One of only two firms selected in all seven domains out of 46 vendors.

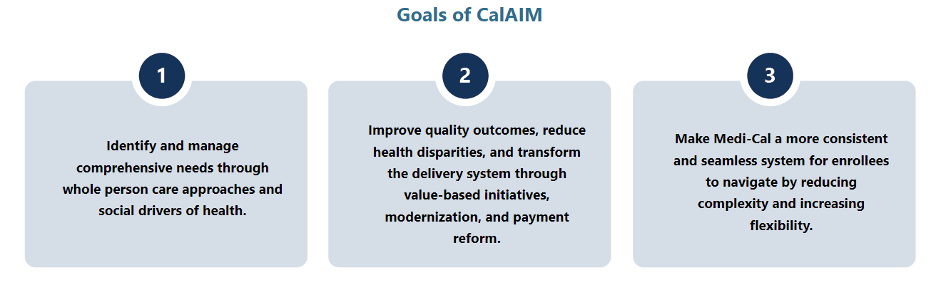

The California Department of Health Care Services (DHCS) has developed a multi-year initiative whose goal is to improve health outcomes and health care quality through broad delivery, payment, and program reforms known as California Advancing and Innovating Medi-Cal (CalAIM). This includes the introduction of new programs and changes to existing programs that will occur over the span of five years. CalAIM further expands upon prior initiatives, such as Whole Person Care, the Health Homes Program, and the Coordinated Care Initiative, and strives to integrate California’s delivery systems to better facilitate the overall Medi-Cal program.

With the rollout of these programs and the vast requirements associated with them, DHCS and California’s Medi-Cal managed care health plans are now tasked with the challenge of implementing CalAIM and enabling the participation of community providers and partners in these opportunities. To support these partners, DHCS developed a funding initiative, known as Providing Access and Transforming Health (PATH) to aid in strengthening capacity and infrastructure of Community Based Organizations, public hospitals, county agencies, and others to stand up CalAIM. This five-year, $1.85 billion initiative includes the creation of a virtual Technical Assistance (TA) Vendor Marketplace that organizations can use to request resources and support from approved vendors through services that are fully paid for by the State.

Health Management Associates (HMA) is recognized as a valued partner to Payers, Community Based Organizations, public hospitals, and county agencies and has deep expertise in CalAIM policy, operations and implementation. Recognized for our extensive capabilities in the field, HMA is one of only two firms out of 46 vendors that received State approval to serve as a technical assistance vendor on the PATH Technical Assistance (TA) Marketplace for all seven domains:

- Domain 1: Building Data Capacity: Data Collection, Management, Sharing, and Use

- Domain 2: Community Supports: Strengthening Services that Address the Social Drivers of Health

- Domain 3: Engaging in CalAIM Through Medi-Cal Managed Care

- Domain 4: Enhanced Care Management (ECM): Strengthening Care for ECM Population of Focus

- Domain 5: Promoting Health Equity

- Domain 6: Supporting Cross-Sector Partnerships

- Domain 7: Workforce

HMA also has expertise in and hands-on experience with addressing the unique challenges experienced by providers and partner agencies serving rural communities. Please visit the PATH Technical Assistance (TA) Marketplace to access TA resources that can help strengthen capacity to provide high quality Enhanced Care Management (ECM) and Community Supports services for Medi-Cal members.