January 29, 2025

Executive Actions and Congressional Budget Reconciliation: Trump Administration's 2025 Healthcare Overhaul

HMA Insights – including our new podcast – puts the vast depth of HMA’s expertise at your fingertips, helping you stay informed about the latest healthcare trends and topics. Below, you can easily search based on your topic of interest to find useful information from our podcast, blogs, webinars, case studies, reports and more.

Executive Actions and Congressional Budget Reconciliation: Trump Administration's 2025 Healthcare Overhaul

This webinar was held on January 15, 2025.

As the Trump Administration takes office and a new Congress is convened, the legislative tool of budget reconciliation could play a pivotal role in shaping the nation’s policy landscape. In this webinar, Liz Wroe, Sara Singleton, and Laura Pence discussed the potential health policy priorities of the new Administration, the implications of reconciliation for healthcare stakeholders, and the challenges and opportunities presented while navigating this expedited process.

On January 6, The Centers for Medicare & Medicaid Services (CMS) approved Medicaid State Plan Amendment (SPA) #23-0010. The SPA authorizes the California Department of Health Care Services Service (DHCS) to use an alternative payment methodology (APM) to pay Federally Qualified Health Centers (FQHC), Rural Health Clinics (RHC), and Tribal Health Programs at the Medi-Cal fee-for-service (FFS) rate for dyadic services. FQHCs and RHCs will receive a separate payment for dyadic services in addition to their standard prospective payment system (PPS)/all-inclusive payment rates in certain circumstances. This SPA is retroactively effective to March 15, 2023.

Key provisions are as follows:

In addition, the dyadic care benefit provides a pathway for families to access additional supports via the new family therapy benefit. Family therapy is a psychotherapy service that managed care plans provide under Medi-Cal’s Non-Specialty Mental Health Services benefits. Family therapy services support members younger than age 21 to receive up to five family therapy sessions before a mental health diagnosis is required. More importantly, children and youth (younger than age 21) may receive family therapy without the five-visit limitation if they (or their parents/caregivers) demonstrate certain risk factors, including separation from a parent/caregiver because of incarceration, immigration status, or death; foster care placement; food insecurity; housing instability; exposure to domestic violence or trauma; maltreatment; severe/persistent bullying; and discrimination.

Health Management Associates (HMA) has been proud to partner with HealthySteps, as a DHCS-recognized model, to provide an evidence-based (APL 22-029 (ca.gov) approach to implementing the new dyadic care benefits. Contact our experts below to learn more.

With full Republican control, expect Congressional Republicans and the Trump Administration to quickly leverage the budget reconciliation process to pass legislation in several priority areas, including taxes, immigration, and domestic energy production. While expiring tax provisions may be the driving force of this year’s reconciliation efforts, Republicans are also likely to include other priorities, potentially including raising the debt ceiling, which will increase the need for reductions in mandatory health programs or changes to health care revenue to be used as offsets.

Budget reconciliation provides a rare opportunity to pass significant health care legislative changes on a party-line basis. However, while budget reconciliation has certain procedural advantages, it is also fraught with complex rules and procedures that can make it very difficult to pass large pieces of policy legislation intact.

Experts from Leavitt Partners, an HMA company, recently held a webinar reviewing the budget reconciliation process, opportunities and legislative strategies to navigate this process, and potential policies that could be considered. Access the webinar replay. Contact experts Elizabeth Wroe, Josh Trent, and Sara Singleton if you’re interested in learning more about the specialized services our team can offer your organization to navigate the Congressional budget reconciliation process and its outcomes.

Trump Administration and Congress to Consider Policy Changes

This week, our In Focus section reviews the final Notice of Benefit and Payment Parameters (NBPP) for 2026. The Centers for Medicare & Medicaid Services (CMS) rule, released January 13, 2025, describes the policy and payment parameters for issuers that participate in federally facilitated and state-based marketplaces in 2026.

The NBPP is particularly notable given that marketplace enrollment is at an all-time high. Last week, CMS reported that 24.2 million people joined a marketplace plan during 2025 Open Enrollment, exceeding last year’s historically high enrollment levels by more than 2 million people.[1] With millions more individuals covered in the individual market, this final rule presents several opportunities for the healthcare industry to improve the well-being of covered individuals and families and the financial health of participating organizations.

Marketplace policies are under scrutiny, however, from new Trump Administration officials and congressional leaders. Subsidies, eligibility, and reimbursement are among the topics receiving the greatest attention.

Key highlights from the final rule and considerations for stakeholders in the changing healthcare landscape follow.

Consumer Protections

The final rule further strengthens consumer protections, consistent with the policies advanced during the Biden Administration. CMS finalized policies to achieve the following:

Revisions to Marketplace User Fees

The enhanced premium tax credits are the driving force behind the increase in nationwide marketplace enrollment to more than 24 million today from 11.4 million in 2020. If not extended, or if Congress takes no action by July 31, 2025, CMS will increase the user fees collected to pay for administration of HealthCare.gov as follows:

CMS also is finalizing an alternative set of user fee rates. If enhanced premium tax credit subsidies are extended through the 2026 benefit year by July 2025 at the current or a higher level the following user fees rates will apply:

CMS originally proposed a March 2025 subsidy extension deadline for activating the lower user fee. Insurer should take into account the higher user fees when setting their 2026 premiums—SBMs as they finalize their 2026 user fee levels and FFM states considering the costs of staying in Healthcare.gov or transitioning to a SBM.

Premium Payment Threshold Options

CMS finalized new options for insurers to avoid triggering late payment grace periods for members who make most but not all their premium payment. The new threshold options are intended to minimize termination of coverage for people who owe small amounts. The options include:

Fixed dollar thresholds will be adjusted for inflation.

Information Sharing and Transparency

CMS is finalizing policies designed to increase transparency and promote program improvements by publicly releasing state marketplace operations data, including spending on outreach and additional open enrollment customer service metrics, such as for call center performance surveys and website visits. The final rule clarifies that CMS will not publicly release each SBM’s annual State-based Marketplace Annual Reporting Tool (SMART), a reversal from what was proposed.

In addition, CMS is finalizing that it will share aggregated, summary-level Quality Improvement Strategy (QIS) information publicly on an annual basis starting January 1, 2026, with data submitted during the 2025 qualified health plan application period.

What’s Next/Key Considerations

The new leadership at the US Department of Health and Human Services (HHS) and CMS will likely conduct a thorough review of these payment and policy changes. In consideration of potential repeals or modifications, states and marketplace plans will need to consider the following:

Connect With Us

Health Management Associates experts support states, managed care organizations, consumer groups, and other interested stakeholders to achieve success in the operation of and participation in the marketplaces. Our team has the broadest historical perspective on the challenges and opportunities in this market and can support every step of the planning and execution processes to optimize markets as they continue to evolve in the coming months and years. If you have questions or want to discuss the final rule, contact our experts below.

[1] Centers for Medicare & Medicaid Services. Over 24 Million Consumers Selected Affordable Health Coverage in ACA Marketplace for 2025. January 17, 2025. Available at: https://www.cms.gov/newsroom/press-releases/over-24-million-consumers-selected-affordable-health-coverage-aca-marketplace-2025.

Jennifer Bridgeforth, associate principal at Health Management Associates, dives into the complexities of fraud, waste, and abuse in healthcare, examining the blurred lines between inefficient processes and intentional misconduct. The conversation explores how value-based care, provider education, and technology could pave the way for more efficient and patient-centered healthcare. Listen to discover insights on navigating these challenges in a shifting healthcare landscape.

We are pleased to announce that Kelsey Stevens, principal at Wakely Consulting Group, an HMA Company, has been named the new chief executive officer (CEO) of Wakely. Kelsey succeeds Mary Hegemann, who recently was promoted to executive vice president at HMA.

A respected and trusted leader, Kelsey has been an integral part of Wakely since 2012, fostering a culture of collaboration, innovation, and excellence. As a champion for both internal teams and client solutions, she has guided Wakely through complex challenges and significant growth. Her leadership combines a deep understanding of healthcare markets with technical expertise and strategic vision, ensuring the continued delivery of exceptional results for clients.

“I’m deeply honored to take on this role and excited for the future of Wakely. Our work has always been about empowering clients with innovative, data-driven solutions, and with the support of our HMA family, we’re uniquely positioned to make an even greater impact,” Kelsey said. “I look forward to collaborating with our incredible team as we navigate the challenges and opportunities of an evolving healthcare landscape.”

With over 18 years of experience in the healthcare field, Kelsey brings expertise in pricing, and rate development, regulatory filings, product design, and financial forecasting. She has worked extensively with health plans, providers, and government agencies across both commercial and government programs, including supporting several accountable care organizations participating in CMS and CMMI programs. She is a Fellow of the Society of Actuaries and a Member of the American Academy of Actuaries.

Kelsey will continue to work out of the company’s Tampa Bay, Fla., office.

This week, our In Focus section examines the Centers for Medicare & Medicaid Services (CMS) calendar year (CY) 2026 Advance Notice for the Medicare Advantage (MA) and Medicare Part D programs, published January 10, 2025. That same day, CMS also released draft CY 2026 Part D Redesign Program Instructions. This regulatory guidance includes CY 2026 payment updates as well as additional technical and methodological changes to MA and Part D for the coming plan year.

The release of the CY 2026 Advance Notice—along with the complementary CMS policy and technical proposed rule released in November 2024—represent the last major Medicare regulations of the Biden Administration, and these annual payment and policy updates will be finalized under the incoming Trump Administration. As a result, the proposed MA and Part D payment policies could be modified before finalization in April 2025.

Comments on the Advance Notice are due by February 10, 2025, leaving a tight timeline for MA plans and other stakeholders to provide formal feedback and written comments to CMS. Following are brief summaries of the major proposals in the Advance Notice and key considerations for stakeholders as they analyze the proposals.

Payment Impact on Medicare Advantage Organizations

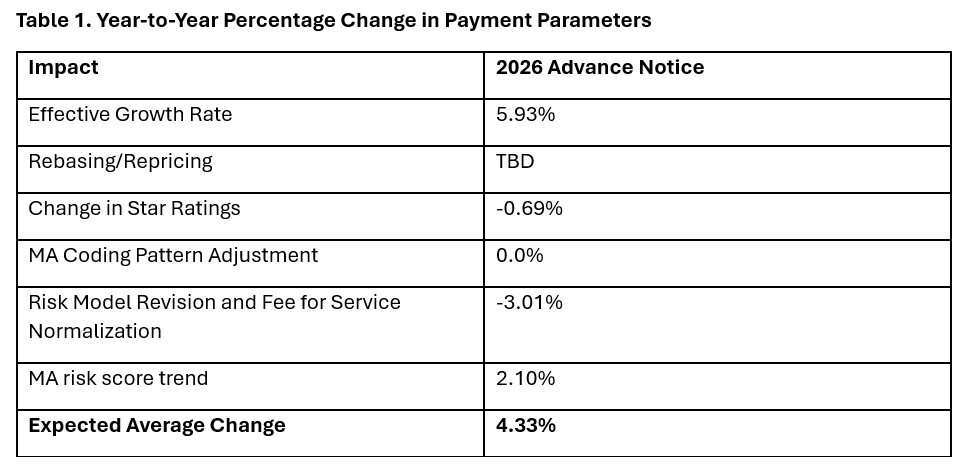

In the Advance Notice, CMS projects that federal payments to MA plans will increase by 4.33 percent from 2025 to 2026—which represents a $21 billion increase in expected payments to MA plans next year. CMS estimates that federal payments to MA plans in 2026 will total $590.9 billion.

The proposed increase in payments accounts for several factors, including growth rates in underlying costs, changes to MA Star Ratings, continued implementation of the new risk adjustment model, and MA risk score trends. The estimated growth rate considers demographic changes in MA enrollment, including projected increases in the number of enrollees.

The Advance Notice estimates represent the average increase in payments to MA plans and actual payments will vary from plan to plan. Below, Table 1 provides estimates of the impact of proposed policy changes on net MA plan payments.

MA Risk Adjustment Changes

CMS intends to complete the three-year phase-in of the MA risk adjustment model that was first published in the CY 2024 Rate Announcement. Specifically, CMS proposes to calculate 100 percent of the risk scores using the new MA risk adjustment model, referred to as the 2024 hierarchical condition categories (CMS-HCC) framework. CMS maintains that the changes to the methodology for calculating risk have improved the predictive accuracy of the model while ensuring risk-adjusted payments to MA plans are accurate.

In addition, CMS has been working to calibrate the risk adjustment model based on MA encounter data, and CMS proposes to begin phasing in an encounter-based MA risk adjustment model as soon as CY 2027.

CMS also proposes to apply the statutory minimum MA coding pattern difference adjustment factor of 5.90 percent for CY 2026.

Technical Adjustment to Cost Calculations Related to Medical Education Costs

Similar to changes in the MA risk adjustment model, CMS plans to complete the three-year phase-in of technical adjustments to the per capita cost calculations related to indirect and direct medical education costs associated with services delivered to MA beneficiaries. This technical adjustment—finalized in the CY 2024 Rate Announcement—has reduced growth rates for MA plans because of the removal of MA-related medical education costs from the benchmarks.

MA Star Ratings

CMS reiterates its continued focus on moving toward a “Universal Foundation” of measures with the goal of creating metrics that center on clinical care, patient outcomes, and improved patient experiences and are aligned across CMS programs. In addition, CMS is soliciting initial feedback on both substantive measure specification updates as well as comments on new measure concepts. CMS also is seeking stakeholder feedback on modifications to the Health Equity Index, including adding social risk factors and geography (urban or rural) to the reward factor. Any specific changes to MA Star Ratings measures, including modifications to the Health Equity Index, would occur through the formal rulemaking process.

Medicare Part D Provisions

The CY 2026 Advance Notice and the CY 2026 Draft Part D Redesign Program Instructions include several payment and benefit updates as required in the Inflation Reduction Act (IRA) of 2022. The CY 2026 updates include:

Other previously implemented IRA reforms will continue in CY 2026, including no cost sharing for Medicare beneficiaries for Part D covered drugs in the catastrophic phase, which begins after the annual out-of-pocket threshold of $2,100 is reached; a $35 monthly cap on enrollee cost sharing for insulin; no cost sharing for adult vaccines recommended by the Centers for Disease Control and Prevention’s (CDC’s) Advisory Commission on Immunization Practices and covered under Part D; and the requirement for Part D plans to offer the Medicare Prescription Payment Plan to beneficiaries.

What to Expect

The CY 2026 Advance Notice includes important technical, programmatic changes and payment updates for MA and Part D plans, which will be finalized when CMS publishes the final CY 2026 Rate Announcement on or before April 7, 2025. MA plans and other stakeholders have a rigid timeframe to provide formal input and written comments to CMS before the February 10 deadline.

Like the policy and technical changes included in the MA proposed rule, the CMS Advance Notice payment updates will be finalized under the incoming Trump Administration. MA plans and other stakeholder can anticipate that the new leadership at the US Department of Health and Human Services and CMS will closely examine and take a fresh look at the proposed payment and policy changes. Though the current CMS leadership maintains that payment updates included in the Advance Notice are sufficient to support stability in MA premiums and benefits, proposed payment policies can be modified or delayed as the new leadership takes shape.

For example, officials in the Trump Administration could seek to delay the phase in of the risk adjustment changes as well as the technical adjustment regarding medical education costs, which CMS estimates would result in an additional $10.4 billion in payments to MA plans.

Connect With Us

Medicare experts at Health Management Associates, will continue to assess and analyze the policy and political landscape, which will determine the final policies included in the CY 2026 Rate Announcement. HMA experts have the depth of knowledge, experience, and subject matter expertise to assist organizations that engage in the rulemaking process and to support implementation of final policies, including policy development, tailored analysis, and modeling capabilities.

For details about the CY 2026 MA Advance Notice and its impact on MA and Part D plans, providers, and beneficiaries, contact our featured experts below.

CMS Stays the Course with Proposed Payment Updates for Medicare Advantage and Part D Services in 2026

Informed by research and exploration of the on some of the most complex challenges facing children in a post-pandemic world, experts from L.A. Care Health Plan, the nation’s largest publicly operated plan, and Children’s Hospital Los Angeles (CHLA), one of the nation’s leading pediatric hospitals, unveiled their first-ever Los Angeles County State of Children’s Health report. The report, made up of four policy briefs, identified core issues impacting kids and teens and key recommendations to proactively address them.

The report originated from roundtables held in November of 2023 that convened expert stakeholders resulting in four distinct policy briefs and action plans. Recommendation highlights include establishing new school-based programs to improve mental health services within educational settings, launching an effort to dispel vaccine myths to improve children’s health, and addressing resource challenges that children and youth with complex chronic conditions and in social welfare system experience in Los Angeles County and beyond.

Health Management Associates experts in child welfare and behavioral health worked with the team of outside children’s health experts to prepare these four policy briefs with actionable solutions:

You can access the comprehensive reports and video series here.

Ohio Medicaid is no stranger to change. Over the last several years, there have been several broad policy changes, from a new managed care system, to new programs like OhioRISE, to an expansion of MyCare Ohio. And, during this time, there have been complicating factors like the covid-19 public health emergency and the resultant impact of inflation on the basic delivery of services and care. Now, as the Trump administration comes in for the second time, questions arise as to what to expect in Medicaid policy and how it may impact Ohio.

While it’s often overlooked, federal rule making has a significant impact on the operations of states. Just in the last couple of years, the Biden Administration has implemented policies including:

These rules are set to be implemented over several years. The Trump Administration could delay implementation of certain provisions, which would eliminate regulations while rolling back enrollee protections, payment transparency, and improved access. Alternatively, the Trump Administration could adjust their enforcement strategy or issue new regulations that would undo or augment these final regulations.

Beyond regulation, there is still the potential for fundamental policy change to the program’s financing. Notably, the concept of block grants or per-capita caps has reemerged as a potential option, where states would no longer receive federal “match”, but rather a fixed amount based on historical averages. In fact, Energy and Commerce Chair Brett Guthrie has already identified per capita caps as an area of active conversation in the House Republican Caucus.

Making a fundamental, national change in the financing arrangement of Medicaid would require an act of Congress. Many think this movement away from a traditional reimbursement structure was one of the main reasons for the failure to repeal the Affordable Care Act during the first Trump administration. Notably, as Ohio is a “recipient” state, meaning it receives more in federal taxes than it provides for the Medicaid program, this could significantly impact the long-term financial stability in future state budgets. Often, this challenge is why block granting is usually associated with additional state powers around curbing enrollment, services and coverage, so states may more easily cut the program to accommodate tighter financing.

Depending on how all of these changes would unfold, Medicaid programs, including Ohio’s may have to adopt their systems to accommodate. However, the Trump administration may also pursue greater flexibility for states to design and innovate in Medicaid in ways that are consistent with their goals. This could include greater flexibility to limit covered services, raise cost-sharing requirements, limit enrollment or require more frequent determination of eligibility. There may also be programmatic refocusing away from initiatives which center health equity and expanded coverage, including alternatives to “Medicaid expansion”, as well as a fundamental reorientation of the use of waivers.

Speaking of waivers, there is likely going to be a dramatic change in the way waivers are applied and executed. This can include, but is not limited to, waivers that test new policies the prioritize cost-cutting measures over access and coverage, including waivers which change how the Medicaid expansion group is managed in states. Included in this are “Work Requirement” waivers, something Ohio is currently in the process of submitting. While examples from other states have shown that such waivers are often costly to operate and ultimately have the impact of decreasing coverage, the Trump administration and many policymakers see these requirements as a way to ensure labor force participation. Though there is evidence to suggest coverage, alone, increases economic mobility,

As Ohio providers, plans and policymakers gear up for the next state budget, the landscape of Medicaid policy will be something to pay attention to. While Medicaid represents nearly 48% of the total state budget, half of that is from the federal government. What’s more, nearly 1 in 3 Ohioans rely on the program, disproportionately in rural communities, and it supports Ohio’s second largest industry in healthcare. Make sure you stay on top of the latest updates to the program in Ohio and beyond and sign up for HMAs Weekly Roundup.