This week's roundup:

- In Focus: States Submit Applications for Rural Health Transformation Program: Trends and Opportunities

- In Focus: Where Duals Integration Is Headed: State-by-State Intelligence

- Florida Awards Children’s Medical Services Contract to Molina

- Michigan Launches Grant Opportunity to Expand Mobile Behavioral Health Crisis Services

- Nevada Releases Children’s Specialty Managed Care Plan RFP

- Vermont Appoints Jill Mazza Olson as Medicaid Director

- Wakely Releases Updated 2025 ACA Marketplace Analysis

- CMS Introduces Drug Model to Curb Medicaid Drug Costs Through Most Favored Nation Pricing

In Focus

States Submit Applications for Rural Health Transformation Program: Trends and Opportunities

On November 5, 2025, the Centers for Medicare & Medicaid Services (CMS) announced that all 50 states had submitted applications to be considered for participation in the Rural Health Transformation Program (RHTP) created under the Budget Reconciliation Act of 2025. States proposed a range of initiatives to strengthen innovation, modernize rural health infrastructure, and address persistent disparities in healthcare access, workforce, and outcomes in rural communities. Funding decisions are expected by December 31, 2025.

The RHTP represents a major federal investment in rural health transformation. For providers, community partners, and other interest holders, applications offer valuable insight into state priorities, partnership models, and the types of initiatives likely to receive funding.

Many state feedback processes are ongoing for providers, community organizations, and other partners. Even after submission, states are refining their proposals and negotiating with CMS. Organizations should review available materials and take advantage of open comment periods or stakeholder meetings to help states prepare for a strong program launch in early 2025.

Health Management Associates (HMA) reviewed state overviews and applications, where available. In this article we highlight key takeaways from this review and the information available through HMA’s Information Services (HMAIS).

Key Issues and Trends

- Breadth of initiatives and focus areas. State initiatives meet the specific categorical CMS requirements and include a range of innovative models, ideas, and investments in building out pilots and infrastructure. The number of initiatives that states have planned also vary, with most proposing four or five, but at least one state has developed 11 planned programs. Many initiatives involved remote patient monitoring and telehealth, including tele-specialty clinics, tele-psychiatry hubs, tele-intensive care unit support, among others. Several states proposed to establish and enhance models involving emergency medical services (EMS). Proposals also include a range of investments in electronic health records (EHRs), data infrastructure, and interoperability to specific provider types and generally in rural communities.

- Subgrant and Partnership Opportunities: Many applications include subgrant programs or call for partnerships with hospitals, clinics, community-based organizations, Tribal entities, and educational institutions. Reviewing state applications can help organizations understand the timelines for upcoming funding and partnership opportunities as well as expectations associated with the state initiatives.

- Diverse governance and implementation models: The tracker reveals a range of governance structures, from state-led advisory boards and interagency task forces to regional hubs and cross-sector partnerships. States are leveraging advisory councils, technical assistance partners, and community engagement frameworks to guide implementation and oversight.

Some states have yet to submit their full applications but still have opportunities to engage and shape state efforts through various methods. Many states have kept open public feedback mechanisms even as they negotiate with CMS on budgets and program details. This situation creates an evolving landscape wherein stakeholders must monitor multiple channels for updates and opportunities.

Why This Matters

HMAIS’ RHTP Inventory provides states, rural communities, and their partners an actionable road map for state initiatives. This inventory covers focus areas for state initiatives, governance models, funding requests, partnership opportunities, and other key information. This tool helps organizations monitor trends and identify where to engage. HMA will continue to follow state activity in this program as states move forward.

Beyond the tracker, HMA offers deep regional market expertise—our consultants understand state-specific priorities and can provide tailored analysis and strategic planning to position your organization for success. Whether you’re exploring telehealth investments, building partnerships, or preparing for new initiatives in rural health transformation, our team can help you navigate the details and seize opportunities.

For questions about the HMAIS RHTP Inventory and to connect with our state-market leads, contact Andrea Maresca and Gabby Palmieri.

Where Duals Integration Is Headed: State-by-State Intelligence

Dually eligible individuals are those who qualify for both Medicare and Medicaid. This population accounts for a disproportionately small share of the total Medicaid or Medicare population, but they account for a disproportionately large share of spending across both programs.

Medicare Advantage Dual Eligible Special Needs Plans Play a Key Role

Over the last several decades, federal and state policymakers have developed and implemented a range of programs, demonstrations, and approaches to improve care for this population and strengthen alignment between Medicare and Medicaid, improve outcomes, and manage costs. Medicare Advantage (MA) Dual Eligible Special Needs Plans (D-SNPs) are a key vehicle to accomplish federal and state goals.

What to Expect in Medicare Advantage Contract Year 2026

In 2026 and beyond, we can expect significant state and local shifts in plan enrollment, due to new federal requirements and state demonstration program transitions. We will see states focused on advancing aligned plan enrollment and setting higher expectations for Medicare-Medicaid integrated programs.

A New Inventory to Stay on Top of State Markets

Health Management Associates (HMA) has published the Duals Integration Environmental Inventory, a state-by-state view of state Medicaid program structures and regulations shaping integration and D-SNP markets. This resource is designed to help state policymakers, insurers, and healthcare organizations track trends, identify opportunities, and inform strategic planning in an evolving policy landscape.

Looking Ahead at the Changes in 2026 and Beyond

Federal rules for the Medicare Advantage 2026 contract year—and state Medicaid contractual agreements with plans—strengthen D-SNP integration standards and coordination between states and plans. Examples include:

- D-SNP Look-Alike Plans: In 2026, the threshold for identifying MA plans as D-SNP look-alikes will decrease from 70 percent to 60 percent. This 10-percentage point drop marks the second of two planned phasedowns in the threshold percentage. Look-alike plans are MA plans that are marketed to dually eligible individuals, but they are not required to comply with D-SNP integration requirements. Stronger federal standards will require MA look-alike plans with high dual enrollment to convert or exit the market, which is expected to lead to shifts in dually eligible enrollment into D-SNPs and other integrated products.

- Financial Alignment Initiative Demonstration Transitions: The Centers for Medicare & Medicaid Services (CMS) has worked with several states operating capitated Financial Alignment Initiative (FAI) demonstrations to transition Medicare-Medicaid Plans (MMPs) to integrated D-SNPs by January 1, 2026. These states include Illinois, Massachusetts, Michigan, Ohio, Rhode Island, South Carolina, and Texas will end their FAI demonstrations on December 31, 2025.

- 2027 D-SNP Rules: Beginning in 2027, D-SNPs affiliated with Medicaid managed care organizations (MCOs) must restrict enrollment to Medicaid MCO enrollees. In addition, federal rules will limit the number of D-SNP plan benefit packages, which will require additional coordination with Medicaid affiliates and planning in designing benefit packages and network.

State Medicaid Program Adjustments

States are working to align new federal D-SNP requirements with existing Medicaid managed care contracts, long-term services and supports carve-in strategies, and service-area mappings. Because State Medicaid Agency Contracts (SMACs) must be updated annually, all SMACs will need to incorporate the new D-SNP provisions as the new requirements take effect. This effort will require close coordination among state agencies, plans, and CMS to manage enrollee transitions, data-sharing, and communications.

Data-Informed Integration Insights

HMA’s Duals Integration Environmental Inventory is a single hub for insights into requirements, approaches to scope of integration programs, and enrollment data. The inventory will help plans and other types of organizations such as providers and community-based organizations to prepare for future contracting, compliance, and operational transitions.

This inventory is designed to answer the four major questions top of mind:

- What is the state’s integration model and D-SNP type. The inventory identifies each state’s approach to integrating care for dually eligible populations, including states with Fully Integrated Dual Eligible Special Needs Plans (FIDE-SNPs), Highly Integrated D-SNPs (HIDE-SNPs), coordination-only models, and Exclusively Aligned Enrollment (EAE) initiatives or comparable rules

- Does the state’s program integrate LTSS and/or Behavioral Health? The inventory details whether long-term services and supports and behavioral health are carved into or out of managed care and how those benefits interact with Medicare coverage within D-SNP structures

- What is the state’s enrollment policy? The inventory captures enrollment in HIDE/FIDE products, identifies Applicable Integrated Plan (AIP) states, and gauges overall alignment maturity

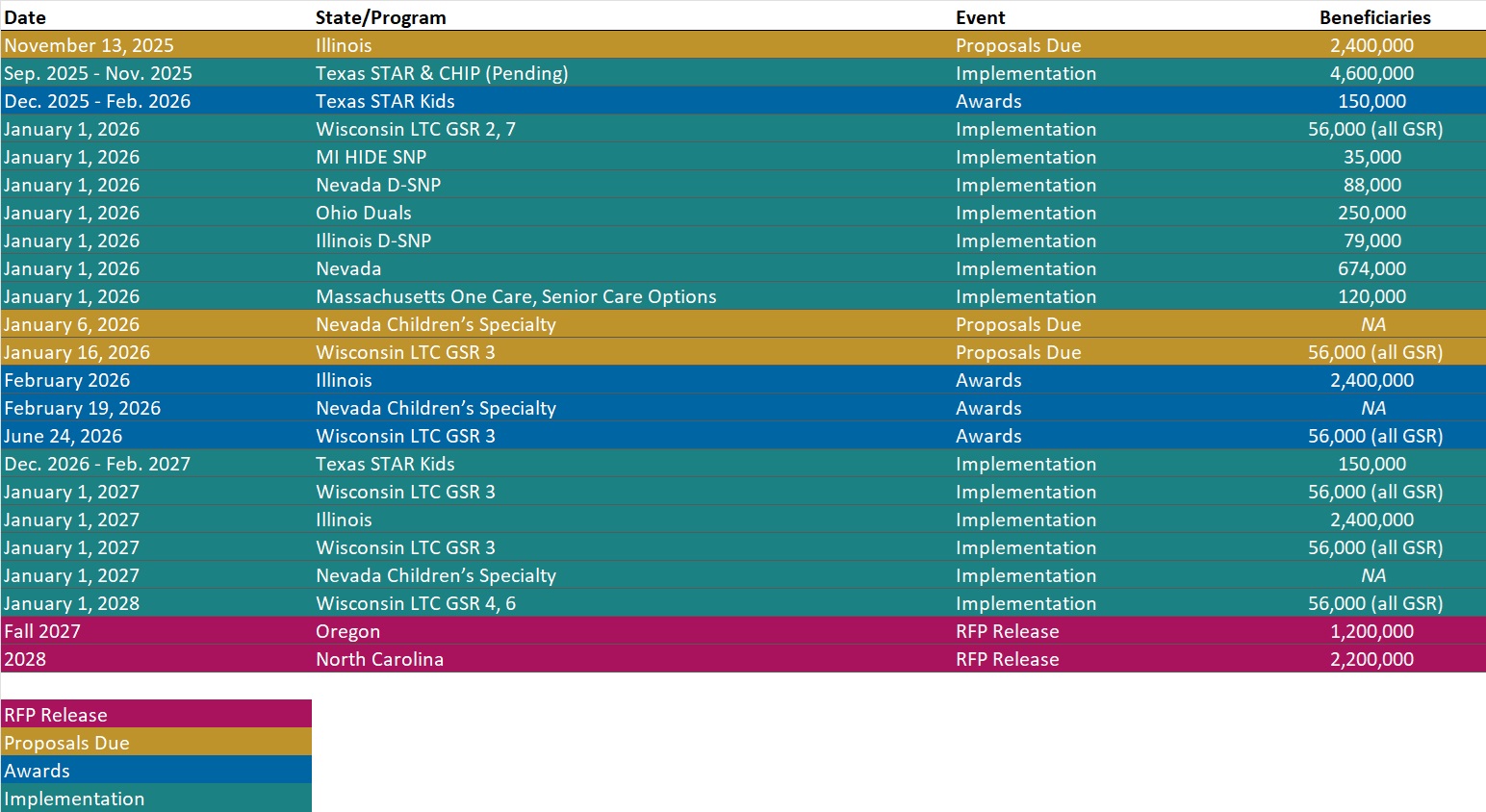

- What is the state’s procurement and contract timeline? The inventory also tracks state procurement timelines, upcoming RFPs, and effective contract dates

Connect with Us

HMA experts are tracking state integration strategies, procurement timelines, and future state planning activities. Beyond the tracker, HMA colleagues provide tailored analysis and planning for state-specific initiatives. Our team can help health plans prepare for enrollment shifts, compliance requirements, and integration opportunities in 2026 and beyond. For information about subscription access to the HMA Information Services (HMAIS) inventory and to connect with HMA consultants who can address your integration questions, contact Andrea Maresca or Gabby Palmieri.

HMA Roundup

Florida

Florida Awards Children’s Medical Services Contract to Molina. The Florida Agency for Health Care Administration (AHCA) announced on November 3, 2025, that it intends to award a sole source contract for the Title XIX and Title XXI Children’s Medical Services Program to non-incumbent Molina Healthcare of Florida. Incumbent Centene did not receive an award. According to the Invitation to Negotiate (ITN) issued in November 2024, the contract term will begin the date of execution and run through December 31, 2030, with no renewal options.

Michigan

Michigan Launches Grant Opportunity to Expand Mobile Behavioral Health Crisis Services. The Michigan Department of Health and Human Services (MDHHS) announced on November 10, 2025, that it is offering up to $9.5 million in a competitive Grant Funding Opportunity (GFO) for crisis response initiatives that would establish or expand community-based mobile crisis intervention services. Eligible applicants include local public entities, Tribal governments, and local health departments, with awards of up to $1 million each for the period of March 1, 2026, to September 30, 2027. Applications are due December 5, 2025.

Nevada

Nevada Releases Children’s Specialty Managed Care Plan RFP. The Nevada Health Authority released on November 5, 2025, a request for proposals (RFP) seeking qualified vendors to administer risk-based capitated managed care services for children and youth with complex behavioral health needs. This procurement creates a new Specialty Managed Care Plan aimed at improving access to physical and behavioral health services as well as pharmacy services for children and young adults with behavioral health disabilities who are involved in the child welfare system. The objectives of the procurement include developing a strength-based system of home and community-based services and preventing enrollees from being removed from their homes and unnecessarily entering hospitals and and treatment facilities. Nevada intends to award one contract effective January 1, 2027, through December 31, 2031, with the option for a two-year extension. Proposals are due January 6, 2026. The notice of intent to award is expected around February 19, 2026, and final awards are expected to be announced around April 7, 2026.

Vermont

Vermont Appoints Jill Mazza Olson as Medicaid Director. Vermont Biz reported on November 10, 2025, that Jill Mazza Olson has been appointed as Medicaid Director in the Department of Vermont Health Access at the Agency of Human Services. Olson previously served as executive director of VNAs of Vermont.

National

Wakely Releases Updated 2025 ACA Marketplace Analysis. Wakely, an HMA company, released an updated white paper in November 2025 analyzing the 2025 Affordable Care Act (ACA) individual Marketplace using Wakely National Risk Adjustment Reporting (WNRAR) data through July 2025. The report finds that relative morbidity increased by nearly seven percent compared to 2024, one of the largest year-over-year increases in recent history. Despite 2026 premium filings showing an average increase of approximately 26 percent, Wakely notes that some state markets may remain underpriced relative to the underlying health risk of enrollees. The analysis highlights growing financial pressure for insurance carriers as they enter 2026, with higher medical loss ratios and tighter margins anticipated. Looking toward 2027, the report stresses the importance of balancing long-term sustainability and pricing competitiveness while accounting for policy, regulatory, and demographic factors that could continue to influence market risk and financial performance.

CMS Introduces Drug Model to Curb Medicaid Drug Costs Through Most Favored Nation Pricing. The Centers for Medicare & Medicaid Services (CMS) issued on November 7, 2025, a Request for Applications (RFA) for drug manufacturers to join the GENErating cost Reductions fOr U.S. Medicaid (GENEROUS) Model, a voluntary five-year initiative beginning January 2026. The model enables manufacturers to offer Most Favored Nation pricing, which aligns U.S. Medicaid drug costs with prices in G7 countries, Denmark, and Switzerland. Manufacturers will provide supplemental rebates to achieve a Guaranteed Net Unit Price, ensuring Medicaid pays a fair and globally benchmarked rate for each drug. Applications are due March 31, 2026, with agreements finalized by June 30, 2026. CMS will issue a state RFA in December 2025 for Medicaid agencies wishing to participate. The program aims to reduce drug spending, streamline rebate negotiations, and ensure more consistent, affordable access to medications for Medicaid beneficiaries.

Industry News

Trump Administration Reaches GLP-1 Price Deals With Eli Lilly, Novo Nordisk. Modern Healthcare reported on November 6, 2025, that the Trump administration has secured deals with Eli Lilly and Novo Nordisk to cut prices on GLP-1 weight loss drugs in exchange for tariff relief and access to more Medicare patients. Consistent with agreements struck with other pharmaceutical companies, these agreements reportedly include a “most favored nation” pricing policy for state Medicaid programs. In addition, the companies will receive a three-year grace period on tariffs for their imported products.

RFP Calendar

Actuaries Corner

Amid Shutdown, Health IT Vendors Say Hospitals Are Cutting Back on Spending. A survey by Black Book Market Research of 107 healthcare IT vendors found that 71% had one or more procurements paused and 68% were seeing new RFPs delayed, as hospitals facing cash-flow stress amid the federal shutdown shift spending toward short-term ROI tools like revenue-cycle and cybersecurity platforms. Editor’s Note: The abrupt pivot from strategic, long-term tech investments toward “must-have” purchases reveal how financial fragility in the broader health-system sector can ripple swiftly through innovation and infrastructure planning.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Webinars

Impact Investing as Good Medicine: Prescribing Capital for Healthier Communities. Thursday, November 13, 2025, 12 PM ET. This webinar will convene investment professionals from major healthcare systems alongside leaders in impact investing to explore how strategic investments in the social drivers of health affordable housing, community infrastructure, food access and security, transportation, and local community and economic development—can both improve population health and deliver financial returns to healthcare systems and payers. Healthcare leaders will discuss how leveraging balance-sheet capital toward upstream solutions strengthens organizational sustainability, creates competitive differentiation in RFPs, builds community trust, and aligns with regulatory and value-based care incentives. Impact investing practitioners will discuss how they identify opportunities that deliver both financial performance and measurable health outcomes, and share lessons from structuring investments that balance institutional rigor with community impact. Register Here

Value Based Care Advisory Services: HMA and Wakely Put Analysis into Action. Thursday, November 20, 2025, 1 PM ET. Join experts from HMA and Wakely for an inside look at how our teams help organizations navigate and thrive in the value-based landscape. This session will highlight case studies and recent work that demonstrate a comprehensive advisory solution for any value-based entity. Attendees will gain a deeper understanding of how integrated insights across strategy, analytics, and implementation can drive measurable results in value-based care. Register Here

Redefining Revenue: Building Financial Resilience in an Era of Policy and Payment Change. Thursday, December 11, 2025, 1 PM ET. As healthcare organizations face sweeping shifts in Medicaid funding, workforce costs, and payer expectations, leaders must think beyond short-term cuts and find sustainable ways to protect access, quality, and mission. Join HMA experts Jose Robles, Juan Montanez, and Kristina Ramos-Callan for a timely discussion on how hospitals, health systems, and providers can reimagine revenue strategy for the next decade. Register Here

Value Based Care Advisory Services: HMA and Wakely Put Analysis into Action. Thursday, November 20, 2025, 1 PM ET. Join experts from HMA and Wakely for an inside look at how our teams help organizations navigate and thrive in the value-based landscape. This session will highlight case studies and recent work that demonstrate a comprehensive advisory solution for any value-based entity. Attendees will gain a deeper understanding of how integrated insights across strategy, analytics, and implementation can drive measurable results in value-based care. Register Here

Wakely, an HMA Company, White Paper

ACA Affordability Scorecard. This white paper analyzes how ACA affordability will change in 2026 if enhanced subsidies expire. Using county-level premium data, it shows that consumers—especially younger and lower-income—will face significant premium increases, though buying down to cheaper Silver or Bronze plans can partially offset costs. Impacts vary widely by state, income, and age, creating risks for market stability and pricing accuracy.

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- New HMAIS RHTP Application Tracker

- Updated Updated Medicaid Managed Care RFP Calendar: 50 States and DC

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].