HMA is pleased to welcome new experts to our family of companies in April 2023. This diverse team brings significant expertise in Medicare, Medicaid, regulatory strategies, and managed care, strengthening HMA’s capabilities in healthcare consulting across areas like actuarial support, regulatory compliance, and strategic leadership in Medicare Advantage and Medicaid programs.

254 Results found.

Illinois requests Section 1115 waiver extension to address HRSNs and eliminate inequities

This week our In Focus section reviews the Illinois Healthcare Transformation 1115 Waiver Extension request, posted for review on May 12, 2023.

In pursuing this waiver extension, Illinois joins a growing list of states taking advantage of new Centers for Medicare & Medicaid Services (CMS) policy flexibilities to address health-related social needs (HRSNs) through Medicaid and test community-driven initiatives that are focused on improving health equity, improving access to care, and promoting whole-person care.

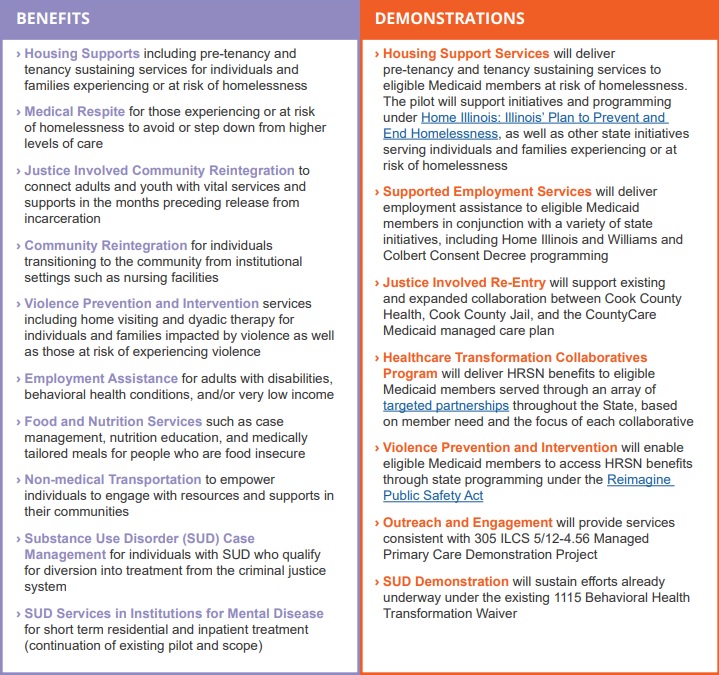

The Illinois waiver incorporates two of the most significant new opportunities in the CMS demonstration waiver flexibilities by proposing to incorporate housing supports for people who are experiencing or at risk of homelessness. The waiver also would extend community reintegration services for justice-involved adults and youths for up to 90 days before their release from incarceration. For a full list of proposed benefits and demonstrations, see Table 1.

Table 1. Summary of Illinois Medicaid 1115 Waiver Extension

Source: Illinois Department of Health and Family Services. Illinois Healthcare Transformation Section 1115 Demonstration Extension Overview.

The Illinois waiver represents an unprecedented opportunity to demonstrate the long-term, positive impact of providing HRSN services to achieve health equity and create a sustainable, community-driven system for delivering those services. The demonstration proposes to offer a range of HRSN services that are focused on the unmet needs of people who are homeless and housing insecure, are justice-involved, have behavioral health conditions, are pregnant, are unemployed, are food insecure, and/or have been exposed to violence or are at risk of violence with the goal of eliminating health disparities.

The waiver projects a five-year total of $4.4 billion in HRSN services expenditures and another $800 million in HRSN-related infrastructure, indicating Illinois’ long-term commitment to healthcare transformation and to building an equitable, accessible, and high-quality delivery system.

For additional information, please email [email protected].

The end of the public health emergency: imminent changes to the coverage of virtual care services

Policy crossroads and the end of the public health emergency due to COVID-19

This is part of a three-part series on significant implications of the end of the Public Health Emergency (PHE).

The end of the Public Health Emergency on May 11, 2023 is likely to mark a transitional point in the rapidly evolving arena of virtual care services and not a dramatic end of coverage. Coverage of virtual care services will continue to evolve significantly over the next five years given the exponential growth in the public’s awareness of, and comfort with, these services — all hastened by the COVID-19 Federal Public Health Emergency.

The U.S. Congress and the Centers for Medicare and Medicaid Services (CMS) used its authority during the PHE to significantly expand Medicare coverage for virtual care services, covering telehealth visits in urban areas and from patient’s homes. In addition, Medicare began covering a wide range of clinical services virtually such as behavioral health and physical therapy; it also expanded coverage for different service delivery modalities to include audio-only visits. As a result of the changes, Medicare became a leading payer for virtual care nationally between 2020 and 2022. Over this same period, private insurers and state Medicaid programs largely followed Medicare’s lead by expanding their own virtual care coverage.

One of the consequences of the PHE is that most payers have embraced Medicare’s basic definitional structure for types of virtual care services. As a part of this typology, virtual care services are divided into two general buckets of services: telehealth visits (physician office visits conducted via audio and video technology), which are typically prohibited by statute in urban areas or a patient’s home; and Communication Technology-Based Services (CTBS) which can be conducted anywhere. CTBSs include: remote patient monitoring (RPM); virtual check-ins (brief patient-to-clinician exchanges); e-visits (online portal or email visits); and e-consults (clinician to clinician interaction).

With the end of the PHE on May 11, Medicare coverage of virtual care services and coverage offered by other payers will change. The details and scope of this change have many stakeholders concerned and confused. HMA has a keen sense for which virtual care services may get a new lease on life in the coming months and which are likely to be hotly debated in the years ahead. The one certainty is that the last 3 years have altered the landscape for virtual care services for years to come.

Shift in Virtual Care Landscape

As a result of the statutory geographic limitations and restrictions placed on traditional fee-for-service (FFS) Medicare coverage, use of telehealth services was minimal most of the last decade, with only one-quarter of 1 percent (0.25%) of beneficiaries in FFS Medicare using virtual care services.[1] Even among Medicare Advantage plans and Medicare Accountable Care Organizations (ACOs), neither of which which face the same restrictions, virtual care was utilized very rarely before 2019.

This sluggish use of telehealth was radically altered when HHS used its PHE authority to relax constraints on the use of use virtual care services by Medicare beneficiaries and providers.[2],[3] Among the most consequential changes made by policymakers at the outset of the PHE were:

- Enabling telehealth services to be provided anywhere (e.g., urban areas and patients’ homes);

- Allowing Federally Qualified Health Centers (FQHC) and Rural Health Clinics (RHC) to conduct virtual care services;

- Granting various types of clinicians permission to deliver virtual care services;

- Enabling new patients to receive virtual care services;

- Authorizing audio-only services;

- Permitting telehealth services for more than 200 different types of clinical services (e.g., mental health, emergency department, physical and occupational therapy, critical care, inpatient care);

- Relaxing HIPPA rules to enable the broad use of smartphones for virtual care.

Due to these policy changes, rates of virtual care skyrocketed during the PHE (Figure 1). In April of 2020 the number of Medicare claims for any type of virtual care service exceeded 9 million, while 2019 the number of these services provided monthly never exceeded 100,000 (Figure 1). On an annual basis, from 2019 to 2021 the number of virtual care visits jumped from roughly 1 million to 39 million and the number of unique beneficiaries receiving these services increased from 300,000 to nearly 12 million.

Figure 1: Number of Virtual Care Service Visits, Number of Unique Medicare Fee-For-Service Beneficiaries, and Number of visits per Utilizer by Month, December 2019 to December 2021.

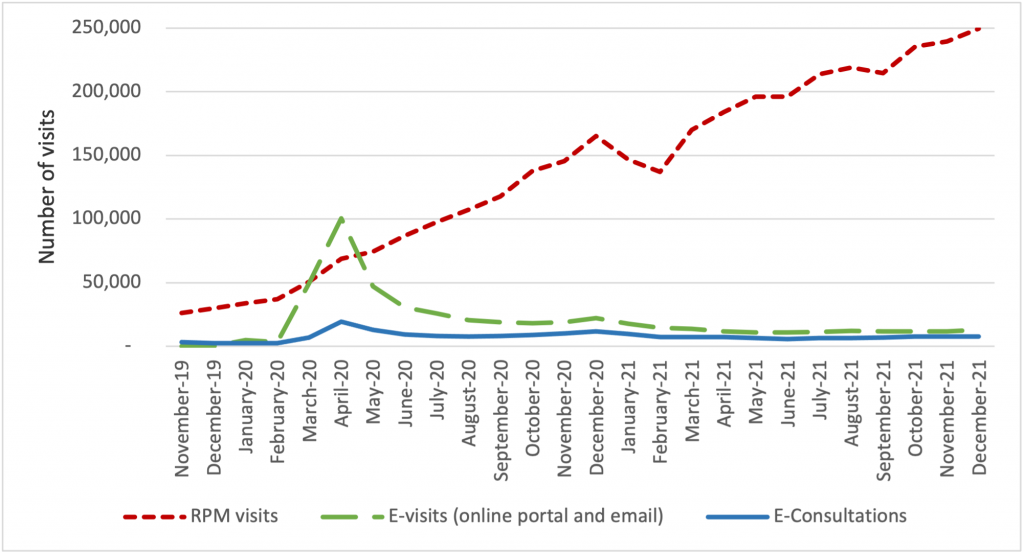

The growth of virtual care services has largely been driven by an increase in telehealth visits, but we observe important trends in the use of CTBSs, as well. In late 2021, more than 90 percent of visits were associated with telehealth, while 10 percent were associated with CTBSs. Early in the PHE, all of these service types experienced an initial, abrupt increase in use (Figure 2). By contrast, the growth in the use of remote patient monitoring (RPM) has been continuous since 2020. The growth in use of RPM reflects the general movement of services into patients’ homes and has been accelerated by specialist such as cardiologists and endocrinologists beginning to leverage the power of RPM. We expect greater diffusion and use of RPM and other CTBSs in the next five years.

Figure 2: Number of Virtual Care Service Visits for Remote Patient Monitoring, Virtual Check-ins, E-visits, and E-Consultations by Month, December 2019 to December 2021.

Policies temporarily in place until the end of 2024

During the PHE, Congress made critical long-term changes to Medicare’s coverage of virtual care services that continued to spur the use of these services and offer access to care for beneficiaries. In 2021, Congress changed the law to permanently allow Medicare beneficiaries to receive behavioral/mental telehealth services regardless of location (urban or rural) and for this care to be available to patients in their own homes.

In 2022, Congress severed the link between the PHE declaration and Medicare coverage policies for virtual care services, extending those benefits through the end of calendar year 2024. We expect that coverage for all telehealth services will receive considerable attention from federal policymakers and stakeholders towards the end of 2024.

Immediate impact of expiring policies

Certain aspects of Medicare’s virtual care policies will, however, terminate May 11, 2023, when the PHE declaration comes to an end. Several of the expiring policies have a broader impact beyond the Medicare program, affecting patients insured by private payers and State Medicaid programs.

Specifically, when the PHE ends, policymakers will need to address the following anticipated changes:

- The Office for Civil Rights (OCR) will return to imposing penalties on providers who violate the provisions of the Health Insurance Portability and Accountability Act (HIPAA) by using public-facing remote communication technologies which are not HIPAA-compliant. This may prohibit the use of some of the most common smartphone-based video conferencing tools for health care visits.

- Medicare beneficiaries without an existing relationship with a clinician will be unable to receive CTBSs such as RPM, virtual check-ins, and e-visits.

- Providers will no longer be allowed to provide virtual care services across state lines, because most state medical licensure boards will return to pre-PHE policy.

- Federal rules from the Drug Enforcement Agency (DEA) may revert to the pre-PHE requirement that clinicians establish a patient-provider relationship in-person before being permitted to prescribe controlled substances for substance use disorder treatment.

Potential policy changes occurring before 2025 As explained earlier, Medicare coverage for many virtual care services will remain in place for the next 19 months. Before the end of 2024, Congress will need to address several policy questions, and among the most widely debated are whether to:

- Restore Medicare’s statutory prohibition on telehealth services being delivered in urban areas or in home settings;

- Allow Federally Qualified Health Centers and Rural Health Clinics to provide telehealth services to Medicare beneficiaries; or

- Continue to cover audio-only telehealth visits under Medicare.

Lawmakers will look to payers, patients, and providers for feedback before making these policy decisions. Among the most critical pieces of information they will also consider will be the results of the study Congress has required of HHS regarding trends in the use of virtual care. This study’s final report is due in 2026, which has led some to speculate that Congress will delay action on virtual care coverage policy until then. In the meanwhile, we expect HHS will be assessing the overall volume of virtual care use, who is using which types of services, and the levels of related fraud and abuse.

Looking Ahead

In the United States, our experience during the acute phase of the pandemic demonstrated that patients and providers are more receptive than previously thought to utilizing digital technologies for the delivery of care. This experience may also influence policymakers’ decisions about reimbursement and coverage of wearable devices, as well as other cutting-edge tools that rely on artificial intelligence or machine learning.

HMA believes payers and providers alike can take steps now to strategically prepare for the still evolving and growing landscape of digital health care.

Based on the various changes that have occurred in the virtual care environment over the last 3 years, we are intently watching several areas of potential change in the practice of medicine and the ways payers set coverage policy. Below are some of the trends we anticipate in the years ahead:

- Continued use of virtual care services at levels observed in 2021.

- An expansion of CMS’s programs to protect against fraud and abuse related to virtual care.

- Notable growth in the use of RPM, and related services for physical and occupational therapy services.

- The proliferation of innovative home-based screening and testing technologies. We anticipate payers will encourage the use of these at-home tests for things like kidney function, liver function, and colorectal cancer screening in order to limit care delivery in higher cost settings.

- Growth in “virtual-first” insurance plans, where patients are encouraged to use virtual care first – prior to being seen in person. As these plan options expand, we anticipate virtual care use will rise, and reimbursement rates will begin to change.

Virtual care services are primed for additional growth and HMA is working with a wide variety of payers, providers, and foundations to develop strategies for adapting to state and federal rules and regulations related to virtual care. Changes in this landscape will hinge on research CMS will complete by the end of 2026, and coverage decisions made by states and commercial payers. HMA is well positioned to assist stakeholders with work in this area and can leverage access to Medicare and Medicaid claims data to conduct health services research to illustrate geographic variations in the use of virtual care.

If you have questions on how HMA can support your agency before or after the end of the PHE, please contact our experts below.

Read other parts of this blog series:

[1] (2016) https://www.cms.gov/About-CMS/Agency-Information/OMH/Downloads/Information-on-Medicare-Telehealth-Report.pdf

[2] Centers for Medicare & Medicaid Services. Medicare telemedicine health care provider fact sheet. March 17, 2020. https://www.cms.gov/newsroom/fact-sheets/medicare-telemedicine-health-care-provider-fact-sheet

[3] HHS Administration for Strategic Preparedness & Response (ASPR). https://aspr.hhs.gov/legal/PHE/Pages/default.aspx

CMS’s 2024 hospital inpatient rule proposes payment increases, support for safety net hospitals, and NTAP program changes

This week, our In Focus section reviews the policy changes proposed by the Centers for Medicare & Medicaid Services’ (CMS) on April 10, 2023, for the Fiscal Year (FY) 2024 Medicare Hospital Inpatient Prospective Payment System (IPPS) and Long-Term Acute Care Hospital (LTCH) Proposed Rule (CMS-1785-P). This year’s IPPS Proposed Rule includes several important policy changes that will alter hospital margins and change administrative procedures, beginning as soon as October 1, 2023.

Key provisions of the FY 2024 Hospital IPPS and LTCH Proposed Rule

For FY 2024, CMS proposes to make modifications to several hospital inpatient payment policies. We highlight six proposed policies that are among the most impactful for Medicare beneficiaries, hospitals and health systems, payors, and manufacturers:

- the annual inpatient market basket update,

- hospital wage index adjustments,

- New Technology Add-on Payment (NTAP) program policy changes,

- the agency’s call for input on how to best support Safety Net Hospitals,

- graduate medical education payments at rural emergency hospitals, and

- changes to many cardiovascular-related MS-DRGs.

Stakeholders will have until June 9, 2023, to submit comments to CMS on the contents of this regulation and request for information

1. Market basket update

Proposed Rule: Overall CMS’s Medicare 2024 Hospital Inpatient Proposed Rule will increase payments to acute care hospitals by an estimated $3.3 billion from 2023 to 2024; however, recent trends in economy-wide inflation may alter this estimate by the time the agency releases the Final Rule version of this regulation in August 2023. The primary driver of the estimated $3.3 billion increase in inpatient payments to hospitals is CMS’s proposed 2.8 percent increase in the annual update to inpatient operating payment rates.

HMA/Moran analysis: CMS’s 2.8 percent increase is largely based on an estimate of the rate of increase in the cost of a standard basket of hospital goods, the hospital market basket. For beneficiaries, increasing payment rates will eventually lead to a higher standard Medicare inpatient deductible and increased beneficiary out-of-pocket costs for many other services. For hospitals and health systems, payors, and manufacturers the proposed payment increase (2.8 percent) falls below economy-wide inflation (5-6 percent in recent months) and hospitals are already saying it is insufficient.[1] For this Proposed Rule, data from the third quarter of 2022 was used to calculate the 2.8 percent increase. Importantly, for the FY 2024 Final Rule, CMS will use data through the first quarter of 2023, which we know to include additional growth in economy-wide inflation. As a result, we anticipate the proposed 2.8 percent increase in payment rates may increase slightly by the time rates are finalized later in the year.

2. Hospital Wage Index Adjustments:

Proposed Rule: CMS proposes two wage index policies for FY 2024. First, CMS proposes to continue temporary policies finalized in the FY 2020 IPPS/LTCH PPS final rule to address wage index disparities affecting low-wage index hospitals, which includes many rural hospitals. Second, CMS proposes to include geographically urban hospitals that choose to reclassify into rural wage index areas in the calculation of state-level rural wage index and the calculation of the state-level wage index floor for urban hospitals (referred to as the rural floor policy).

HMA/Moran analysis: The two wage index policies proposed by CMS for FY 2024 will support rural hospitals. The first policy, to continue the low-wage index policy for an additional year beyond the original 4-year plan will allow hospitals with low wage indexes to boost their wage index and their payment rates across all MS-DRGs. Specifically, hospitals with wage indexes below 0.8615 (the 25th percentile across all hospitals) will automatically receive an increase in their wage index by CMS. This policy will bring additional millions of dollars to individual rural hospitals in FY 2024. The second policy, to include the labor data of geographically urban hospitals that choose to reclassify into rural wage index areas within the calculation of the state-level rural wage index and the state-level rural floor will largely benefit rural hospitals. In recent years several large geographically urban hospitals in several markets have chosen to reclassify into rural wage index areas to benefit their Medicare payments. In the past, CMS has not included the labor costs of these hospitals, which tend to have higher than average labor costs in their calculation of the state rural wage index or the rural floor wage index. In making this change, to include the labor costs of the geographically urban hospitals in these calculations, CMS will very likely increase the state-wide rural wage index. This will have the effect of increasing the wage index of many rural hospitals around the country. The overall impact of both proposed wage index policy changes for FY 2024 will be to increase inpatient payment rates to rural hospitals.

3. New technology add-on payments (NTAP):

Proposed Rule: Citing the increased number of applications over the past several years and noting the need for CMS staff to have time to fully review and analyze the applications, CMS proposes two changes to the NTAP application requirements. First, CMS proposes to require all applicants to have a complete and active FDA market authorization request in place at the time of NTAP application submission (if not already FDA approved). In addition, CMS proposes to move the FDA approval deadline from July 1 to May 1, beginning with applications for FY 2025.

HMA/Moran Analysis: CMS’ proposals to change the NTAP application process aim to ameliorate the problem of manufacturers withdrawing applications because they miss the FDA approval deadline. These withdrawals increase CMS’ workload, as the agency reviews some applications multiple times. However, while these proposals provide CMS with more time to review applications, they increase the amount of time some applicants will not receive NTAP payments, depending on the timing of the FDA approval process. The annual NTAP approval cycle and FDA approval deadline create difficulties for manufacturers with products that miss the deadline, which many stakeholders argue creates barriers to access for new technologies. Stakeholders have proposed a variety of potential solutions to these barriers, such as biannual or quarterly NTAP decisions, or extending the conditional approval pathway currently used for certain antibiotic products to all NTAP applications.

4. Safety Net Hospital Request for Information:

Proposed Rule: CMS is seeking public input on the unique challenges faced by safety-net hospitals and the patients they serve, and potential approaches to help safety-net hospitals meet those challenges.

HMA/Moran Analysis: In the 2024 Proposed Rule CMS poses a variety of questions to the public about how safety net hospitals and their patients can be better supported by the Medicare program, both in terms of payment and infrastructure investment. The agency specifically asks stakeholders their opinion on measures that could be used to define safety net hospitals and potentially make differential or additional payments to safety net hospitals. CMS names the safety net index (SNI) developed by the Medicare Payment Advisory Commission (MedPAC) in recent years and the Area Deprivation Index (ADI) developed by the National Institutes for Health (NIH) as the two leading options for defining and potentially reimbursing safety net hospitals. These two methods have several significant differences, including that the SNI is a hospital-level measure based in-part on the volume of cases at a given hospital associated with Medicare beneficiaries that are fully or partially eligible for Medicaid and the ADI is a geographic measure that correlates local socioeconomic factors with medical disparities. HMA has modeled the SNI for hospital stakeholders in the last year and has identified hospitals that would be potential winners and losers if an SNI approach were implemented by CMS.

5. Graduate Medicare Education Training in Rural Emergency Hospitals:

Proposed Rule: CMS proposed to allow Graduate Medical Education (GME) payments for training Rural Emergency Hospitals. Rural Emergency Hospitals are a new provider type established by the Consolidated Appropriations Act, 2021, to address the growing concern over closures of rural hospitals. If finalized, this proposal would allow hospitals converting to REH status and other hospitals newly designated as REHs to receive Medicare GME payments even though they do not have an inpatient facility.

HMA/Moran analysis: If finalized, the proposed policy to allow REHs to offer GME training and to be paid for GME training will enhance access to care in rural areas and will enable hospitals that convert to REHs to expand their capabilities. CMS’s proposal to allow REHs to receive payment based on 100 percent of the reasonable costs for GME training costs allows REHs to operate training programs and to focus new training programs on rural care and outpatient care. This policy, if finalized, will bring additional revenues to hospitals that decide to convert to REHs (thereby relinquishing their inpatient capacity) and will improve access to care for beneficiaries living in rural areas.

6. MS-DRG weights:

Proposed Rule: To set MS-DRG weights for FY 2024 inpatient cases, CMS proposed to use FY 2022 data, which is consistent with pre-pandemic CMS methods. In previous years, CMS had modified its MS-DRG weight calculation to account for high volumes of COVID cases. However, for FY 2024, CMS has returned to its longstanding method of using a single year of data to set MS-DRG weights. In addition, among the various changes CMS has proposed as a part of the 2024 MS-DRG weight setting process CMS has proposed significant changes to many MS-DRGs in the category for diseases and disorders of the circulatory system (Major Diagnostic Category 5).

HMA/Moran analysis: CMS’s return to using a single year of data without COVID modification will be welcomed by many stakeholders, but particularly for those with an interest in short-stay surgical cases. The modifications CMS proposes to make to the MS-DRGs within Major Diagnostic Category 5, which includes numerous cardiovascular MS-DRGs, are likely to be disruptive for many stakeholders initially but over the long term are likely to make CMS coding more consistent with standard clinical practice and per case resource use. For example, CMS is proposing to consolidate five cardiac defibrillator MS-DRGs into three, consolidate three Thrombolysis MS-DRGs into two, and overhaul the family of stenting MS-DRGs. We anticipate that these changes and other proposed by CMS may result in initial coding confusion for hospitals, but that they will slowly adapt throughout 2024.

HMA and The Moran Company work collaboratively to monitor legislative and regulatory developments in the inpatient hospital space and assess the impact of inpatient policy changes on the hospital sector. HMA’s Medicare experts interpret and model inpatient policy proposals and use these analyses to assist clients in developing their strategic plans and comment on proposed regulations. Moran annually replicates the methodologies CMS uses in setting hospital payments and models alternative payment policies to help support its clients’ comments to the rule. Moran also assists clients with modeling for DRG reassignment requests and to support NTAP applications. Typically, these projects run through the summer, to ensure readiness for October deadlines. Finally, many clients find it useful to model payments for different types of cases under different payment scenarios. For example, a client may be interested in how payments for COVID-19 cases may change after the expiration of the Public Health Emergency, and which hospitals will face the biggest payment cuts. Moran is available to help with these and other payment modeling questions—and works on many of these issues in tandem with HMA’s Medicare experts.

For more information or questions about the policies described below, please contact our experts below.

[1] https://www.aha.org/news/headline/2023-04-10-cms-issues-hospital-ipps-proposed-rule-fy-2024

Policy changes in Medicare Advantage: implications for coding, risk adjustment, and reimbursement

On Tuesday, April 11, 2023, HMA hosted a Future Frame Conversation covering some of the changes outlined in the recent 2024 Medicare Advantage (MA) Rate Announcement. This cycle signals a new era for MA funding and risk adjustment. The Final Rate Announcement, in particular the new risk adjustment model to be phased in over three years, will spark stakeholders to reevaluate benefit design through the bid cycle and risk adjustment strategies in the future. These refinements will impact both health plan and provider reimbursement.

During the discussion:

- Amy Bassano from HMA talked about the CMS strategy for these changes; and

- Tim Murray from Wakely Consulting, an HMA company, discussed how payers should be using data and analytics to evaluate and forecast the impact of CMS changes.

Click here to view referenced Wakely white papers mentioned in this recording.

Medicare Advantage capitation rates and Part C/D payment policies

This week, our In Focus section reviews the recently announced major policy updates from the Centers for Medicare and Medicaid Services (CMS) that affect the Medicare Advantage (MA) and Part D programs.

First, on January 30, CMS released the final Risk Adjustment Data Validation Final Rule, a highly anticipated and controversial policy that establishes the agency’s approach to auditing MA Organizations’ (MAOs) risk-adjustment payments and collecting overpayments as needed. Second, CMS released the CY 2024 Advance Notice for MA Capitation Rates (Part C) and Part D Payment Policies on February 1, 2023. Read HMA’s summary of the advance notice.

Most recently, on March 31, 2023, CMS released the CY 2024 Final Rate Notice for Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies, which incorporates CMS’s responses to public comments on the Advance Notice. These changes reflect CMS’ continued efforts to strengthen oversight in the MA program, including improving payment accuracy, and implementation of Part D policies from the Inflation Reduction Act (IRA).

Below are highlights of some of the key provisions of the CY 2024 Final Rate Notice and significant changes CMS made from the Advance Notice to the Final Rate Notice.

Risk Adjustment: The Final Rate Notice details the updated risk adjustment model using restructured condition categories based on ICD-10 codes, newer data, and clinical adjustments made to ensure the conditions are stable predictors of costs in the model. Specifically, diagnoses data will come from 2018 rather than 2014 and expenditure data will come from 2019 rather than 2015 to reflect changes in costs. These updates should more accurately reflect the cost of caring for beneficiaries and make payments less susceptible to discretionary coding that can lead to excess payments to MA plans.

Also, CMS changed course from its initial proposal in the Advance Notice to implement the above risk adjustment model changes fully in 2024, and instead decided to phase in these changes over three years. The updated risk adjustment policy will be phased in over three years for organizations other than PACE. As a part of the agency’s phase-in plan, 67 percent of the CY 2024 risk adjustment will come from the risk scores measured under the 2020 adjustments and 33 percent will come from the 2024 adjustments. In CY 2025, 67 percent of the risk adjustment will come from the 2024 adjustment. In 2026, 100 percent of the risk adjustment will come from the 2024 adjustment. For PACE organizations in CY 2024, CMS will continue to use the 2017 risk adjustment model and associated frailty factors to calculate risk scores.

Effective Growth Rate: The effective growth rate identified within the Final Rate Notice for CY 2024 is 2.28%, up from 2.09% in the Advance Notice. The Effective Growth Rate is largely driven by growth in Medicare Fee-for-Service expenditures. CMS will phase in a technical adjustment to remove MA-related indirect medical education and direct graduate education costs from the historical and projected expenditures. The technical adjustment to the Effective Growth Rate will be phased in over three years, where 33 percent of the adjustment will apply in CY 2024, 67 percent in CY 2025, and 100 percent in CY 2026.

Payment rate impact in MA: CMS expects that average payments to MAOs will increase by 3.32 percent in CY 2024 because of the finalized rate announcement, which is higher than the 1.03 percent increase outlined in the Advance Notice. This will result in an estimated $13.8 billion increase in MA payments for CY 2024.

Medicare Part D: The changes from the Inflation Reduction Act to the Part D drug benefit will be implemented as described in the Advance Notice. The changes for CY 2024 include:

- Elimination of cost sharing for covered Part D drugs for beneficiaries in the catastrophic phase of coverage.

- Increased income limits from 135 percent of the federal poverty limit (FPL) to 150 percent of the FPL for the low-income subsidy program (LIS) under Part D for the full LIS benefit with a $0 deductible.

- Continuation of the policy to not apply the deductible for any Part D covered insulin product. Also, in the initial coverage phase and the coverage gap phase, cost sharing must not exceed the applicable copayment amount, which for CY 2024 is $35 for a month’s supply of each covered insulin product.

- Continuation of the policy not to apply the deductible to any adult vaccine recommended by the Advisory Committee on Immunization Practices (ACIP). Also, the statute requires these vaccines to be exempt from any co-insurance or other cost sharing, including cost sharing for vaccine administration and dispensing fees for such products, when administered in accordance with ACIP’s recommendation, for beneficiaries in the initial coverage and coverage gap phases.

- Base beneficiary premium (BBP) growth will be held to no more than 6 percent by statute. The BBP for Part D in 2024 will be the lesser of the BBP for 2023 increased by 6 percent or the amount that would otherwise apply under the original methodology if the IRA were not enacted.

Star Ratings: Medicare Advantage star ratings for CY 2024 will include 30 measures with 12 included in the 2024 categorical adjustment index (CAI) values. By contrast, Part D star ratings for CY 2024 will include 12 measures with 5 of those measures included in the 2024 CAI values. The CAI for the 2024 Star Ratings is expected to be issued later in 2023. The CAI was introduced in 2017 as an interim analytical adjustment to address the average within-contract disparity in performance among beneficiaries who receive a low-income subsidy, are dual eligible, and/or are disabled.

The Final Rate Notice also includes three criteria for determining if Part C and D organizations are eligible for the “extreme and uncontrollable circumstances” adjustment to their Star Ratings. To be eligible, an organization must be in a 1) service area that is within the “emergency area” during the “emergency period,” 2) service area that is within a geographic area designated in a major disaster declaration under the Stafford Act and the Secretary exercised authority under the Act based on the same triggering events, and 3) a certain minimum percentage (25 or 60 percent) of beneficiaries must reside in the Federal Emergency Management Agency (FEMA) designated Individual Assistance area at the time of the extreme and uncontrollable circumstance. If an organization meets the criteria outlined and meets the 25 percent minimum, then they will receive the higher of their measure-level rating from the current and prior Star Ratings years for purposes of calculating the 2024 Star Ratings. For organizations meeting the 60 percent minimum and the other criteria, they are excluded from the measure-level cut point calculations for non-CAHPS measures, and the performance summary and variance thresholds.

Upcoming LinkedIn Live: Join HMA for our Future Frame Conversation on Policy Changes in Medicare Advantage and the Implications for Coding, Risk Adjustment, and Reimbursement. Tuesday April 11, 2023, at 12 p.m. E.T.

If you have questions about the contents of CMS’s MA final notice and how it will affect MA plans, providers, and patients, contact our featured experts below.

Health Management Associates Acquires Crestline Advisors

Jay Rosen, founder, president, and co-chairman of Health Management Associates (HMA), today announced the firm’s acquisition of Crestline Advisors, an Arizona based healthcare consulting firm.

Founded in 2013, Crestline Advisors supports health plans, provider organizations, and state agencies with an array of services designed to help them navigate the changing healthcare landscape. The company’s team of independent consultants has an extensive track record of developing successful RFP responses, provider networks, and business development strategies to fuel client success.

“Crestline Advisors brings an impressive mix of expertise and relentless client focus – that delivers results – to HMA,” Rosen said. “Their ability to consistently develop winning proposal responses for Medicaid managed care organizations (MCO) complements our extensive MCO supports as we continue to expand the ways in which we serve our clients.”

In addition to Crestline’s proposal response development and MCO network management and operations support services, the company also assists clients with regulatory and contract compliance, accreditation, and strategic planning for business development.

“Crestline has demonstrated a commitment to supporting health plans, providers, and states to improve healthcare for Medicaid beneficiaries,” said Crestline CEO Susan Dess. “We firmly believe that as part of the HMA family of companies we will bring even more success to our clients and drive continued growth and development in Medicaid healthcare delivery.”

Dess and Tim Mechlinski will continue to lead Crestline Advisors, an HMA Company, as managing directors. Terms of the transaction were not disclosed.

About HMA

Founded in 1985, HMA is an independent, national research and consulting firm specializing in publicly funded healthcare and human services policy, programs, financing, and evaluation. Clients include government, public and private providers, health systems, health plans, community-based organizations, institutional investors, foundations, and associations. With offices in more than 20 locations across the country and over 500 multidisciplinary consultants coast to coast, HMA’s expertise, services, and team are always within client reach. Learn more about HMA at healthmanagement.com, or on LinkedIn and Twitter.

About Crestline Advisors

Established in 2013, Crestline Advisors, LLC is a consulting company designed to support the needs of health plans, provider organizations, and state agencies. Crestline specializes in helping large and small organizations operate successfully and grow despite the constant operational, financial, and political challenges they face. Crestline uses its current understanding of industry drivers to strategize with our clients so they can respond timely and effectively to small, large, or enormous market-place changes. Learn more about Crestline Advisors at crestlineadvisors.com.

Medicare drug negotiation guidance: what you need to know

This week our In Focus section reviews the Centers for Medicare and Medicaid Services’ (CMS) announcement of initial guidance for the new Medicare Drug Price Negotiation Program for 2026. This initial guidance is one of many steps CMS described in the Medicare Drug Price Negotiation Program timeline for the first year of negotiation.

The Drug Price Negotiation Program was approved as part of the Inflation Reduction Act (IRA) (P.L. 117- 169) in August 2022. As discussed in our previous In Focus, the IRA includes several other policies aimed at addressing cost, affordability and access to prescription drugs within the Medicare program.

The Drug Negotiation Program allows the U.S. Department of Health and Human Services (HHS) to negotiate maximum fair prices (MFPs) for Part D drugs. Negotiations between HHS and prescription drug manufactures will begin in 2023 and continue into 2024 before negotiated prices go into effect Jan. 1, 2026.

For Medicare payment in 2026, HHS can negotiate prices for up to 10 Part D drugs that do not have generic or biosimilar competition. CMS can increase the number of Part D drugs selected for price negotiation each subsequent year. Starting in 2028, the agency can annually add up to 20 new Part B or Part D drugs to the program.

The published guidance describes CMS’ approach for identifying the drugs selected for the initial year of the program. However, CMS is finalizing these policies as announced for the initial drug negotiation year.

The initial guidance also details the requirements and procedures for implementing the process for the first set of negotiations. For example, the guidance details aspects related to the offer-counter-offer exchange process, confidentiality terms following an agreement, penalties for violations, and the dispute resolution process.

Key Considerations

The drug negotiation program presents numerous operational and policy questions for CMS, manufacturers, and the healthcare sector broadly. The program is expected to have a direct impact on prices and affordability for the Medicare program and its beneficiaries. Additionally, other public and commercial payers will want to consider the potential downstream impacts on their costs. Ongoing monitoring of HHS’ implantation of the drug negotiation program and the pharmaceutical industry’s response to the drug negotiation program will help health plans, providers, and other interested stakeholders navigate this new landscape.

What’s Next

In the short-run, CMS will benefit from feedback from stakeholders about the outstanding policy and operational issues the agency has identified. Comments can be submitted until April 14, 2023

CMS anticipates issuing revised guidance for the first year of negotiation in Summer 2023. By September 1, 2023, CMS plans to publish the first 10 Part D drugs selected for the initial program year. The negotiated maximum fair prices for these drugs will be published by September 1, 2024 and prices will be in effect starting January 1, 2026.

HMA and HMA companies will continue to analyze this and subsequent guidance. We have analytical capabilities and expertise to assist with tailored analysis for manufacturers, providers, patient groups, health plans, and other stakeholders. HMA has the ability to model policy impacts of the drug negotiation program, support the drafting of feedback to CMS as the program is designed and implemented, and provide technical assistance in considering how this new program may interact with other Medicare and Medicaid initiatives.

If you have questions about the Drug Negotiation Program or other aspects of the Inflation Reduction Act and how it will affect manufacturers, Medicare providers, Medicaid programs and patients, contact our experts below.

Financial impact summary of the 2024 Medicare Advantage advance notice

This week, our In Focus section highlights a Wakely, an HMA Company, summary and analysis of the 2024 Medicare Advantage Advance Notice, prepared for America’s Health Insurance Plans (AHIP). The Centers for Medicare & Medicaid Services (CMS) released the contract year (CY) 2024 Advance Notice with an accompanying fact sheet on February 1, 2023. AHIP has retained Wakely Consulting Group to provide a financial impact summary report of the information presented in the notice. Specifically, Wakely was asked to analyze changes to Medicare Advantage (MA) revenue, risk adjustment models, and fee-for-service (FFS) normalization.

Key highlights of the analysis are:

- The CY 2024 FFS growth rate is lower than projections from the 2023 Final Announcement. A portion of the downward restatement is driven by a technical change. CMS has not commented on the additional drivers.

- Based on a large sample of plans, Wakely estimated that the proposed Part C risk adjustment model is expected to decrease plan risk adjusted payment by 3.7 percent overall, which represents a bigger headwind than the CMS estimated decrease of 3.12 percent. The impacts vary significantly by model segment and geographic region, and for individual plans.

- The proposed FFS normalization factor excludes PY 2021 risk scores in the calculation of the underlying trend. The exclusion of PY 2021 increases the FFS normalization factor which decreases PY 2024 risk scores.

The report, released March 6, 2023, provides additional detail and discussion of these issues. For questions, please contact our experts below.

CMS announces plans to pursue new Medicare and Medicaid drug payment models

This week our In Focus section reviews the Centers for Medicare and Medicaid Services’ (CMS) announcement that the agency will explore three new prescription drug payment models in the Medicare and Medicaid programs:

- Medicare High-Value Drug List Model

- Cell and Gene Therapy (CGT) Access Model

- Accelerating Clinical Evidence Model

The announcement – and accompanying report – responds to President Biden’s October 2022 Executive Order directing CMS’ Center for Medicare and Medicaid Innovation (the Innovation Center) to identify models that could lower cost sharing for commonly used drugs and include value-based payment for drugs.

Notably, the Innovation Center offered varying levels of specificity about the models, leaving unanswered many questions about the structures and timelines for the potential models. The Innovation Center will need to conduct more robust analysis to determine the design specifications for each model, stakeholder interest, and practical and political feasibility for each. In addition, each model will need to have its own application or rulemaking process to identify participants and other key model parameters. While this makes it difficult for the Innovation Center to specify timelines, it provides stakeholders some flexibility to analyze and develop recommendations for the potential models over the next several months.

HMA’s experts are also closely tracking CMS’ work on additional areas identified for the agency to research. For example, CMS could consider other regulatory pathways, partnerships, or campaigns to promote the following changes:

- Opportunities to encourage price transparency for prescription drugs

- Options to improve biosimilar adoption

- Medicare fee-for-service options to support CGT access and affordability

The drug payment models build on other federal and state-level efforts to address prescription drug costs and total cost of care initiatives. For example, CMS’ drug payment model announcement comes just a week after the agency released its implementation approach for the drug payment policies approved as part of the inflation Reduction Act of 2022 (IRA) (P.L. 117-169). CMS is balancing the extensive implementation needs for the IRA while also acknowledging the new law may not directly address other value-based considerations impacting cost and access for certain prescription medications.

Below are some of the highlights of the Innovation Center’s drug payment models.

Medicare High Value Drug List Model

The Medicare High Value Drug List model would provide standardized approach to cost sharing for specified Part D medications. CMS suggests a standardized list with consistent cost-sharing to allow providers to easily identify and prescribe appropriate medications. Part D Sponsors could offer a Medicare-defined standard set of approximately 150 high-value generic drugs with a maximum co-payment of $2 for a month’s supply. Under this model, generic drugs included in the standardized list would not be subject to step therapy, prior authorization, quantity limits, or pharmacy network restrictions.

According to the report, CMS could explore leveraging existing systems, which would allow for a streamlined implementation. CMS also plans to seek input from beneficiaries, Part D Sponsors, manufacturers, and providers, but the agency did not provide a more specific timeline for announcing the Model specifications and start date.

Cell and Gene Therapy (CGT) Access

The Cell and Gene Therapy (CGT) Access model would be a voluntary opportunity for states and manufacturers. The model builds on existing state Medicaid initiatives to develop outcomes-based agreements (OBAs) with certain manufacturers of high-cost and breakthrough medications. CMS suggests the multistate test could inform a more permanent framework for evaluating, financing, and delivering CGTs on a broader scale. This model may also help address complexities with the federal drug rebate requirements in states that wish to pursue value-based contracting arrangements. Under this model a state Medicaid agency could choose to adopt the CMS structure for multi-state OBAs with participating manufacturers. CMS would be responsible for implementing, monitoring, reconciling, and evaluating financial and clinical outcomes. Initially the model would focus on CGTs for illnesses like sickle cell disease and cancer. This approach could remove some of the barriers that have slowed state uptake of OBAs.

CMS plans to begin model development in 2023, announce the model sometime in 2024-25, and test it as early as 2026.

Accelerating Clinical Evidence Model

The Innovation Center is considering mandatory participation for Medicare Part B providers in the Accelerating Clinical Evidence Model. Under this potential model, the agency would adjust Medicare Part B payment amounts for Accelerated Approval Program (AAP) drugs to determine if adjustments incentivize manufacturers to timely complete trials, which in turn may facilitate earlier availability of clinical evidence.

The Innovation Center identified some challenging aspects for this model and stated the agency will need to consult with the U.S. Food and Drug Administration (FDA) in 2023 to consider approaches for this model. Statements from agency officials about the model also indicate the need for consultation with the Medicare Payment Advisory Commission (MedPAC) and other stakeholders, including through an Advance Notice of Proposed Rulemaking.

If the Innovation Center determines this model is feasible, the agency will provide more details about a targeted launch. The Innovation Center has previously attempted to implement mandatory Part B drug payment models but never implemented them due to legal challenges and stakeholder opposition.

HMA and HMA companies will continue to analyze these potential models and initiatives developing in parallel with the Innovation Center’s work. We have the depth and breadth of expertise to assist with tailored analysis, to model policy impacts of the potential models, and to support the drafting of feedback to CMS as it considers these options.

If you have questions about the Innovation Center’s proposed models and how it will affect manufacturers, Medicare providers, Medicaid programs and patients, contact our experts below.

How will changes to Medicare Part C and D Star Ratings impact your plan?

What are your plans to minimize your risk to avoid dropping in your Star Rating or to plan a head to maintain or improve your Star Rating?

On February 1, 2023, the Center for Medicare and Medicaid Services (CMS) released the 2024 Advance Notice and included some key specifics on the upcoming changes to the Medicare Star Rating program. CMS is proposing changes that will align with the recently announced “Universal Foundation” of quality measures, a core set of measures that are aligned across CMS quality rating and value-based care programs. The Advance Notice also included information on substantive measure specification updates, new measure concepts, and the addition of measures to align with other CMS programs.

You can learn more about these proposed changes along with a blueprint for improving your Medicare Advantage Star Ratings at the HMA quality conference on March 6 in Chicago. The working session “Moving the Needle on Medicare Stars Ratings” will feature speakers Katharine Iskrant, MPH, CHCA, CPHQ, HEDIS/Stars Auditor, President and Owner, Healthy People; John Myers, BS, M.Eng., VP of Health Quality & Stars, Humana; Vanita Pindolia, PharmD, MBA, VP of Stars Program, Emergent Holdings; and Dr. Kate Koplan, MD, MPH, FACP, CPPS, Chief Quality Officer & Associate Medical Director Quality and Safety, Kaiser Permanente of Georgia

Moderators of this session are Mary Walter, Managing Director of Quality and Accreditation, and David Wedemeyer, Principal. Both have health plan legacy experience in Stars strategy, execution and getting results.

Objectives of this session:

- Overview of the CMS proposed changes and their impact on the Stars program

- Attendees will obtain a blueprint for improving Medicare Advantage Star Ratings, including the importance of ensuring executive management buy-in

- Discussion of how the use of data analytics can help plans to identify quality gaps, target interventions, and track improvement

- Strategies to avoid the type of siloed initiatives that often fail to achieve lasting results

- Speakers will also address the importance of quality in achieving market viability and financial

sustainability

Stay in the know about the upcoming proposed changes and develop your organization’s strategy in this interactive impactful working session. This session will allow attendees to integrate any learnings and take-aways into your Stars program to meet your overall Star Rating strategic goal.

Follow #HMAtalksQuality on Twitter and LinkedIn for more updates on Stars and quality initiative efforts throughout the year. View the full agenda and register for HMA’s first annual quality conference on March 6 in Chicago. Registration closes on February 21, 2023.

CMS creating a ‘Universal Foundation’ to align quality measures

Leaders at the Centers for Medicare and Medicaid Services (CMS) announced in the New England Journal of Medicine this month a new initiative called the “Universal Foundation,” which seeks to align quality measures across the more than 20 CMS quality initiatives. The implications for the broader healthcare system are immense.

At Health Management Associates upcoming quality conference March 6 in Chicago, Dr. Lee Fleisher, one of the authors of the Universal Foundation initiative and, Chief Medical Officer and Director, CMS’ Center for Clinical Standards and Quality, will deliver the keynote address “A Vision for Healthcare Quality: How Policy Can Drive Improved Outcomes.”

Attendees will hear from industry leaders and policy makers about evolving healthcare quality initiatives and participate in substantive workshops where they will learn about and discuss solutions that are using quality frameworks to create a more equitable health system. In addition to Dr. Fleisher, featured speakers will include executives from American College of Surgeons, ANCOR, CareJourney, CareOregon, Commonwealth Care Alliance, Council on Quality and Leadership, Denver Health, Institute on Public Policy for People with Disabilities, Intermountain Health, NCQA, Reema Health, Kaiser Permanente, Social Interventions Research and Evaluation Network, UnitedHealth Group, United Hospital Fund, 3M, and many other organizations.

The Universal Foundation seeks to align quality measures to “focus providers’ attention on measures that are meaningful for the health of broad segments of the population; reduce provider burden by streamlining and aligning measures; advance equity with the use of measures that will help CMS recognize and track disparities in care among and within populations; aid the transition from manual reporting of quality measures to seamless, automatic digital reporting; and permit comparisons among various quality and value-based care programs, to help the agency better understand what drives quality improvement and what does not.”

CMS has established a cross-center working group focused on coordination of these processes and on development and implementation of aligned measures to support a consistent approach. As part of this announcement, the group published a list of Preliminary Adult and Pediatric Universal Foundation Measures. This new quality program will affect clinicians, healthcare settings such as hospitals or skilled nursing facilities, health insurers, and value-based entities such as accountable care organizations.

HMA can help organizations improve their quality efforts in line with the new CMS Universal Foundation initiative. HMA’s more than 500 consultants include past roles as senior officials in Medicaid and Medicare, directors of large nonprofit and social services organizations, top-level advisors, C-level executives at hospitals, health systems and health plans, and senior-level physicians. Our depth of industry-leading policy expertise and clinical experience provides comprehensive solutions that make healthcare and human services work better for people.

To learn more about HMA and Quality, follow #HMAtalksQuality on Twitter and LinkedIn. View the full agenda and register for HMA’s first annual quality conference on March 6 in Chicago. Registration closes on February 21, 2023.