This week's roundup:

- In Focus: Medicaid Expansion: Data-Driven Insights into Healthcare Needs

- In Focus: Disaggregating Managed Care Payments: New Insights into Medicaid Spending

- In Focus: The Medicaid HRSN Pivot: What’s Next for States, Plans, and Providers?

- HMA Welcomes Matt Allen as New Chief Growth Officer

- Disaggregating Managed Care Payments: New Insights into Medicaid Spending

- Iowa Submits 1115 Demonstration Request to Implement Medicaid Expansion Work Requirements

- Kentucky Proposes HCBS Waiver for Youth with Complex Needs

- Mississippi Finalizes $8.4 Billion Medicaid Budget with Projected Deficit for Fiscal 2026

- New York Governor Announces Strengthened Medicaid Behavioral Health Parity

- CMS Approves Medicaid SPAs Expanding Tribal Clinic Flexibility in Six States

- Senate Finance Committee Releases Draft Budget Outlining Deeper Medicaid Cuts

- Purdue Pharma, Sackler Family to End U.S. Opioid Sales Under $7.4 Billion Multi-State Agreement

In Focus

Medicaid Expansion: Data-Driven Insights into Healthcare Needs

As the US Senate debates H.R. 1—a sweeping legislative package that the House passed on May 22, 2025, which would impose nationwide Medicaid work and community engagement requirements by the end of 2026— Health Management Associates’ (HMA’s) latest analysis offers insights into the potential impact of these changes. Drawing on Transformed Medicaid Statistical Information System (T-MSIS) data, HMA experts examine the health and demographic profiles of the approximately 16 million individuals who comprise the Medicaid expansion population.

This 10-slide presentation of findings underscores the high prevalence of chronic and behavioral health conditions among these individuals, raising important questions about how new eligibility requirements could affect access to care and health outcomes. Notably, the presentation contextualizes health needs with Medicaid spending patterns, comparing the Medicaid expansion group with other eligibility categories, such as dual eligibles and children. We explore how the proposals of the nine state 1115 demonstration applications could affect the work requirements policy and implementation landscape. It also breaks down pharmacy spending by therapeutic class, spotlighting common conditions like opioid use disorder.

These insights are especially valuable for Medicaid managed care organizations, providers, and other stakeholders that will play a key role in designing work requirement initiatives and operationalizing any new requirements. Our May 22, 2025, article—Building State Capacities for Medicaid Work and Community Engagement Requirements—delves into the issues that are central to such discussions.

With deep expertise in Medicaid policy, demonstration design, and advanced analytics, HMA is uniquely positioned to help states, plans, and providers navigate the evolving federal landscape. For more information about HMA’s T-MSIS capabilities, contact featured experts Matt Powers and Shreyas Ramani.

Disaggregating Managed Care Payments: New Insights into Medicaid Spending

As states and stakeholders seek greater transparency and accountability in Medicaid, a new analysis from Health Management Associates (HMA), offers a fresh perspective on how dollars flow through the system. Drawing on publicly available data from the Transformed Medicaid Statistical Information System (T-MSIS), HMA disaggregated funding dispersed to Medicaid managed care organizations to discern spending for specific categorically eligible populations. The findings significantly enhance policy discussions and can facilitate development of pragmatic and specific care management interventions that support quality patient care.

For policymakers, regulators, and other stakeholders, this level of disaggregation provides a clearer view of how public dollars are used—and where there may be opportunities to improve performance or reinvest savings. It also supports more informed rate development and contract negotiations, particularly as states pursue value-based purchasing and other reforms. As Medicaid continues to evolve, especially in the context of budget pressures and changes in enrollment and risk profiles of enrollees, understanding the financial picture of managed care programs is essential to ensuring sustainability.

HMA’s team of experts—including actuaries, former Medicaid directors, and data analysts—has deep experience working with T-MSIS data and advising states, plans, and providers on Medicaid program analysis, evaluation, and strategy. For more information about working with T-MSIS data and the insights it can provide, contact Matt Powers.

The Medicaid HRSN Pivot: What’s Next for States, Plans, and Providers?

On March 4, 2025, the Centers for Medicare & Medicaid Services (CMS) rescinded the 2023 and 2024 guidance on Health-Related Social Needs (HRSN) Section 1115 demonstrations. This policy shift signals a significant pivot in federal Medicaid priorities under the current administration. While states with approved HRSN demonstrations may continue operating under existing terms, the path forward for pending proposals and future renewals is less certain.

This article explores key considerations Health Management Associates (HMA), experts identified for states that need to realign HRSN activities with other activities to align with the Trump Administration’s federal policy objectives and priorities for Section 1115 Medicaid and CHIP demonstrations.

Background on HRSN Initiatives in Section 1115 Demonstrations

In November 2023 and December 2024, CMS published guidance on a new Section 1115 demonstration that gave state Medicaid and CHIP agencies the opportunity to address the broad environmental conditions, or social determinants of health (SDOH), that affect people’s health. This initiative permitted states to address the individual-level adverse social conditions of enrollees that contribute to negative health outcomes. To assist states in their efforts, CMS approved Section 1115 demonstrations that piloted the provision of housing, food, non-medical transportation, and other environmental supports that meet enrollees’ HRSNs.

What does CMS’s rescission of the HRSN demonstration policy initiative mean for states planning their next steps and priorities for Medicaid and CHIP?

First, CMS’s March 4 rescission has no impact on states with a current, active Section 1115 demonstration that includes HRSN. States with HRSN demonstrations can maintain their approved programs until the scheduled expiration date; however, requests to amend any aspect of the program before it expires could subject the state to renegotiation of HRSN components that align with the new federal direction.

Second, states with pending HRSN Section 1115 demonstration proposals should proactively consider new coverage approaches to authorize services that address an individual’s SDOH. Pending proposals developed using the now rescinded guidance may require substantial changes to gain approval. States should also prepare for additional public comment periods if revisions significantly alter the original design.

Looking ahead, CMS is not expected to renew demonstration components that no longer align with current federal objectives. This projection pertains to any demonstration component, not just the rescinded HRSN guidance. States should start planning now for how they will sustain successful HRSN-related outcomes through alternative coverage pathways.

Strategic HRSN Pivot Considerations

While the HRSN guidance has been rescinded, CMS has not withdrawn the 2021 State Health Official Letter RE: Opportunities in Medicaid and CHIP to Address Social Determinants of Health (SDOH) (SHO# 21-001), published during the first Trump Administration. This leaves room for states to pivot HRSN initiatives into other federal authorities, such as:

- State Plan Amendments and Waivers. These approaches include state plan options, 1915 waiver options, CHIP Health Services Initiatives, as well as certain special program authorities like Program of All-Inclusive Care for the Elderly or Money Follows the Person.

- Behavioral Health Integration: States may expand SDOH supports for individuals with substance use disorder, serious mental illness, or serious emotional disturbance, leveraging still-active guidance from first Trump Administration, Letter to State Medicaid Directors Strategies to Address the Opioid Epidemic (SMD # 17-003) and Opportunities to Design Innovative Service Delivery Systems for Adults with a Serious Mental Illness or Children with a Serious Emotional Disturbance (SMD # 18-011). By expanding activities focused on improving addiction or behavioral health treatment for Medicaid or CHIP beneficiaries, states could explore novel approaches to offering SDOH services.

- Childhood Chronic Disease Prevention: States could consider aligning SDOH activities with the Make America Healthy Again initiative of the current administration by focusing on environmental factors that adversely affect an enrollee’s health, such as poor nutrition, chronic stress, overexposure to synthetic chemicals, and mental health challenges.

- Justice-Involved Populations: States could explore reentry services and SDOH supports for individuals transitioning from carceral settings to the community, including compliance with new Medicaid requirements for incarcerated youth under the Consolidated Appropriations Act of 2023.

- School-Based Health Services. States could explore SDOH activities as part of new approaches to address gaps in the provision of school-based health services to Medicaid and CHIP eligible children. CMS and the US Department of Education launched a joint effort to expand school-based health services by establishing the Medicaid School-Based Services (SBS) Technical Assistance Center to help states increase healthcare access to children enrolled in Medicaid and CHIP. States could explore SDOH initiatives that expand the capacity of school-based entities that provide assistance under Medicaid or CHIP.

Looking Ahead

As states recalibrate their Medicaid and CHIP strategies, understanding how they can align with evolving federal priorities is critical for all stakeholders. Notably, Medicaid stakeholders, including managed care organizations, hospitals and health systems, and providers, also have several opportunities, including:

- Inform State Strategy: Plans and providers can share data and outcomes from HRSN interventions to help states assess the value of these services and whether they should continue under alternative authorities.

- Shape New Demonstration Designs: As states pivot to align with new federal priorities, plans and providers can offer practical insights into how SDOH interventions could be integrated into behavioral health, reentry, school-based services, and chronic disease prevention efforts.

- Strengthen Community Partnerships: Continued collaboration with community-based organizations will be essential to maintain service delivery and demonstrate impact in new policy contexts.

Connect With Us

HMA’s team—including former CMS Section 1115 leaders and other colleagues steeped in Medicaid and CHIP policies and operations—offers unique expertise in designing demonstrations that reflect current federal policy priorities and maximize state outcomes in alignment with program objectives that CMS will support.

For questions about these developments and your organization’s plan to adapt to new federal Medicaid policy priorities, contact our featured experts Tonya Moore and Carter Kimble. Connect with our experts and other leaders experienced in new pathways for covering effective services at the HMA National Conference, October 14-16, 2025, in New Orleans, LA.

HMA Welcomes Matt Allen as New Chief Growth Officer

HMA welcomes Matt Allen as the firm’s first Chief Growth Officer (CGO). He will report to Chief Executive Officer Chuck Milligan and work out of HMA’s Washington, D.C., office. Matt brings more than 25 years of diverse experience in the healthcare sector and a proven track record of advancing growth and innovation to HMA. He will shape the firm’s enterprise-wide growth initiatives, oversee strategic partnerships, and help guide efforts that continue to advance innovation to meet current and emerging client needs. Prior to joining HMA, Matt was Avalere Health’s practice director and senior vice president of Client Partnerships, and previously held roles in Optum’s legacy Advisory Board Company data and analytics practices, at healthcare policy firm Marwood Group, and in Johnson & Johnson’s pharmaceutical division. Read More

HMA Roundup

Iowa

Iowa Submits 1115 Demonstration Request to Implement Medicaid Expansion Work Requirements. The Centers for Medicare & Medicaid Services (CMS) announced on June 13, 2025, that Iowa submitted a request to amend its Section 1115 Iowa Health and Wellness Plan (IHAWP) demonstration, the state’s Medicaid expansion program, to implement work requirements for beneficiaries ages 19 to 64 as a condition of maintaining eligibility. Public comments will be accepted through July 13, 2025.

Kentucky

Kentucky Proposes HCBS Waiver for Youth with Complex Needs. The Kentucky Department for Medicaid Services (DMS) released on June 16, 2025, a draft proposal for a new 1915(c) Community Health for Improved Lives and Development (CHILD) Home and Community Based Services (HCBS) waiver for children, youth, and young adults with complex, multi-system needs. The waiver would support individuals who meet the level of care for a hospital, psychiatric residential treatment facility, or intermediate care facility for individuals with intellectual disabilities. Public comments are being accepted through July 15, 2025.

Mississippi

Mississippi Finalizes $8.4 Billion Medicaid Budget with Projected Deficit for Fiscal 2026. The Magnolia Tribune reported on June 13, 2025, that Mississippi’s Division of Medicaid is expected to operate on an $8.4 billion budget for FY 2026, with $969.9 million in state funding, a $58 million increase over the prior year. Lawmakers approved a $60 million deficit allowance, though the agency anticipates needing up to $120 million. Enrollment declined from over 904,000 in June 2023 to about 705,000 by April 2025 due to redeterminations. Despite discussions, no Medicaid expansion bills advanced this session.

New York

New York Governor Announces Strengthened Medicaid Behavioral Health Parity. New York Governor Kathy Hochul announced on June 10, 2025, that the state is strengthening parity of behavioral health services in Medicaid consistent with the federal Mental Health Parity and Addiction Equity Act. The New York State Office of Mental Health (OMH) has been reviewing the state’s managed care plans and has issued over 95 citations and $1 million in fines. Although the Trump Administration has indicated it does not intend to enforce some of the mental health parity laws, Hochul indicated that New York will continue to do so with its managed care plans.

National

CMS Approves Medicaid SPAs Expanding Tribal Clinic Flexibility in Six States. The Centers for Medicare & Medicaid Services (CMS) announced on June 13, 2025, that it has approved Medicaid State Plan Amendments (SPAs) in six states—Minnesota, New Mexico, Oregon, South Dakota, Washington, and Wyoming—to allow Indian Health Service and Tribal clinics to deliver Medicaid clinic services beyond traditional clinic sites. This policy change enables care delivery in homes, schools, and other community settings, addressing long-standing tribal concerns and improving access for American Indian and Alaska Native populations. The approvals reflect each state’s adoption of the federal “four walls” exception, expanding flexibility to reach patients in remote and underserved areas.

Senate Finance Committee Releases Draft Budget Outlining Deeper Medicaid Cuts. The Associated Press reported on June 17, 2025, that the U.S. Senate Finance Committee has released legislative text for its portion of the budget reconciliation bill. The committee’s proposals would cut Medicaid spending more than the budget passed by the House, with provisions that would phase down the cap on provider taxes to 3.5 percent of net patient revenue by 2031 and restrict state-directed payments by not allowing the payments to exceed Medicare rates in expansion states or 110 percent of Medicare rates in non-expansion states. Notably, the committee also revised the Medicaid work requirements passed in the House to exclude parents, guardians, and caretaker relatives of children aged 14 or under.

Industry News

Purdue Pharma, Sackler Family to End U.S. Opioid Sales Under $7.4 Billion Multi-State Agreement. The Wall Street Journal reported on June 16, 2025, that all 55 U.S. state and territory attorneys general have finalized a $7.4 billion settlement with Purdue Pharma and the Sackler family over their role in the opioid crisis. The agreement ends the Sacklers’ control of Purdue, prohibits them from selling opioids in the U.S., and directs funds toward opioid treatment and prevention nationwide. Final implementation depends on local government participation and bankruptcy court approval.

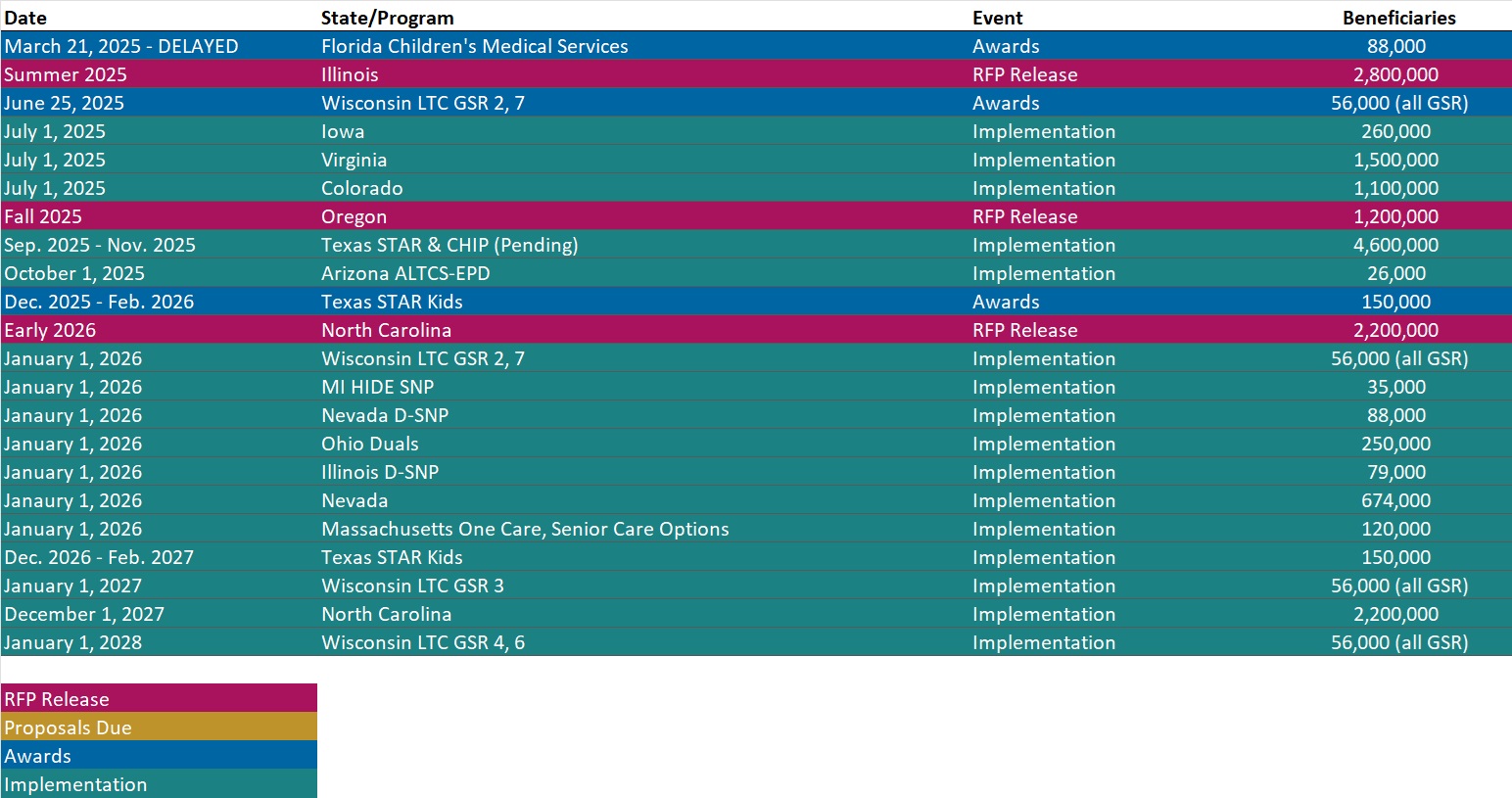

RFP Calendar

Actuaries Corner

Rising Costs Push Employers to Rethink Benefits Strategies: WTW. WTW’s latest Benefit Trends Survey reveals that rising costs are prompting employers to adopt a more strategic approach to managing their benefits. A growing number plan to reallocate or rebalance their benefits spending over the next several years.

Discover other developments in the Wakely Wire here.

Company Announcements

MCG White Paper

The Impact of Social Media on Mental Health. In this new MCG white paper, Physician Editor for Behavioral Health and forensic psychiatrist, João Ramos, MD, examines the dual-edged nature of social media as both a groundbreaking mode of connectivity and a potential contributor to declining mental health. He emphasizes that while social media has been linked to mental health concerns – especially among youth – effective, personalized interventions can mitigate its adverse effects.

HMA News & Events

HMA Webinar

Ask HMA Experts: Medicaid Town Hall. Monday, June 30, 2025, 12 PM ET.

Join us for a dynamic and interactive Medicaid Town Hall hosted by Health Management Associates (HMA). Our experts will be available to answer your questions live on a wide range of timely and critical topics, including:

- Key policies and insights about the ongoing 2025 federal budget reconciliation negotiations, including changes to Medicaid eligibility policies, financing, and cost-sharing rules.

- New executive branch priorities to address program integrity and agency regulations and guidance reshaping provider tax rules and state-directed payment arrangements.

- The evolving landscape of Medicaid Section 1115 demonstrations, including updated federal monitoring approaches and new state initiatives.

- Medicaid managed care trends, payment innovation, and emerging strategies to address whole-person care focused on maternal health and behavioral health needs.

Leavitt Partners Webinar

Ditching the Clipboard: What the Federal RFI Signals About the Future of Health Care Data Exchange. Monday June 23, 2025, 2:30 PM ET. In March 2025, Leavitt Partners, an HMA Company, in conjunction with a number of multi-sector stakeholders, released Kill the Clipboard! A Federal Policy and Industry Roadmap to Accelerate Innovation and Cut Administrative Waste. Just three months later, the U.S. Department of Health and Human Services released its Request for Information (RFI) on the Health Technology Ecosystem. The priorities in the RFI closely reflect the multi-sector roadmap’s recommendations, underscoring the influence and relevance of effective public/private sector collaboration. This session will explore how the paper and the RFI’s recommendations on interoperability, TEFCA modernization, digital identity, patient access, and administrative burden reduction can reduce unnecessary burden and waste. The presenters will also discuss how this alignment offers a path forward for policy leaders, healthcare organizations, and technology partners committed to modernizing the U.S. health system.

HMA Conference

Overburdened but Unstoppable: Recharge & Connect with Healthcare Peers in New Orleans. October 15, 2025

Right now, healthcare professionals everywhere are facing mounting demands—yet they continue to double down on the work that matters. At the HMA National Conference, you’ll join a community that understands the strain, shares your pride in this work, and comes together to lift each other up. Whether you lead policy, operations, clinical programs, or innovation initiatives, you’ll leave with practical tools, fresh inspiration, and a network of colleagues you can draw insights from.

Come for the content. Stay for the community. Enjoy the wonderful ambiance of New Orleans. We can’t wait to see you!

Early bird pricing ends July 31, 2025.

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

- Updated Idaho Overview

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].