HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- HMA Conference on the New Normal for Medicaid, Medicare, and Other Publicly Sponsored Programs to Feature Insights from Health Plan Leaders, State Medicaid Directors, Providers

- In Focus: CMS’s Hospital Inpatient Regulation Proposes the Use of Novel Methods to Calculate 2023 Payment Rates

- California Medicaid Plan to Pay Providers for Performance for Some Services

- California Exchange Automates Enrollment for Medicaid Members Losing Coverage

- Colorado Bills to Protect Medicaid Behavioral Health Providers from Clawbacks

- District of Columbia Mayor to Apply for Federal Funds for Health Disparities

- Georgia Proposal to Bypass Healthcare.gov Is Rejected by Federal Regulators

- Legislature Approves Bill to Delay Reprocurement of KanCare Contracts Until 2023

- Michigan Launches Initiative to Improve Behavioral Health Services for Children

- Minnesota Submits Request to Expand Self-Directed Personal Care Options

- Nebraska Establishes Advisory Committee for State Medicaid Program

- New Hampshire Legislature Passes Medicaid Adult Dental Bill

- North Carolina HCBS Medicaid Waiver Access Varies by Race, Study Finds

- Ohio Delays Launch of ‘Next Generation’ Medicaid Managed Care Program

- Rhode Island Senate Committee to Hear Medicaid Rate Legislation

- South Carolina Extends Telehealth Flexibilities Beyond PHE

- Tennessee House Panel Clears Bill to Renew D-SNP Contracts with Losing Bidders

- Texas Seeks Comment on Criteria for Selecting Medicaid Managed Care Plans

- Texas 10-Year Medicaid Waiver Extension to Survive

- MACPAC Announces New Executive Director, Members

- Bow River Capital Completes Investment in Amazing Care Home Health Services

- HCA Healthcare to Acquire BetterMed

In Focus

HMA Conference on the New Normal for Medicaid, Medicare, and Other Publicly Sponsored Programs to Feature Insights from Health Plan Leaders, State Medicaid Directors, Providers

Pre-Conference Workshop: October 9, 2022

Conference: October 10-11, 2022

Location: Fairmont Chicago, Millennium Park

Early Bird registration is now open for HMA’s fifth national conference on trends in publicly sponsored health care.

This year’s event, The New Normal: How Medicaid, Medicare, and Other Publicly Sponsored Programs Are Shaping the Future of Healthcare in a Time of Crisis, features leading experts from across the country. Speakers include Medicaid directors, Medicaid managed care leaders, Medicare and dual eligible plan executives, federal regulators, policy experts, and providers addressing important challenges and opportunities facing publicly sponsored healthcare programs.

Group rates and sponsorships are available. Visit https://conference.healthmanagement.com/ for details. Agenda follows:

| The New Normal: How Medicaid, Medicare, and Other Publicly Sponsored Programs Are Shaping the Future of Healthcare in a Time of Crisis | |

| Pre-Conference Workshop: Sunday, October 9 | |

| 1:00 – 5:00 pm | The Future of Payment Reform: Delivery Value, Managing Risk in Medicare and Medicaid |

| Conference Day One: Monday, October 10 | |

| 7:00 – 8:00 am | Registration & Breakfast |

| 8:00 – 8:45 am | Keynote Address Politics and the ‘New Normal’ for U.S. Healthcare The COVID-19 pandemic may have led to a “new normal” for the U.S. healthcare industry, but one thing remains the same: the politics around healthcare are still divisive and difficult to navigate. During this keynote address, Drew Altman, president and chief executive of the Kaiser Family Foundation, will discuss the politics of healthcare at the state and federal level, including a look at how the midterm elections may further complicate efforts to reach a consensus on necessary changes and improvements in the wake of COVID-19.Speaker Drew Altman, President and CEO, Kaiser Family FoundationModerator Jay Rosen, President and Co-Chairman, HMA, Lansing, MI |

| 8:45 – 10:00 am | State Medicaid Q&A Keynote Session State Medicaid Priorities & Challenges – Now and After the Public Health Emergency State Medicaid programs have shown remarkable resiliency during the COVID-19 pandemic, despite soaring enrollment, rising costs, and system-wide staffing shortages. States also have managed to continue the roll out of innovative Medicaid initiatives aimed at improving quality, addressing inequities, and expanding benefits. During this keynote Q&A session, leading state Medicaid directors will outline key priorities and challenges for Medicaid programs, including eligibility redeterminations, the expiration of enhanced FMAP, the future of telehealth, and continued efforts to reform care delivery and ensure value.Speakers Jacey Cooper, Medicaid Director, Chief Deputy Director, California Department of Health Care Services Dave Richard, Deputy Secretary, North Carolina Medicaid Jami Snyder, Director, Arizona Health Care Cost Containment System Allison Matters Taylor, Medicaid Director, Indiana Moderator |

| 10:00 – 10:30 am | Break |

| 10:30 am – 12:00 pm | Medicaid Managed Care Keynote Q&A Session Key Strategies, Opportunities, and Concerns for Medicaid Managed Care The end of the public health emergency will have important implications for Medicaid managed care plans, including the impact of eligibility redeterminations, the end of enhanced federal funding to states, and a likely increase in care utilization. That’s on top of growing pressure to address equity, quality, cost, and social determinants of health, as well as demands that plans participate in value-based payment initiatives. During this keynote Q&A session, leading managed care executives will discuss the strategies, priorities, and concerns they have as they strive to meet the needs of vulnerable populations during an unprecedented time of healthcare disruption. Speakers will also outline growing opportunities to serve Medicare-Medicaid dual eligibles, foster children, individuals with substance use disorder, and individuals with developmental disabilities, among others.Speakers John Barger, National VP, Dual Eligible and Medicaid Programs, Humana, Inc. Aimee Dailey, President, Medicaid, Anthem, Inc. Rebecca Engelman, EVP, Medicaid Markets, AmeriHealth Caritas Brent Layton, President, COO, Centene Corporation Kelly Munson, President, Aetna Medicaid Timothy Spilker, CEO, UnitedHealthcare Community & State Moderator |

| 12:00 – 1:30 pm | Lunch |

| 1:30 – 3:00 pm | Concurrent Breakout Session From Concept to Implementation: Successful Social Determinants of Health Initiatives Most healthcare organizations recognize the importance of addressing social determinants of health (SDOH) to improve health outcomes and foster equity. Translating that into action is a bidirectional challenge: providers of SDOH interventions are often community-based organizations that are inexperienced or ill-equipped to meet Medicaid managed care contracting expectations, and Medicaid systems often lack the relationships and understanding of how to work with these providers. What’s needed now is an effective implementation strategy that considers payment structures, contract mechanisms, quality requirements, data sharing, and capacity building to launch and operate successful SDOH partnerships. During this session, organizations on the front lines developing and implementing SDOH initiatives will discuss how to structure an effective partnership that all parties can agree to and that drives improved member outcomes.Speakers Debra Sanchez-Torres, Senior Advisor, Centers for Disease Control and Prevention Amanda Van Vleet, Associate Director, Innovation, NC Medicaid Strategy Office, North Carolina Department of Health & Human Services Additional speakers to be announced.Moderator Christina Altmayer, Principal, Los Angeles, CA |

| Concurrent Breakout Session Trends in Behavioral Health: Emerging Opportunities and Challenges for Providers and Payers During this breakout session, representatives of behavioral health organizations will discuss several key challenges and opportunities faced by payers, providers, and regulators of behavioral health services. Foremost are staffing concerns exacerbated by the COVID-19 pandemic and the rising needs of patients seeking behavioral care. Speakers will also address questions concerning the quality and accountability of value-based payment models, the restructuring by states of behavioral health programs, and the emergence of Certified Community Behavioral Health Clinics (CCBHCs).Speakers Courtnay Thompson, Market President, Select Health of South Carolina, an AmeriHealth Caritas Company Mark Sasvary, Chief Clinical Officer, CBHS, IPA, LLC Additional speakers to be announced.Moderator Gina Lasky, Managing Director, Behavioral Health, HMA, Denver, CO | |

| Concurrent Breakout Session Investing in Innovative Healthcare Companies Investment firms are deploying billions of dollars in capital in search of innovative organizations serving Medicaid, Medicare, and other publicly sponsored healthcare markets. During this breakout session, speakers from private equity backed companies in healthcare technology, care delivery, population health, member engagement, and other areas will assess emerging market opportunities, prospects for sustainable growth, and key differentiators of success at the cutting edge of healthcare innovation. The session will include representatives from companies offering innovative solutions to improve quality and lower costs as well as experienced managed care executives that will explore how the business models support those goals.Speakers To be announced.Moderator Greg Nersessian, Managing Director, HMA Investment Services, New York, NY | |

| 3:00 – 3:30 pm | Break |

| 3:30 – 5:00 pm | Concurrent Breakout Session Assessing Progress in the Treatment of Addiction, Opioid Use Disorder State regulators, federal officials, health plans, and providers continue to push forward with efforts to ensure access to effective treatment for addiction and opioid use disorder. During this breakout session, speakers will provide an overview of the current state of addiction in the U.S. and assess the strengths and weaknesses of ongoing efforts to address the problem. Speakers will also provide case studies and best practices for offering addiction treatment across all the ASAM Levels of Care, including hospitals, community-based organizations, prisons, and jails. The focus will be on the upcoming fourth edition of the ASAM Criteria and its impact on quality, cost, and capacity of care throughout the care continuum.Speakers To be announced.Moderator Corey Waller, Managing Director, HMA Institute on Addiction, Lansing, MI |

| Concurrent Breakout Session Critical Information Technology Capabilities for Enabling Integrated Care As the move to integrated care accelerates, state and county agencies, health plans, and providers are changing how they invest in and utilize information systems. That’s particularly true for integrated care that effectively addresses physical health, behavioral health, and social determinants of health in a holistic manner. During this session, speakers will highlight critical capabilities that information systems need to enable true integrated care. The session will also showcase initiatives designed to better align information technology capabilities with the needs of integrated care programs.Speakers Tim Skeen, Senior Corporate VP, CIO, Sentara Healthcare Todd Rogow, President, CEO, Healthix Martin Lupinetti, President, CEO, HealthShare Exchange (HSX)Moderator Juan Montanez, Managing Director, HMA IT Advisory Services, Washington, DC | |

| Concurrent Breakout Session The Role of Health Plans, Providers, and States in Addressing Health Equity States are playing a central role in promoting health equity, with important implications for health plans and providers. During this breakout session, representative from states, Medicaid managed care plans, and providers will discuss how they are responding to new requirements and demands aimed at making health equity a key component of overall quality efforts. Topics will include how states are driving equity through health plan requirements, health system quality initiatives that include new equity components, and health plan efforts to innovate and prepare for new equity expectations.Speakers Kody Kinsley, Secretary, North Carolina Department of Health and Human Services Andrew Martin, National Director of Business Development (Housing+Health), UnitedHealth Group Joshua Traylor, Senior Director, Health Care Transformation Task Force Shannon Wilson, VP, State Markets East, Priority HealthModerator Leticia Reyes-Nash, Principal, HMA, Chicago, IL | |

| 5:00 – 7:00 pm | Reception |

| Conference Day Two: Tuesday, October 11 | |

| 7:00 – 8:00 am | Breakfast |

| 8:00 – 8:45 am | Medicare Policy Keynote Address The Future of Medicare Value-Based Payments Medicare has been testing value-based programs for more than 10 years. While results to date have been mixed, there has been significant progress. The Center for Medicare & Medicaid Innovation continues to refine existing value-based models and experiment with new ones to find the right combination of incentives that truly drives value in healthcare. Medicare Advantage plans are helping foster value-based efforts among providers. And CMS continues to view value-based payments as central to helping control costs and improve quality. During this keynote address, a leading Medicare policy expert will provide a frank assessment of what has worked and what hasn’t when it comes to Medicare value-based payments. Key insights will include a roadmap for likely value-based developments in the future and a broad understanding of why value-based payments are still viewed as the future of Medicare.Speaker To be announced.Moderator Amy Bassano, Managing Director, Medicare, HMA, Washington, DC |

| 8:45 – 10:00 am | The Evolution of Medicare Advantage: Expanded Reach, Emerging Opportunities The Medicare Advantage program is a bona fide success story, serving more than 45 percent of the total Medicare population and still growing. Medicare Advantage plans have also been expanding their reach, offering coverage and expanded benefits to special needs populations such as dually eligible individuals, those requiring institutional levels of care, individuals with significant chronic conditions, and individuals with end stage renal disease (ESRD). During this session, representatives from some of the nation’s most innovative Medicare Advantage plans will discuss emerging growth opportunities as well as the challenges and solutions associated with serving a growing array of populations with increasingly complex needs.Speakers To be announced.Moderator Julie Faulhaber, Managing Director, Medicare and Dual Eligibles, HMA, Chicago, IL |

| 10:00 – 10:30 am | Break |

|

10:30 – 11:30 am

| Health System and Provider Success Stories: Value-Based Payment Initiatives that Work Healthcare organizations participating in value-based payment programs over the past decade have learned important lessons about what works and what doesn’t when it comes to driving value through financial incentives. During this session, representatives from some of the nation’s most innovative health systems and Federally Qualified Health Centers (FQHCs) will outline best practices for designing and implementing value-based programs, including case studies of several successful value-based initiatives. Speakers will also discuss how to decide which value-based arrangement is best for a particular organization.Speakers To be announced.Moderator Doug Elwell, CEO, HMA, Chicago, IL |

| 11:30 am – 12:30 pm | What’s Next for PACE: Evolving Capabilities for a Post-Pandemic World The Program of All-inclusive Care for the Elderly (PACE) experienced significant operational challenges during the pandemic, including the need to shift from providing care exclusively in PACE clinics to more of a reliance on home care services and telehealth. Now that clinics are reopening, PACE organizations are evaluating how many of these alternative care delivery capabilities to continue offering. During this session, representatives of PACE organizations will discuss how their operations changed during the pandemic. Speakers will also outline what the “new normal” will likely look like for PACE going forward.Speakers To be announced.Moderators Don Novo, Principal, HMA, San Francisco, CA Debby McNamara, Senior Consultant, Tallahassee, FL |

| 12:30 pm | Adjourn |

__________

CMS’s Hospital Inpatient Regulation Proposes the Use of Novel Methods to Calculate 2023 Payment Rates

This week, our In Focus section reviews the policy changes included in the Centers for Medicare & Medicaid Services’ (CMS) Fiscal Year (FY) 2023 Medicare Hospital Inpatient Prospective Payment System (IPPS) and Long-Term Acute Care Hospital (LTCH) Proposed Rule (CMS-1771-P). This year’s IPPS Proposed Rule includes several important policy changes that will alter hospital margins and change administrative procedures, beginning as soon as October 1, 2022.

HMA continues to monitor legislative and regulatory developments that will impact the hospital sector. For more information or questions about the policies described below, please contact Zach Gaumer ([email protected]), Amy Bassano ([email protected]), Andrea Maresca ([email protected]) or Clare Mamerow ([email protected]).

Key provisions of the FY 2023 Hospital IPPS and LTCH Proposed Rule

On April 18, 2022, CMS released the FY 2023 IPPS and LTCH Final Rule (CMS-1771-P). For FY 2023, CMS proposed to make modifications to several hospital inpatient payment policies. We highlight six payment specific 2023 payment policies that are among the most impactful for Medicare beneficiaries, hospitals and health systems, payors, and manufacturers: the annual inpatient market basket update and economy-wide inflation, the methodology used to calculated the weights of Medicare severity adjusted diagnosis related groups (MS-DRG), disproportional share hospital (DSH) payments, hospital wage index adjustments, and new technology add-on payments (NTAP). Stakeholders will have until June 17, 2022 to submit comments to CMS on the contents of this regulation, including several specific areas where CMS requests input.

1. Market basket update

Proposed Rule: Overall CMS’s Medicare 2023 Hospital Inpatient Proposed Rule will increase payments to acute care hospitals by an estimated $1.6 billion from 2022 to 2023; however, recent trends in economy-wide inflation may alter this estimate by the time the agency releases the Final Rule version of this regulation in August 2022. The primary driver of the estimated $1.6 billion increase in inpatient payments to hospitals is CMS’s proposed 3.2 percent increase in the annual update to inpatient operating payment rates.

HMA analysis: CMS’s 3.2 percent increase is largely based on an estimate of the rate of increase in the cost of a standard basket of hospital goods, the hospital market basket. For this Proposed Rule, data from the third quarter of 2021 was used to calculate this rate of increase. Importantly, for the FY 2023 Final Rule, CMS is likely to use data through the first quarter of 2022, which we know to include growth in economy-wide inflation. As a result, we anticipate the proposed 3.2 percent increase in the annual update to inpatient rates may increase by the time rates are finalized later in the year due to inflation, and with that the estimated increase in total Medicare inpatient payments to acute care hospitals is likely to be higher than $1.6 billion. For beneficiaries, increasing payment rates will eventually lead to a higher standard Medicare inpatient deductible and increased beneficiary out-of-pocket costs for many other services. For hospitals and health systems, payors, and manufacturers we will be watching to see if Medicare payment rates increase consistently with real-time inflation.

2. MS-DRG weights:

Proposed Rule: To set MS-DRG weights for FY 2023 inpatient cases, CMS proposed to use FY 2021 data with modifications to account for anticipated changes in COVID hospitalization rates. Contrary to the agency’s typical methodology of using all claims in a given year to calculate MS-DRG weights, CMS proposed to calculate weights by averaging weights derived from two separate calculations: 1) weights using all FY 2021 claims excluding COVID claims and 2) weights using all FY 2021 claims including COVID claims. Importantly, relative to the typical CMS methodology for setting MS-DRG weights, the proposal to control for COVID claims is designed to reduce the overall variability in DRG-level weights and in payment rates from 2022 to 2023. Further, CMS proposed to implement a permanent 10-percent cap on the reduction in any individual MS-DRG’s relative weight in a given fiscal year. CMS requested comments on the proposed 10-percent cap policy and whether the modified rate setting methodology is more accurate than simply using FY 2021 claims through the usual rate setting methodology.

HMA analysis: Our analysis of the new MS-DRG weight methodology confirms that the new methodology reduces the variability in weight changes from 2022 to 2023, relative to the typical MS-DRG weight methodology. Absent the use of CMS’s novel methodology for setting rates, the variability in MS-DRG weights from 2022 to 2023 will be more significant. Despite the use of the novel methodology, HMA’s own analysis of the data identified large changes in the weights (and payment rates) for many MS-DRGs in 2023. Specifically, we observe large increases in the weights of medical MS-DRGs likely to include COVID cases (e.g., sepsis cases) and large decreases in the weights of surgical cases with relatively short lengths of stay. Given the extent of changes occurring for many MS-DRGs in 2023, hospitals, payers, and manufacturers will need to be aware of the proposed impact to specific inpatient MS-DRGs that affect their business.

3. Disproportionate Share Hospital (DSH) and Uncompensated Care (UC) payments

Proposed Rule: CMS proposed to reduce DSH and UC payments by $0.8 billion from 2022 to 2023, with most of this decline coming from reductions in UC payments. Further, CMS proposed to use two years of pre-COVID hospital cost report data to calculate the UC portion of these payments. In addition, CMS proposed to add hospital inpatient days attributed to patients associated with Medicaid section 1115 demonstrations within the calculation of total Medicaid days and therefore the calculation of hospital-level Medicare disproportionate share hospital (DSH) payments.

HMA analysis: Our analysis of the two DSH-related proposals highlighted above finds that the proposed reductions in DSH and uncompensated care payments will have a differential impact on hospitals nationwide, with some increasing DSH and UC payments and others losing DSH and UC payments. Hospitals serving larger shares of Medicaid patients are likely to benefit, while those with small or declining shares are likely to see declining DSH and UC payments.

CMS’s proposal to begin to count patients participating in section 1115 demonstrations in the calculation of DSH share will be a welcome change for hospitals and health systems, as this has the potential to increase DSH payments to individual hospitals. However, this change is complicated by the fact that many hospitals do not track patients participating in section 1115 demonstrations. Therefore, it will take hospitals and health systems time to begin tracking these data and recording it within their hospital cost reports. In addition, this policy change will have a differential impact by state because of the variation in the scope of benefits and populations states cover in their section 1115 demonstrations. CMS proposed to define patients associated with section 1115 demonstrations as those who either receive health insurance or those who receive premium assistance from a state program to purchase health insurance which provides essential health benefits (EHB) and the assistance amounts to at least 90 percent of the cost of the health insurance. CMS proposed to exclude from this policy patients who use premium assistance to buy health insurance that does not provide EHB or for whom the premium assistance provided by the demonstration accounts for less than 90 percent of the cost of the health insurance. Further, hospitals that receive direct reimbursement for under- or uninsured patients through uncompensated care or similar pools under Section 1115 demonstration programs, will not be permitted to include patient days associated with these programs in the calculation of DSH share.

For beneficiaries, these policy changes will have a minimal direct impact. For hospitals and health systems, the DSH and UC payment declines could be large for some individual hospitals. In addition, to benefit from the Section 1115 demonstration policy proposal hospitals will need to begin tracking patients involved with these programs as soon as possible. Further, this policy could create downstream implications for reporting and transparency around Medicaid supplemental payments while also exacerbating tensions in states with a heavy reliance on uncompensated care pools in lieu of expanding Medicaid coverage.

4. Hospital Wage Index Adjustments:

Proposed Rule: CMS proposed a permanent 5-percent cap on any year-over-year decrease in an individual hospital’s geographic wage index, regardless of the circumstances causing the decline. Further, CMS proposed to implement this policy on a budget neutral basis.

HMA analysis: CMS’s wage index cap policy has been considered in past regulatory cycles, but the impetus for proposing this policy in FY 2023 likely associated with the difficulty hospitals have had over the last two years with staffing costs and staffing availability. The data used to set individual hospital wage indexes is impacted by volatility in staffing levels and the wages paid to hospital staff. CMS’s proposed 5-percent cap policy will moderate the volatility of these data and changes to individual hospital wage index calculations. For hospitals and health systems, this wage index 5-percent cap policy will protect them from large decreases in their wage index and therefore changes in the payments they receive from the Medicare program. Further, because CMS proposed to implement this policy on a budget neutral basis, any additional costs of this policy will be paid for across all hospitals.

5. New technology add-on payments (NTAP):

Proposed Rule: CMS continues to receive a large number of NTAP applications. The agency proposed to continue NTAP payments for 15 drug and device technologies in FY 2023 which received an NTAP for FY 2022. In addition, CMS proposed to consider the applications of 26 other drug and device technologies for possible NTAPs. CMS also proposed to discontinue NTAPs for 13 technologies in FY 2023 which had been given a special 1-year NTAP coverage extension for FY 2022. CMS proposed to use National Drug Codes (NDCs) to identify drugs receiving NTAP payments starting in FY 2023. In addition, CMS proposed to post, on a publicly accessible website, all NTAP applications (minus pricing and volume estimates) starting in FY 2024. Both of these proposals aim to streamline the application submission and review process.

HMA Analysis: CMS continues to expand the use of the NTAP program to foster innovation within the Medicare program while also proposing changes to reduce CMS’ administrative burden in maintaining the program.

6. Outlier payments:

Proposed Rule: CMS proposed to modify the methodology for calculating payments on outlier cases within the IPPS to account for data uniquely impacted by COVID-19 and the public health emergency. The agency proposes to compute the outlier level at which cases become outlier cases, referred to as the fixed loss amount (FLA) by using data from pre-COVID years (2018 and 2019) instead of their typical method of using more recently available data.

HMA analysis: As a result of using the new methodology, the inpatient outlier FLA will increase significantly, but not as significantly as it would have if CMS had used their typical methodology which would have relied on more recent years of data from the 2020 and 2021. If finalized as proposed, we anticipate a decrease in the number of outlier cases and outlier-related spending for hospitals from 2022 to 2023. Hospitals and health systems will need to closely monitor the level at which CMS finalizes the FLA within the Final Rule.

Other important proposals introduced in the FY 2023 Medicare Hospital IPPS Proposed Rule include:

- A proposal to establish the criteria for a new “Birthing Friendly” (or maternity) hospital designation,

- A proposal to continue to suppress data impacted by COVID-19 and the public health emergency which is used within several quality-related hospital payment programs;

- A solicitation for feedback from stakeholders on ways to advance health equity and key considerations to improve data collection for measuring and analyzing disparities;

- A proposal to modify how resident FTEs above the cap are counted within the Graduate Medical Education payment program; and

- A request for information on potential mechanisms to address issues related to rare diseases with low volumes in the MS-DRG structure.

HMA Roundup

Alabama

Alabama Pilot Program Extends Medicaid Postpartum Coverage to One Year. AL.com reported on April 21, 2022, that Alabama enacted a pilot program extending Medicaid postpartum coverage to one year from 60 days. The program was included in the state’s fiscal 2023 budget, recently signed into law by Governor Kay Ivey. Read More

Alabama, Drug Companies Settle Opioid Litigation. The Hill reported on April 19, 2022, that drug companies Johnson & Johnson, McKesson, and Endo Pharmaceuticals agreed to pay the state of Alabama $276 million to settle litigation concerning their role in the opioid crisis. The companies did not admit guilt. Alabama, which still has outstanding litigation against Purdue Pharma, Mallinckrodt and Insys, said it will use the funds to support impacted communities. Alabama and West Virginia had opted out of the national opioid settlement. West Virginia recently settled litigation with Johnson & Johnson for $99 million. Read More

California

California Medicaid Plan Implements Pay-for-Performance Provider Reimbursement Model for Certain Services. Health Payer Intelligence reported on April 28, 2022, that California Medicaid plan CenCal Health is employing a pay-for-performance provider reimbursement model for certain services, with the goal of improving care quality and streamlining the plan’s current quality incentive programs. The Quality Care Incentive Program, which went into effect on March 1, 2022, focuses on behavioral, diabetes, pediatric, respiratory, and women’s healthcare. Read More

California Investigates Health Plan for Allegedly Overcharging Medicaid for Prescription Drugs. Modern Healthcare reported on April 25, 2022, that the California Department of Health Care Services is investigating Centene for allegedly overcharging the state’s Medicaid program for prescription drugs. Centene serves 2.14 million Medicaid beneficiaries in California. Read More

City Seeks Shared Regulatory Control Over Long-Term Care Facilities. McKnight’s Senior Living reported on April 25, 2022, that Pasadena Mayor Victor Gordo is seeking shared control over assisted living communities and nursing homes, which are currently regulated by the state. Gordo, who made the recommendation at a Public Safety Committee meeting, said the change is needed to ensure quality of care. Approximately 3,300 individuals receive care in these facilities in Pasadena. Read More

California Exchange Implements Automated Enrollment System for Medicaid Members Losing Coverage. Health Payer Specialist reported on April 20, 2022, that the Covered California Exchange will automatically enroll eligible individuals who lose Medicaid coverage after the public health emergency ends. Individuals must be eligible for subsidies and will be enrolled in the lowest-cost silver-tier health plan. Eligible bronze-plan enrollees will also be enrolled automatically in silver-tier plans for 2023, with a zero-dollar premium. Read More

Colorado

Senate Passes Bill Requiring Actuarial Review on New Health Benefit Mandates. Colorado Newsline reported on May 4, 2022, that the Colorado Senate unanimously passed a bill requiring actuarial reviews of health benefit mandates imposed on insurers, including Medicaid plans. Reviews, which would be handled by an outside firm contracted by the state, would include an assessment of the impact of mandates on health insurance premiums. Additionally, the House Health and Insurance Committee advanced a bill to expand Medicaid coverage to survivors of torture receiving rehabilitative services in Colorado. Read More

Colorado Bills Aim to Ensure ‘Equitable’ Payments, Protection from Clawbacks to Medicaid Behavioral Health Providers. The Colorado Sun reported on April 25, 2022, that the Colorado legislature is expected to pass two bills designed to ensure equitable payments to Medicaid mental health and substance use disorder providers as well as protection from clawbacks. House Bill 1268, which passed the House and cleared a Senate committee, would require the Colorado Department of Health Care Policy and Financing to audit reimbursement rates for behavioral health providers to ensure independent providers are paid equitably to those in community health centers. The second bill, Senate Bill 156, would prevent regional accountable entities from clawing back payments from providers for services already provided and rescind the requirement that providers get prior authorization before providing outpatient psychotherapy services. Read More

Connecticut

Legislature Approves Medicaid Funding for Children Under 12 Regardless of Immigration Status. The Connecticut Mirror reported on May 3, 2022, that the Connecticut legislature approved funding to extend Medicaid coverage to children up to age 12 regardless of immigration status in households up to 201 percent of poverty. Currently, Medicaid is available to children up to age eight regardless of immigration status. Read More

District of Columbia

Mayor to Apply for $92 Million in Federal Funding to Address Health Disparities. The Washington Business Journal reported on April 29, 2022, that District of Columbia Mayor Muriel Bowser is planning to apply for $92 million in financing from the U.S. Department of Treasury’s Capital Project Fund to address health disparities. The initiative, Helping Our People Endure (HOPE), will support projects focused on life sciences innovation at four local institutions: Children’s National Hospital, Whitman-Walker Health, Howard University, and George Washington University. Read More

Georgia

Proposal to Bypass Healthcare.gov in Favor of Private Websites, Agents Is Rejected by Federal Regulators. ABC News/The Associated Press reported on April 30, 2022, that federal regulators rejected a plan from Georgia Governor Brian Kemp to bypass the Healthcare.gov insurance Exchange in favor of allowing individuals to shop for federally subsidized plans through private health insurance websites and agents. The Trump administration had approved the plan in 2020.

Hawaii

Hawaii Medicaid Program Invests $10 Million in Health Outcomes Effort. State of Reform reported on May 3, 2022, that Hawaii’s Medicaid program, Med-QUEST, recently announced a $10 million investment in the University of Hawaii at Mānoa’s Health Policy Initiative, which strives to improve health outcomes through research and policy recommendations. Read More

Illinois

Illinois Expands Medicaid Coverage to Eligible Individuals 42 and Up, Regardless of Immigration Status. The State Journal-Register/Capitol News Illinois reported on April 25, 2022, that the Illinois legislature passed an omnibus Medicaid bill (HB 4343) expanding Medicaid coverage to all income-eligible undocumented noncitizens aged 42 and up, regardless of immigration status. The current age is 55 and up. Illinois does not have a citizenship requirement for Medicaid enrollment for children under 18 and pregnant women. The bill awaits signature by Governor JB Pritzker. Read More

Kansas

Legislature Approves Bill to Delay Reprocurement of KanCare Contracts Until January 2023. The Kansas City Star reported on April 26, 2022, that the Kansas Legislature approved a bill that would delay the process of procuring new Medicaid managed care contracts until January 2023. Previously, the legislature had approved separate bills that would have extended the current contracts through 2024. Kansas Governor Laura Kelly has criticized the proposal but has not said if she will veto the bill. Read More

Kansas Approves Funding to Extend Postpartum Medicaid Coverage from 60 Days to 12 Months. KCUR reported on April 20, 2022, that Kansas Governor Laura Kelly signed a $16 billion state budget that includes funding to extend postpartum Medicaid coverage from 60 days to 12 months. The budget also increases funding for mental health services in home and community-based services and behavioral crisis stabilization for individuals with intellectual and developmental disabilities. Read More

Louisiana

Louisiana Announces Intent to Submit HCBS Setting Transition Plan for Federal Approval. The Louisiana Department of Health (LDH) announced on April 22, 2022, its intent to submit its final home and community-based services (HCBS) transition plan to the Centers for Medicare & Medicaid Services (CMS) to evaluate HCBS settings in the Children’s Choice Waiver, Residential Options Waiver, Supports Waiver, and the New Opportunities Waiver to assure compliance with new CMS regulations. LDH will accept public comments on the plan until May 22, 2022. Read More

Louisiana Files Lawsuit Against Medicaid Managed Care Plan, PBM for Overcharging Prescriptions. Modern Healthcare reported on April 20, 2022, that UnitedHealth Group was hit with a lawsuit claiming that the company overcharged the Louisiana Medicaid program for prescription drugs. The suit, which was filed by the Louisiana attorney general, names UnitedHealth’s OptumRx pharmacy benefits management operation and its UnitedHealthcare health plan operation. Read More

Michigan

Michigan Extends Postpartum Medicaid Coverage from 60 Days to 12 Months. Michigan Governor Gretchen Whitmer announced on May 2, 2022, federal approval of the state’s request to extend postpartum Medicaid coverage from 60 days to 12 months. There are an estimated 35,000 pregnant and postpartum individuals who will receive coverage. Approximately $20 million has been budgeted for the extension. Read More

Michigan Launches Initiative to Improve Behavioral Health Services for Children. The Michigan Department of Health and Human Services announced the launch of MI Kids Now, an effort to improve behavioral health services for children and youth on Medicaid or in the foster care system. The initiative will focus on early screenings, assessments, and treatment services. Read More

Minnesota

Minnesota Submits Request to Expand Self-Directed Personal Care Options. The Minnesota Department of Human Services submitted to federal regulators on April 8, 2022, a request to replace Medicaid personal care assistance (PCA) services with a new program called Community First Services and Supports (CFSS), which is designed to expand self-directed care options. The federal comment period is from April 25, 2022, through May 25, 2022. Read More

Nebraska

Nebraska Establishes Medical Care Advisory Committee for State Medicaid Program. The Nebraska Department of Health and Human Services (DHHS) announced on April 28, 2022, the formation of a Medical Care Advisory Committee (MCAC) to make recommendations to the state Medicaid program. MCAC consists of Medicaid beneficiaries, advocates, and providers. Jessica Meeske, DDS, will serve as chair, and consultant Karma Boll will serves as vice chair. MCAC is currently seeking applicants for additional committee members, and meetings are open to the public. Read More

New Hampshire

Legislature Passes Medicaid Adult Dental Bill. The Laconia Daily Sun reported on April 21, 2022, that the New Hampshire Senate passed a bill to expand Medicaid dental coverage to 100,000 adults throughout the state. The bill, which already passed the House, now heads to the Senate Finance Committee for discussion of the bill’s fiscal considerations. Funding for the first three years of the coverage expansion would come from a $21 million settlement the state reached with Centene over the cost of Medicaid pharmacy benefit services. Read More

New York

New York Medicaid Spending Increased 13.6 Percent from Fiscal 2020 to 2022. The Office of the New York State Comptroller reported on May 2022, that New York Medicaid spending increased 13.6 percent between fiscal 2020 and 2022. The data is based on a preliminary review of the three most recent state budget fiscal years. Read More

Legislature Considers Three Hospice Care Bills. Spectrum News reported on May 2, 2022, that the New York legislature is considering three bills related to hospice care. Two bills sponsored by Assemblymember Monica Wallace (D-Lancaster) and Senator Michelle Hinchey (D-Saugerties) would establish a campaign to promote individual awareness of hospice and palliative care options and create an office of hospice and palliative care access and quality within the state Department of Health. The third bill would authorize assisted living program residents to receive hospice care. Read More

New York Cites Medicaid Plans for Noncompliance with Mental Health Parity Law. Crain’s New York reported on April 21, 2022, that New York has issued at least 95 citations to Medicaid managed care plans for noncompliance with the state’s mental health parity law. Citations typically lead to discussions and corrective action plans, but advocates say the process is drawn out and fails to result in meaningful change. Read More

North Carolina

HCBS Medicaid Waiver Access Varies by Race, Age, Region, Study Finds. Spectrum News reported on April 22, 2022, that Hispanic and Black individuals with autism or intellectual and developmental disabilities are 37 percent and 15 percent less likely, respectively, to receive Medicaid waiver services for home and community-based services (HCBS) than non-Hispanic White individuals, according to a recent study in the Journal of Developmental & Behavioral Pediatrics. The study also found that individuals living in rural areas, women, and children were also less likely to receive waiver services than adult men in urban areas. Of the 53,531 individuals in the study, only 22 percent had access to Medicaid waiver services. The study is based on Medicaid claims data from 2017 to 2018. Read More

Ohio

Ohio Delays Launch of ‘Next Generation’ Medicaid Managed Care Program. The Columbus Dispatch reported on April 27, 2022, that Ohio will delay the rollout of newly contracted Medicaid managed care plans and the launch of a single pharmacy benefit manager from July to October at the earliest. However, coverage for children under the new OhioRISE program will launch in July as planned. The changes, which are part of the state’s Next Generation Medicaid managed care program, are being delayed to allow the state time to deal with the potential fallout from Medicaid eligibility redeterminations at the end of the federal public health emergency. Read More

Rhode Island

Senate Committee to Hear Medicaid Rate Legislation. What’s Up Newp reported on April 26, 2022, that the Rhode Island Senate Finance Committee will hear six Medicaid rate setting bills sponsored by Senator Louis DiPalma (D-Middletown). The bills would require the state to submit a Medicaid state plan amendment for dental and chiropractic rates, increase nursing facility rates, allocate funding for home care provider reimbursement rates increases and payments, and increase delivery rates paid to obstetricians by managed care plans. The legislation would also establish regular rate reviews for state social services and clinical programs. Read More

South Carolina

South Carolina Extends Telehealth Flexibilities Beyond PHE. The South Carolina Department of Health and Human Services announced on April 29, 2022, the permanent extension of most of the state’s temporary Medicaid telehealth flexibilities, including care from physicians, nurse practitioners, and physicians assistants. Behavioral health services received through telehealth will be extended for one year beyond the end of the public health emergency. Telehealth flexibilities, which were implemented during the COVID-19 pandemic, were previously set to expire at the end of the PHE.

South Dakota

South Dakota Group Submits Second Medicaid Expansion Ballot Measure. KEVN Black Hills FOX reported on May 4, 2022, that Dakotans for Health submitted 23,000 signatures in support of a November Medicaid expansion ballot measure in South Dakota. The new measure would be an initiated state law, as opposed to the previously announced ballot measure which would amend the state constitution. Read More

Tennessee

Tennessee Proposes Medicaid Coverage Extension to Children Adopted from State Custody. The Centers for Medicare & Medicaid Services announced on April 28, 2022, that Tennessee has submitted an 1115 Waiver Amendment to extend Medicaid coverage to children adopted from state custody who would not otherwise be eligible. Public comments will be accepted through May 28, 2022. Read More

House Committee Advances Bill to Renew D-SNP Contracts with Losing Bidders. Tennessee Lookout reported on April 27, 2022, that the Tennessee House Finance Committee advanced a bill (House Bill 2625), which included an amendment that could allow the state to renew dual-eligible special needs plan (D-SNP) contracts with plans that failed to win a bid. Specifically, the bill would require the state to study and report back to the legislature on the impact of not contracting with existing D-SNPs from Centene, Humana, and Cigna. Meanwhile, the state would allow members to remain in their current plans. The bill is headed to the House floor for consideration. A version of the bill currently in the Senate does not contain a similar amendment. Read More

Texas

Texas Seeks Public Comment on Criteria for Selecting Medicaid Managed Care Plans. The Texas Health and Human Services Commission released on April 28, 2022, a request for public comment on the “best value criteria” that the state will use to evaluate bids for the upcoming Medicaid managed care procurement for plans serving the state’s traditional Medicaid program (STAR) and Children’s Health Insurance Program. Public comments will be accepted through May 12, 2022. Read More

Texas Releases EVV System Management Services RFO. The Texas Health and Human Services Commission released on April 26, 2022, a request for offers (RFO) to procure a vendor to provide Electronic Visit Verification (EVV) system management services to support the Texas Medicaid program. Proposals are due June 7. The contract is anticipated to begin on March 1, 2023, and will run four years with three one-year options.

Texas to Seek Exemption from Medicaid Home Health Care EVV Deadline. The Texas Department of Health and Human Services announced on April 22, 2022, that it will request a one-year exemption from the federal deadline for implementing Electronic Visit Verification (EVV) for Medicaid home health care services from January 1, 2023, to January 1, 2024. The Centers for Medicare & Medicaid Services will begin accepting exemption requests in July 2022. Read More

Texas 10-Year Medicaid Waiver Extension to Survive. Modern Healthcare reported on April 22, 2022, that the Biden administration withdrew its opposition to a 10-year extension of the Texas 1115 Medicaid waiver, which includes the extension of an uncompensated care program for providers. The waiver extension had been approved by the Trump administration, but the approval was revoked by the Centers for Medicare & Medicaid Services last year citing failure to comply with public comment requirements. Read More

Wisconsin

Wisconsin Awards $2.5 Million in Medicaid Grants for Residential Treatment of Opioid Use Disorder. WisPolitics.com reported on April 21, 2022, that the Wisconsin Department of Health Services awarded $2.5 million in Medicaid grants for residential treatment of beneficiaries with an opioid use disorder. An estimated 1,100 individuals will receive treatment through the grants. Read More

National

Lawmakers Seek Electronic Prior Authorization for Medicare Advantage. Fierce Healthcare reported on May 3, 2022, that U.S. Representatives Suzan DelBene (D-Washington), Mike Kelly (R-Pennsylvania), and Ami Bera (D-California) are calling for the adoption of electronic prior authorization for Medicare Advantage (MA) plans. The renewed push comes after a report by the U.S. Office of the Inspector General showed prior authorization led to delayed or denied access to care for some MA beneficiaries. Read More

Medicaid Covers Growing Share of Individuals Accessing Substance Use Treatment, Study Finds. Health Affairs reported on May 2, 2022, that the share of individuals receiving substance use disorder (SUD) treatment with services paid for by Medicaid rose 14.9 percentage points over to 32.1 percent 10 years through 2019, according to a recent study. The data is from the National Survey on Drug Use and Health from 2010-19. Read More

Small Percentage of Primary Care Physicians, Specialists Provide Most Medicaid Managed Care, Study Finds. Health Affairs reported on May 1, 2022, that just 25 percent of Medicaid managed care network primary care physicians provide 86 percent of primary care to Medicaid beneficiaries, according to a study of four states. Additionally, 25 percent of specialists provide 75 percent of specialty care. The results suggest that “current network adequacy standards might not reflect actual access,” the study said. Read More

SCOTUS to Hear Case on Whether State-Owned Nursing Homes Can Face Private Lawsuits for Medicaid, Medicare Violations. Reuters reported on May 2, 2022, that the U.S. Supreme Court will hear a case over whether state-owned nursing homes can face private lawsuits for violating Medicare and Medicaid patient care rules. Health and Hospital Corp of Marion County, IN, and Valparaiso Care and Rehabilitation appealed to the Supreme Court after a lower court allowed a lawsuit on behalf of a nursing home resident to proceed. Read More

HHS Announces Uninsured Rate Is Near All-Time Low. The U.S. Department of Health and Human Services (HHS) announced on April 29, 2022, that the uninsured rate in the U.S. was 8.8 percent at the end of 2021, a near all-time low and down from the 10.3 percent uninsured rate at the end of 2020, according to a report from the Office of the Secretary for Planning and Evaluation. The report found a record 35 million people are enrolled in Medicaid expansion, Exchanges, and the Basic Health Program as of early 2022. Read More

MACPAC Announces New Executive Director, Members. The Medicaid and CHIP Payment and Access Commission (MACPAC) announced on April 29, 2022, that Kate Massey has been named executive director, effective May 2022. Massey is the Medicaid director in Michigan. Additionally, the U.S. Government Accountability Office (GAO) appointed as MACPAC members through April 2025 Sonja Bjork, chief operating officer of Partnership HealthPlan of California; Jennifer Gerstorff, principal and consulting actuary at Milliman; Angelo Giardino, MD, chief medical officer at Intermountain Primary Children’s Hospital and chair of the Department of Pediatrics at University of Utah’s Spencer Fox Eccles School of Medicine; and Rhonda Medows, MD, president of Providence Population Health Management. Tricia Brooks, a research professor at the McCourt School of Public Policy at Georgetown University; and Dennis Heaphy, a researcher at the Massachusetts Disability Policy Consortium, were reappointed to the commission. Read More

CMS Finalizes Rule Requiring Standardized Exchange Plan Option at Every Tier. Fierce Healthcare reported on April 28, 2022, that the Centers for Medicare & Medicaid Services (CMS) finalized a rule requiring insurers to offer a standardized Exchange plan option at every plan tier in 2023. Plans can still offer non-standardized options, but they must also offer a standardized option. Under the final Notice of Benefits and Payment Parameters rule, federal regulators will also conduct network adequacy audits in every state that uses the Healthcare.gov federal Exchange; states already conducting network adequacy audits are exempt. Read More

CMS Defends 3.2 Percent Medicare Inpatient Hospital Rates Increase for Fiscal 2023. Fierce Healthcare reported on April 25, 2022, that the Centers for Medicare & Medicaid Services (CMS) defended a 3.2 percent Medicare payment increase for hospitals in fiscal 2023, noting it is aimed in part at shifting facilities towards more whole patient-centered care. CMS included the increase in a recently released proposed Inpatient Prospective Payment System rule. Hospital groups say the proposed increase is inadequate. The proposed rule is open for comment until June 17. Read More

CMS Releases Medicare Advantage and Part D Final Rule. The Centers for Medicare & Medicaid Services (CMS) released on April 29, 2022, the 2023 final rule for Medicare Advantage and Part D, with the goal of lowering out-of-pocket prescription drug costs and improving customer protections. The final rule includes changes to network adequacy requirements, medical loss ratio reporting, maximum out-of-pocket calculations, and regulations for dual-eligible special needs plans. Read More

Health Disparities Persist Among Medicare Advantage Enrollees, Report Says. Modern Healthcare reported on April 29, 2022, that Black and American Indian and Alaska Native Medicare Advantage (MA) enrollees reported worse clinical measures than other MA racial subgroups, according to a report from the Centers for Medicare & Medicaid Services and RAND Health Care. The report also found that Asian American and Pacific Islander MA enrollees reported the worst customer service experiences of all racial subgroups. However, the report found gender parity for clinical outcomes in all racial subgroups except among Black enrollees. The report is based on an analysis of 2021 data from the Healthcare Effectiveness Data and Information Set and the Consumer Assessment of Healthcare Providers and Systems. Read More

Hospitals File Federal Lawsuit Over Medicare Part A Payments, DSH Payment Adjustments. HealthLeaders Media reported on April 29, 2022, that a group of hospitals filed a federal lawsuit against the U.S. Department of Health and Human Services (HHS) over the calculation of payments owed under Medicare Part A and the disproportionate share hospital (DSH) payment adjustment. The lawsuit alleges that HHS used different definitions for factors in the DSH payment adjustment calculation, which led to lower payments to the hospitals. Read More

Federal Investigators Call for Increased Oversight of Medicare Advantage Plans. The New York Times reported on April 28, 2022, that federal investigators are calling for increased oversight of Medicare Advantage (MA). According to a report from the inspector general’s office of the Health and Human Services Department, tens of thousands of MA members are being denied necessary care. Read More

CMS Proposes Rule to Reduce Barriers to Medicare Coverage. The Centers for Medicare & Medicaid Services (CMS) released on April 22, 2022, a proposed rule aimed at limiting retroactive Medicare Part B premium liability for states to 36 months, discontinuing stand-alone buy-in agreements, and extending the Medicare Savings Programs to cover premiums and cost sharing for individuals enrolling in the new Medicare immunosuppressive drug benefit. The proposed rule would also create a new Medicare special enrollment period for individuals losing Medicaid eligibility after the end of the COVID-19 public health emergency. If finalized, the rule will go into effect on January 1, 2023. Read More

CMS Proposes Special Enrollment Periods for Medicare Coverage. Modern Healthcare reported on April 22, 2022, that the Centers for Medicare & Medicaid Services (CMS) is proposing five special enrollment periods for Medicare. The special enrollment periods would be available to individuals facing an emergency or disaster, formerly incarcerated people, and those who were unable to enroll in Medicare because of a health plan or employer error. Special enrollment would also be available on a case-by-case basis to individuals seeking to enroll after their Medicaid eligibility is terminated and other exceptional cases. Read More

Industry News

Bow River Capital Completes Investment in Amazing Care Home Health Services. Bow River Capital announced on May 3, 2022, that it had completed an investment in Amazing Care Home Health Services, a home health, skilled nursing, therapy, and related services agency for children and adults in Colorado, Texas, and Utah. Amazing Care chief executive Art Lowry and the leadership team retained a meaningful ownership stake and will continue to lead the organization. Read More

UnitedHealth Group Proposed Acquisition of Atrius Health Is Approved by State Court. Modern Healthcare reported on May 2, 2022, that a Massachusetts Supreme Court Judge gave final approval to UnitedHealth Group’s acquisition of not-for-profit physician group Atrius Health in a $236 million deal. Net proceeds from the sale will move to the Atrius Health Equity Foundation. Atrius, which was struggling financially, will no longer be a not-for-profit. The approval requires Altrius make its “best efforts” to continue serving Medicaid and Medicare beneficiaries. Read More

HCA Healthcare to Acquire BetterMed. Richmond BizSense reported on April 28, 2022, that HCA Healthcare has agreed to acquire BetterMed, a chain of 12 urgent care centers in Virginia and North Carolina. The deal, expected to close in late Summer 2022, will expand HCA’s operations in the Richmond area, where it has five hospitals. Read More

Xpress Wellness Acquires Integrity Urgent Care. Latticework Capital Management announced on April 28, 2022, the acquisition of Integrity Urgent Care by portfolio company Xpress Wellness, which provides primary care, testing, and other services in rural areas. Integrity currently operates 10 urgent care clinics in rural Central Texas. Read More

UnitedHealth to Divest Change Healthcare’s Claims Editing Business Upon Completion of Merger. Seeking Alpha reported on April 25, 2022, that UnitedHealth Group has agreed to sell the ClaimsXten claims editing business of Change Healthcare to TPG Capital for $2.2 billion, contingent upon UnitedHealth completing its previously announced acquisition of Change. UnitedHealth’s acquisition of Change is being blocked by the U.S. Department of Justice. Read More

Bristol Hospice Acquires Hospice Select. Hospice News reported on April 20, 2022, that Bristol Hospice acquired Hospice Select, a Dallas-based hospice and palliative care provider. Bristol, a Webster Equity Partners portfolio company, operates 45 locations across 13 states. Read More

UnitedHealth Acquires 2 Oregon-Based Physician Practices. The Lund Report reported on April 21, 2022, that UnitedHealth Group has acquired two Oregon-based physician practices, Oregon Medical Group in Eugene-Springfield and GreenField Health in Portland. The two practices have about 120 doctors and other clinicians at 11 locations. UnitedHealth has acquired roughly 1,500 primary and specialty practices nationwide. Read More

Bradford Health Services Acquires The Estate at River Bend. Bradford Health Services announced on April 25, 2022, the acquisition of The Estate at River Bend, a substance use disorder treatment center based in Mississippi. Bradford operates 40 facilities across five states. Read More

Massachusetts Approves UnitedHealth’s Planned Acquisition of Atrius Health. Health Payer Specialist reported on April 21, 2022, that Massachusetts approved UnitedHealth Group’s planned acquisition of Atrius Health, a not-for-profit physician group serving 690,000 patients. United will be required to donate $236 million to a charity. The acquisition would change Atrius to a for-profit company. The deal still requires state court approval. Read More

Humana to Sell Majority Interest in Kindred at Home Hospice, Personal Care Divisions to Clayton, Dubilier & Rice. Humana announced on April 21, 2022, a definitive agreement to sell a majority stake in the hospice and personal care divisions of Kindred at Home to private investment firm Clayton, Dubilier & Rice. Humana had stated its intent to sell a majority stake in these lines when it acquired the remaining interest in Kindred at Home in April 2021. Read More

Kentucky, Oregon to Establish Basic Health Programs. Politico reported on April 30, 2022, that Kentucky and Oregon will establish Basic Health Programs, which use federal funds to cover individuals who make up to twice the federal poverty level and do not qualify for Medicaid. An estimated 85,000 Oregonians and 37,000 Kentuckians will be eligible to enroll in the plans as soon as 2023. While the Basic Health Program has been available since the passage of the Affordable Care Act, only Minnesota and New York have utilized it. Read More

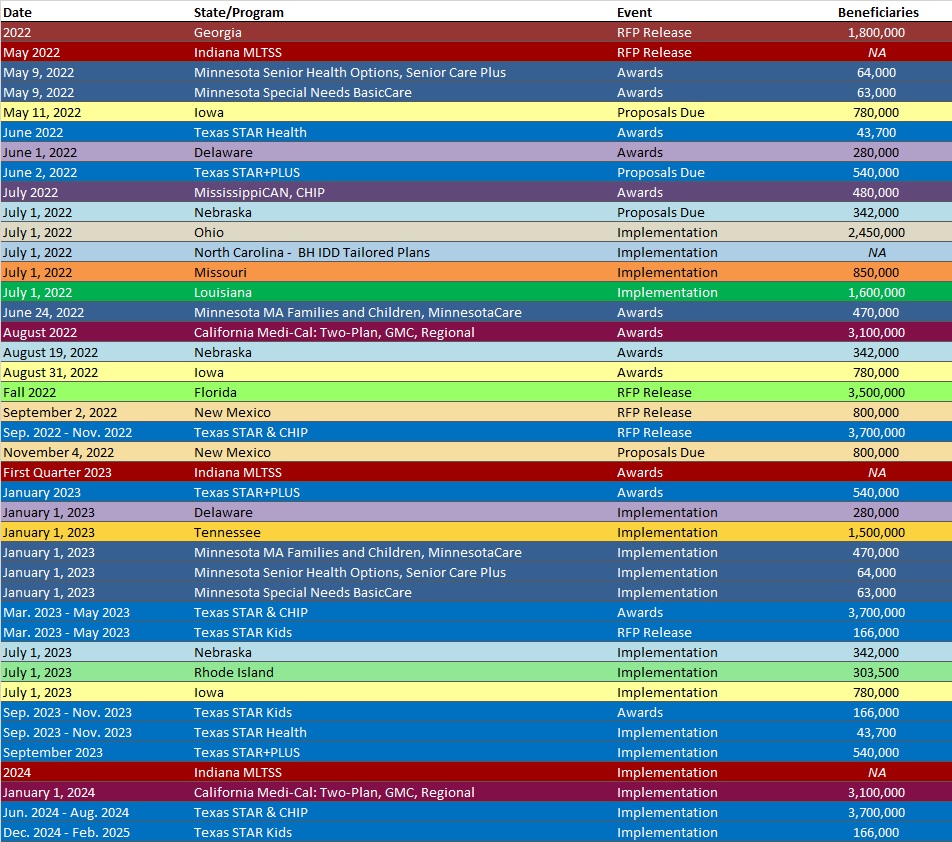

RFP Calendar

Company Announcements

HMA News & Events

Join Leavitt Partners “Quality Standards in Addiction Care” LinkedIn Live webinar on May 5 at 11 am. They will discuss the ASAM Level of Care Certification process and the opportunities it presents to improve SUD treatment facilities. Learn what providers, payers, and local governments can do now to become accredited and how Health Management Associates is helping facilities prepare for and achieve certification.

NEW THIS WEEK ON HMA INFORMATION SERVICES (HMAIS):

Medicaid Data

- Arizona SNP Membership at 131,262, Mar-22 Data

- Idaho SNP Membership at 12,096, Mar-22 Data

- Indiana SNP Membership at 93,463, Mar-22 Data

- Kentucky Medicaid Managed Care Enrollment is Up 1.9%, Apr-22 Data

- Louisiana SNP Membership at 118,924, Mar-22 Data

- Maryland SNP Membership at 18,113, Mar-22 Data

- Mississippi Medicaid Managed Care Enrollment is Down 5.3%, Mar-22 Data

- Missouri Medicaid Managed Care Enrollment is Up 5.4%, Mar-22 Data

- New Mexico SNP Membership at 21,478, Mar-22 Data

- New York SNP Membership at 480,738, Mar-22 Data

- North Carolina SNP Membership at 146,899, Mar-22 Data

- Oregon SNP Membership at 29,622, Mar-22 Data

- South Carolina SNP Membership at 71,206, Mar-22 Data

- Texas SNP Membership at 393,891, Mar-22 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- Colorado Medicaid Enrollment Broker Services RFI, Apr-22

- District of Columbia Home Health Care Services HCA, Apr-22

- Florida Statewide Medicaid Managed Care Model Contract, Sep-21

- Minnesota Evidence Based Opioid Response Services RFP, Apr-22

- Minnesota SUD Treatment and Prevention Services for American Indian Urban Communities RFP, Apr-22

- North Dakota Communicating with Medicaid Members about End of the Public Health Emergency RFPs, 2022

- Ohio Third Party Liability Services RFP, Apr-22

- Texas EVV Systems Management Services RFO, Apr-22

- Vermont SSDC Program for Medicaid Supplemental Drug Rebates RFP, Apr-22

Medicaid Program Reports, Data and Updates:

- Indiana Medicaid Managed Care Quality Strategy Plan, 2017-22

- Louisiana Medicaid Managed Care Quality Companion Guide, Apr-22

- Louisiana Statewide Transition Plan for HCBS Community-Settings Regulations, Apr-22

- Maryland Medicaid Managed Care EPSDT Medical Record Review, CY 2020

- Texas Quarterly Reports from the HHS Ombudsman Managed Care Assistance Team, FY 2019-22

- Washington Medicaid Title XIX Advisory Committee Meeting Materials, 2021-22

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Carl Mercurio at [email protected].

About HMA

HMA is an independent, national research and consulting firm specializing in publicly funded healthcare and human services policy, programs, financing, and evaluation. We serve government, public and private providers, health systems, health plans, community-based organizations, institutional investors, foundations, and associations. Every client matters. Every client gets our best. With more than 20 offices and over 500 multidisciplinary consultants coast to coast, our expertise, our services, and our team are always within client reach.

Among other services, HMA provides generalized information, analysis, and business consultation services to investment professionals; however, HMA is not a registered broker-dealer or investment adviser firm. HMA does not provide advice as to the value of securities or the advisability of investing in, purchasing, or selling particular securities. Research and analysis prepared by HMA on behalf of any particular client is independent of and not influenced by the interests of other clients.