This week's roundup:

- In Focus: Medicaid Spending in Federal FY 2024 Totals Nearly $909 Billion

- In Focus: H.R. 1 Signed Into Law—What It Means for Medicaid and Public Coverage

- Florida to Submit IDD Waiver Amendment Request

- Illinois Governor Signs Laws Restricting PBMs, Prior Authorizations

- Montana Prepares Section 1115 Waiver to Implement Work Requirements, Cost-Sharing

- New Hampshire Governor Signs Biennial Budget Implementing Medicaid Expansion Work Requirements

- Wisconsin Governor Signs Budget Preserving Some Medicaid Funding

- CMS Announces $10.4 Billion in ACA Risk-Adjustment Transfers as Market Consolidates

- Federal Judge Temporarily Blocks Medicaid Defunding Provision Targeting Planned Parenthood

- Humana Subsidiary to Acquire FL-Based Senior Care Clinics

In Focus

Medicaid Spending in Federal FY 2024 Totals Nearly $909 Billion

This week, our In Focus section highlights findings from the Centers for Medicare & Medicaid Services (CMS) preliminary CMS-64 Medicaid expenditure report for federal fiscal year (FFY) 2024. According to the preliminary estimates, Medicaid expenditures on medical services across all 50 states and six territories in FFY 2024 totaled $908.8 billion.

This figure provides important context and an initial baseline for tracking Medicaid spending trends following the enactment of H.R. 1, the One Big Beautiful Bill Act. According to the Congressional Budget Office’s preliminary analysis, H.R. 1 will reduce federal Medicaid and Children’s Health Insurance Program (CHIP) spending by approximately $1.02 trillion over the next decade (2025−2034)—a significant share of total Medicaid expenditures.

Total Medicaid Managed Care Spending

The following analysis is based on a Health Management Associates Information Services (HMAIS) analysis of the draft CMS-64 report. This report contains preliminary estimates of Medicaid spending by state for FFY 2024. CMS tracks state expenditures through the automated Medicaid Budget and Expenditure System/State Children’s Health Insurance Budget and Expenditure System (MBES/CBES). The CMS-64 form identifies annual expenditures through these systems.

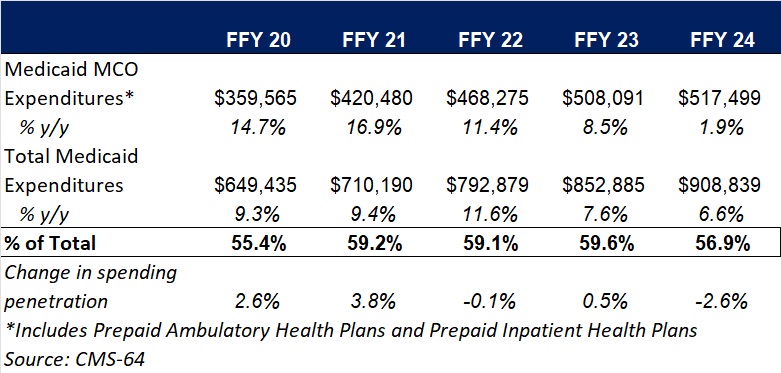

Key findings from HMAIS’ analysis, as also shown in Table 1, include:

- Total Medicaid managed care spending (federal and state share combined) reached $517.5 billion in FFY 2024, up from $508.1 billion in FFY 2023.

- This amount represents a 1.9 percent year-over-year increase from FFY 2023 to FFY 2024, a notable slowdown compared to the 8.5 percent growth observed in our analysis of year-over-year spending from FFY 2022 to FFY 2023.

- Managed care accounted for 56.9 percent of total Medicaid spending in FFY 2024, down 2.6 percentage points from the previous year.

- In terms of dollars, the increase in Medicaid managed care spending from FFY 2023 to FFY 2024 was $9.4 billion, compared with $39.8 billion from FFY 2022 to FFY 2023.

These figures include spending on comprehensive risk-based managed care organizations (MCOs), prepaid inpatient health plans (PIHPs), and prepaid ambulatory health plans (PAHPs). PIHPs and PAHPs refer to prepaid health plans that provide only certain services, such as dental or behavioral health care. Fee-based programs, such as primary care case management models, are not included in this total.

Table 1. Medicaid MCO Expenditures as a Percentage of Total Medicaid Expenditures, FFY 2020−2024 ($M)

Medicaid Managed Care Spending Insights

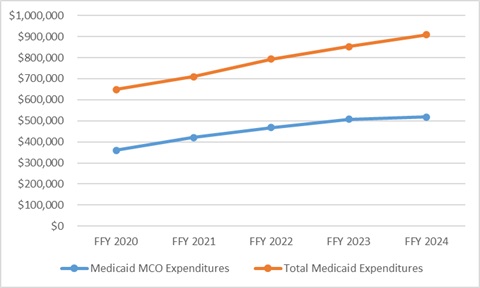

Medicaid managed care expenditures have grown consistently each year with total Medicaid expenditures. In FFY 2024, however, the growth in the share of managed care expenditures was notably lower than in the previous four years. The slower growth in managed care spending aligns with the post-COVID-19 policy unwinding period, during which many states completed eligibility redeterminations that had been paused during the public health emergency, driving historic enrollment increases (see Figure 1).

Figure 1. Total and MCO Medicaid Expenditures, FFY 2020−2024 ($M)

In addition, Health Management Associates (HMA) has access to data in the Transformed Medicaid Statistical Information System (T-MSIS) and has analyzed MCO spending in major categories of healthcare, including inpatient and outpatient hospital care, physician and other professional services, skilled nursing facilities (SNFs) and home and community-based services (HCBS), clinics, pharmaceuticals, and other services. Similarly, based on the CMS-64 data, in FFY 2024, the largest non-managed care spending categories included:

- HCBS: $108.8 billion

- Inpatient hospital services: $71.9 billion

- Nursing facilities: $46.3 billion

HMA’s analysis of the T-MSIS database shows that while managed care remains the dominant delivery system model for Medicaid, spending in certain categories, such as SNFs and professional services, is growing faster. This shift may explain the declining share of managed care in overall Medicaid expenditures, even as absolute spending remains high. Further details can be found here and here.

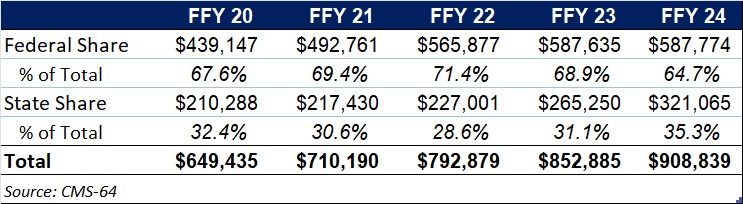

Federal Versus State Spending

This year’s data reflect the phase-out of the temporary 6.2 percentage-point federal medical assistance percent increase under the Families First Coronavirus Response Act, which ended December 31, 2023. In FFY 2024, 64.7 percent of FFY 2024 spending came from federal sources (see Table 2).

Table 2. Federal versus State Share of Medicaid Expenditures, FFY 2020−2024 ($M)

What to Watch

Looking ahead, state Medicaid agencies will need to reassess financing strategies as total Medicaid federal funding declines because of H.R. 1 and other federal regulatory oversight and policy changes take effect. H.R. 1 includes provisions to gradually reduce allowable state provider tax rates from 6 percent to 3.5 percent by 2032, potentially requiring states to restructure financing or identify cost-saving measures.

CBO projections estimate that the Medicaid provisions in the bill will increase the number of uninsured individuals by an estimated 7.8 million by 2034.

Connect with Us

HMAIS, a subscription-based tool offered by HMA, provides detailed state by state analysis of the CMS-64 data and Medicaid managed care enrollment trends. For more information about the HMAIS subscription and access to the CMS-64 data, contact Andrea Maresca and Alona Nenko.

H.R. 1 Signed Into Law—What It Means for Medicaid and Public Coverage

Just one week after we reviewed the Senate’s version of the budget reconciliation bill, H.R. 1, President Trump has now signed the legislation into law. The final iteration of H.R. 1 includes sweeping changes to Medicaid, the Affordable Care Act (ACA) Marketplaces, and Medicare—several of which diverge significantly from the version that the House passed May 22, 2025.

This update outlines many of the most consequential healthcare provisions, with a focus on Medicaid financing, eligibility, and operational impacts. It also highlights how stakeholders can act now to prepare for what happens next.

From Proposal to Policy: What Changed

The Senate’s amended version of H.R. 1, approved on July 1 and passed by the House on July 3, 2025, reshaped several key provisions in the earlier version of the House bill. Although the bill retains its core focus on tax policy and entitlement reforms, it further constrains state Medicaid financing and eligibility and scales back Marketplace subsidies for certain populations.

According to preliminary analysis from the Congressional Budget Office, the final bill will reduce federal healthcare spending by approximately $1.15 trillion over the next decade but also will increase the number of uninsured individuals by 11.8 million by 2034 because of changes to both Medicaid and Marketplace programs.

Medicaid Eligibility: A New Era of Policy and Operational Complexity

Mandatory Community Engagement Requirements

By December 31, 2026, states must implement community engagement (work) requirements for certain Medicaid enrollees. These requirements cannot be waived under Section 1115, though states may request “good faith” exemptions through 2028.

States must notify enrollees through multiple channels and develop the infrastructure needed to track compliance. Managed care organizations and other entities that have financial relationships with Medicaid services are prohibited from determining compliance.

Tighter Eligibility and Redetermination Requirements

States must now conduct Medicaid eligibility redeterminations every six months for expansion populations. The bill also delays implementation of previously finalized rules that would have streamlined enrollment and imposes new verification requirements, including address checks. For immigrants, H.R. 1 narrows the definition of “qualified” individuals who are eligible for Medicaid and CHIP, removing coverage for refugees, asylees, and other humanitarian categories.

Cost Sharing for Expansion Adults

Starting in 2028, states must apply cost-sharing requirements to Medicaid expansion adults with incomes greater than 100 percent of the federal poverty level. Though primary care, mental health, and certain other services are exempt, the policy introduces new administrative burdens for states and many providers.

Medicaid Financing: A Structural Shift

Provider Tax Restrictions

H.R. 1 freezes existing provider tax programs and bars any new taxes. Also, Medicaid expansion states must phase down the maximum allowable tax rate from 6 percent to 3.5 percent by 2032. This change will significantly constrain states’ ability to use provider taxes to finance Medicaid and draw down federal matching funds.

Limits on State-Directed Payments

The bill caps state-directed payments at either 100 percent or 110 percent of Medicare rates, depending on the state’s expansion status. Grandfathered payment arrangements will be phased down by 10 percent annually beginning in 2028. These provisions will require states to reassess supplemental payment strategies and may affect provider participation and access to care.

Other Key Provisions

The Rural Health Transformation Program provides $50 billion over five years to support financially distressed rural providers. H.R. 1 requires that each state submit a plan, and the Centers for Medicare & Medicaid Services (CMS) administrator must approve or deny the plan by December 31, 2025, giving CMS and the US Department of Health and Human Services significant authority to shape the approval/denial processes, as well as critical details of the program and funding decisions.

For the Marketplace, the law eliminates ACA subsidy eligibility for certain lawfully present immigrants, ends conditional eligibility for ACA subsidies as well as passive re-enrollment, and eliminates the cap on ACA subsidy repayment at tax time. It also prohibits individuals who are not enrolled in Medicaid because of a failure to satisfy community engagement requirements from receiving any subsidies.

In addition, a new 1915(c) waiver option allows states to offer home and community-based services (HCBS) without requiring that they provide institutional level of care but only if waiting lists for existing services are not extended. Another provision excludes family planning and abortion service providers from receiving Medicaid funding if they received at least $800,000 in Medicaid reimbursements in 2023.

Finally, the law includes a one-year, 2.5 percent increase to the Medicare physician fee schedule conversion factor, which will be in effect for calendar year 2026 and expire thereafter.

What Stakeholders Should Do Now

States can begin planning for eligibility system changes, redetermination volume, and community engagement implementation, all of which require an understanding of the potential interactions of the federal Medicaid, Medicare, and ACA Marketplace policy changes. In addition, state officials should consider reassessing provider tax structures and supplemental payment strategies, where applicable. They need to engage early on rural health transformation funding opportunities and other provider supports.

Health plans can forecast enrollment and risk mix changes. They have opportunities to support states in compliance efforts to avoid federal funding recoupments. In addition, plans must prepare for new administrative requirements related to cost sharing and work requirements, among other policy changes on the horizon. Consumer communications should also be a focus area.

Providers and community-based organizations will need to prepare for greater uncompensated care needs and costs, which can lead to potential revenue loss, as well as new reporting and program integrity expectations. They also will play an integral role in assisting patients in maintaining coverage and navigating new requirements.

Vendors and health information exchanges have several opportunities to support the implementation of new requirements in H.R. 1 alongside the changing regulatory priorities. Examples include reviewing system capabilities to support new eligibility, verification, and reporting requirements and coordinating with states to ensure smooth implementation and program integrity.

Looking Ahead

The passage of H.R. 1 marks a turning point in federal health policy. Although the law’s fiscal goals are clear, its operational impacts will unfold over the coming months and years. States, plans, providers, and community organizations must now pivot from policy analysis to implementation readiness.

HMA will continue to monitor federal guidance, state responses, and stakeholder strategies. For more detailed analysis or support with scenario planning, contact Kathleen Nolan or Patrick Tigue.

HMA Roundup

Florida

Florida to Submit IDD Waiver Amendment Request. The Florida Agency for Health Care Administration (AHCA) announced on July 2, 2025, that it will be submitting a request to the Centers for Medicare & Medicaid Services to amend its Comprehensive Intellectual and Developmental Disabilities Managed Care (IDD Pilot) Waiver. The amendment seeks to expand services statewide, increase enrollment capacity, and add Participant Direction Option as an additional service. Public comments are open through July 31, 2025.

Illinois

Illinois Governor Signs Laws Restricting PBMs, Prior Authorizations. Health Payer Specialist reported on July 7, 2025, that Illinois Governor J.B. Pritzker has signed legislation restricting pharmacy benefit managers (PBMs) and the use of prior authorizations for mental health services. House Bill 1697, the Prescription Drug Affordability Act, bans spread pricing, requires PBMs to return all rebates from drugmakers to health insurance sponsors, employers, or covered individuals, and requires PBMs to disclose all rebate amounts to the state. House Bill 3019 bans payers’ use of prior authorizations for outpatient and partial hospitalization mental health services. Both laws go into effect January 1, 2026.

Montana

Montana Prepares Section 1115 Waiver to Implement Work Requirements, Cost-Sharing. Montana Public Radio reported on July 9, 2025, that Montana has initiated a 60-day public comment period as it prepares a Section 1115 demonstration request to implement Medicaid work requirements and beneficiary cost-sharing, in line with provisions in the newly enacted federal policy package. The state plans to release a draft waiver by July 18. State officials indicated that existing statutory work requirements will need to be revised to align with new federal parameters.

New Hampshire

NH Governor Signs Biennial Budget Implementing Medicaid Expansion Work Requirements. The Keene Sentinel reported on July 8, 2025, that New Hampshire Governor Kelly Ayotte has signed the biennial budget, which requires the state to seek federal approval to implement work requirements for enrollees in Granite Advantage, the Medicaid expansion program. The provision would require enrollees to prove they are working or engaging in other qualifying activities for at least 100 hours per month. New Hampshire previously attempted to implement Medicaid work requirements in 2018.

Wisconsin

Wisconsin Governor Signs Budget Preserving Some Medicaid Funding. The Associated Press reported on July 3, 2025, that Wisconsin Governor Tony Evers has signed the state’s $111 billion biennial budget bill meant to preserve some Medicaid funding as Congress debates larger Medicaid cuts. The budget increases the hospital assessment rate from 1.8 percent to 6 percent, which is meant to secure more federal matching funds for Medicaid, rural hospitals, and hospital provider payments. The bill was brought up to vote in both the state House and Senate on the same day to secure the increased assessment tax rate, which would not have been possible if the federal budget passed first.

National

CMS Announces $10.4 Billion in ACA Risk-Adjustment Transfers as Market Consolidates. Modern Healthcare reported on July 7, 2025, that the Centers for Medicare & Medicaid Services (CMS) will redistribute $10.4 billion in Affordable Care Act (ACA) Marketplace risk-adjustment payments among insurers for the 2024 plan year. Centene, Aetna, and UnitedHealthcare are set to receive more than expected, while Cigna, Elevance Health, Molina, and Oscar will owe more than projected, according to Barclays Capital. Risk-adjustment payments, which help offset costs for plans enrolling sicker individuals, will account for 8.9 percent of premiums, down from 10.3 percent in 2023, reflecting market consolidation. CMS is expected to recalculate some payments by mid-July after a major carrier submitted revised data late; UnitedHealthcare is the only plan operating in all affected markets.

Federal Judge Temporarily Blocks Medicaid Defunding Provision Targeting Planned Parenthood. The Hill reported on July 7, 2025, that a federal judge has issued a two-week temporary injunction halting enforcement of a provision in the recently enacted federal tax and spending law that would block Medicaid payments to Planned Parenthood. Planned Parenthood sued over the provision, which imposes a one-year ban on state Medicaid payments to nonprofit providers that both offer abortion services and received over $800,000 in federal funding in 2023. Planned Parenthood argues the measure violates equal protection principles and unlawfully targets the organization despite longstanding federal restrictions on the use of Medicaid funds for abortion.

Industry News

Humana Subsidiary to Acquire Florida-Based Senior Care Clinics. Health Payer Specialist reported on July 7, 2025, that Humana subsidiary CenterWell Senior Primary Care has entered into a “stalking horse” agreement to acquire The Villages Health, a Florida-based health system that provides primary and specialty care to seniors in a retirement community, for $50 million. Villages has eight primary care clinics and two specialty clinics that serve approximately 55,000 patients.

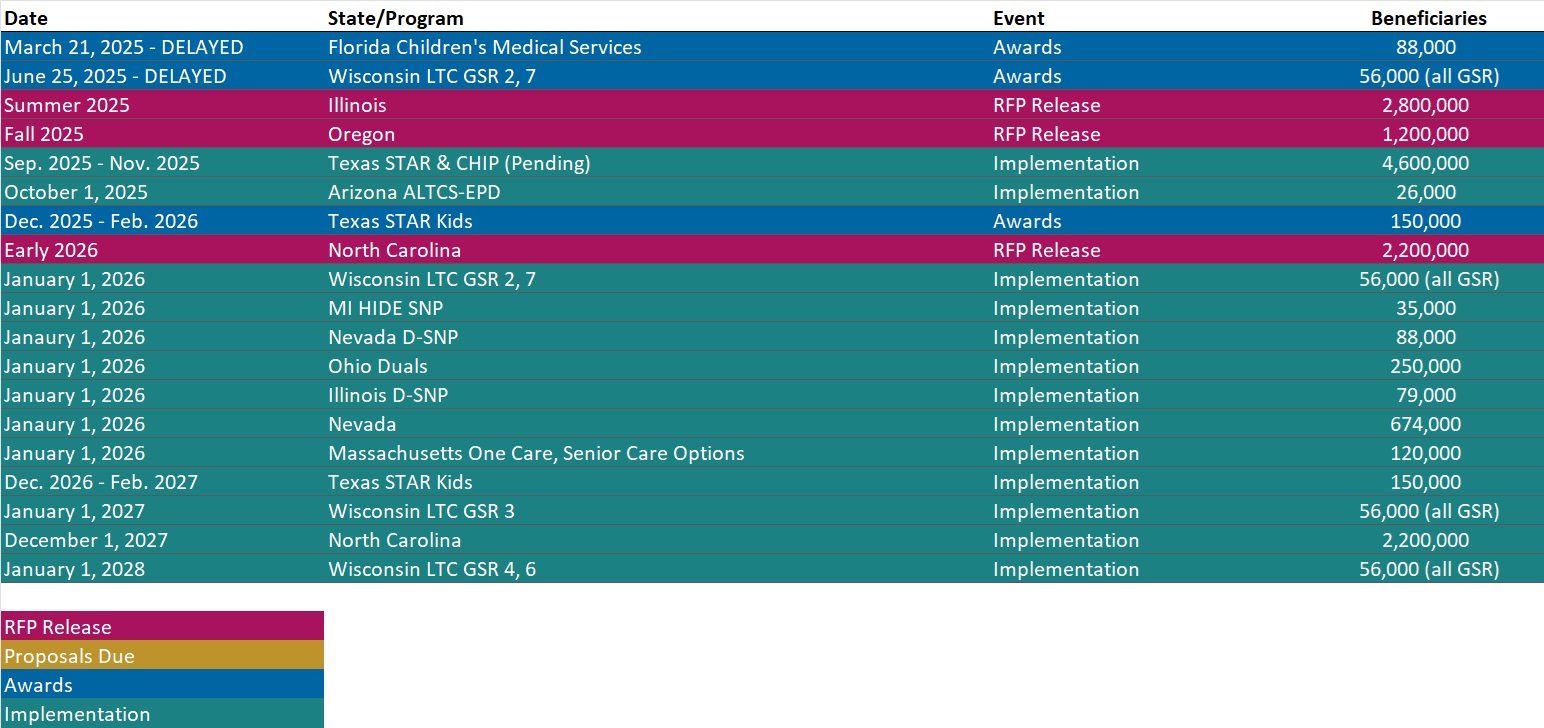

RFP Calendar

Actuaries Corner

Centene Corporation Withdraws 2025 Guidance. Centene Corporation is withdrawing its previous 2025 GAAP and adjusted diluted earnings per share (EPS) guidance, including the underlying guidance elements.

Editor’s Note

Centene Corporation has withdrawn its 2025 earnings guidance due to preliminary data indicating significantly higher market morbidity and lower risk adjustment revenue than expected in the Health Insurance Marketplace. The company anticipates a negative impact of approximately $2.75 per share and is taking corrective pricing actions for 2026, while also noting higher Medicaid cost trends and better-than-expected Medicare performance.

Discover other developments in the Wakely Wire here.

HMA News & Events

HMA Webinar

The Future of the ACA Individual Market: Policy Shifts and the House Reconciliation Bill. Thursday, July 10, 2025, 2 PM ET. Join us for an in-depth discussion on the future of the individual market and the impacts of potential Congressional and regulatory changes to the Affordable Care Act (ACA). This webinar will explore findings from a new Wakely report which estimates that ACA enrollment could decrease by 11 to 13 million as a result of these pending changes, representing a 47% to 57% decline. The report also projects that market average premiums could increase between 7% and 11.5% on top of claims trend. The report’s analysis considers a range of influential factors, including provisions in the House budget reconciliation bill, the Marketplace Integrity and Affordability regulation, and the scheduled expiration of enhanced premium tax credits in 2026. Experts will unpack how these shifts may reshape coverage, affordability, and the long-term viability of the individual market.

Digital Quality Measures: Opportunities to Electronically Share Digital Quality Measurement Data With Stakeholders. Wednesday, July 16, 2025, 3 PM ET. As federal and state governments continue to evolve regulations and reimbursement models, healthcare providers are under increasing pressure to do more with fewer resources. Digital innovation, particularly through digital quality measures or dQMs, is a key strategy for easing administrative burdens while enhancing care delivery. This webinar will explore how emerging policies and regulations are shaping the digital quality landscape—and what healthcare organizations can do now to prepare for continued transformation.

HMA Conference

Navigating the New Federal Policy Shifts? Get Grounded with this Year’s Workshops. October 15, 2025

In a landscape defined by rapid policy shifts, technological disruption, and mounting financial pressures, it’s easy to feel unsteady. With this year’s workshops, you’ll find the firm footing you need—starting with a broad overview of the trends and forces reshaping Medicare, Medicaid, digital health, and behavioral care, and then diving deep into real-world use cases, operational strategies, and peer-driven solutions. These back-to-back sessions are designed to give you both the context and the concrete tools to navigate uncertainty with confidence—and leave you ready to lead change in your organization.

Four Expert-Led Tracks

• Medicare Payment & Financing

• Community Strategies for At-Risk Groups

• Jumpstarting Digital Healthcare

• Bridges to Behavioral Healthcare

Early bird pricing ends July 31, 2025.

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- New Report: Medicaid MCO Financial Filings Including Medical Loss Ratio by State, 2024

- New Report: Medicaid Managed Care Expenditure and Enrollment Penetration Data, 2024

- Updated Medicaid Managed Care Rate Certifications Inventory

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states

- Updated Louisiana and Puerto Rico Overviews

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].