This week's roundup:

- In Focus: HHS Issues Immediate Policy Shift on Federal Benefit Eligibility Under PRWORA

- In Focus: CMS Proposes New Ambulatory Specialty Model, Provides Details About Cell and Gene Therapy Model

- Arizona to Hold Listening Session on Section 1115 Demonstration Renewal

- Colorado Medicaid to Cover Mental Health Services Under Collaborative Care Model

- Kentucky Submits New 1115 Application to Refer Expansion Enrollees to Job Services

- Nebraska to Cut Medicaid Reimbursement for ABA Services

- South Carolina Submits Section 1115 Demonstration Application to Expand Medicaid to Certain Caregivers with Work Requirements

- Utah Seeks Federal Approval to Amend Medicaid Reform Section 1115 Demonstration

- CMS Proposes Hospital Outpatient, Ambulatory Surgical Center Rate Increase of 2.4 Percent in CY 2026 Proposed Rule

- Sycamore Partners to Buyout Walgreens Boots Alliance

In Focus

HHS Issues Immediate Policy Shift on Federal Benefit Eligibility Under PRWORA

On July 10, 2025, the US Department of Health and Human Services (HHS), Department of Labor, Department of Justice, Department of Education, and US Department of Agriculture (USDA) issued notices that significantly reinterpret the definition of “federal public benefit” used in Title IV of the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA). These changes are effective immediately upon publication in the Federal Register, though agencies have opened 30-day public comment periods to solicit feedback.

In this article, Health Management Associates (HMA) experts explain two of these notices—those from HHS and USDA—based on what we know and outstanding issues that organizations should expect to arise in the coming months.

Programs Affected by HHS’s Revised Interpretation

The notice changes HHS’s 1998 interpretation of PRWORA and will have sweeping implications for service delivery across the country. It does this by reversing the classification of many long-standing programs to be “Federal public benefits;” until now, these programs had been specifically excluded from that definition. People with Unsatisfactory Immigration Status are not permitted to access these benefits. People classified as such include those who are undocumented, but also several categories of people lawfully in the United States, such as holders of H1B and J-1 visas, as well as some lawful permanent residents (green card holders — only for the purposes of eligibility for certain programs).

Programs newly subject to these restrictions include:

- Head Start

- Certified Community Behavioral Health Clinics (CCBHCs)

- Community Mental Health Services Block Grant

- Community Services Block Grant (CSBG)

- Health Center Program (Community Health Centers/FQHCs)

- Health Workforce Programs (including grants, loans, scholarships, and loan repayments)

- Services administered by the Substance Abuse and Mental Health Services Administration (SAMHSA)

- Title IV-E programs (Educational and Training Voucher Program, Kinship Guardianship Assistance Program and Prevention Services Program)

- Title X Family Planning

Organizations that receive federal or pass-through federal funding may now be required to assess immigration status as a condition of service delivery—something many have never done before. This shift raises significant operational, ethical, and mission-aligned challenges for hospitals, community health centers, behavioral health providers, and human services organizations. PRWORA does include language exempting 501(c)(3) charitable organizations from being required to verify immigration status, but as the administration notes in its announcement, they are not barred from doing so. This will be an area to watch.

USDA Interpretation

The USDA’s notice similarly identifies all 16 programs the Food and Nutrition Services (FNS) administers as meeting the definition of “Federal public benefit” used in Title IV of PRWORA. These programs include:

- Supplemental Nutrition Assistance Program (SNAP)

- Nutrition Assistance Program for Territories

- Food Distribution Program on Indian Reservations (FDPIR)

- Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)

- National School Lunch Program, School Breakfast Program, and Summer Food Service Program

- Child and Adult Care Food Program

The notice, however, states that there is a difference between defining a program as a federal public benefit and applying other provisions of PRWORA to those programs. The USDA’s notice clarifies that providers of non-exempt benefits must verify that applicants have a qualified immigration status for purposes of PRWORA but does not address how verification should be implemented or how exceptions should be applied.

What We Know—and Don’t Know

Though the list of affected programs is extensive, many critical implementation details remain uncertain. Both agencies acknowledge that further guidance will be needed to clarify how these changes will be operationalized.

Organizations should expect additional updates and further clarifications from federal agencies in the coming months. Legal challenges to these changes are almost certainly forthcoming.

Looking Ahead

These policy changes are both significant and still evolving. They will affect how and where services are delivered, as well as whether people choose to access the services at all.

During this period of uncertainty, frequent and transparent communication is essential. Deploy information and updates in multiple formats —written, verbal, visual—to reach diverse audiences, including your organization’s staff and other stakeholders in your community. When policy is fluid and changing rapidly, authentic messaging about what is known and what remains unclear will position your organization as an honest broker and trusted partner.

HMA experts are tracking these and related developments. For questions and to discuss the impact of these policies on your organization, contact our featured experts Warren Brodine and Amanda Maynord.

CMS Proposes New Ambulatory Specialty Model, Provides Details About Cell and Gene Therapy Model

Specialty model will focus on upstream management of lower back pain and congestive heart failure in traditional Medicare

This week, the Centers for Medicare & Medicaid Services (CMS) released the Calendar Year (CY) 2026 Medicare Physician Fee Schedule (MPFS) proposed rule, which introduces a new mandatory Ambulatory Specialty Model (ASM), and announced updates on the Cell and Gene Therapy Access Model. These developments reflect CMS’s continued focus on value-based care, chronic condition management, and new payment strategies.

Specialists will be financially accountable for the upstream management of low back pain and congestive heart failure in traditional Medicare. The model is designed to reduce costs and improve healthcare quality through performance-based payment adjustments and enhanced care coordination. The proposal is open for public comment, and CMS may revise model parameters before finalizing the rule later this year.

In this article, Health Management Associates (HMA) experts break down the ASM model’s goals and design features and explains developments in CMS’s Cell and Gene Therapy Access Model. HMA experts are reviewing the CY 2026 MPFS and the CY 2026 Hospital Outpatient Prospective Payment System proposed rules and will highlight key policy provisions in a forthcoming article.

ASM Focus on Chronic Care

CMS estimates that more than two-thirds of traditional Medicare beneficiaries have at least one chronic condition. CMS states that spending on heart failure comes to $10‒$13 billion annually, while annual costs associated with low back pain are $6‒$8 billion. A lack of coordinated care can impede patients’ ability to manage their health and result in low-value care like unnecessary procedures and avoidable hospitalizations that run up costs without improving healthcare outcomes. The ASM will test how incentives such as payment adjustments to providers can encourage preventive care, earlier diagnosis, and better disease management.

Program Goals

The ASM is designed to encourage collaboration and communication between patients’ primary care providers and specialists who treat low back pain and heart failure. According to CMS, improved coordination will lead to the following:

- Better patient outcomes and reduced disease progression

- Decreased spending on low-value care experiences, such as unnecessary hospitalizations and procedures

- Ensure providers are evaluated based on performance measures that are linked to the care they offer their patients

- Optimize data transparency to allow providers to compare their performance with their peers when being measured on patient-centered outcomes

Performance will be assessed based on the Merit-based Incentive Payment System (MIPS) Value Pathways (MVPs) across four factors:

- Improving outcomes, such enhancing patients’ functional status or controlling their blood pressure

- Lowering costs, especially through reduced provision of unnecessary services

- Increasing patient engagement through clinical care processes

- Expanding interoperability and data communication through certified electronic health record technology

Though based on the MIPS MVPs, the ASM will enhance the focus of performance measures, thereby simplifying reporting and allowing for comparisons across different providers and regions.

Table 1. ASM Model Payments, Participants, and Timeline

| Category | Details |

| Model Type | Two-sided risk payment model |

| Payment Adjustment Range | -9% to +9% based on performance relative to peers |

| Performance Tiers | – Positive adjustment for high performance – Neutral for average performance – Negative adjustment for low performance |

| Geographic Scope | Rolled out in ~25% of core-based statistical areas (CBSAs) and metropolitan divisions nationwide |

| Specialties Included | – Low back episodes: Anesthesiologists, pain management, interventional pain management, neurosurgeons, orthopedic surgeons, physical medicine or rehabilitation specialists

– Heart failure episodes: General cardiologists |

| First Performance Year | January 1, 2027 |

| Duration | 5 years |

| Relation to Other Models | – ASM is the second mandatory model proposed by CMS, following TEAM (Transforming Episode Accountability Model). While TEAM focuses on hospital-based episodes, ASM shifts accountability to specialists.

– Both models align with CMS’s broader strategy to reduce low-value care, a theme also reflected in the recently announced the Wasteful and Inappropriate Service Reduction (WISeR) model. |

| Policy Context | Part of CMS Innovation Center’s strategy to promote evidence-based prevention, high-value care, and reduce unnecessary utilization |

Cell and Gene Therapy Model

On July 15, 2025, CMS announced the participants in the Cell and Gene Therapy (CGT) Access Model. A total of 33 states, plus the District of Columbia and Puerto Rico, will participate in this model, which has the federal government negotiating outcomes-based agreements with CGT manufacturers of sickle cell disease treatments. Participating states represent approximately 84 percent of Medicaid beneficiaries with the condition. Under the model, participating states receive guaranteed discounts and rebates from participating CGT manufacturers if the therapies fail to deliver their promised therapeutic benefits. States also have the option of receiving federal support of up to $9.55 million each to assist with implementation, outreach, and data tracking. States may choose when to begin their participation between January 2025 and January 2026. CMS indicated it may modify the model in the future to cover other diseases with high-cost, high-impact therapies.

Connect with Us

The ASM introduces opportunity and financial risk for specialists, hospitals, and health systems. Providers should consider strategies and tactics that will strengthen their collaboration with primary care teams to manage the chronic conditions addressed in the ASM model, which may require workflow redesign and new communication protocols. Providers also should consider whether they will need to make investments in data infrastructure and reporting to meet their performance quality goals.

HMA’s Medicare team—including actuaries, data analysts, and policy experts—helps organizations model, understand, and navigate the impact of proposed frameworks and policy changes, quantify risk, and more, so organizations can improve both financial performance and patient outcomes.

For details about these model announcements or the new proposed rules, contact the HMA Medicare team tracking these policies—Amy Bassano, Rachel Kramer, and Kevin Kirby.

HMA Roundup

Arizona

Arizona to Hold Listening Session on Section 1115 Demonstration Renewal. The Arizona Health Care Cost Containment System (AHCCCS) announced on July 8, 2025, that it will hold a virtual listening session on July 17, 2025, to gather public input on the renewal of its Section 1115 Medicaid Demonstration. The demonstration program authorizes key initiatives including managed care, the Arizona Long Term Care System (ALTCS), Targeted Investments (TI) 2.0, Parents as Paid Caregivers, KidsCare expansion, and the Housing and Health Opportunities (H2O) program. AHCCCS has not yet submitted the renewal to the Centers for Medicare & Medicaid Services, and this session represents the final opportunity to provide public input.

Colorado

Colorado Medicaid to Cover Mental Health Services Under Collaborative Care Model. The Denver Post reported on July 14, 2025, that Colorado’s Medicaid program began reimbursing primary care practices on July 1, 2025, for behavioral health and substance use services delivered under the collaborative care model. Colorado is the 36th state allowing Medicaid coverage of the collaborative care model, which integrates mental health services into primary care and allows patients to receive support without external referrals.

Kentucky

Kentucky Submits New 1115 Application to Refer Expansion Enrollees to Job Services. The Centers for Medicare & Medicaid Services (CMS) announced on July 10, 2025, that Kentucky submitted an application for a new Section 1115 Community Engagement demonstration proposal which would require able-bodied Medicaid expansion adults without dependents, enrolled for more than 12 months, to be automatically referred to the state’s Department of Workforce Development for job placement support. Exemptions would apply to groups such as full-time students, individuals with disabilities, pregnant women, and caregivers. The state estimates 75,000 individuals would be subject to the program, with minimal impact on overall enrollment. Public comments will be accepted through August 9, 2025.

Nebraska

Nebraska to Cut Medicaid Reimbursement for ABA Services. Behavioral Health Business reported on July 14, 2025, that Nebraska will reduce Medicaid reimbursement rates for applied behavior analysis (ABA) services by up to 78 percent starting August 1, 2025, with a 48 percent cut for direct therapy by behavior technicians. The state will also cut funds for parent training, group therapy, care plan and protocol adjustments by board certified behavioral analysts, and treatment assessment developments. The state previously maintained some of the nation’s highest ABA rates to attract providers to rural areas, helping grow its workforce.

South Carolina

South Carolina Submits Section 1115 Demonstration Application Seeking to Expand Medicaid Coverage to Certain Caregivers with Work Requirements. The Centers for Medicare & Medicaid Services (CMS) announced on July 10, 2025, that South Carolina has submitted an application for a new five-year Section 1115 demonstration, titled Palmetto Pathways to Independence, which seeks to expand Medicaid coverage to qualified parent caretaker relatives between the ages of 19 and 64 and have incomes between 67 and 100 percent of the federal poverty level. The demonstration would also require this population to work or do other qualifying activities for at least 20 hours per month. CMS will accept public comments through August 9, 2025.

Utah

Utah Seeks Federal Approval to Amend Medicaid Reform Section 1115 Demonstration. The Centers for Medicare & Medicaid Services (CMS) announced on July 10, 2025, that Utah has submitted an amendment request for its Medicaid Reform Section 1115 demonstration seeking to provide wraparound coverage for qualified disabled individuals who have minimum essential healthcare coverage. The state is also looking to shift Medicaid dental coverage for children under 21 and pregnant and postpartum women from managed care to fee-for-service in partnership with the University of Utah School of Dentistry. CMS will accept public comments through August 9, 2025.

National

CMS Proposes Hospital Outpatient, Ambulatory Surgical Center Rate Increase of 2.4 Percent in CY 2026 Proposed Rule. The Centers for Medicare & Medicaid Services (CMS) released on July 15, 2025, the Calendar Year (CY) 2026 Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) Payment System proposed rule, introducing reforms focused on site-neutral payment, hospital price transparency, and enhanced provider accountability. CMs proposes to increase OPPS and ASC payments by 2.4 percent. Key provisions include aligning Medicare payments for similar services across hospital and off-campus settings to reduce beneficiary cost-sharing, phasing out the inpatient-only list to expand outpatient surgical options, and requiring hospitals to publish actual, consumer-usable prices in standardized formats. The proposal also updates the Hospital Star Rating methodology to penalize facilities with poor patient safety performance and streamlines reporting in quality programs. CMS estimates nearly $11 billion in combined Medicare program and beneficiary savings over the next decade. Public comments will be accepted through September 15, 2025.

Industry News

Sycamore Partners to Buyout Walgreens Boots Alliance. Modern Healthcare reported on July 11, 2025, that shareholders of Walgreens Boots Alliance have approved a $10 billion buyout by private equity firm Sycamore Partners, with 96 percent of votes in favor. The transaction, which values Walgreens at $23.7 billion including debt, is expected to close later this year pending regulatory approval. The deal, if finalized, will take Walgreens private for the first time since 1927.

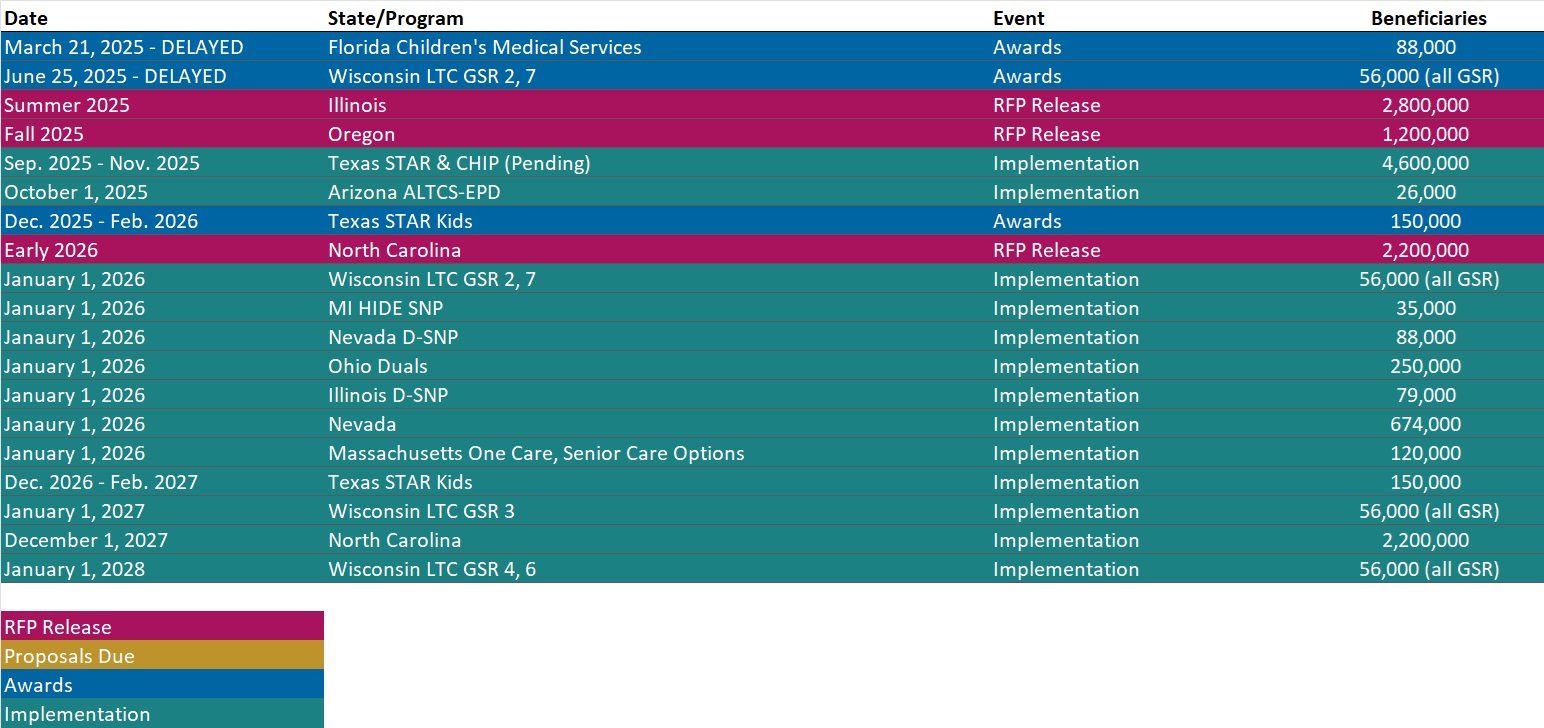

RFP Calendar

Actuaries Corner

Alignment Healthcare Claims Victory in CMS Star Ratings Lawsuit. Medicare Advantage (MA) insurer Alignment Healthcare scored a partial victory in its longstanding lawsuit over 2025 star ratings with the Centers for Medicare & Medicaid Services (CMS). Wakely Wire Editor’s Note: Based on the new CMS calculation, Alignment will earn larger bonus payments and achieve higher scores on quality measures. The insurer serves 217,500 members across five states, including California, where the company is based.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Conference

Adapting for Success in a Changing Healthcare Landscape

Navigating the New Federal Policy Shifts? Get Grounded with Timely Workshops at the HMA National Conference

As Medicaid work requirements, new Medicare models, and the evolving federal policy landscape reshape healthcare, it’s more important than ever to adapt quickly and effectively. At the HMA National Conference in New Orleans, join us for expert-led sessions that directly address these issues—offering practical insights and actionable strategies you can put to work. With this year’s workshops, you’ll find the firm footing you need—starting with a broad overview of the trends and forces reshaping Medicare, Medicaid, digital health, and behavioral health, and then diving deep into real-world use cases, operational strategies, and peer-driven solutions. The main stage sessions and workshops are designed to give you both the context and the concrete tools to navigate uncertainty with confidence—and prepare you to lead change in your organization.

Early bird pricing ends July 31, 2025.

HMA Webinars

Medicaid, Money & Mission: Unlocking Community Reinvestment Opportunities in Georgia. Tuesday, July 22, 2025, 10 AM ET. Join us for a powerful and practical town hall designed to inform Georgia’s community-based organizations (CBOs) with the knowledge to access new funding opportunities through the new community reinvestment requirements in Georgia Medicaid. Learn how HMA can help you to build strategic partnerships with managed care organizations (MCOs) to support your mission—and position your organization for success amid upcoming federal Medicaid work requirements.

Webinar Replay: The Future of the ACA Individual Market: Policy Shifts and the Proposals Before Congress

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- New Report: Medicaid MCO Financial Filings Including Medical Loss Ratio by State, 2024

- New Report: Medicaid Managed Care Expenditure and Enrollment Penetration Data, 2024

- Updated Medicaid Managed Care Rate Certifications Inventory

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

- Updated Louisiana and Puerto Rico Overviews

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].