This week, our In Focus section reviews the projected healthcare expenditure and enrollment data from the Centers for Medicare & Medicaid Services (CMS) Office of the Actuary, published June 14, 2023. The Office of the Actuary provides annual updates to historical and projected National Health Expenditure data on Medicare, Medicaid, CHIP, and other public insurance programs, as well as commercial healthcare insurance.

CMS projects that the average annual growth for national healthcare spending from now through 2031 will be 5.4 percent. CMS estimated that the number of insured individuals in the United States was projected to reach a high of 92.3 percent in 2022 and would decrease to 90.5 percent by 2031. CMS projects 93.6 million Medicaid and CHIP members will account for more than $1.2 trillion in annual spending in 2031 and that 76.4 million Medicare beneficiaries will account for more than $1.8 trillion in expenditures that year. A summary of other key takeaways from the actuarial report follows.

Enrollment Projections

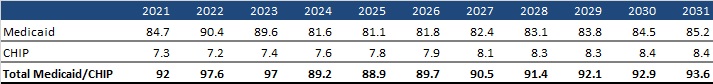

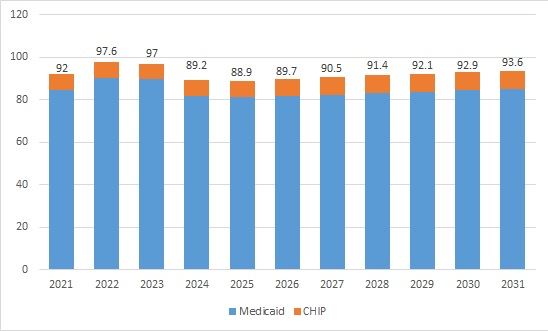

Approximately 92 million people were enrolled in Medicaid and CHIP programs in 2021. Enrollment is projected to have reached a high of 97.6 million in 2022 and is expected to fall between 2023 and 2026 because of Medicaid redeterminations. CMS projects the largest loss in 2024, with 8 million people leaving Medicaid and CHIP that year alone. By 2026, enrollment is projected to hit a low of 89.7 million and start to rise back up in the subsequent years until reaching 93.6 million enrollees in 2031.

Table 1. Historical and Projected Medicaid/CHIP Enrollment (in Millions)

Figure 1. Historical and Projected Medicaid/CHIP Enrollment (in Millions)

Medicare enrollment is projected to continue growing steadily. CMS estimates that Medicare beneficiaries totaled 63.6 million in 2022. By 2031, Medicare enrollment is expected to climb to 76.4 million.

Expenditure Projections

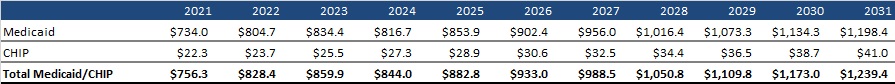

Medicaid expenditures are expected to grow by 5 percent on average in 2022−2031. In 2022, the Medicaid annual growth rate was projected to be −2.1 percent. Following the public health emergency unwinding, average expenditure growth would pick up to 5.6 percent in 2025−2031.

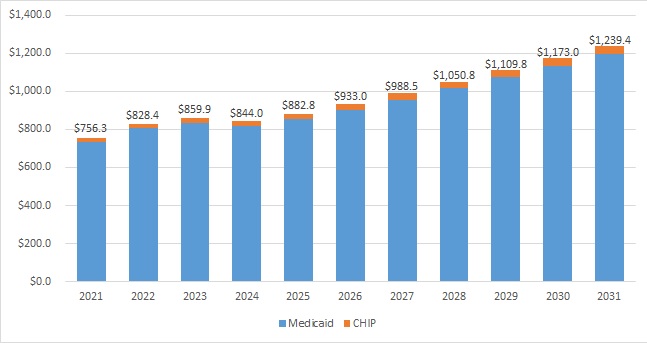

CMS estimated that total Medicaid and CHIP annual spending in 2022 was $828.4 million; by 2031, it is projected to hit $1.2 trillion. For context, private health insurance is projected to reach nearly $2.1 trillion in 2031.

Table 2. Historical and Projected Medicaid/CHIP Expenditures (in Billions)

Figure 2. Historical and Projected Medicaid/CHIP Expenditures (in Billions)

Medicare spending is projected to grow to more than $1.8 trillion in 2031 from $944.2 million in 2022. During this time, average annual expenditure growth is projected to be 7.5 percent. In 2022, spending growth dropped to 4.8 percent compared with 8.4 percent in 2021 because fee-for-service beneficiaries were using fewer emergency department services and as a result of reinstated payment rate cuts associated with the Medicare Sequester Relief Act of 2022.

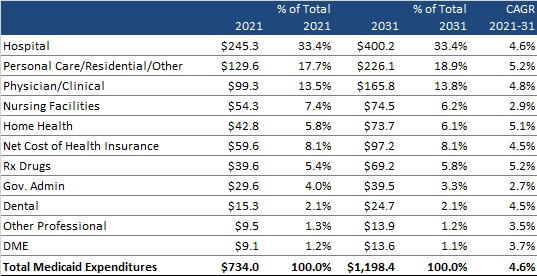

Medicaid Expenditure Projections by Category

CMS provides a historical and projected breakdown of expenditures by category for Medicaid only (CHIP is bundled with Department of Defense and other public spending). Table 3 summarizes the projected change in annual expenditures for several categories of services and other expenditures. It also shows each category’s percentage contribution to total Medicaid expenditures and the compounded annual growth rate (CAGR) in 2021−2031 for each category of spending. Hospital spending, personal care/residential/other, and physician/clinical expenditures are projected to continue to be the largest contributors to overall Medicaid expenditures, together equaling approximately 65 percent of total expenditures in 2021 and a projected 66 percent in 2031.

Table 3. Historical and Projected Medicaid-Only Expenditures by Category, 2021-2031 (in Billions)