HMA has published a white paper examining the use of risk mitigation strategies among state Medicaid programs and assessing their limiting impact on capitation’s incentives for managed care organizations (MCOs). This paper seeks to assist policymakers in designing future Medicaid program payment policies that advance state financial and programmatic goals. This paper offers a timely examination of this topic as state Medicaid programs emerge from the COVID-19 public health emergency (PHE) and navigate the unwinding of Medicaid continuous coverage. This paper also builds upon the Health Management Associates May 2021 white paper, Moving Beyond COVID-19 Public Health Emergency Risk Corridors, which more narrowly focused on appropriate and inappropriate use of risk corridors.

1855 Results found.

Health Management Associates selected as CalAIM Technical Assistance vendor

One of only two firms selected in all seven domains out of 46 vendors.

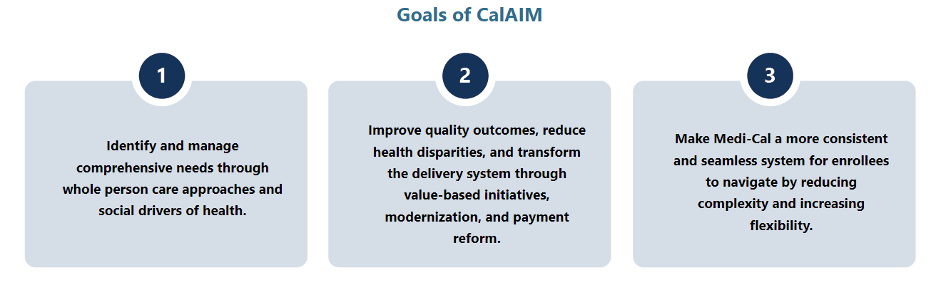

The California Department of Health Care Services (DHCS) has developed a multi-year initiative whose goal is to improve health outcomes and health care quality through broad delivery, payment, and program reforms known as California Advancing and Innovating Medi-Cal (CalAIM). This includes the introduction of new programs and changes to existing programs that will occur over the span of five years. CalAIM further expands upon prior initiatives, such as Whole Person Care, the Health Homes Program, and the Coordinated Care Initiative, and strives to integrate California’s delivery systems to better facilitate the overall Medi-Cal program.

With the rollout of these programs and the vast requirements associated with them, DHCS and California’s Medi-Cal managed care health plans are now tasked with the challenge of implementing CalAIM and enabling the participation of community providers and partners in these opportunities. To support these partners, DHCS developed a funding initiative, known as Providing Access and Transforming Health (PATH) to aid in strengthening capacity and infrastructure of Community Based Organizations, public hospitals, county agencies, and others to stand up CalAIM. This five-year, $1.85 billion initiative includes the creation of a virtual Technical Assistance (TA) Vendor Marketplace that organizations can use to request resources and support from approved vendors through services that are fully paid for by the State.

Health Management Associates (HMA) is recognized as a valued partner to Payers, Community Based Organizations, public hospitals, and county agencies and has deep expertise in CalAIM policy, operations and implementation. Recognized for our extensive capabilities in the field, HMA is one of only two firms out of 46 vendors that received State approval to serve as a technical assistance vendor on the PATH Technical Assistance (TA) Marketplace for all seven domains:

- Domain 1: Building Data Capacity: Data Collection, Management, Sharing, and Use

- Domain 2: Community Supports: Strengthening Services that Address the Social Drivers of Health

- Domain 3: Engaging in CalAIM Through Medi-Cal Managed Care

- Domain 4: Enhanced Care Management (ECM): Strengthening Care for ECM Population of Focus

- Domain 5: Promoting Health Equity

- Domain 6: Supporting Cross-Sector Partnerships

- Domain 7: Workforce

HMA also has expertise in and hands-on experience with addressing the unique challenges experienced by providers and partner agencies serving rural communities. Please visit the PATH Technical Assistance (TA) Marketplace to access TA resources that can help strengthen capacity to provide high quality Enhanced Care Management (ECM) and Community Supports services for Medi-Cal members.

New Hampshire releases Medicaid Managed Care RFP

This week, our In Focus section reviews the New Hampshire Medicaid Care Management (MCM) request for proposals (RFP), which the state’s Department of Health and Human Services released on September 8, 2023. The new contracts will be worth approximately $1.1 billion and will provide full-risk, fully capitated Medicaid managed care services to approximately 190,000 beneficiaries. Implementation will begin September 2024.

MCM Program

The MCM program covers traditional Medicaid, the Children’s Health Insurance Program (CHIP), and the state’s adult Medicaid expansion Granite Advantage Health Care Program. MCM provides integrated acute care, behavioral health, and pharmacy services. Managed long-term services and supports are not included in the program.

Incumbents are AmeriHealth Caritas, Boston Medical Center/WellSense, and Centene/New Hampshire Healthy Families.

RFP

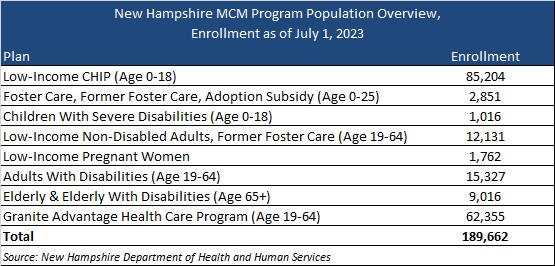

New Hampshire will award contracts to three Medicaid managed care organizations (MCOs). MCOs will cover the populations outlined in Table 1.

Table 1. New Hampshire MCM Program Enrollment as of July 1

The state outlines several key areas of focus within the RFP, including introducing a primary care and preventive services model of care—an approach centered on patient-provider relationships and provider-delivered care coordination. The RFP also will have a greater emphasis on priority populations, such as individuals with inpatient admissions for behavioral health diagnoses; children in the child welfare system; babies with low weight or neonatal abstinence syndrome; and people who are incarcerated and eligible for the Community Reentry demonstration program, pending approval from the Centers for Medicare & Medicaid Services.

Timeline

Mandatory letters of intent are due September 18, 2023, and a mandatory conference will take place September 21. Proposals are due October 30, 2023. An award date has yet to be announced, but the state contract discussions with selected MCOs will occur November 20−December 11, 2023. Contracts will run from September 1, 2024, through August 31, 2029.

Evaluation

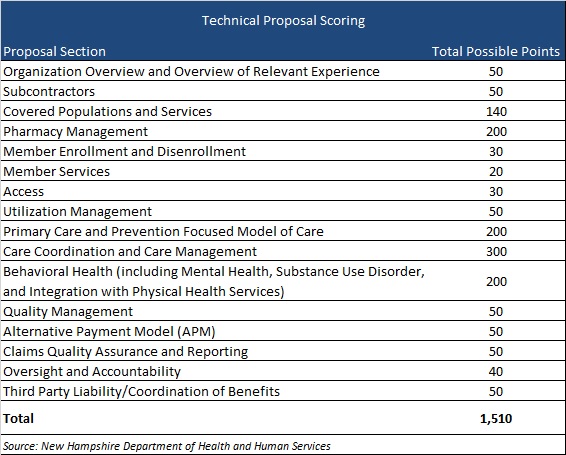

MCOs will be scored on their ability to meet a possible 2,160 points. The technical proposal comprises a possible 1,510 points, as shown in Table 2.

Table 2. Technical Proposal Scoring

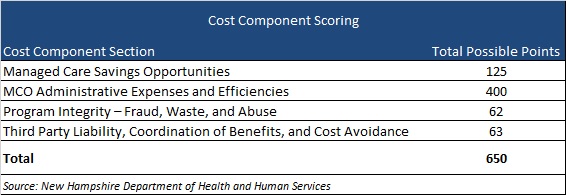

The cost component sections will make up 650 points, as shown in Table 3.

Table 3. Cost Component Scoring

Virginia releases Cardinal Care Medicaid Managed Care RFP

This week, our In Focus section reviews the request for proposals (RFP) for the Virginia Cardinal Care Medicaid managed care program, released by the Department of Medical Assistance Services (DMAS) on August 31, 2023. The RFP includes a new foster care specialty plan. Implementation is scheduled to begin July 1, 2024.

Cardinal Care

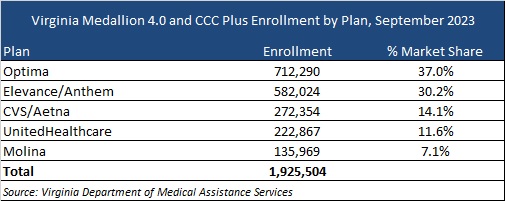

Cardinal Care launched in January 2023 as a rebranding of the state’s Medicaid program and Children’s Health Insurance Program—Family Access to Medical Insurance Security Plan (FAMIS). Cardinal Care Managed Care (CCMC) will combine the state’s existing Medallion 4.0 managed care program for traditional Medicaid and the Commonwealth Coordinated Care Plus (CCC Plus) managed long-term services and supports (MLTSS) program to serve 1.9 million Medicaid managed care members.

RFP

The state will award statewide fully capitated, risk-based contracts to a maximum of five health plans. A separate foster care specialty plan contract will also be awarded to one of the winners. If none of the plans win the separate foster care specialty program, all plans awarded a CCMC contract will be required to cover all services.

Selected plans will provide acute care, behavioral health, and MLTSS services to all Virginians who are eligible for Medicaid, including children, adults, and pregnant women in low-income households; children and adults with disabilities; low-income older adults; and individuals receiving LTSS, including dual-eligible populations. The foster care plan will cover children in foster care, individuals younger than 26 years old who were formerly in foster care, and children eligible for adoption assistance.

The RFP contains several targeted focus areas and changes to the managed care program. For example, it emphasizes improvements to the state’s behavioral health care system and improved health outcomes through a focus on health-related social needs such as housing stability and food insecurity for CCMC members.

Contracted plans will be required to operate a dual-eligible special needs plan (DSNP) in Virginia.

Market

CVS/Aetna, Elevance/Anthem, Sentara/Optima Health, Molina, and UnitedHealthcare are the current incumbents. Effective with the new RFP, DMAS intends to reassign most CCMC members as part of an enrollment process. At present, Optima holds the largest market share of enrollment at 37 percent, followed by Anthem at 30 percent.

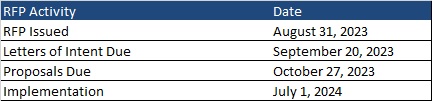

Timeline

Letters of intent are due by September 20 and proposals are due on October 27. As previously mentioned, new contracts will begin July 1, 2024. Contracts will have a six-year initial term, with two two-year renewal options. Award dates have not been announced.

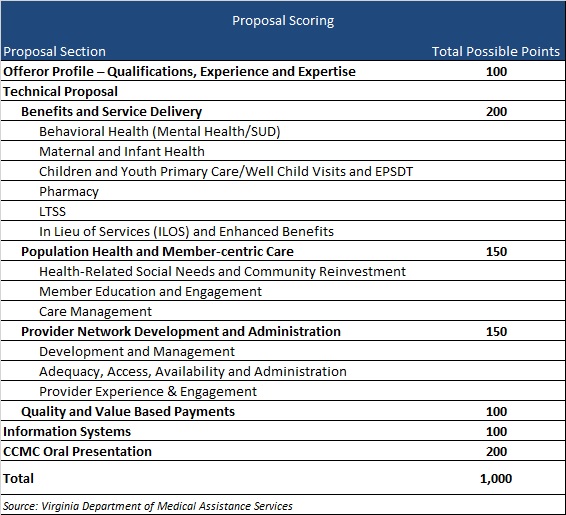

Evaluation

Plans will be awarded up to 1,000 points during the evaluation process based on the categories shown below.

Leading ideas and solutions for long-term services and supports

Dedicated to supporting the effectiveness of publicly financed healthcare programs, Health Management Associates (HMA) is committed to promoting the design, financing and operation of effective models of person-centered long-term services and supports (LTSS) which:

Support an individual’s ability to receive services in the most integrated setting

Promote successful community living

Improve integration of LTSS with quality physical and behavioral healthcare

Support Medicare and Medicaid integration and coordination

Address the social determinants of health for people with support needs

Support direct care workforce initiatives for states, managed care organizations and long-term care providers

Support strategic planning focused on long-term care

Support managed care readiness initiatives

What we offer

With deep expertise in the field, our colleagues and the work we do help to shape current system trends. In addition, we support improved outcomes for beneficiaries and successful participation for the wide range of LTSS providers including managed care organizations, states offering critical services, and purchasers through:

LTSS Models of Care

Developing and promoting person-centered integrated, and holistic LTSS models of care

LTSS Quality Standards

Supporting the development of LTSS quality standards and metrics, including technical assistance for NCQA and other accreditation and credentialing

LTSS Regulatory Compliance

Facilitating readiness and compliance with federal and state regulations, including home and community-based settings of care, Medicaid managed care, the Fair Labor Standards Act, and the Americans with Disabilities Act

LTSS Integration

Implementing care management and service delivery models that promote integration of services across physical, behavioral, and LTSS providers and between Medicare and Medicaid including those developed under PACE, managed LTSS, and managed fee-for-service

LTSS Stakeholder Engagement

Supporting effective community engagement by public policy makers, and empowering advocacy organizations and other stakeholders in understanding, shaping, and responding to change

LTSS Delivery and Payment Models

Assisting organizations and providers to prepare and respond to payment and structural changes in LTSS (e.g., managed care, accountable care, value-based purchasing)

LTSS and Social Determinants Design

Designing innovative approaches to addressing the social determinants of health, including improved strategies for affordable and accessible housing, competitive employment for persons with disabilities, access to technology, and social equity-based care delivery models

LTSS Market Analysis

Providing expert market analysis for investors relating to LTSS providers, managed care organizations, service vendors, or emerging trends in the LTSS landscape

LTSS Research and Evaluation

Enabling the use of data to uncover opportunities for improvement and to demonstrate value to ACOs, hospital systems, payers, and funders

Our wide-ranging expertise includes:

Medicaid LTSS waiver and state plan authority options

Operation and oversight of managed LTSS

Public procurements

LTSS provider operations

Federal and state compliance

Care management and care coordination

Workforce development

Strategic planning and practice redesign

LTSS policy analysis

Value-based purchasing

Quality monitoring, evaluation and research

Community capacity and network adequacy

Readiness reviews

Our Clients Include:

Federal, state and local governments

For-profit, not-for-profit and public health plans

Institutional and home and community-based services providers and their associations

National, state and local advocacy organizations

National and regional foundations

Direct care workforce representatives

Investment services entities

Contact our experts:

Sharon Lewis

Principal