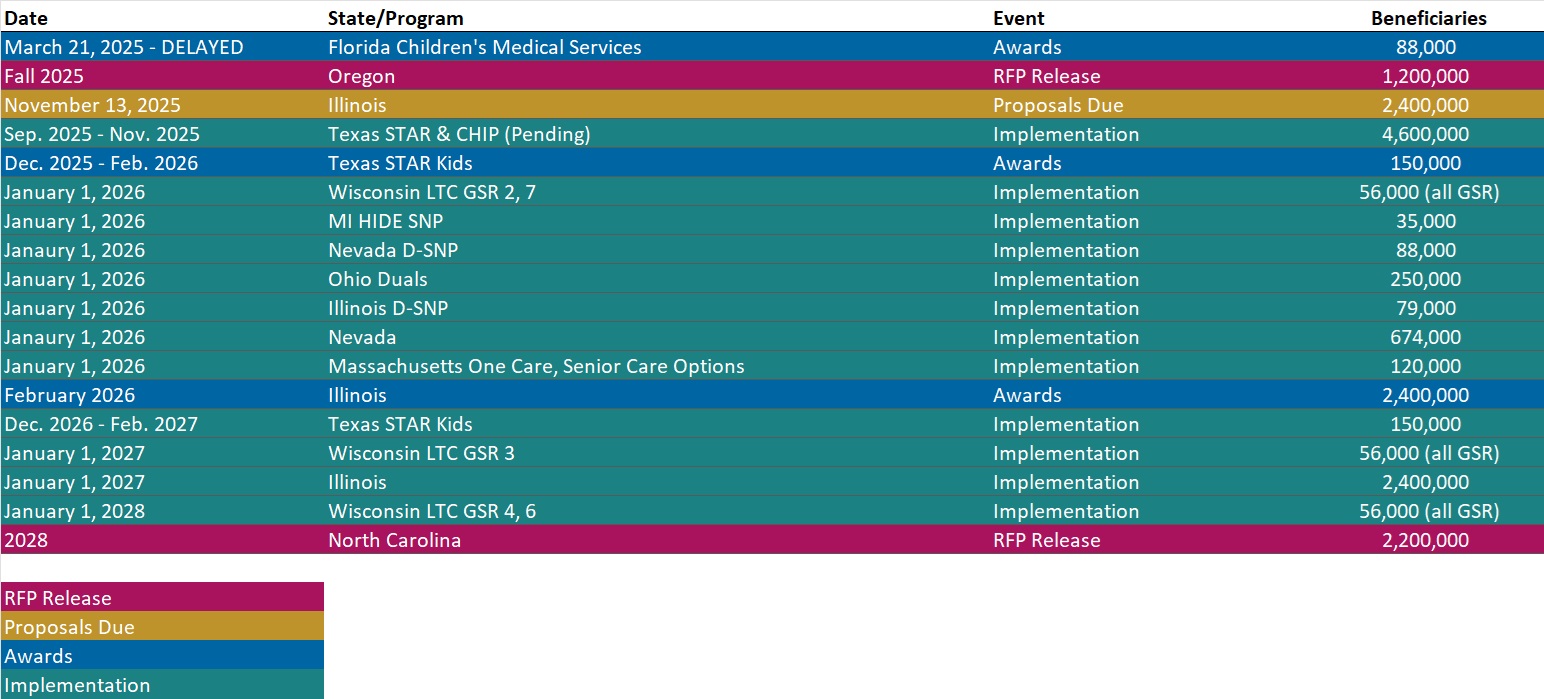

- Updated Medicaid Managed Care RFP Calendar

- Updated H.R. 1 Rural Health Transformation Program State Tracker

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].