On November 28, 2025, the Centers for Medicare & Medicaid Services (CMS) released the Contract Year 2027 Policy and Technical Changes to the Medicare Advantage Program and Medicare Prescription Drug Benefit Program. Each annual rulemaking cycle offers CMS an opportunity to recalibrate program priorities.

This proposed rule offers a road map for CMS’s vision for Medicare Advantage (MA) and Part D. Signaling how CMS leadership intends to shape the MA and Part D programs beyond 2027—prioritizing outcomes, streamlining operations, and inviting dialogue on modernization—the proposed rule reflects a strategic imprint on the program’s trajectory. The deadline to submit comments is January 26, 2026.

Given CMS’s goal of modernizing MA and Part D, plans, providers, and advocates should engage early to inform final policies. Health Management Associates (HMA) policy and actuarial experts, including Wakely and Leavitt Partners (both HMA companies), are analyzing and modeling the effect of the proposed changes. This article highlights some of the major policy updates that require near-term planning by states, Medicare Advantage plans, providers who serve MA beneficiaries, and their partners.

Key Themes in the Proposed Rule

Requests for Information

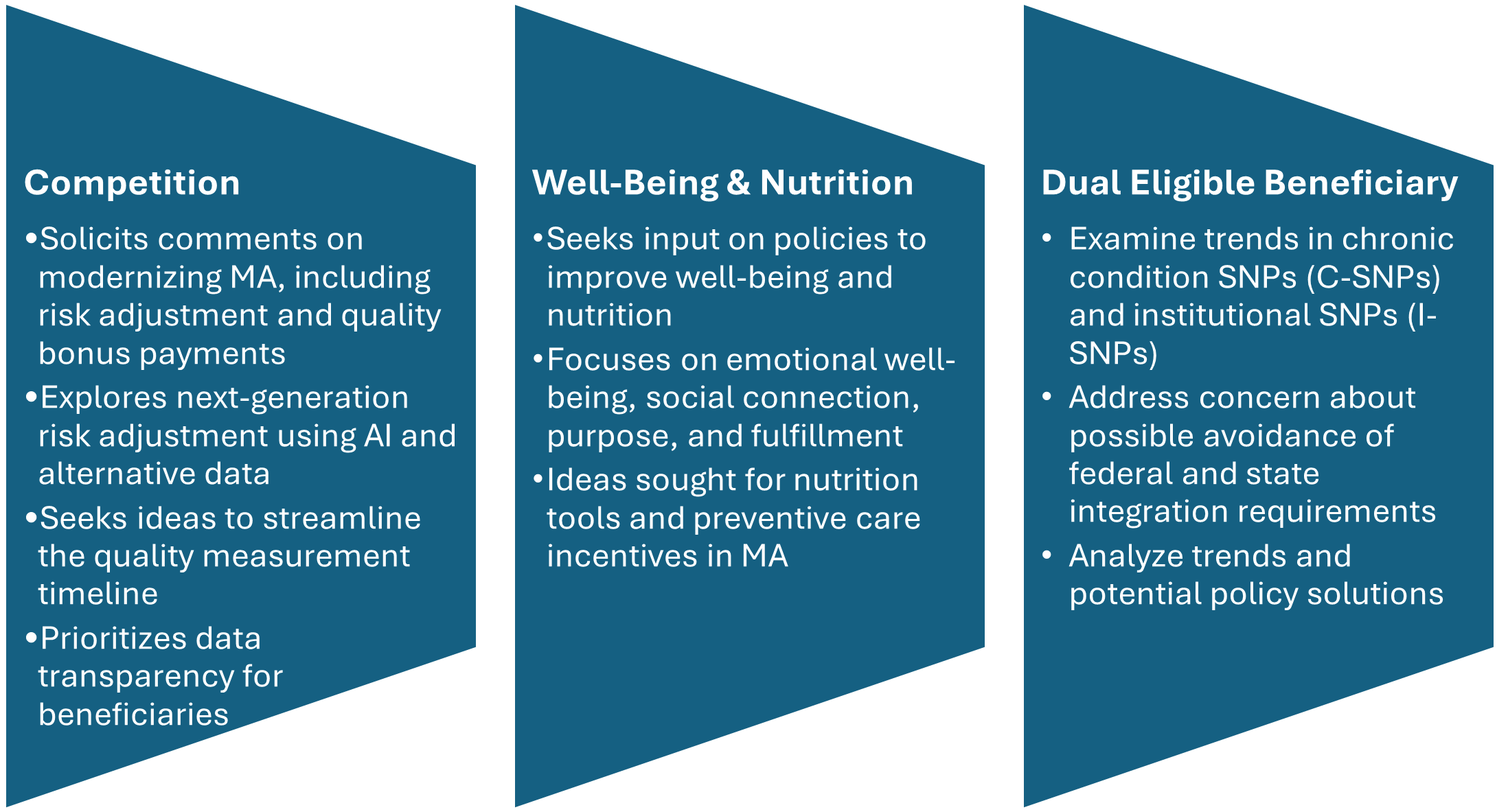

CMS includes three significant requests for information (RFIs) and highlights additional opportunities to provide input on approaches to reduce administrative burden throughout the program. CMS’s modernization RFI focuses on financing and other strategies to support beneficiaries with plan selection. In addition, CMS seeks input on emerging trends in MA special needs plans (SNPs), citing concerns about rapid growth and potential program integrity issues. Consistent with the departmentwide priorities, the RFI also delves into potential strategies for plans to address nutrition and wellness benefits for MA enrollees.

Figure 1. RFIs Signaling New Policy Directions

Star Ratings Overhaul: Refocusing on Outcomes and Experience

CMS proposes significant changes to the Star Ratings system, which influences plan bonuses and consumer choice. The changes increase the focus on clinical care, outcomes, and patient experience of care measures where performance is not topped out and align with universal foundation of measures.

- Health Equity Index Rollback: Rather than implement the previously planned Excellent Health Outcomes for All reward (formerly Health Equity Index) for 2027, the agency will continue using the historical reward factor that incentivizes consistently high performance across all measures.

- Measure Streamlining: Twelve process-heavy or administrative measures will be removed.

- Behavioral Health: A new measure for depression screening and follow-up will be introduced for the 2027 measurement year, with integration into Star Ratings by 2029.

Why It Matters: Removing these measures continues the shift away from administrative compliance, easing burden while strengthening quality incentives.

Medicare and Medicaid Dual Eligible SNPs and Integration

CMS is proposing several changes to improve how Medicare Advantage plans serve people who qualify for both Medicare and Medicaid (dual-eligible beneficiaries):

- Starting in calendar year (CY) 2027, CMS proposes to allow D-SNPs and I-SNPs two opportunities to change to their model of care (MOC)—the framework for how they coordinate care. These windows would be January 1 through March 31 and October 1 through December 31.

- When beneficiaries are automatically moved (i.e., passively enrolled) from one integrated D-SNP to another, CMS will no longer require the new plan’s provider network to closely match the old plan’s network. Instead, the new plan must ensure that all incoming members receive uninterrupted care for at least 120 days (up from 90 days), helping prevent gaps in treatment.

- In states where dually eligible individuals are explicitly carved out from or not required to enroll in Medicaid managed care, CMS proposes to let highly integrated dual eligible special needs plan (HIDE SNP) continue to enroll full-benefit, dual-eligible (FBDE) individuals in the same service area, even if those individuals are in Medicaid fee-for-service. This change is intended to maintain coverage and simplify enrollment for these beneficiaries.

Why It Matters: While the proposed changes revise broader policies, the updates could have significant effects on D-SNP and MA integration. These changes also could shape states’ decisions regarding their integration policies. Plans should continue to monitor these developments.

Other Notable Changes

CMS proposes a new special enrollment period (SEP) for beneficiaries when their providers leave a plan’s network, eliminating the requirement that CMS deem the change “significant.” The intent of this change is to preserve continuity of care and ease the burden of beneficiaries switching plans. In addition, CMS plans to codify SEP policies for greater consistency.

The proposed rule also calls for the following:

- Codifying multiyear changes stemming from the Inflation Reduction Act, including elimination of the coverage gap phase

- Lowering annual out-of-pocket thresholds and removal of cost sharing in catastrophic coverage

- Transitioning to the Manufacturer Discount Program and updating true out-of-pocket (TrOOP) calculations

- Clarifying specialty-tier drugs and subsidy structures

As a result, plans will have updated financial responsibilities.

Connect With Us

As CMS sets a new course for Medicare Advantage and Part D, organizations face both opportunities and challenges in adapting to these changes. HMA brings deep expertise in Medicare policy, actuarial modeling, and operational strategy. Our team—including experts from Wakely and Leavitt Partners—can help plans, providers, and stakeholders interpret the proposed rule, assess its impact, and develop actionable strategies for compliance and competitive positioning.

Whether you need data-driven analysis, scenario modeling, or hands-on support preparing for implementation, HMA is ready to partner with you to navigate the evolving Medicare landscape and achieve your goals. Contact our experts below to discuss your questions and how HMA can help.