This is part of an ongoing series highlighting efforts in human services and family wellbeing.

For decades, practitioners have recognized that child neglect was often interconnected in some families with stressors associated with familial poverty. Poverty is often a stressor in cases of child neglect, poor health, and even youth incarceration. Food insecurity, housing instability, and family stressors often related to unemployment, incarceration, and domestic violence can in some circumstances, result in parental burnout and lead to poor parenting decisions. There is also a perverse disincentive for families to experience career and wage progression which often results in steep fiscal cliffs with benefits that are needed to stabilize families and guide them towards economic self-sufficiency[1]. There is advocacy and increasing recognition through efforts such as Universal Basic Income Pilot programs and experiments with expanding Earned Income Tax Credits and Child Tax Credits attempting to mitigate catastrophic benefits cliffs that impact child and family wellbeing and economic self-sufficiency.

Public Safety Net programs such as Temporary Assistance to Needy Families, Supplemental Nutrition Assistance Program, WIC, Free and Reduced School Meals, Child Care Subsidies, Earned Income Tax Credit, Eviction Prevention Grants, and a host of other federal, state, and local programs are intended to support and strengthen families and increase protective factors for children[2].

Recent investments in the safety net including the childcare tax credit and the Pandemic Electronic Benefit Card (P-EBT) have shown that when concrete supports are provided to families, child maltreatment rates significantly decrease.[3]

During the height of the COVID-19 pandemic, the federal government implemented a One-Year Expansion of the Child Tax Credit which extended the eligibility to families with little to no income. It helped increase the credit amount families received from $3,600 per qualifying child younger than six years old and $3,000 for qualifying child between the ages of 6 and 17. It also provided monthly payments of $250 to $300 per qualifying child as opposed to an annual payment which aligned with monthly living expenses. According to the US Census Bureau, 2021 saw a historic decline in child poverty which lifted one million children under the age of six out of poverty, and 1.9 million for children between the ages of six and 17.

More recently States are experimenting with Universal Basic Income projects aimed at reducing child poverty, improving protective factors in families and reducing child maltreatment.[4] These experiments are currently being evaluated, but early research is showing promising signs of reduced child poverty in jurisdictions where these projects have gone live.

There is considerable literature that shows that changes in income alone, holding all other factors constant, have a major impact on the numbers of children being maltreated. Conversely, reduction in income or other economic shocks to the family increase incidents of child maltreatment.

A study performed by the Nuffield Foundation noted that internationally, evidence has shown a much stronger relationship between poverty and child abuse and neglect. Research has shown that without government and service providers responding to increased pressures on family life will lead to the risk of more children suffering harm, abuse and neglect.[5]

Another study by Casey Family Programs on predicting chronic neglect, found that the strongest predictors of chronic neglect were parent cognitive impairment, history of substitute care, parent mental health problems, and a higher number of substantiated allegations in the first CPS report[6]. This suggests that families at risk for chronic neglect face multiple challenges and significant financial insecurity that require significant support.

- Other significant predictors include:

- Younger parents

- Families with a higher number of children

- Families with a child under age 1

Recognizing these challenges to strengthening the protective factors for young moms, there have been several successful efforts around the country to focus on pregnant and parenting teen and young adult moms. From Health Families America, Nurse Home Visiting Programs, there has been a body of evidence created that shows the strengths of providing wrap around services and home-based interventions for moms and babies. These supports strengthen the mom-baby nurturing relationship and reduce risk of maltreatment and increase protective factors.

One such organization that has demonstrated significant success in disrupting the cycle of generational poverty is The Jeremiah Program. This is a national organization that aids single mothers and their children to provide coaching and assistance in navigating barriers to education, college access and career support, safe and affordable housing, early childhood education and childcare, and empowerment, leadership, and career training. This supportive program helps build up single mothers to achieve their educational and career goals and gain long-term economic prosperity.

As child welfare and poverty policies intersect, the current thought leadership is focused on recognizing that economic and concrete supports reduce involvement in child welfare.[7] As the science and voices of children and families with lived experience intersect and rise up, the federal and state policy landscape around alleviating poverty to improve child wellbeing will continue to gain momentum. Family and Child Well-Being indicators significantly reflect racial and ethnic inequalities both in child welfare and across the poverty landscape. Economic stability is also a key strategy to address racial and ethnic inequalities and closing the opportunity gap for all. Over the next 3-5 years we believe there will be a fundamental shift in policy, financing, and outcomes tracking that reflect our commitment to our society’s most vulnerable children and families. That is why it is crucial for States and Local governments to enact policies that would support programming to alleviate poverty and improve child and family resilience and protective factors.

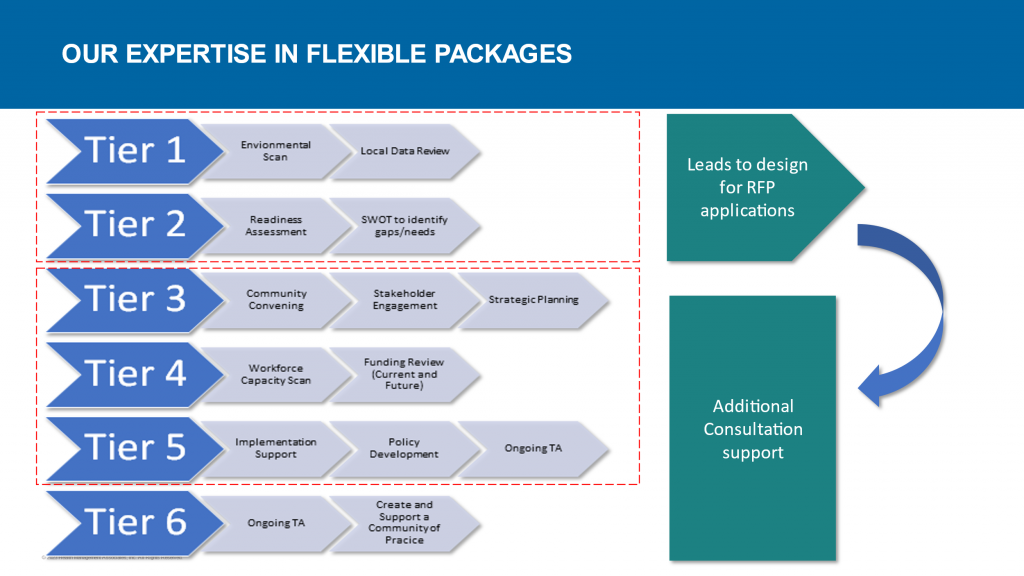

HMA consultants have decades of experience working hand-in-hand with public health, social services, behavioral health, Medicaid, and human services agencies. We help strengthen relationships surrounding policy, practice and revenue maximization in the human services space. Our experts work to help support programs in areas of Nutrition: Women, Infants & Children (WIC), Supplemental Nutrition Assistance Program (SNAP); Financial Support: Child Support, Temporary Assistance for Needy Families (TANF); Child and Adult Welfare Services; Medicaid; Housing and Weatherization; Early Education: Childcare Subsidy, Child Care and Development Block Grant (CCBDG) programs; and Workforce Development and Workforce Innovation and Opportunity Act (WIOA) programs.

If you have questions on how HMA can support your efforts in Child and Family Wellbeing, please contact Uma Ahluwalia, MSW, MHA, Managing Principal or Kathryn Ngo, MPH, BSN, Project Manager.

[1] What Are Benefits Cliffs? – Federal Reserve Bank of Atlanta (atlantafed.org)

[2] Economic Supports Chapin Anderson Nov 2020b (chapinhall.org)

[3] Research Reinforces: Providing Cash to Families in Poverty Reduces Risk of Family Involvement in Child Welfare | Center on Budget and Policy Priorities (cbpp.org)

[4] Understanding The Difference Between Guaranteed Basic Income Vs Universal Basic Income – Orange and Blue Press

[5] https://www.nuffieldfoundation.org/news/relationship-between-poverty-and-child-abuse-and-neglect

[6] Predicting Chronic Neglect – Casey Family Programs

[7] Economic Supports Chapin Anderson Nov 2020b (chapinhall.org)