This week, our In Focus section reviews highlights and shares key takeaways from the 19th annual Medicaid Budget Survey conducted by The Kaiser Family Foundation (KFF) and Health Management Associates (HMA). Survey results were released on October 18, 2019, in two new reports: A View from the States: Key Medicaid Policy Changes: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2019 and 2020 and Medicaid Enrollment & Spending Growth: FY 2019 & 2020. The report was prepared by Kathleen Gifford and Aimee Lashbrook from HMA; Eileen Ellis and Mike Nardone; and by Elizabeth Hinton, Robin Rudowitz, Maria Diaz, and Marina Tian from the Kaiser Family Foundation. The survey was conducted in collaboration with the National Association of Medicaid Directors.

This survey reports on trends in Medicaid spending, enrollment, and policy initiatives for FY 2019 and FY 2020, highlighting policy changes implemented in state Medicaid programs in FY 2019 and those planned for implementation in FY 2020. The conclusions are based on information provided by the nation’s state Medicaid Directors.

Key Report Highlights

In the following sections, we highlight a few of the major findings from the reports. This is a fraction of what is covered in the 50-state survey reports, which include significant detail and findings on policy changes and initiatives related to eligibility and enrollment, managed care, long-term services and supports (LTSS), provider payment rates, and covered benefits (including prescription drug policies). The reports also look at the key issues and challenges now facing Medicaid programs.

Medicaid Enrollment and Spending Growth

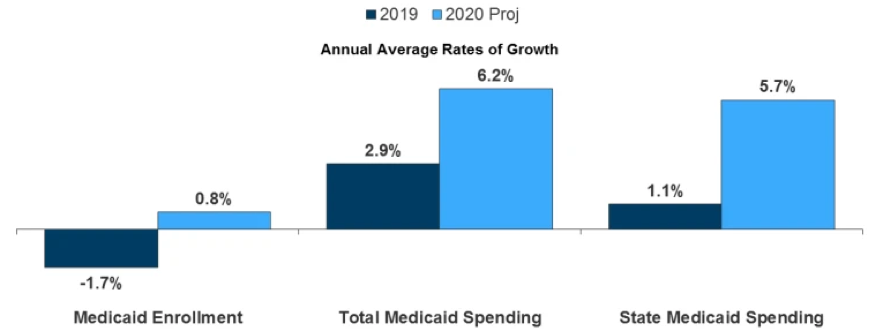

Enrollment declined in FY 2019 (-1.7 percent) due to changes in renewal processes, new functionality of upgraded eligibility systems, and enhanced verifications and data matching efforts. Enrollment peaked in FY 2015 as a result of the Affordable Care Act. Growth in FY 2020 is predicted to be 0.8 percent. Total Medicaid spending growth slowed to 2.9 percent in FY 2019 because of enrollment declines. It is projected to return to a more typical growth of 6.2 percent in FY 2020 due to higher costs for prescription drugs, provider rate increases, and higher costs for the elderly and individuals with disabilities from increased utilization of LTSS. Total Medicaid spending growth outpaced state spending growth in FY 2019 despite an increase in the state contributions for Medicaid expansion under the Affordable Care Act. This was attributed to some expansion states using provider taxes and other savings to finance expansion. States predict that state spending growth will be similarly lower than total spending growth in FY 2020.

Figure 1 – Medicaid Enrollment and Spending Growth, FY 2019 and FY 2020 (Projected)

SOURCE: Enrollment growth for FY 2019 is based on KFF analysis of CMS, Medicaid & CHIP Monthly Applications, Eligibility Determinations, and Enrollment Reports. Other growth rates are from the KFF survey of Medicaid officials in 50 states and DC conducted by Health Management Associates, October 2019.

Medicaid Eligibility Standard Changes

- Maine and Virginia implemented Medicaid expansion in FY 2019.

- Idaho, Nebraska, and Utah adopted Medicaid expansion through November 2018 ballot initiatives. Idaho is seeking changes through a 1332 waiver, with plans to implement expansion in FY 2020. Nebraska and Utah are also pursuing waivers, which led to implementation delays.

- Kansas, Missouri, and North Carolina are actively debating Medicaid expansion.

- Other eligibility expansions for six states in FY 2019 and 19 states in FY 2020 (planned) include expanding coverage for pregnant and postpartum women, covering children with disabilities/complex needs, increasing income limit for parents/caretakers, and restoring retroactive coverage.

- Eligibility restrictions implemented in FY 2019 (by seven states) or planned for implementation in FY 2020 (in six states) through Section 1115 waivers target broader Medicaid populations including expansion adults and parents/caretakers and could result in enrollment declines. Most restrictions were for work requirements.

- Work requirements litigation is underway in several states. Additionally, six non-expansion states have pending work requirements waiver requests.

- Other eligibility restrictions include conditioning eligibility on premium payment, waiving reasonable promptness, and conditioning eligibility on completion of a health risk assessment.

Medicaid Managed Care Initiatives

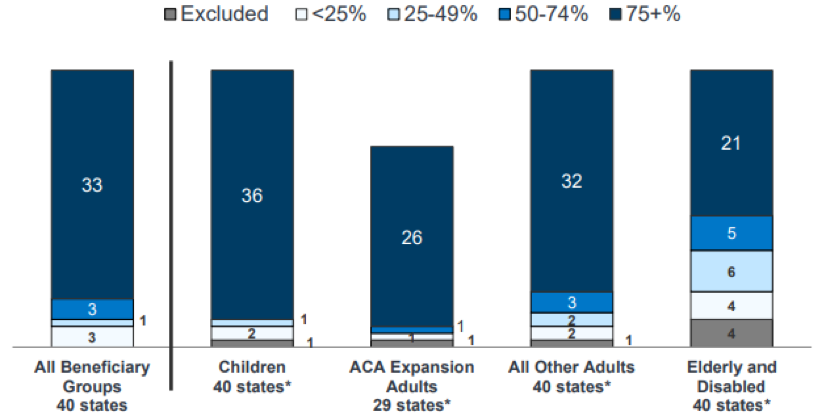

- A total of 40 states (including DC) contract with risk-based managed care organizations (MCOs) to serve their Medicaid enrollees. As of July 2019, 33 states reported that 75 percent or more of their Medicaid beneficiaries were enrolled in MCOs. Children and adults, particularly those enrolled through the ACA Medicaid expansion, are much more likely to be enrolled in an MCO than elderly Medicaid beneficiaries or individuals with disabilities.

Figure 2 – MCO Penetration Rates for Select Groups of Medicaid Beneficiaries, as of July 1, 2019

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by HMA, October 2019.

- Arkansas reported implementing managed care program for the first time in FY 2019. The Provider-led Arkansas Shared Savings Entities (PASSEs) program serves Medicaid beneficiaries who have complex behavioral health and intellectual and developmental disabilities (I/DD) service needs. Only five percent of Medicaid enrollees are in the program.

- North Carolina will implement risk-based, capitated managed care contracts for the first time to cover approximately 1.6 million enrollees in FY 2020, with mandatory enrollment for most population groups.

- Alaska reported that it will no longer implement an MCO arrangement in FY 2020, which would have served one geographic area (Anchorage and the Mat-Su Valley).

- Because of nearly full MCO saturation in most MCO states, only six states in FY 2019 and eight states in FY 2020 reported actions to increase MCO enrollment, with the majority looking to add new population groups.

- In FY 2019, Mississippi, New Jersey, New York, and Virginia reported actions to carve behavioral health services into their MCO contracts, and in FY 2020, Kentucky, Nebraska, West Virginia, and Wisconsin reported plans to add substance use disorder (SUD) waiver services to their MCO contracts.

- In FY 2019, eight states had contracts that required MCOs to participate in a state-directed VBP initiative and 12 states required MCOs to develop a VBP strategy within state-specified guidelines. In FY 2020, seven states planned to participate in a state-directed VBP initiative, and five states required MCOs to develop a VBP strategy within state-specified guidelines.

- Thirty-five states are planning to leverage Medicaid MCO contracts to promote at least one strategy to address social determinants of health in FY 2020.

Emerging Delivery System and Payment Reforms

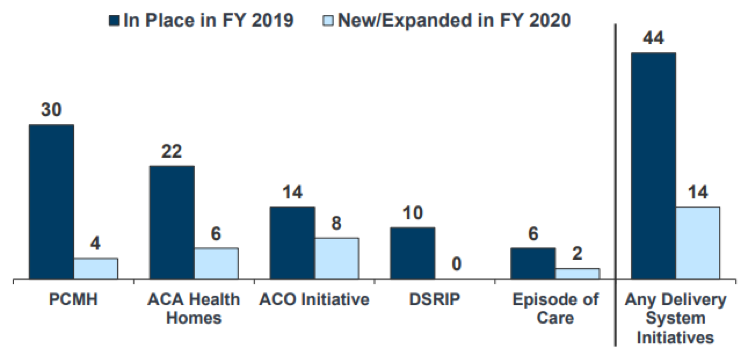

- Forty-four states had one or more delivery system or payment reform initiatives in place in FY 2019, including patient-centered medical homes (PCMHs), ACA Health Homes, accountable care organizations (ACOs), episode of care payments, or delivery system reform incentive programs (DSRIPs). PCMH and health home initiatives were the most common in FY 2019.

Figure 3 – State Delivery System Reform Activity, FYs 2019-2020

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by HMA, October 2019.

Long-Term Services and Supports Reforms

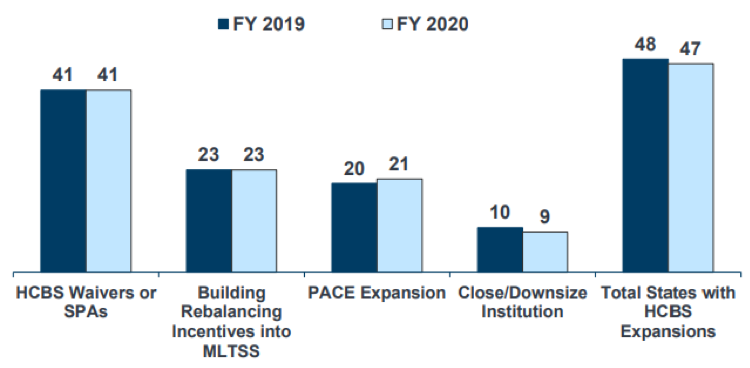

- Nearly every state reported actions to expand the number of people served in home and community-based settings in both years (48 states in FY 2019 and 47 states in FY 2020).

Figure 4 – State Long-Term Care Actions to Serve More Individuals in Community Settings, FYs 2019-2020

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by HMA, October 2019.

- Housing supports remains an important part of state LTSS benefits, with 37 states offering housing related supports. Congress provided a short-term extension to the Money Follows the Person (MFP) program, however, due to the uncertain future of the program, some initiatives may be at risk.

- In an effort to retain LTSS workers, approximately half the states reported raising wages for direct care workers in FY 2019 and FY 2020.

- Twenty-seven states reported using one or more MLTSS models, as of July 1, 2019, with nine offering an MCO-based Financial Alignment Initiative (FAI). Pennsylvania introduced MLTSS in FY 2018, with a plan to complete statewide expansion in FY 2020. Idaho, Illinois, and Tennessee reported geographic or population expansions for FY 2020.

Provider Rates and Taxes

- Nearly half of MCO states (17 states) require MCO payment changes for some or all types of providers to be consistent with percentage or level of changes made in comparable fee-for-service (FFS) rates. Nineteen states reported that their MCO contracts include rate floors for some provider types, and seven states reported they had minimum MCO payment requirements for all types of Medicaid providers.

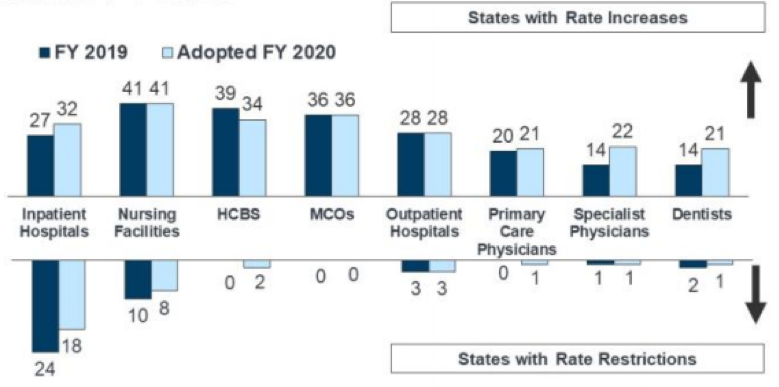

Figure 5 – Provider Rate Changes Implemented in FY 2019 and Adopted for FY 2020

SOURCE: KFF survey of Medicaid officials in 50 states and DC conducted by HMA, October 2019.

- In FY 2019, 34 states, including DC, had three or more provider taxes in place. Thirty-two states have at least one provider tax that is at or above 5.5 percent of net patient revenues (close to the maximum safe harbor threshold of 6 percent). Therefore, federal action to lower that threshold as proposed in the past would have financial implications for many states. Alaska was the only state with no provider taxes.

- California became the eighth state to implement an ambulance tax in FY 2019.

- For FY 2020, 17 states reported planned increases to one or more provider taxes, while six states reported planned decreases.

Benefits and Copayments

- The number of states reporting new benefits and benefit enhancements continues to significantly outpace the number of states reporting benefit cuts and restrictions. Twenty-three states expanded or enhanced covered benefits in FY 2019, and 28 states plan to add or enhance benefits in FY 2020. The most common benefit enhancements reported were for mental health/SUD services (including waiver of the IMD exclusion for SUD treatment).

- Five states reported new or increased copayment requirements for FY 2019 or FY 2020, including for non-emergency use of a hospital emergency department (ED) and for pharmacy services. Meanwhile 11 states reported policies to eliminate or reduce a cost-sharing requirement.

Pharmacy and Opioid Strategies

- All states reported FFS pharmacy management strategies to reduce opioid harm in FY 2019 and 32 states plan to take further action in FY 2020. Of the states that used MCOs to deliver pharmacy benefits, 29 reported that they required MCOs to follow some or all of their FFS pharmacy management policies for opioids.

- States continue to increase access to Medication Assisted Treatment (MAT) for opioid use disorder, and 44 states reported coverage of methadone in FY 2019.

- States also continue to focus on controlling prescription drug costs. In FY 2019, 24 states reported implementing or expanding at least one initiative to contain costs, and in FY 2020, 26 states plan to do so. Strategies include addressing PBM transparency, spread pricing in managed care, innovative purchasing arrangements, placing prior authorization, among others.

Looking Ahead: Perspectives of Medicaid Directors

When asked to identify the top priorities, issues, and challenges for FY 2020 and beyond, Medicaid directors listed the following:

- Delivery system and payment reforms

- Information technology (IT) systems projects, including Medicaid Management Information Systems (MMIS) procurements and eligibility system upgrades and replacements and implementation of health information exchanges (HIEs)

- Medicaid budget and fiscal challenges

- Section 1115 demonstration waivers, waiver amendments, or waiver renewals

- Preparing for an aging population

- Exploring potential state-based coverage expansion options beyond Medicaid

- Medicaid block grant options