This week, our In Focus section shares key takeaways from the Kaiser Family Foundation (KFF) and Health Management Associates (HMA) mini-survey of Medicaid directors in all 50 states and the District of Columbia titled, Medicaid Spending and Enrollment Trends Amid the COVID-19 Pandemic – Updated for FY 2021 & Looking Ahead to FY 2022. The survey, released on March 12, 2021, is an update to the 20th annual Medicaid Budget Survey conducted by KFF and HMA. The brief is authored by Elizabeth Hinton , Lina Stolyar , and Robin Rudowitz from KFF with survey assistance and dissemination from HMA Principal Kathy Gifford and Consultant Anh Pham.

Background

Of the 50 states KFF reached out to, 38 states responded to the survey. These states accounted for over three-quarters of total Medicaid enrollment. The 13 states that did not respond were Arkansas, the District of Columbia, Georgia, Hawaii, Idaho, Louisiana, New Hampshire, New Jersey, New Mexico, Ohio, Texas, Utah, and Vermont.

The COVID-19 pandemic impacted states significantly, causing state revenues to decline in FY 2020, with expected declines in FY 2021. In the annual survey conducted in June through August of 2020 and released in October 2020, states predicted Medicaid enrollment would increase 8.2 percent in FY 2021 and spending would increase by 8.4 percent in FY 2021.

Medicaid Enrollment

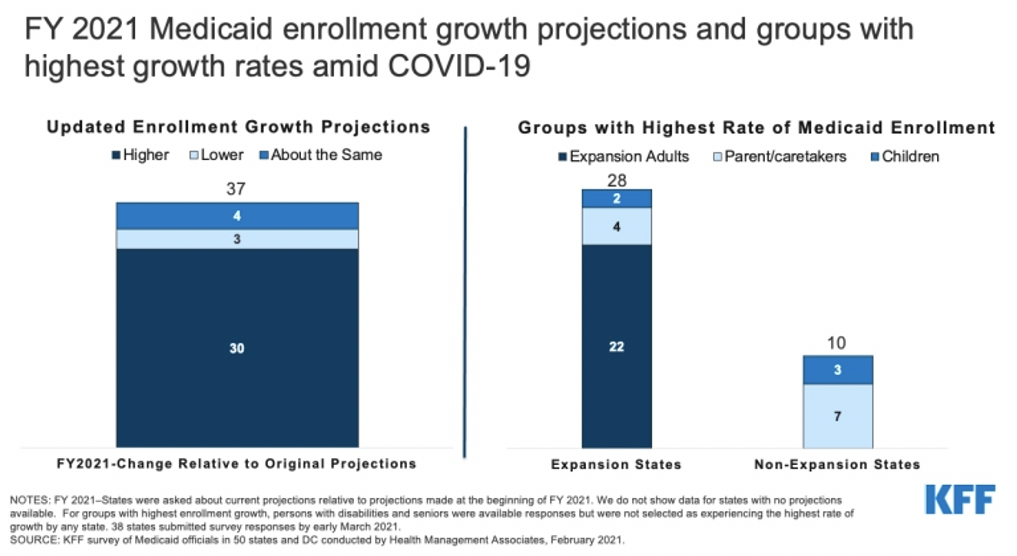

The survey follow-up found that 30 out of 37 states expect overall Medicaid enrollment to exceed the original projections. Furthermore, of the 28 states that expanded Medicaid, 22 states indicated “expansion adults” have experienced the highest rate of enrollment growth in FY 2021. Among the 10 states that did not expand Medicaid, seven found “parent/caretakers” have experienced the highest enrollment growth in FY 2021.

More than half the states said the projections reflect the assumption that the public health emergency (PHE) would remain in effect through calendar year 2021, partway through FY 2022. States expect a gradual enrollment decline beginning in calendar year 2022 after the expiration of continuous coverage requirements.

Source: Kaiser Family Foundation

Medicaid Spending

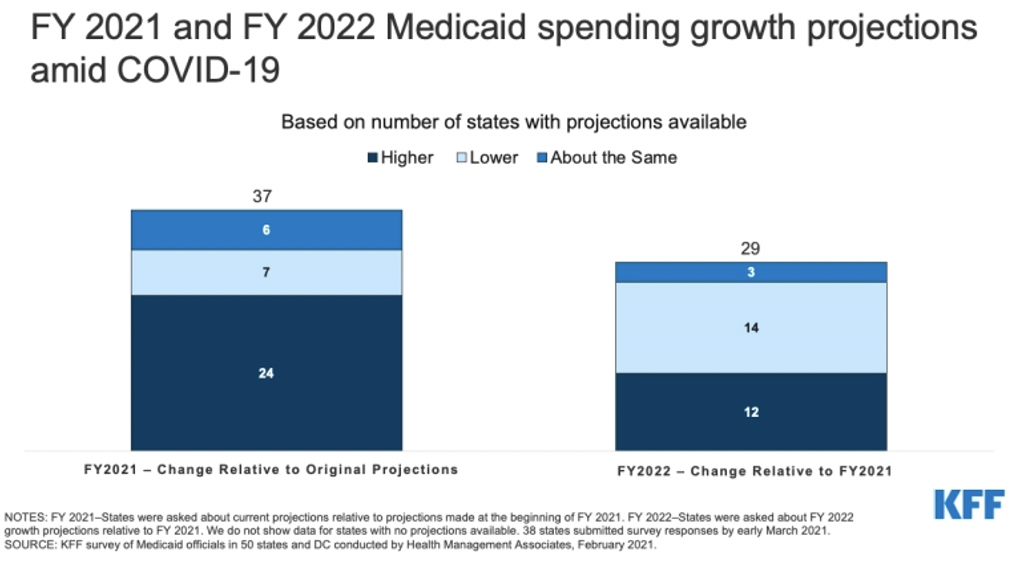

Similarly, the majority (24 of 37) of states expect to exceed their original total Medicaid expenditure projections for FY 2021. Of these, all except one state say higher Medicaid enrollment is the most significant driver of FY 2021 Medicaid expenditures. Only four states expected lower Medicaid expenditures due to lower utilization; three of these states have fee-for-service delivery models that would immediately reflect the lower utilization in expenditures.

Nine of 38 states reported implementing mid-year cost containment policy actions, including provider rate cuts, managed care plan rate adjustments, and benefit restrictions/expansions in FY 2021. In FY 2022, 12 states plan to make mid-year cost containment policy actions.

Of the 29 states that made projections for FY 2022, states were divided in whether total Medicaid expenditures would increase or decrease/stay the same relative to FY 2021. However, the state portions of spending are likely to accelerate in FY 2022 when the PHE and enhanced federal match rate (FMAP) expire.

Source: Kaiser Family Foundation

Looking Ahead

States must account for the impacts of the COVID-19 pandemic as they adopt budgets for FY 2022. Medicaid enrollment can continue to grow in FY 2022, as individuals continue to struggle from the economic downturn and from the additional special enrollment period for the Affordable Care Act Exchanges. Although the rate of growth will slow as states resume eligibility renewals and redeterminations. States will also need to consider the end of the enhanced FMAP once the public health emergency is over.

As a companion piece to the Medicaid Director survey update, KFF also looked at how Medicaid agencies are assisting with the COVID-19 vaccine roll-out. The brief can be found here.