This week, our In Focus section reviews the California request for information (RFI) regarding the Medi-Cal Managed Care Plan (MCP) contract and the upcoming Medi-Cal MCP procurement. The California Department of Health Care Services (DHCS) is seeking information to update boilerplate contracts and develop the request for proposals (RFP) scheduled for release in 2021.

RFP Schedule

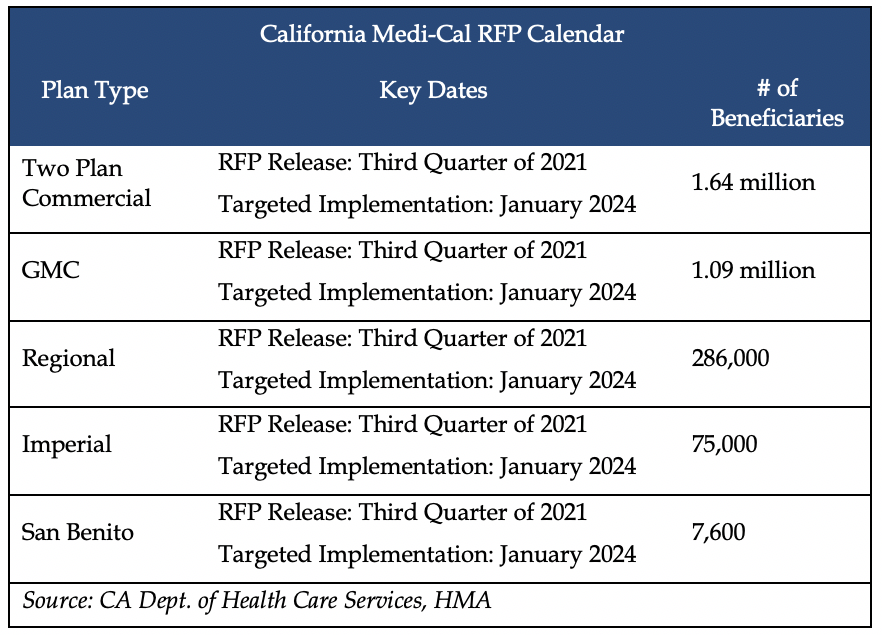

California expects to release the Medi-Cal RFP in the third quarter of 2021 for implementation in January 2024. A draft RFP is anticipated to be shared publicly during the first quarter of 2021. The current schedule is delayed from previous RFP calendars, which had anticipated implementation as early as July 2021. Of the more than 8.1 million Medi-Cal managed care members residing in the counties covered by the RFP, only 3.1 million members enrolled in the Two-Plan, Geographic Managed Care (GMC), Imperial, Regional, and San Benito model markets will be affected. According to the RFI, total enrollment in California Medi-Cal enrollment is nearly 11 million people.

Background

Medi-Cal, the state’s Medicaid program, uses six distinct models:

- Two-Plan Model counties contract with a commercial plan and a local, county-organized plan called the Local Initiative (a prepaid health plan). The model operates in 14 counties: Alameda, Contra Costa, Fresno, Kern, Kings, Los Angeles, Madera, Riverside, San Bernardino, Santa Clara, San Francisco, San Joaquin, Stanislaus, and Tulare.

- County Organized Health Systems (COHS), in which the state contracts with a plan created by the County Board of Supervisors. Only one managed care plan is operated by each county. COHS contracts may be on a non-bid basis. The model operates in 22 counties: Del Norte, Humboldt, Lake, Lassen, Marin, Mendocino, Merced, Modoc, Monterey, Napa, Orange, San Luis Obispo, San Mateo, Santa Barbara, Santa Cruz, Shasta, Siskiyou, Solano, Sonoma, Trinity, Ventura, and Yolo.

- Regional Model counties contract with two commercial plans. Rural counties that elected not to participate as a COHS model or as the Local Initiative of a Two-Plan Model participate. The model operates in 18 counties: Alpine, Amador, Butte, Calaveras, Colusa, El Dorado, Glenn, Inyo, Mariposa, Mono, Nevada, Placer, Plumas, Sierra, Sutter, Tehama, Tuolumne, and Yuba.

- Geographic Managed Care (GMC) has several commercial plans per county. The model operates in two counties: Sacramento and San Diego.

- Imperial County has two commercial plans to serve rural expansion needs.

- San Benito County has one commercial plan to serve rural expansion needs.

Again, the planned RFP will not be used to procure the COHS plans or Local Initiative plans.

RFI

The RFI is seeking input from plans on eight different questions:

- What MCP contract changes or actions do you recommend DHCS consider to address health disparities and inequities, as well as, identify and address social determinants of health?

- a. In July 2020, Will Lightbourne, director of the California DHCS, announced that Medi-Cal is planning to amend certain contracts and use performance reviews to help address racial disparities in healthcare.

- What MCP contract changes or actions do you recommend DHCS consider to increase MCP’s community engagement?

- What MCP contract changes or actions do you recommend DHCS consider for emergency preparedness and response for disasters?

- What MCP contract changes or actions do you recommend DHCS consider to achieve the other MCP goals listed?

- What, if any, of the listed MCP goals provide significant challenges and what should be done to address those challenges?

- What additional MCP goals should DHCS consider?

- What additional changes or actions do you recommend DHCS consider for the planned structural updates to the MCP contract?

- What additional changes or actions do you recommend DHCS consider for the planned content updates to the MCP contract?

Additionally, the RFI outlines planned updates to the boilerplate MCP contract that will be included in the RFP. This includes structural updates and content updates, such as incorporating California Advancing and Innovating Medical (CalAIM) initiative policy updates into the contract, as well as budget-related policy updates, incorporation of new statues and regulation requirements, California State Auditor (CSA) report recommendations, medical audit findings, inclusion of All Plan Letter (APL) language, and terminology updates.

There will be a DHCS hosted Medi-Cal MCP RFI webinar on September 10, 2020, from 10 a.m. PT to 11:30 a.m. PT. Click here to register for the webinar: https://dhcs.webex.com/dhcs/onstage/g.php?MTID=e39fd3a7e3f2f9d53bbb989081ee116bd

Current Market

Overall, the California managed Medicaid market is huge. As of July 2020, California had nearly 10.6 million Medi-Cal members.

| California Medicaid Managed Care Enrollment by Plan, 2017-19, July 2020 | ||||

| Plan Name | 2017 | 2018 | 2019 | Jul-20 |

| L.A. Care Health Plan | 2,057,191 | 2,049,452 | 2,004,346 | 2,065,395 |

| % of total | 19.2% | 19.6% | 19.7% | 19.6% |

| Centene Total | 1,682,981 | 1,606,095 | 1,553,801 | 1,570,512 |

| % of total | 15.7% | 15.4% | 15.3% | 14.9% |

| Health Net1 | 1,489,664 | 1,409,913 | 1,358,618 | 1,370,375 |

| % of total | 13.9% | 13.5% | 13.4% | 13.0% |

| CA Health & Wellness | 193,317 | 196,182 | 195,183 | 200,137 |

| % of total | 1.8% | 1.9% | 1.9% | 1.9% |

| Inland Empire Health Plan | 1,224,903 | 1,219,492 | 1,215,001 | 1,263,086 |

| % of total | 11.4% | 11.7% | 12.0% | 12.0% |

| CalOptima | 767,433 | 742,386 | 708,682 | 750,127 |

| % of total | 7.2% | 7.1% | 7.0% | 7.1% |

| Anthem Blue Cross | 778,801 | 745,085 | 720,393 | 760,821 |

| % of total | 7.3% | 7.1% | 7.1% | 7.2% |

| Partnership Health Plan of CA | 567,861 | 551,778 | 533,504 | 556,240 |

| % of total | 5.3% | 5.3% | 5.2% | 5.3% |

| Molina Healthcare | 467,896 | 440,100 | 414,706 | 425,086 |

| % of total | 4.4% | 4.2% | 4.1% | 4.0% |

| Central CA Alliance for Health | 350,278 | 339,666 | 331,477 | 349,196 |

| % of total | 3.3% | 3.3% | 3.3% | 3.3% |

| CalViva | 363,363 | 359,286 | 351,063 | 361,207 |

| % of total | 3.4% | 3.4% | 3.5% | 3.4% |

| Health Plan of San Joaquin | 349,007 | 342,105 | 334,128 | 346,422 |

| % of total | 3.3% | 3.3% | 3.3% | 3.3% |

| Community Health Group Partner | 280,920 | 263,897 | 246,431 | 256,722 |

| % of total | 2.6% | 2.5% | 2.4% | 2.4% |

| Alameda Alliance For Health | 264,480 | 258,288 | 242,656 | 254,092 |

| % of total | 2.5% | 2.5% | 2.4% | 2.4% |

| Santa Clara Family H.P. | 259,440 | 244,388 | 235,619 | 248,217 |

| % of total | 2.4% | 2.3% | 2.3% | 2.3% |

| Kern Family Health Care | 248,244 | 252,167 | 258,401 | 270,488 |

| % of total | 2.3% | 2.4% | 2.5% | 2.6% |

| Gold Coast Health Plan | 202,817 | 196,535 | 191,472 | 202,553 |

| % of total | 1.9% | 1.9% | 1.9% | 1.9% |

| CenCal | 179,637 | 175,497 | 172,501 | 183,921 |

| % of total | 1.7% | 1.7% | 1.7% | 1.7% |

| Contra Costa Health Plan | 182,985 | 178,101 | 170,604 | 180,569 |

| % of total | 1.7% | 1.7% | 1.7% | 1.7% |

| San Francisco Health Plan | 133,936 | 127,900 | 125,367 | 131,228 |

| % of total | 1.3% | 1.2% | 1.2% | 1.2% |

| Kaiser | 145,264 | 145,864 | 144,951 | 152,382 |

| % of total | 1.4% | 1.4% | 1.4% | 1.4% |

| Health Plan of San Mateo | 109,842 | 103,970 | 99,305 | 106,617 |

| % of total | 1.0% | 1.0% | 1.0% | 1.0% |

| Promise Health Plan/Care 1st | 85,131 | 83,114 | 78,982 | 87,783 |

| % of total | 0.8% | 0.8% | 0.8% | 0.8% |

| UnitedHealthcare | 1,547 | 7,843 | 12,048 | 16,096 |

| % of total | 0.0% | 0.1% | 0.1% | 0.2% |

| CVS/Aetna Better Health | 11,057 | 19,561 | 24,769 | |

| % of total | 0.1% | 0.2% | 0.2% | |

| Total California | 10,702,410 | 10,444,066 | 10,164,999 | 10,563,529 |

| % chg. between reporting periods | 0.8% | -2.4% | -2.7% | 3.9% |

| Source: CA Dept. of Health Care Services, HMA (1) Centene acquired Health Net in 2016. | ||||