This week's roundup:

- In Focus: The Rural Health Transformation Program: Options to Address the Maternity Care Crisis

- In Focus: HMA Enrollment Update: Medicaid Managed Care Organizations See Drop in Enrollment in 2Q25

- HMA Conference: Incentives to Add One or Both Days of the HMA Conference to Your Calendar

- Federal Government Goes Into Partial Shutdown

- CMS Updates Guidance on Managed Care Payments for Emergency Medicaid Coverage for Undocumented Immigrants

- Idaho DOGE Task Force May Consider Medicaid Expansion Repeal

- Massachusetts Issues NOI to Identify Rural Facilities for Federal RHTP Application

- Missouri Medicaid Director to Step Down After Seven Years

- New York Launches $25 Million Fund for Medicaid Providers

- North Dakota to Submit Medicaid State Plan Amendment Seeking Coverage of Community Health Workers, Other Services

- Medicare Advantage SNP Enrollment Grows to 7.3 Million in 2024

In Focus

The Rural Health Transformation Program: Options to Address the Maternity Care Crisis

This article is part of HMA’s Weekly Roundup series on the RHT Program, highlighting key opportunities and considerations for states and healthcare organizations.

The Centers for Medicare & Medicaid Services (CMS) recently launched the Rural Health Transformation (RHT) Program, which is intended to help states reimagine and rebuild rural healthcare delivery. As outlined in our earlier In Focus article, Rural Health Transformation Program Represents a One-Time Opportunity to Reshape Rural Care, this historic $50 billion federal investment provides states with flexibility to design and implement strategies that improve access, quality, and outcomes in rural communities.

As states develop their RHT applications, they can consider a range of approaches to address persistent gaps in care particularly in maternal health, where rural residents often face limited access to local services. A range of solutions is needed to expand and stabilize access to maternal care, given the shortage of close-to-home birthing care. This article explains one such option: investing in midwifery.

Maternity Care in Rural Communities

Maternity Care Deserts Driving a National Maternal Health Crisis

Families in rural communities—and some urban communities—face “maternity care deserts,” meaning they do not have access to a birthing facility or obstetric clinician. Hospital closures are another reality in rural communities, with additional closures projected. Even in larger communities where a hospital is open, obstetric services could be shut down. These deserts are a key driver of the national maternal health crisis. In Nowhere to Go: Maternity Care Deserts in the US, the March of Dimes (MOD) reported that “two in three maternity care deserts are rural counties (61.5%)” and that “counties with low access to telehealth were 30% more likely to be maternity care deserts.”

Midwifery as an Option for Rural Communities

Midwives are trained healthcare professionals who specialize in supporting women through typical, low-risk pregnancies. They provide care during pregnancy, labor, and the postpartum period. There are several types of midwives, each with different training and credentials. States determine which types of midwives may practice and under what conditions.

Expanding the midwifery workforce can be part of a broader strategy to improve access, particularly in rural areas where hospitals and obstetric providers are scarce. In some places, midwives already serve as a critical access point for maternal care in rural communities, with midwives attending to 30 percent of deliveries in rural hospitals.

The Rural Health Transformation Program Can Help Address the Crisis

The strategic goals of the RHT, as outlined in the CMS application materials and Notice of Funding Opportunity (NOFO), are designed to guide states in transforming rural healthcare delivery. These goals are grounded in the statutorily approved uses of funds and must be explicitly addressed in each state’s RHT application.

Midwives have long contributed to expanding access to maternal care across diverse settings. For example, midwives can support preventive health by providing prenatal and postpartum care in community settings. Their integration into rural care teams may help sustain access to maternity services where hospitals and obstetric providers are limited. States may also consider workforce development strategies, such as expanding midwifery training and retention programs, and innovative care models—including hub-and-spoke systems—that incorporate midwives to improve coordination and person-centered experiences (Figure 1).

According to Ginger Breedlove, PhD, CNM, founder of Grow Midwives, one of the nation’s leading midwifery organizations, “midwifery aligns with all strategic goals of the RHT program.”

States may consider midwifery as one of many options to help build sustainable, community-centered maternity care systems that reflect the RHT Program’s vision for rural health transformation.

Figure 1. Midwifery Alignment with RHT Strategic Goals

| RHT Strategic Goals | Midwifery Alignment |

| Make Rural America Healthy Again | Midwives support preventive, community-based maternal care and contribute to improved outcomes, such as higher rates of spontaneous vaginal delivery and breastfeeding and lower rates of preterm birth and low birthweight. |

| Sustainable Access | Midwives can serve as consistent local access points for maternity care, particularly in areas with limited obstetric services. States with midwifery care more fully integrated have better maternal and infant health outcomes. |

| Workforce Development | Midwifery workforce initiatives expand the pool of high-skilled providers practicing at the top of their license, aligning with goals to strengthen recruitment, retention, and licensure flexibility in rural areas. |

| Innovative Care | Midwives can be integrated into flexible care arrangements—hub-and-spoke or CMS’ Transforming Maternal Health model—alongside doulas and community health workers, improving care coordination and patient experience. |

| Tech Innovation | Midwives can leverage telehealth, remote monitoring, and data-sharing and digital care platforms to extend the reach of maternal care in rural communities and connect patients to the broader maternal care system, including remote specialist consultations. Tech innovations ensure that women receive the appropriate level of care for their risk and needs. |

Connect with Us

Health Management Associates (HMA) has deep expertise in supporting states and healthcare organizations across all phases of rural health transformation. Our team can assist with strategy and writing grants, program design, and implementation plans tailored to specific state goals and approaches. Whether states choose to explore midwifery or other care delivery models, HMA can help define the approach that best fits the needs of rural communities and support organizations in transforming workflows and operations, implementing new initiatives, and enhancing the systems and IT enhancements that sustains them.

HMA brings together experts in maternal health, finance, rural communities, and delivery systems, including Sarah Boateng, Ellen Breslin, Rebecca Kellenberg, Diana Rodin, and Sharon Silow-Carroll.

For inquiries, please contact Kathleen Nolan.

HMA Enrollment Update: Medicaid Managed Care Organizations See Drop in Enrollment in 2Q25

This week, our second In Focus provides insights into Medicaid managed care enrollment in the second quarter of 2025. Health Management Associates Information Services (HMAIS) obtained and analyzed monthly Medicaid enrollment data in 30 states,[1] offering a reliable baseline and timely view of the immediate impact of the current policy landscape as new federal policies take effect.

This analysis presents a snapshot of HMAIS’s comprehensive detailed quarterly Medicaid managed care enrollment report (available by subscription), which includes plan-level information for nearly 300 health plans in 41 states, corporate ownership, for-profit versus not-for-profit status, and similar information regarding publicly traded plans. Table 1 provides a sample of enrollment trends, representing 57 million Medicaid managed care enrollees of a total of 66 million Medicaid managed care enrollees nationwide. Data reporting periods and program coverage vary by state, so figures may not be fully comparable.

Key Insights from 2Q25 Data

The 30 states included in our review have released monthly Medicaid managed care enrollment data—via a public website or in response to a public records request from HMAIS—for April through June of 2025. This report reflects the most recent data posted or obtained from states. HMA has made the following observations regarding the enrollment data:

- Year-over-year decline. As of June 2025, in the 30 states reviewed, Medicaid managed care enrollment declined by 1.6 million members year-over-year, a 2.7 percent drop from June 2024.

- Widespread decreases. Of the 30 states, 27 experienced enrollment declines in June 2025 compared to June 2024. Oregon and the District of Columbia saw modest growth, while California remained flat (Table 1).

- Sharpest contractions. Arizona and Maryland reported double-digit percentage drops in enrollment in June 2025 (Table 1), underscoring the uneven impact of redeterminations and eligibility policy changes.

- Difference among expansion and non-expansion states. Among the 24 states included in the analysis that expanded Medicaid, enrollment fell by 1.2 million—a 2.5 percent drop—to 49.2 million. The six non-expansion states saw a steeper proportional decline of 4.2 percent, to a total of 8 million enrollees.

Table 1. 2Q25 Monthly MCO Enrollment by State, April–June 2025

The data in Table 1 should be viewed as a sampling of enrollment trends across these states rather than as a comprehensive comparison, which cannot be established based solely on publicly available monthly enrollment data. It is also important to note the limitations of the data presented. For example, not all states report data at the same time during the month, resulting in a range of snapshots from the beginning to the end of the month. Second, in some instances, the data cover all Medicaid managed care programs, while in others they reflect only a subset of the broader managed Medicaid population, depending on what data is publicly available.

Market Share and Plan Dynamics

HMAIS’s report includes plan-level details for nearly 300 plans, covering corporate ownership, program participation, and tax status. As of June 2025, Centene continues to lead the national Medicaid managed care market with 17.8 percent share, followed by Elevance (10.4 percent), United (8.6 percent), and Molina (6.2 percent; see Table 2).

Table 2. National Medicaid Managed Care Market Share by Number of Beneficiaries for a Sample of Publicly Traded Plans, June 2025

What to Watch

The OBBBA (P.L. 119-21) calls for significant changes to Medicaid eligibility and enrollment policies, including work requirements and more frequent eligibility redeterminations. Projections indicate that Medicaid and Children’s Health Insurance Program enrollment could decline by up to 7.5 million people by 2034. In addition, the Centers for Medicare & Medicaid Services (CMS) has announced that it will not approve or extend waivers for multi-year continuous eligibility for adults or children.

As these policies are implemented, state governments and healthcare organizations should prepare for increased administrative complexity, potential coverage disruptions, and the resulting effect on MCO revenue and value-based care arrangements.

Connect with Us

HMA is home to experts who know the Medicaid managed care landscape at the federal and state levels. As the Medicaid landscape continues to evolve, HMAIS equips stakeholders with timely, actionable intelligence, including enrollment data, quarterly by-plan and by-state enrollment reports, financials, Medicaid demonstration and Rural Health Transformation program tracking, and a robust library of publicly available Medicaid-related documents. HMAIS combines publicly available information with HMA expert insights on the structure of Medicaid in each state, as well as our comprehensive, proprietary State Medicaid Overviews.

For questions about the HMAIS enrollment report and information about the HMAIS subscription, contact Andrea Maresca and Alona Nenko.

[1] Arizona, California, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Virginia, Washington, West Virginia, Wisconsin.

Incentives to Add One or Both Days of the HMA Conference to Your Calendar

As states and organizations across the country are navigating tight budgets and difficult decisions, Health Management Associates (HMA) recognizes the challenge and is committed to supporting leaders and teams who are driving change. We want to make it easier for you to join us for one or both days of the conference. If you are only able to attend one day, register with one of the codes below for single day admission:

- NOLADAY15 ($895) for Wednesday October 15, or

- NOLADAY16 ($495) for Thursday October 16

If you can join us for the full conference, use the code FLASH25 for up to $475 off the standard registration fee for this year’s HMA National Conference.

HMA Roundup

National

Federal Government Goes Into Partial Shutdown. Health Payer Specialist reported on October 1, 2025, that the federal government has gone into a shutdown after Congress failed to pass appropriations bills that would keep operations up and running. Lawmakers were unable to agree on funding measures for healthcare as Democrats looked to reverse some of the Medicaid cuts made in OBBBA and extend enhanced premium tax credits for individuals who get their healthcare coverage on the Marketplace. The U.S. Department of Health and Human Services contingency plan will go into effect, with Medicare, Medicaid, CHIP, and Marketplace benefits continuing for some time. Medicaid has enough funding to operate through at least the first quarter of fiscal 2026.

CMS Updates Guidance on Managed Care Payments for Emergency Medicaid Coverage for Undocumented Immigrants. The Centers for Medicare & Medicaid Services (CMS) released on September 30, 2025, a state Medicaid director letter that reinterprets how Medicaid funds may be used to cover emergency services for undocumented individuals who are otherwise ineligible for full Medicaid benefits. Under this updated interpretation, CMS now limits federal Medicaid funding to payment for services directly tied to the treatment of an emergency medical condition provided to undocumented individuals. In addition, CMS states that this funding does not apply to Medicaid managed care payments, including risk-based capitation payments, state directed payments, in lieu of services, prepaid inpatient health plan (PIHP) payments, prepaid ambulatory health plan (PAHP) payments, and primary care case management (PCCM) payments. CMS notes that the change is intended to “improve program and fiscal integrity in the Medicaid program.”

Idaho

Idaho DOGE Task Force May Consider Medicaid Expansion Repeal. The Idaho Capital Sun reported on September 29, 2025, that the Idaho Department of Government Efficiency (DOGE) Task Force is considering a potential repeal to Medicaid expansion in order to find cost-savings in the program. The task force is also examining other cost-cutting options, including implementing a lifetime cap on Medicaid use and moving more participants onto private insurance through the federal premium tax credit, which is currently set to expire at the end of 2025. Idaho’s Medicaid expansion program covers 87,000 individuals, according to the state Department of Health and Welfare.

Massachusetts

Massachusetts Issues NOI to Identify Rural Facilities for Federal RHTP Application. The Massachusetts Executive Office of Health and Human Services (EOHHS) issued a notice of intent (NOI) on September 25, 2025, to participate in the federal Rural Health Transformation Program (RHTP). The NOI details how Massachusetts defines rural areas using its State Office of Rural Health Rural Definition and identifies both rural-located facilities (such as critical access hospitals, federally qualified health centers, and rural health clinics) and rural-serving facilities (organizations that served at least 5,000 rural patients in 2023). Attachment A of the NOI lists the facilities eligible as potential partners in the state’s RHTP application. Entities not included but meeting the criteria may submit documentation by October 9, 2025.

Missouri

Missouri Medicaid Director to Step Down After Seven Years. The Missouri Independent reported on September 30, 2025, that the director of the Missouri Healthnet Division Todd Richardson will leave his post as Medicaid director at the end of October 2025 after seven years in the role. The state Department of Social Services is working to find an interim replacement director by mid-October.

New York

New York Launches $25 Million Fund for Medicaid Providers. Crain’s New York Business reported on September 26, 2025, that the New York Office for People with Developmental Disabilities has launched a new funding stream that will provide $25 million for community health clinics and other Medicaid providers as federal Medicaid cuts loom. The funding aims to expand access and improve quality, and will focus especially on expanding dental and specialty care in healthcare deserts. Providers may also receive funding to improve the physical layout of facilities to better accommodate those with disabilities.

North Dakota

North Dakota to Submit Medicaid State Plan Amendment Seeking Coverage of Community Health Workers, Other Services. North Dakota Health and Human Services (HHS) reported on September 29, 2025, that it will be submitting a Medicaid state plan amendment to the Centers for Medicare & Medicaid Services (CMS) to add additional services to its Medicaid program. Effective for dates of service on or after October 1, 2025, HHS wants to cover services provided by community health workers and community paramedics and remove the end date for coverage for Medication-Assisted Treatment services for substance use disorder. Effective for dates of service on or after December 1, 2025, HHS seeks to provide reimbursement for rural emergency hospitals. North Dakota will accept public comments for two weeks after the date of posting.

Industry News

Medicare Advantage SNP Enrollment Grows to 7.3 Million in 2024. Fierce Healthcare reported on September 29, 2025, that enrollment in Medicare Advantage (MA) Special Needs Plans (SNPs) grew from 13 percent of MA enrollment in 2018 to 21 percent in 2024, or 7.3 million people. Most of this growth has come from dual-eligible SNPs (D-SNPs), which increased from 2.2 million to 5.5 million members since 2018, though chronic condition SNPs (C-SNPs) recently drove most of the year-over-year growth. Institutional SNPs remain smaller, serving people needing long-term care. The SNP market is highly concentrated, with UnitedHealthcare and Humana covering over half of enrollees and UnitedHealthcare holding dominant shares across all SNP types.

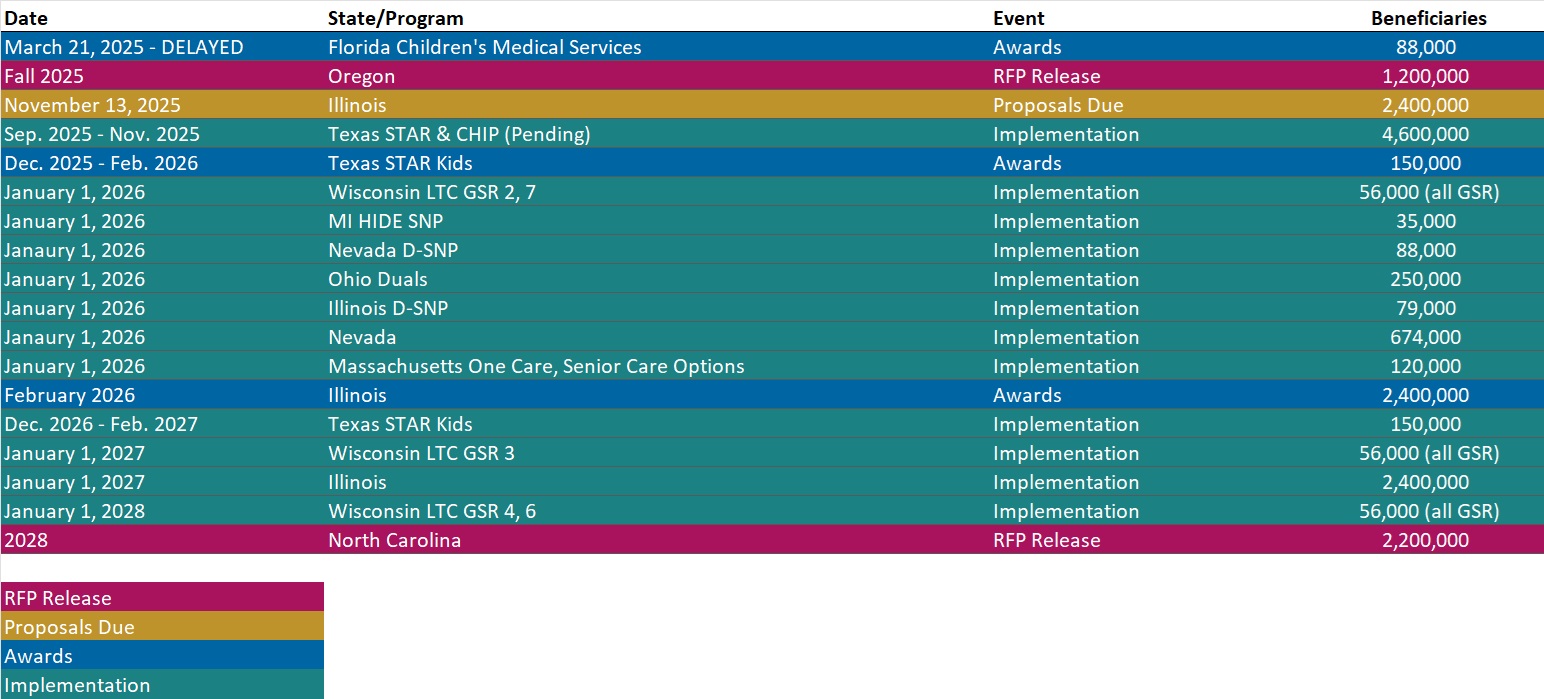

RFP Calendar

Actuaries Corner

Privia Acquires Evolent’s Value-based Primary Care Unit for $100M. It’s an opportunity for Privia to further increase its shared savings from Medicare’s largest value-based program. Editor’s Note: Privia Health is one of the biggest physician enablement companies in the U.S., with a footprint in 15 states and Washington, D.C. It is now acquiring a value-based primary care business from Evolent Health as it continues to expand its care delivery network into new geographies.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Report

Finding a Path to Support Aging in Place in California. New HMA report discusses the unmet needs of older adults in low-income housing, highlighting the challenges of siloed programs and the difficulty in blending services. Research consistently shows that more than 70 percent of Americans want to age in place, remaining in their own homes. Yet the country’s shifting demographics, rising costs for long-term services and supports, and changing financing landscape make achieving this goal more challenging than ever, especially for low-income older adults. In fact, more than one-quarter million older Californians live in senior affordable housing developments that range in size from a few dozen apartments to over a thousand units in large high rises. Most striking was the finding that while many of these residents are not only low-income and disproportionately burdened with chronic disease and also dually eligible for Medicaid and Medicare—a group shown in countless studies to represent a considerable proportion of Medicare and Medicaid costs, but that few residents appear to participate in aligned Medicare and Medicaid special needs plans (D-SNPs) or to access Medi-Cal waiver services.

The report gathers direct input from older adults, including Asian populations, in eight languages, addresses critical funding gaps, and identifies policy priorities that if implemented offer innovative recommendations for California to reduce duplication and better serve older adults using current resources.

HMA Webinars

Beyond the Bill: How Pair Team and MCOs Are Meeting Community Needs Under HR 1. Thursday, October 2, 2025, 1 PM ET. As Medicaid evolves under HR 1, Managed Care Organizations face increasing pressure to meet new engagement requirements while ensuring vulnerable communities don’t fall through the cracks. This shifting landscape demands scalable, innovative care models that go beyond compliance – focusing instead on meaningful connections, coordinated support, and whole-person care.

In this session, Jami Snyder, former HHSC Commissioner of TX and Medicaid Director of AZ, joins Neil Batlivala, CEO and Co-Founder of Pair Team, and Dr. Nate Favini, Chief Medical & Strategy Officer, to explore how Pair Team and its MCO partners are meeting this moment. Learn how their model combines technology, care coordination, and community-based partnerships to engage hard-to-reach members and address social drivers of health. You’ll hear real-world examples of how payers and partners can come together in smarter, more connected ways. By aligning efforts and building trust, they can drive better outcomes and create stronger community connections for the people who need support the most.

Medicaid 1115 Justice Involved Reentry Demonstration Opportunities: Engaging Key Stakeholders. Wednesday, October 22, 2025, 12 PM ET. This webinar will explore how states, local agencies, and community organizations can maximize Medicaid’s new 1115 demonstration authority to improve reentry outcomes for justice-involved individuals. Presenters will discuss practical strategies for assessing health and social needs, building strong collaborations with community providers, and implementing effective Medicaid enrollment processes. Attendees will gain insights into designing and operationalizing reentry programs that promote continuity of care, reduce recidivism, and support successful community reintegration. This session is ideal for State Medicaid agencies, carceral facilities, correctional healthcare companies, health plans, community-based organizations, and federally qualified health centers.

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- Updated HMAIS Medicaid Managed Care Rate Certifications Inventory

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].