This week's roundup:

- Countdown to the HMA Conference: Unlocking Solutions in Medicaid, Medicare, and Marketplace

- In Focus: Highlights from HMA Survey on State Approaches to Managing the Medicaid Pharmacy Benefit

- In Focus: Navigating the Impact of Medicare Drug Price Negotiations: Current Insights and Future Considerations

- Arizona Denies Appeal Over ALTCS-EPD Procurement; Will Not Rebid Contracts

- Arkansas Maternal Health Committee Recommends Medicaid Doula Coverage, Prenatal Presumptive Eligibility

- Florida Plan Drops Final Medicaid Managed Care Award Protest

- Federal Judge Declines to Block Maryland Law Requiring 340B Participation

- Massachusetts Awards One Care, Senior Care Options Program Contracts

- Michigan Expands Opioid Health Home Initiative Coverage to Include SUD, Additional Region

- Vermont Releases Medicaid Permanent Supportive Housing Assistance RFP

- Washington Medicaid Housing Program Faces Funding Shortage

- Wisconsin Medicaid to Offer Housing, Meal Support for Certain Beneficiaries in 2025

- CMS Releases Medicare Administrative Contractor Consolidation RFI

- Biden Administration Issues Final Rule Strengthening Mental Health Parity, Addiction Equity Act

- Humana to Exit 13 Medicare Advantage Markets in 2025

- More News Here

In Focus

Countdown to the HMA Conference: Unlocking Solutions in Medicaid, Medicare, and Marketplace

Join HMA at the Marriott Marquis Chicago from Oct. 7–9, 2024 for our annual fall conference: Unlocking Solutions in Medicaid, Medicare, and Marketplace. Choosing our conference will give you the opportunity to:

- Participate in intimate tactical workshops during the pre-conference led by actuaries, strategists, advisors, and former federal and state agency leaders.

- Attend your choice of 10 concurrent breakout panels, where experts will discuss and strategize on problems facing Medicaid, Medicare, and the Marketplace. Check out the new speakers we’ve added to our agenda.

- Network with more than 200 attendees from over 130 different organizations across all healthcare sectors. Explore the list of attending organizations here!

Get a special rate on your conference hotel room if you book before Monday, September 16. Register today and join your fellow healthcare leaders in unlocking solutions in publicly-funded healthcare!

Highlights from HMA Survey on State Approaches to Managing the Medicaid Pharmacy Benefit

This week, our In Focus highlights key takeaways and insights from a new Health Management Associates, Inc. (HMA), survey report, State Approaches to Managing the Medicaid Pharmacy Benefit: Insights from a National Survey for State Fiscal Years 2023 and 2024.

The report, released in August 2024 with support from Arnold Ventures, includes survey responses from 47 states (including DC) for state fiscal years (SFYs) 2023 and 2024. The survey instrument builds on questions posed in the 2019 Medicaid Pharmacy Study of all 50 states and the District of Columbia, which HMA and the Kaiser Family Foundation conducted.

The report discusses state trends for how Medicaid pharmacy benefits are administered across the country, including planned priorities and anticipated challenges in SFY 2025 and beyond. The findings are based on information provided by the nation’s state Medicaid Directors, Medicaid Pharmacy Directors, and other Medicaid agency experts.

Pharmacy Benefit Administration

In many states, managed care delivery systems play a pivotal role in administering Medicaid benefits, including prescription drugs. As of July 1, 2023, survey results found that:

- A total of 33 states carved pharmacy benefits into managed care organization (MCO) contracts, with one state, Kentucky, directing its MCOs to use a single state-selected pharmacy benefit manager (PBM).

- Eight states carve-out the pharmacy benefit—double the number in 2019.

MCO states were surveyed about their use of carve outs for certain drug products/classes, inclusive of physician-administered drugs covered under the medical benefit.

- In all, 19 states reported carving out one or more drug classes or select agents within a drug class—often high-cost specialty drugs.

- Of those states, 13 reported using the carve-out as part of a risk mitigation strategy.

Pharmacy Benefit Managers

The significant role and market power of PBMs have prompted many state legislatures to enact greater transparency practices and require health plans to accept more responsibility for monitoring the PBMs they contract with, which reflect notable changes since the 2019 survey. More specifically:

- A total of 33 states reported contracting with a PBM.

- The most frequently reported PBM functions included utilization management, drug utilization review, claims processing and/or payment, and rebate administration activities.

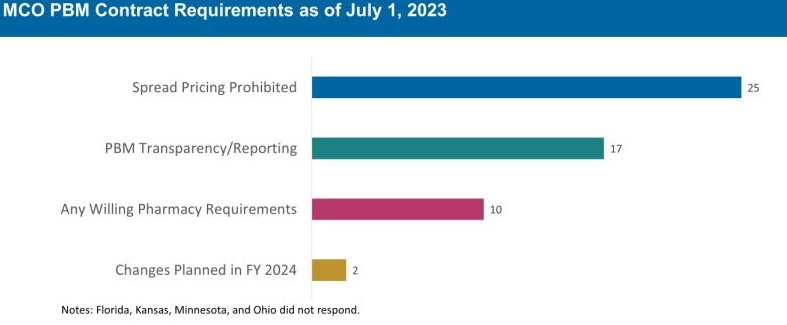

The 30 MCO states that carve in pharmacy benefits responded to survey questions about PBM transparency and spread pricing requirements. Of these states:

- 25 prohibit spread pricing in MCO PBM contracts—more than double the number of states reporting prohibitions on spread pricing in 2019.

- 17 reported having PBM transparency reporting requirements.

- 10 states reported having “any willing” pharmacy requirements.

The Role of PDLs, Prior Authorization, and Step Therapy in Controlling Drug Costs and Utilization

HMA’s experts also sought information on state payment strategies and utilization management protocols that are used to manage pharmacy expenditures. Nearly all responding states (44) have a preferred drug list (PDL) in place for fee-for-service prescriptions, which allow states to drive the use of lower cost drugs by encouraging providers to prescribe preferred drugs. Further, nearly two-thirds of responding MCO states (19 of 30 states) that do not carve out the pharmacy benefit reported having a uniform PDL for some or all drug classes, requiring all MCOs to cover the same drugs.

Many states have implemented step therapy and prior authorization (PA) guardrails in their Medicaid programs through legislation. However, 85.1 percent of responding states (40 of 47) report utilization controls like PA or step therapy applied to drugs that are reimbursed through the medical benefit to control utilization and costs. States also play an active role in managing MCO clinical protocols or medical necessity criteria, with 22 out of 30 MCO pharmacy carve-in states reporting that they require uniform clinical protocols for some or all drugs with clinical criteria. Approximately one-half of responding MCO carve-in states also require review and approval of MCOs’ PA criteria (15 of 30 states) and step therapy criteria (14 of 30 states).

State Adoption of VBAs: Improving Patient Access to Cell and Gene Therapies

A growing number of states are actively considering entering into value-based arrangements (VBAs) with manufacturers, as pressure to improve patient access to cell and gene therapies increases. Nine states have at least one VBA in place, and 23 states reported that VBAs are among their future solutions for addressing coverage of new high-cost therapies. States will need to address common barriers to VBA implementation, which involves more upfront costs and operational challenges to implement than traditional contracts.

Subsequent to the submission of survey responses, the Centers for Medicare & Medicaid Services (CMS) released a Cell and Gene Therapy (CGT) Access Model, which begins with a focus on sickle cell disease, anticipated to go live on January 1, 2025. Under the model, CMS will negotiate outcomes-based agreements with manufacturers on behalf of the state to ensure that treatment pricing is related to treatment effectiveness. In the coming years, experiences with this model will help determine whether a CMS-led approach to developing and administering VBAs for CGTs improves Medicaid member access to innovative treatment and their impact on expenditures, if any.

Looking Ahead

Managing the Medicaid pharmacy benefit has never been more challenging. In FY 2025 and beyond, most states will be focused on managing their Medicaid pharmacy budgets, especially the development of VBAs and other policies and strategies for managing new high-cost therapies. Other top priorities and challenges cited by multiple states include management of PBM arrangements and considering coverage of the new generation of GLP-1 anti-obesity medications. States also must react to changing drug marketplace conditions driven, in part, by federal policy changes to the Medicaid drug rebate formula and changes designed to lower Medicare drug costs. Drug manufacturer responses to these changes have implications for Medicaid state budgets, but also for state PDL management decisions and beneficiary access to needed medications.

Connect with Us

The upcoming event, Unlocking Solutions in Medicaid, Medicare, and Marketplace, hosted by HMA, will offer more opportunities to engage with report author Kathy Gifford at the pre-conference workshop Paying for Innovative Pharmaceuticals: State and Federal Trends Shaping Public Programs. Leaders from various sectors will join Kathy to discuss trends in prescription drug policies in public and commercial insurance programs.

For details about the report, contact Kathy Gifford, Principal, Aimee Lashbrook, Associate Principal or Constance Payne, PharmD, Associate Principal.

Navigating the Impact of Medicare Drug Price Negotiations: Current Insights and Future Considerations

This week’s second In Focus section continues the discussion on drug policies and trends with updates and insights regarding the current landscape for Medicare’s drug price negotiations.

The Centers for Medicare & Medicaid Services (CMS) recently released the negotiated prices for the first 10 Medicare Part D drugs under the Inflation Reduction Act’s (IRA’s) negotiation authority. CMS plans to add more drugs to the negotiation list, including 15 additional Part D drugs in 2027 and 15 more products from both Part D (pharmacy benefit drugs) and Part B (mostly physician administered drugs). In 2029 and later years, another 20 drugs from either Part B or Part D will be chosen.

Negotiated Prices for First 10 Drugs Leave Unanswered Questions

CMS estimates the negotiated prices for 30-day supplies of each medication will result in savings ranging from 38 percent to 79 percent compared with list prices when they take effect in 2026. This comparison, however, does not account for several factors that could affect the actual savings for the Medicare program and beneficiaries, including:

- Current negotiated discounts available to Medicare Part D plans

- Changes in tier placement for the negotiated drugs and their impact on patient cost sharing

- The exemption for manufacturers from the 10 percent discount during the initial coverage phase and the 20 percent discount thereafter once negotiated prices take effect in 2026

- The effect of Medicare’s negotiations on prices paid by other payers

- The impact of the IRA program on prices for other products and manufacturer investments in research and development of new products

CMS is required to provide a detailed explanation of how negotiated prices were determined by March 1. The price comparisons with privately negotiated prices, however, will remain unclear and the effects on other payers and longer-term investments in new products may not be fully understood for some time. The table below lists the negotiated discounts for the first 10 drugs, which CMS selected from the top 50 Part D drugs by spending, which lacked generic or biosimilar alternatives and met other IRA criteria.

Negotiated Drug Prices Applicable in 2026

Looking Ahead

Age of Products and Role of Generic and Biosimilar Competition: Drugs eligible for negotiation are typically the highest expenditure drugs that have been on the market for at least seven years or 11 years in the case of biologics. Importantly, products with generic or biosimilar competition are exempt from negotiation. This exemption may increase the speed at which biosimilar or generic competition comes to market, as the IRA requires competitors to engage in bona fide marketing to exempt an innovator from negotiation. Despite approval, biosimilars for some of the drugs will remain subject to negotiated prices until their marketing efforts begin.1

Impact on Medicaid and Other Payers: The IRA’s negotiated discounts are not required to be available outside of the Medicare program. It remains uncertain whether other payers will use Medicare-negotiated prices as leverage in their own negotiations. For Medicaid, the direct impact of negotiations themselves is expected to be negligible; however, the IRA’s inflation penalties could encourage more manufacturers to moderate price increases over time, potentially leading to reduced inflation penalty rebates to state Medicaid programs.

Connect with Us

To explore these topics further, join Health Management Associates at the upcoming event, Unlocking Solutions in Medicaid, Medicare, and Marketplace. Engage with Medicare experts such as Kevin Kirby (kkirby@healthmanagment.com), and Amy Bassano (abassano@healthmanagment.com). Kevin will lead a small group discussion on trends in prescription drug policies during the pre-conference workshop.

For details on IRA pricing issues or other Medicare health policy developments, contact Mr. Kirby (kkirby@healthmanagment.com), Mark Desmarais (mdesmarais@healthmanagment.com), or Ms. Bassano (abassano@healthmanagment.com). HMA’s Wakely Actuaries also are available to discuss the IRA’s role in Medicare Part D.

HMA Roundup

Arizona

Arizona Denies Appeal Over ALTCS-EPD Procurement; Will Not Rebid Contracts. The Arizona Health Care Cost Containment System (AHCCCS) issued on September 9, 2024, a Director’s Decision which denies an Administrative Law Judge recommendation to grant appeals for Banner-University Family Care, Mercy Care Plan, and Blue Cross Blue Shield of Arizona Health Choice, over the Long Term Care System/Elderly & Physically Disabled (ALTCS-EPD) procurement. AHCCCS stated the non-awarded health plans failed to show that the alleged errors created a disadvantage to them. Arizona plans to move forward with the awarded contracts to Centene/Health Net Access and UnitedHealthcare Community Plan, which were scheduled to go live October 1. However, the state has not indicated when planned transition activities will resume. The non-awarded health plans will have the opportunity to either file a Motion for Rehearing or Review with the agency or file an appeal in Superior Court to seek judicial review.

Arkansas

Arkansas Maternal Health Committee Recommends Medicaid Doula Coverage, Prenatal Presumptive Eligibility. The Arkansas Advocate reported on September 5, 2024, that the Arkansas committee tasked with developing a comprehensive statewide strategic health plan aimed at improving maternal health, has submitted its first report to Governor Sarah Huckabee Sanders. Recommendations include prenatal presumptive eligibility; Medicaid coverage for doulas and community health workers; higher reimbursements for existing care providers; and implementing digital platforms to track women’s Medicaid eligibility and application processing.

California

California Health and Human Services Secretary Dr. Mark Ghaly to Step Down from Role. The Los Angeles Times reported on September 6, 2024, that the California Health and Human Services (CalHHS) Secretary Dr. Mark Ghaly is stepping down after leading the agency since 2019. CalHHS oversees 12 departments, including the Department of Health Care Services that administers Medi-Cal. California Governor Gavin Newsom has appointed Kim Johnson, Director of the state Department of Social Services, to replace Ghaly in October.

Colorado

Colorado Implements Hospital Price Transparency Tool. The Colorado Department of Health Care Policy and Financing announced on September 11, 2024, that it has implemented a new hospital price transparency tool that allows providers, consumers, payers, and other stakeholders to compare the cost of over 5,000 procedures at 82 hospitals across the state. The tool compares gross charges, cash discounted prices, estimated Medicare costs, and commercially negotiated prices.

Florida

Florida Plan Drops Final Medicaid Managed Care Award Protest. Florida Politics reported on September 4, 2024, that incumbent plan AmeriHealth Caritas has dropped its protest against the Florida Agency for Health Care Administration (AHCA) over the Medicaid managed care contract award decision. The other two plans that challenged the awards—Sentara and Imagine Care, a joint venture of Spark Pediatrics and CareSource—previously dropped their protests. At the same time, plans are awaiting the state’s invitation to negotiate the $13 billion contract for Florida’s Children’s Medical Services Health Plan, as the current contract with Centene/Sunshine Health Plan expires January 31, 2025.

Florida to Put $100 Million From KidCare Budget in Reserves. Florida Phoenix reported on September 6, 2024, that the Florida Agency for Health Care Administration (AHCA) will redirect around $100.7 million of funds from the state’s KidCare budget to general reserves after the state overestimated the number of children that would enroll after being disenrolled from Medicaid during the post-pandemic unwinding. The fund redistribution aims to realign the state’s budget with updated expenditure and enrollment projections. Meanwhile, Florida’s planned KidCare expansion has yet to receive federal approval as the state continues its challenge to a federal rule requiring states to provide 12 months of continuous coverage for children on subsidized health plans, regardless of payment of premiums.

Florida to Submit Familial Dysautonomia Section 1915c Demonstration Renewal Request. The Florida Agency for Health Care Administration announced on September 4, 2024, that it will submit a request to the Centers for Medicare & Medicaid Services (CMS) to renew the state’s Familial Dysautonomia (FD) Section 1915(c) waiver demonstration, which provides home and community-based services to eligible beneficiaries with FD. The waiver renewal will add additional provider types that are eligible to perform services outlined in the waiver, clarify participant rights to fair hearings and grievances, and clarify safeguards for participants reporting critical incidents. The public comment period will be open until October 3.

Illinois

Illinois Joint Committee Extends Enrollment Pause for HBIA Program. Health News Illinois reported on September 11, 2024, that the Illinois Joint Committee on Administrative Rules have extended an emergency rule which pauses enrollment for a Medicaid-like program providing coverage to undocumented adults ages 42 through 64. The Health Benefits for Immigrant Adults (HBIA) program will expire in June 2025.

Kansas

Kansas Submits Letter of Intent to Apply for Transforming Maternal Health Grant. The Kansas Reflector reported on September 10, 2024, that Kansas has submitted a letter of intent to apply for the Transforming Maternal Health grant, which will provide up to $17 million in funding for states to participate in the 10-year model supporting prenatal and postpartum care. The Centers for Medicare & Medicaid Services will issue awards for up to 15 state Medicaid agencies, and the model is expected to begin in early 2025.

Maryland

Federal Judge Declines to Block Maryland Law Requiring 340B Participation. Reuters reported on September 6, 2024, that a federal judge declined to preliminarily block a Maryland law requiring prescription drug manufacturers to offer discounts on medications distributed by third-party pharmacies contracted with medical facilities serving low-income patients through the federal 340B program. The challenge was filed by the Pharmaceutical Research and Manufacturers of America, Novartis, AbbVie, and AstraZeneca. Similar legal challenges have surfaced in West Virginia, Kansas, Mississippi, and Louisiana.

Massachusetts

Massachusetts Awards One Care, Senior Care Options Program Contracts. The Massachusetts Executive Office of Health and Human Services announced on September 6, 2024, that it has awarded contracts for both its One Care and Senior Care Options (SCO) programs. One Care awardees are incumbents Commonwealth Care Alliance, Tufts, UnitedHealthcare, Molina/Senior Whole Health, and non-incumbents Mass General Brigham Health Plan and Community Care Cooperative. SCO awardees are the same six plus incumbent Fallon Health. The programs provide physical, behavioral, long-term services and supports, and other community services to dual-eligibles. One Care, which serves 43,000 dual eligible individuals ages 21 to 64, will transition from Medicare-Medicaid Plan operating under demonstration authority to a Fully Integrated Dual Eligible Special Needs Plan (FIDE SNP) with a companion Medicaid managed care plan. SCO, which serves 77,000 dual eligibles or Medicaid-only beneficiaries ages 65 and older, currently consists of Medicare FIDE SNPs with companion Medicaid managed care plans. Contracts are set to begin January 1, 2026.

Michigan

Michigan Expands Opioid Health Home Initiative Coverage to Include SUD, Additional Region. The Michigan Department of Health and Human Services reported on September 10, 2024, that they have submitted a State Plan Amendment to expand the state’s Opioid Health Home (OHH) initiative to provide coverage and reimbursement of Substance Use Disorder (SUD) Health Home services, with a proposed effective date of October 1. The proposed policy would add alcohol and stimulant use disorder as eligible diagnoses, and add Prepaid Inpatient Health Plan region 3 (Allegan, Kent, Lake, Mason, Muskegon, Oceana, Ottawa counties).

Missouri

WellCare of Missouri Medicare Advantage Plan Suspended From Enrollment in 2025. Health Payer Specialist reported on September 11, 2024, that the Centers for Medicare & Medicaid Services has sanctioned Centene’s WellCare of Missouri Medicare Advantage (MA) plan after it failed to meet the minimum 85 percent Medical Loss Ratio (MLR) requirement for three consecutive years. The plan will not be allowed to add new enrollees or switch current enrollees into other WellCare MA plans in 2025. The MLR for the insurer, which has approximately 4,400 enrollees, was 84 percent in 2023, 77.7 percent in 2022 and 78.9 percent in 2021.

New Mexico

New Mexico Personal Care Services Program Used Unqualified Workers, Audit Finds. The HIPAA Journal reported on September 11, 2024, that approximately 69 percent of attendants in New Mexico’s personal care services (PCS) Medicaid program did not meet all state and federal requirements in 2019, according to an audit conducted by the Department of Health and Human Services Office of the Inspector General (HHS-OIG). The most common lacking qualifications included no annual training, no background or abuse registry checks, and no current first aid certificate. According to New Mexico’s Human Services Department, the state relied on Medicaid managed care organizations (MCOs) to provide oversight over PCS attendants. HHS-OIG recommended the state develop a system to monitor and educate attendants, take action against providers who do not ensure attendant qualifications, and include PCS attendant oversight in MCO contracts.

New York

New York to Receive $10 Billion for Essential Plan Expansion. Crain’s New York Business reported on September 9, 2024, that New York will receive $10 billion in Affordable Care Act federal funds to support the expansion of the state’s Essential Plan—a public health insurance option offered through New York’s marketplace— under the Section 1332 demonstration. The funds will cover April through December 2024 and will have to be renewed annually.

New York Awards Medicaid Recovery Audit Contract to Performant Financial Corporation. Performant Financial Corporation announced on September 5, 2024, that New York has tentatively selected the company to be the New York State Medicaid Recovery Audit Contractor, where it will work alongside the Office of the Medicaid Inspector General to audit Medicaid payments. Once executed, the initial contract will run for three years with the possibility of two one-year extensions.

Senator to Introduce Bill Reversing Single Statewide Fiscal Intermediary for CDPAP Contract. Crain’s New York Business reported on September 6, 2024, that New York Senator Gustavo Rivera (D, Bronx) will introduce a bill to repeal language related to a single statewide fiscal intermediary (FI) for the Consumer Directed Personal Assistance Program (CDPAP). The legislation would allow multiple brokers to operate under stricter state regulations, including required licensing by the Department of Health and adhering to annual reporting mandates. The legislation would also establish a registry and minimum training requirements for caregivers.

Vermont

Vermont Releases Medicaid Permanent Supportive Housing Assistance RFP. The Vermont Department for Children and Families released on September 9, 2024, a request for proposals (RFP) to operate Medicaid Permanent Supportive Housing Assistance (PSHA) services authorized by the state’s Global Commitment to Health Section 1115 demonstration. The state plans to contract with one or more providers to offer pre-tenancy support services, tenancy sustaining services, and community transition services to eligible housing insecure and homeless Vermonters with disabilities, mental health conditions, or substance use disorder. The program will operate in two to four counties initially, with 100 available spots the first year. The six-month contracts are expected to start December 1, with four 12-month renewal options. Proposals are due October 18.

Washington

Washington Medicaid Housing Program Faces Funding Shortage. The Seattle Times reported on September 9, 2024, that organizations operating Medicaid-covered housing services in Washington have received less money than anticipated in 2024. Earlier this year, the Washington Health Care Authority (HCA) paused enrollments into the Medicaid housing program, which had more than 14,000 participants at the time, because budget projections showed it would exceed the $33.5 million allotted for 2024. However, the program will reopen this month due to additional anticipated funding streams and an increase in open slots available from people leaving the program. HCA has requested more federal funds from the Centers for Medicare & Medicaid Services and is preparing to request more money from the state to help stabilize the program.

Wisconsin

Wisconsin Medicaid to Offer Housing, Meal Support For Certain Beneficiaries in 2025. Wisc News reported on September 8, 2024, that Wisconsin Medicaid managed care organizations will begin offering meals and nutritional counseling for beneficiaries in an effort to prevent expensive emergency room visits and hospital stays, effective in January 2025. The state has also started covering security deposits, utility activations, and related expenses for pregnant women or families with children who are homeless or at risk of becoming homeless, at a cost of about $1,300 per family. Pending federal approval, the state will also begin a similar program for homeless adults who have mental health or substance use conditions.

National

CMS Releases Medicare Administrative Contractor Consolidation RFI. The Centers for Medicare & Medicaid Services (CMS) released on September 4, 2024, a request for information (RFI) to obtain public feedback on consolidating Part A and B Medicare Administrative Contractor (MAC) jurisdictions. The RFI also seeks feedback on extending the MAC contract award period of performance from seven years to 10 years. Currently, there are a total of 16 MAC contracts spread across seven companies that provide claims administration and other services.

Biden Administration Issues Final Rule Strengthening Mental Health Parity, Addiction Equity Act. The departments of Health and Human Services, Labor, and Treasury on September 9, 2024, published final rules aimed at clarifying and strengthening protections provided by the Mental Health Parity and Addiction Equity Act. The rule requires plans to evaluate their provider networks, how much they pay out-of-network providers, and how often they require prior authorization, as well as prohibits plans from using more restrictive prior authorization for mental health than for physical health.

CMS Renews $298 Million BFCC-QIO Contract with Acentra Health. Acentra Health announced on September 5, 2024, that the Centers for Medicare & Medicaid Services (CMS) has renewed its $298 million contract to serve as a Beneficiary and Family Centered Care-Quality Improvement Organization (BFCC-QIO) through April 30, 2029. As a BFCC-QIO, Acentra will address quality of care concerns, safeguard Medicare beneficiaries’ rights, and provide advocacy services for Medicare beneficiaries in 29 states.

Medicare Advantage Quality Bonus Payments to Decline by $1 billion in 2024, KFF Finds. KFF released on September 11, 2024, an analysis which found that federal spending on Medicare Advantage (MA) bonus payments will decline by $1 billion to $11.8 billion in 2024, following a decline in star ratings after the expiration of COVID-19 pandemic-era policies. Total bonus spending was still higher in 2024 than in every year between 2015 and 2022, with total spending on the quality bonus program being less than 3 percent of the projected payments to MA plans in 2024. Individual plans accounted for 60 percent of bonus spending; employer plans accounted for 22 percent; and special needs plans accounted for 18 percent in 2024.

ACA Marketplace Coverage Tops 20 Million in 2024. Reuters reported on September 10, 2024, that a total of 49.4 million Americans have signed up for health insurance coverage through Affordable Care Act (ACA) Marketplaces since their 2014 launch, according to data released by the U.S. Department of the Treasury. Enrollment has reached a high of 20.8 million people in 2024. Marketplace coverage has been higher in states that have not expanded Medicaid under the ACA or did so later, with Florida, Utah, and Georgia having an average of 20 percent of residents enrolled compared to 12 percent in states that expanded Medicaid coverage.

Uninsured Rate Remained Stable in 2023, Census Data Shows. KFF Health News reported on September 10, 2024, that the rate of uninsured Americans was around 8 percent in 2023, a 0.1 percent decrease from 2022, according to data from the U.S. Census Bureau. Factors contributing to the rate include a near record-low unemployment rate, enhanced federal subsidies helping lower the cost of private insurance available through the Affordable Care Act Marketplace, and states further expanding Medicaid eligibility. However, the data may not fully reflect the effects of the Medicaid unwinding because a person qualifies as being insured in 2023 if they had coverage at any point in time during the year, even if that was before the unwinding began.

Medicaid Eligibility System Errors Could Take Years and Millions to Fix. KFF Health News reported on September 5, 2024, that the errors facing Medicaid eligibility software operated by Deloitte—which received $6 billion worth of contracts to run 25 states’ eligibility systems—could take millions of dollars and years to fix. Deloitte has faced a federal complaint over the errors, which the company claims has no merit, and was called to testify in a lawsuit about wrongful Medicaid disenrollments in Florida. However, the company is not named as a defendant in the lawsuit.

Industry News

Elevance to Acquire IU Health Plans. Modern Healthcare reported on September 11, 2024, that Elevance Health subsidiary Anthem Blue Cross Blue Shield will acquire Indiana University Health’s IU Health Plans for an undisclosed amount. The deal—which is expected to close by the end of the year—will increase Elevance’s Medicare Advantage (MA) market share in the state.

Humana to Exit 13 Medicare Advantage Markets in 2025. Fierce Healthcare reported on September 4, 2024, that Humana is leaving 13 Medicare Advantage markets in 2025. Around 560,000 beneficiaries will be affected; however, Humana anticipates about half of those members will transition into other Humana plans that will be available in those markets.

Molina Healthcare CFO to Lead Medicaid, ACA Marketplace Businesses. Molina Healthcare announced on September 4, 2024, that Senior Executive Vice President and Chief Financial Officer, Mark Keim, will expand his leadership role to include Molina’s Medicaid and Affordable Care Act Marketplace businesses, in addition to his current responsibilities.

RFP Calendar

HMA News & Events

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Reports

- Updated New York State Overview

Medicaid Data

Medicaid Enrollment:

- Georgia Medicaid Managed Care Enrollment is Down 7.9%, Sep-24 Data

- Indiana Medicaid Managed Care Enrollment Is Down 0.9%, Feb-24 Data

- North Dakota Medicaid Expansion Enrollment is Down 15.9%, Aug-24 Data

- Pennsylvania Medicaid Managed Care Enrollment is Down 9.7%, Jul-24 Data

- Pennsylvania Medicaid LTSS Enrollment is Down 5.3%, Jun-24 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- Alabama Medicaid Pharmacy Average Acquisition Cost Program RFP, Aug-24

- Arizona Long Term Care System RFP, Proposals, Scoring, Protests, and Related Documents, 2023-24

- Indiana Pathways for Aging Contracts, 2024

- Iowa Health Link RFP, Award, Proposals, and Scoring, 2024

- Massachusetts One Care, Senior Care Options RFR and Awards, 2023-24

- Vermont Medicaid Permanent Supportive Housing Assistance RFP, Sep-24

- Wisconsin Medicaid D-SNP Model Contracts, 2019-25

Medicaid Program Reports, Data, and Updates:

- Arizona AHCCCS Section 1115 Waiver Documents, 2020-24

- Maryland HealthChoice Consumer MCO Report Cards, 2019-24

- New Mexico HHS-OIG Personal Care Services Audit, Aug-24

- Tennessee TennCare Annual Reports, FY 2010-23

- Washington Healthier Washington Community Checkup Reports, 2017-24

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at amaresca@healthmanagement.com.