The Medicare Advantage (MA) program continues to evolve as plans respond to shifting policy signals, market pressures, and beneficiary expectations. A new paper from Wakely, an HMA Company—The Value Shift: How Medicare Advantage Benefits Are Evolving for 2026—provides a data-driven examination of how MA benefit designs are changing and what those changes signal about the future direction of the program.

This paper refreshes Wakely’s ongoing MA benefit analysis, updating prior findings with the latest 2026 plan enrollment data. It builds on Wakely’s established work examining benefit design, supplemental offerings, and the relationship between bids, rebates, and plan value, including The Value Shift: Inside the C-SNP Surge.

This article highlights findings from the proprietary value-add metric that Wakely developed to provide a comprehensive assessment of MA plan value. Although it can be used as a comparative metric to evaluate relative changes year over year, it is not intended to represent pricing.

From Benefit Expansion to Optimization

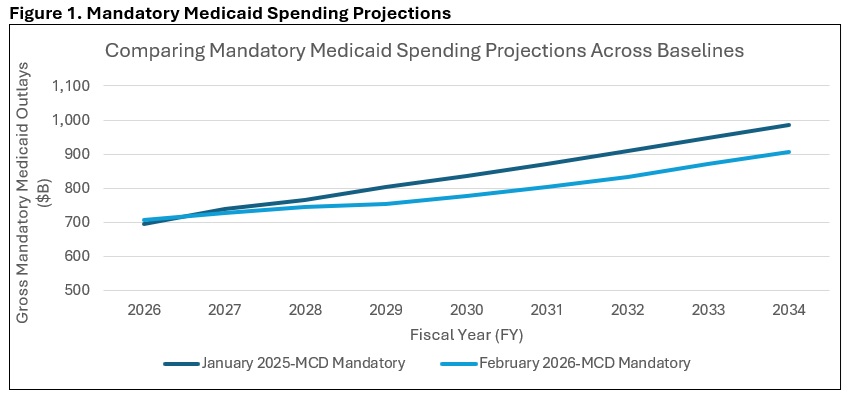

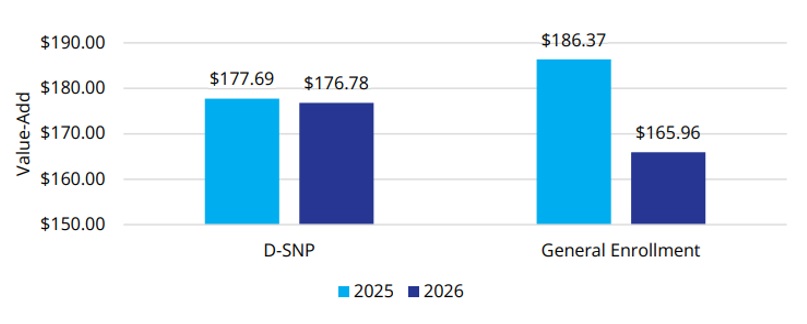

Over the past decade, MA plans have steadily expanded benefit offerings, supported by strong enrollment growth and favorable rebate dynamics. The 2026 benefit landscape suggests that plans have been taking a more measured approach (see Figure 1). Wakely’s analysis finds that plans are becoming more strategic in how benefits are designed and deployed, maintaining or enhancing benefits that are best aligned with quality performance, affordability, and target populations while pulling back in other areas.

Plans appear to be optimizing benefits to better align with member needs, quality performance, and financial parameters. Examples include refining supplemental benefits, adjusting cost-sharing structures, and rethinking how benefits support care management and health outcomes.

Figure 1. Change in Plan Value-Add from 2025 to 2026

The shift reflects an MA market in which differentiation and long-term sustainability are increasingly important.

Supplemental Benefits: More Targeted, More Strategic

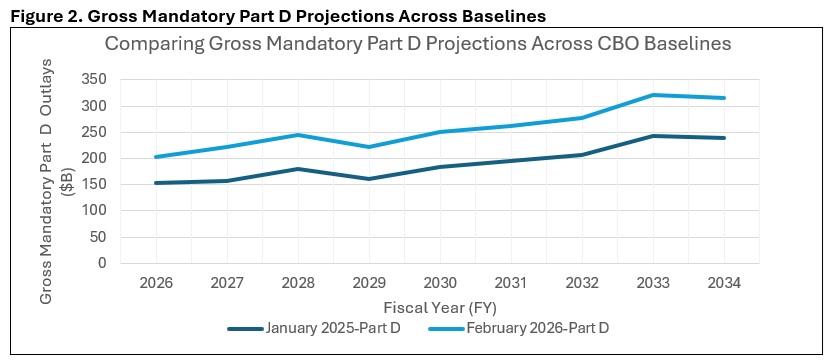

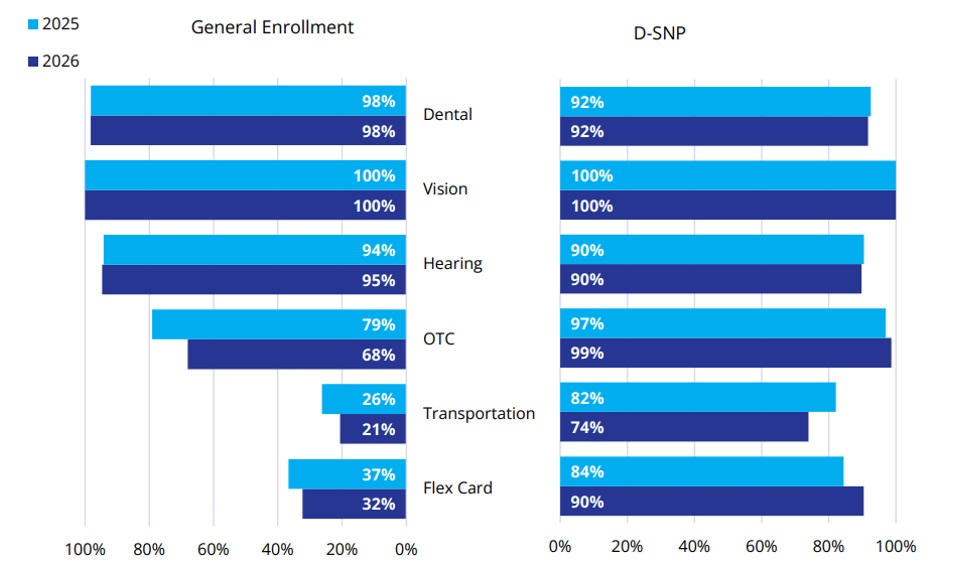

Supplemental benefits remain a defining feature of Medicare Advantage, but their role is evolving. Wakely’s paper highlights a move away from expanding the number of benefits toward targeted benefit offerings that are more clearly connected to member engagement and outcomes.

Plans are homing their focus on benefits that support daily living, chronic condition management, and access to care, particularly for populations with higher needs. This targeted approach suggests plans are thinking about value, operational complexity, and how benefits contribute to overall value propositions.

Between 2025 and 2026, the percentage of members with access to common supplemental benefits has, on average, stayed consistent or slightly decreased among the general enrollment population (Figure 2). The percentage of members who are enrolled in plans that offer over-the-counter (OTC) drug, transportation, and Flex Card benefits has decreased by 11 percent, 6 percent, and 4 percent, respectively. Conversely, the Dual Eligible Special Needs Plan (D-SNP) population saw an increase in member access to all supplemental benefit categories except transportation (an 8% decrease).

Figure 2. Percent of Enrollment in Common Supplemental Benefits

For stakeholders across the healthcare ecosystem, this trend underscores the importance of understanding not just what benefits are offered, but why.

Shifts in Cost Sharing and the Enrollee Experience

Wakely’s analysis also points to notable shifts in cost sharing and premium structures. There is continued attention to balancing affordability for members with the need to manage plan liability amid changing benchmarks and utilization patterns.

These decisions directly affect the member experience. Small shifts in copays, deductibles, or benefit limits can influence enrollment, retention, and satisfaction, particularly in competitive markets. As plans fine tune these levers, data-driven insights become critical to understanding how benefit changes may resonate with different member segments.

2026 Signals for Future Bid Cycles

The benefit trends identified in “The Value Shift” series suggest several broader signals for the MA market:

- Value over volume: Plans are prioritizing benefits that support quality, outcomes, and sustainable growth.

- Greater segmentation: Benefit designs are increasingly tailored to specific populations and market dynamics.

- Data-informed decision-making: As margins tighten, plans are relying more heavily on analytics to guide benefit strategy.

- Special needs plans continue to drive growth. Enrollment in Chronic Condition Special Needs Plans (C-SNPs) is the fastest-growing segment in MA.

These dynamics have implications for MA organizations and for providers, policymakers, and partners seeking to understand how MA continues to shape care delivery and costs.

Value-Add Metric and Benefit Design Insights

In this paper, Wakely paired its actuarial and analytic expertise with tools that enable detailed benefit and market analysis. One of those tools, Wakely’s Medicare Advantage Competitive Analysis Tool (WMACAT), calculates a comprehensive value-add metric that integrates five core components into a consistent framework that allows for apples-to-apples comparisons across plans, markets, and years. In addition, Wakely’s Strategic Market Analysis and Ranking Tool (SMART) supports broader competitive assessments by layering enrollment weighting, geographic variation, and plan positioning into the analysis.

As an HMA company, Wakely’s work is complemented by broader policy, market, and strategy expertise, helping organizations connect benefit decisions to regulatory developments, operational considerations, and long-term goals.

For health plans and healthcare organizations navigating the next phase of Medicare Advantage, these combined capabilities can respond to questions such as:

- How competitive is our benefit design today, and where are the risks?

- Which benefits are most aligned with our population and quality strategy?

- How might future policy or payment changes affect benefit sustainability?

Looking Ahead

MA benefit design remains an important signal of market direction by showing how plans are responding to policy change, market competition, and financial pressure. As plans shift from broad expansion to more targeted value strategies, the ability to measure, compare, and interpret benefit changes becomes essential as plans look ahead to the 2027 and 2028 bid cycles.

Wakely will continue to build on this work with upcoming analyses, including deeper dives into Part D design changes and the implications of the sunset of the Value-Based Insurance Design (VBID) program.

For information about this analysis and the Wakely tools, contact Dani Marino and Amanda Nelessen.