This week, our In Focus section reviews the new States Advancing All-Payer Health Equity Approaches and Development (AHEAD) Model, which the Centers for Medicare & Medicaid Services (CMS) Center for Medicaid and Medicare Innovation (the Innovation Center) announced on September 5, 2023. AHEAD is the third major model that the Innovation Center has introduced to its payment portfolio since July, clearly signaling that CMS has transitioned from conducting its internal review to laying the groundwork for action on approaches that will be tested over the next decade.

CMS views this model as the next iteration of earlier total cost of care (TCOC) models that were designed and tested in three states—Maryland, Vermont, and Pennsylvania. The AHEAD model includes several important updates based on its experience with these earlier models. For example, the AHEAD model is designed to be scalable in multiple states. Although it most certainly will be adapted to state-specific markets, landscapes, and provider needs, CMS intends to apply a consistent framework across participating states.

Additionally, though Medicare has been involved in formulating some state-level total cost of care initiatives, the AHEAD model promises specific investments in primary care and enhanced member engagement to support all-payer movement toward patient-centered care.

AHEAD Model Parameters

The goal of the AHEAD Model is to improve population health and health equity in states that apply and that CMS selects for participation. CMS plans to select up to eight pilot states, each eligible to receive up to $12 million to support statewide implementation over a six-year period. States will be accountable for constraining overall growth in healthcare expenditures. Requirements centered on health equity mirror other CMS policies and are integrated throughout the model.

The model focuses heavily on strengthening primary care. The primary care AHEAD component includes Medicare reimbursement for care management, a commitment to align with ongoing Medicaid transformation efforts, and expectations for primary care practices to achieve certain goals on quality measures.

The investments in primary care are paired with global budgets for hospitals. Participating hospitals will receive a fixed payment that will include both Medicare fee-for-service and Medicaid. States will need to ensure participation among other payers, including at least the state employee health plan, Marketplace Qualified Health Plans, or other commercial payers in the state or sub-state region. Other payers will have the option to pay participating hospitals based on a global budget.

All-Payer Health Equity Approaches and Developments (AHEAD)

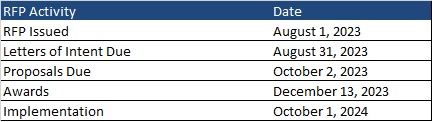

The model will be in operation 2024−2034, and three cohorts will be to accommodate variation in readiness among participating states and providers. The first cohort pre-implementation period is scheduled to begin in summer 2024, and the performance period is scheduled to begin as soon as January 2026. CMS expects to release additional details in fall 2023.

AHEAD Opportunities and Considerations

The AHEAD Model will need significant gubernatorial leadership and possibly from state legislators, depending upon the particular state’s related healthcare laws, and the model does provide flexibility for interested states and relevant stakeholders to develop programs that are adaptable to their needs.

Health Management Associates (HMA) experts have identified the following list of policies and considerations that states; hospitals, health systems, and provider organizations; other payers, including employers; and other stakeholders will need to bear in mind when determining whether to participate in the program.

- States will need to describe their partners and provide an assessment of their readiness to implement the AHEAD model. CMS will expect states to address whether they have legislation in place related to primary care investment and/or cost growth. Potential participating states should be able to describe their vision for population health improvement and primary care transformation, a proposed strategy for hospital and primary care provider recruitment, a plan for Medicaid and multi-payer alignment, and their current population health and health equity activities. Interested states will need early input from hospitals and health systems, providers, and other payers to define, develop, and implement a model that accommodates their healthcare landscape.

- States will develop a Medicaid hospital global budget methodology that must have CMS approval. Medicaid hospital global budgets must be implemented in the first performance year. CMS will develop a standardized Medicare fee-for-service (FFS) hospital global budget methodology, that also accommodates critical access hospitals (CAHs).

- CMS will set the parameters for quality measurement, but states will have significant flexibility to establish the metrics that will be applied for accountability and bonus purposes. CMS will use the current CMS hospital quality programs as the basis for determining eligibility for a health equity improvement bonus. CAHs will have a similar opportunity. States will work with CMS to set quality measures for participating primary care practices.

- The model requires a statewide health equity plan. Additionally, participating hospitals will need to create their own health equity plans in alignment with statewide priorities and activities.

- Participating states will need to generate savings. CMS will identify state-specific factors to determine the level of expected savings. All-payer cost growth targets include Medicare FFS, Medicare Advantage, Medicaid, commercial, state employee health plans, and marketplace-qualified health plans. States will also be responsible for performance on all-payer and Medicare FFS primary care investment targets.

The HMA team will continue to evaluate the AHEAD model as more information becomes available. We also can answer questions about the Innovation Center’s other recently announced models and the linkages with new Medicare and Medicaid regulations. For more information, contact Amy Bassano ([email protected]), Caprice Knapp ([email protected]), and Andrea Maresca ([email protected]).