This week's roundup:

- In Focus: Medicaid Managed Care Enrollment Update – Q1 2025

- Medicaid Redetermination Ripple Effects in the Individual Market

- Delaware Releases Medicaid NEMT RFP

- Iowa Governor Enacts Medicaid Work Requirements

- Minnesota Budget Deal Ends MinnesotaCare Coverage for Undocumented Adults

- Nebraska Hospitals Form Clinically Integrated Network

- North Carolina Healthy Opportunities Pilot Funding to End July 1 Amid Budget Negotiations

- Senate Committee Releases Draft Provisions to One Big Beautiful Bill; House Updates Technical Lines to Comply with Senate Rules

- President Trump Issues Memorandum Calling to End State Directed Payments in Medicaid

- State Health Insurance Marketplace Plans Seek Large Premium Increases for 2026

- Actuaries Corner: Amazon Pharmacy’s PillPack Expands to Medicare Patients

In Focus

Medicaid Managed Care Enrollment Update – Q1 2025

In this week’s In Focus section, Health Management Associates Information Services (HMAIS) draws on its database of monthly enrollment in Medicaid managed care programs to provide the latest quarterly analysis of Medicaid managed care enrollment, offering a snapshot of developments across 28 states. [1] The data and insights are particularly timely as stakeholders, including states, Medicaid managed care organizations (MCOs), hospitals and health systems, and providers, continue to plan for multiple possible federal policy changes and the operational realities that will follow.

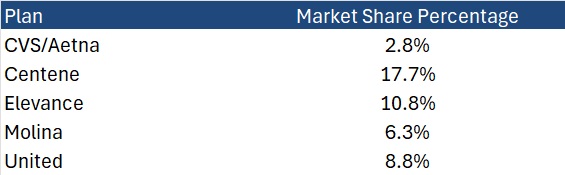

HMAIS also compiles a more detailed quarterly Medicaid managed care enrollment report representing nearly 300 health plans in 41 states. The report provides by plan enrollment plus corporate ownership, program inclusion, and for-profit versus not-for-profit status, with breakout tabs for publicly traded plans. Table 1 shows a sampling of plans and their national market share of Medicaid managed care beneficiaries based on a total of 66 million enrollees. These data should be viewed as a broader representation of enrollment trends rather than as a comprehensive comparison.

Key Insights from Q1 2025 Data

The 28 states included in our review have released monthly Medicaid managed care enrollment data via a public website or in response to a public records request from Health Management Associates (HMA). This report reflects the most recent data posted or obtained. HMA has made the following observations related to the enrollment data:

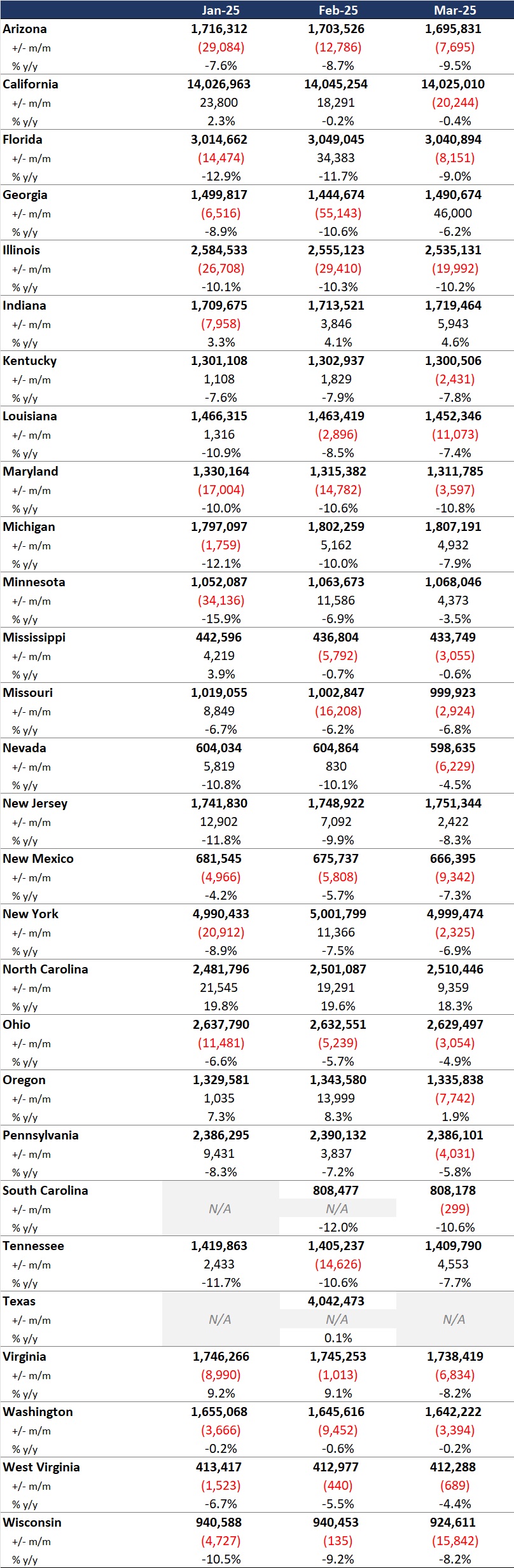

- Year-over-year growth. As of March 2025, across the 28 states reviewed, Medicaid managed care enrollment declined by 2.5 million members year-over-year, a 3.9 percent drop as of March 2025 (see Figure 1). This marks a continuation of the downward trend reported in late 2024, though with notable variation across states.

Figure 1. Year-over-Year Growth in Medicaid Managed Care States, 2020−24, March 2025

- Localized growth amid broader declines. While most states experienced enrollment reductions, Indiana and North Carolina bucked the trend with measurable gains, suggesting the influence of state-specific policy shifts or demographic factors. Oregon and Texas also saw modest growth.

- Sharpest contractions. Illinois, Maryland, and South Carolina, reported double-digit percentage drops, underscoring the uneven impact of redeterminations and eligibility changes.

- Difference among expansion and non-expansion states. Among the 21 states included in our analysis that expanded Medicaid, enrollment fell by 1.8 million (-3.6%) to 48.6 million. In contrast, the seven non-expansion states saw a steeper proportional decline (-5.4%), to a total of 12.2 million enrollees.

Table 1. Monthly MCO Enrollment by State, January 2025 through March 2025

It is important to note the limitations of the data presented. First, states report the data at the varying times during the month. Some of these figures reflect beginning of the month totals, whereas others reflect an end of the month snapshot. Second, in some instances, the data are comprehensive in that they cover all state-sponsored health programs that offer managed care options; in other cases, the data reflect only a subset of the broader managed Medicaid population. This limitation complicates comparison of the data described above with figures reported by publicly traded Medicaid MCOs. Hence, the data in Table 1 should be viewed as a sampling of enrollment trends across these states rather than a comprehensive comparison, which cannot be established solely based on publicly available monthly enrollment data.

Market Share and Plan Dynamics

Using our data repository from 300 health plans across 41 states, HMAIS’s report addresses corporate ownership, program participation, and tax status. As of March 2025, Centene continues to lead with 17.7 percent of the national Medicaid managed care market, followed by Elevance (10.8%), United (8.8%), and Molina (6.3%), as Table 2 shows.

Table 2. National Medicaid Managed Care Market Share by Number of Beneficiaries for a Sample of Publicly Traded Plans, March 2025

What to Watch

The policy backdrop remains fluid. The US House of Representatives’ passage of the One Big Beautiful Bill Act introduces sweeping changes to Medicaid financing, including proposed cuts of up to $715 billion. Additional federal proposals, such as mandatory work requirements, could further reshape enrollment patterns.

Stakeholders should prepare for:

- Implementation of work/community engagement mandates for certain adult populations

- Potential redesign of Affordable Care Act expansion programs

- Retraction of federal regulations focused on streamlining of eligibility and redetermination processes to improve accuracy and efficiency

Connect with Us

HMA is home to experts who know the Medicaid managed care landscape at the federal and state levels. As the Medicaid landscape continues to evolve, HMAIS equips stakeholders with timely, actionable intelligence. Our subscription service includes enrollment data, financials, waiver tracking, and a robust library of public documents.

For more information about the HMAIS subscription, contact Andrea Maresca and Alona Nenko.

[1] Arizona, California, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin.

Medicaid Redetermination Ripple Effects in the Individual Market

As Congress intensifies negotiations over budget reconciliation, including potential changes to Medicaid financing and Affordable Care Act (ACA) subsidies, new data from Wakely Consulting Group, an HMA (Health Management Associates) company, sheds light on how the effects of the Medicaid redetermination process continued to unfold well into 2024. Appendix A of the May 2025 white paper Medicaid Redetermination Impacts on the Individual Market, provides a full-year view of enrollment and morbidity trends, showing that the influx of former Medicaid enrollees had some negative effects on risk scores. In fact, relative risk increased across all market types—state-based exchanges (SBEs), in federally facilitated exchange (FFE) Medicaid expansion states, and FFEs in non-expansion states—despite substantial enrollment growth.

Data presented in Wakely’s white paper and their experts’ findings challenge the conventional assumption that higher enrollment dilutes risk and suggest that many new enrollees may have had unmet health needs or delayed care. The data also show that states with the highest enrollment growth did not necessarily experience the greatest morbidity shifts. This decoupling of enrollment and morbidity complicates forecasting for insurers and policymakers alike, especially as Congress debates Medicaid funding and ACA subsidy structures in the ongoing budget reconciliation process.

What to Watch

As federal lawmakers consider reforms that could alter Medicaid eligibility, subsidies, and risk adjustment mechanics, these findings underscore the importance of monitoring not just how many people enroll, but who they are and the type of care they need. The individual market’s evolving risk profile will have direct implications for premium setting, subsidy design, and the financial stability of plans that serve this population.

Connect with Us

Wakely is experienced in all facets of the healthcare industry—from carriers to providers to government agencies. Wakely’s actuarial experts and policy analysts continually monitor and analyze potential changes to inform clients’ strategies and propel their success.

For more questions about the analysis contact Michelle Anderson.

HMA Roundup

Delaware

Delaware Releases Medicaid NEMT RFP. The Delaware Department of Health and Social Services issued on June 5, 2025, a request for proposals (RFP) for a Medicaid Non-Emergency Medical Transportation Services (NEMT) broker. The state will award one or more contracts to serve approximately 256,000 Medicaid and 8,900 Delaware Healthy Children enrollees through the Diamond State Health Plan (DSHP) and Diamond State Health Plan Plus (DSHP-Plus). Proposals are due July 31, 2025, and awards are expected September 30, 2025. The current NEMT provider is ModivCare.

Iowa

Iowa Governor Enacts Medicaid Work Requirements. The Iowa Capital Dispatch reported on June 6, 2025, that Iowa Governor Kim Reynolds signed Senate File 615 into law, instituting an 80-hour monthly work or community engagement requirement for Medicaid enrollees aged 19–64 within the Iowa Health and Wellness Plan. The policy includes exemptions for individuals with disabilities, serious illnesses, or caregiving responsibilities for young children. Its implementation is contingent upon CMS approval of an 1115 demonstration, with a trigger clause that would eliminate Medicaid expansion if the demonstration were denied or later withdrawn. Reynolds also enacted House File 1038, enabling immediate distribution of $29 million from opioid settlement funds, allocating 75 percent to Iowa Health and Human Services and 25 percent to the Attorney General’s office, designated explicitly for prevention, treatment, and recovery initiatives.

Minnesota

Minnesota Budget Deal Ends MinnesotaCare Coverage for Undocumented Adults. The Associated Press reported on June 9, 2025, that as part of Minnesota’s newly passed $66 billion budget, lawmakers voted to repeal a 2023 law that expanded MinnesotaCare eligibility to adults living in the U.S. without legal status, affecting an estimated 17,000 residents. MinnesotaCare is the state’s Basic Health Program. Governor Tim Walz, who ensured undocumented children remain eligible, has pledged to sign the legislation along with a broader set of bills finalized during the special session. The full budget package is set to take effect on July 1.

Nebraska

Nebraska Hospitals Form Clinically Integrated Network. Modern Healthcare reported on June 5, 2025, that 19 critical access hospitals in Nebraska have joined to form a clinically integrated network called the Nebraska High Value Network. The coalition’s goal is to support rural hospitals in lowering costs, investing in new technology, improving treatment, and expanding value-based contracts. Cibolo Health will manage the daily operations of the network.

North Carolina

North Carolina Healthy Opportunities Pilot Funding to End July 1 Amid Budget Negotiations. The North Carolina Department of Health and Human Services announced on June 2, 2025, that the Healthy Opportunities Pilot (HOP) will run out of funding and cease new services July 1. The program addresses non-medical health needs such as food insecurity, housing instability, transportation challenges, and interpersonal violence. The proposed House and Senate budgets do not include funding for HOP as the General Assembly negotiates the 2025 -2027 biennial state budget.

National

Senate Committee Releases Draft Provisions to One Big Beautiful Bill; House Updates Technical Lines to Comply with Senate Rules. Modern Healthcare reported on June 11, 2025, that the Senate Health, Education, Labor and Pensions Committee released its draft provisions to the One Big Beautiful Bill. The legislation mirrors that of the House and includes measures to cut premiums at state health insurance Marketplaces by undoing “silver loading,” which focuses rate increases on the Silver-level plans. As a result, subsidies would decrease for patients. Meanwhile, the House updated their tax and spending package to comply with Senate reconciliation rules.

President Trump Issues Memorandum Calling to End State Directed Payments in Medicaid. The White House issued on June 6, 2025, a statement from President Trump addressing the U.S. Department of Health and Human Services and the Centers for Medicare & Medicaid Services to end “waste, fraud, and abuse” in Medicaid by cracking down on State Directed Payments, ensuring Medicaid payment rates are not higher than Medicare. The memorandum stated that these payments have quadrupled in the last four years and reached $110 billion in 2024. In follow-up to the memo, on June 9, the Centers for Medicare & Medicaid Services submitted a proposed rule, Medicaid Managed Care-State Directed Payments, to the Office of Management and Budget for review.

Industry News

State Health Insurance Marketplace Plans Seek Large Premium Increases for 2026. Health Payer Specialist reported on June 6, 2025, that state health insurance marketplace plans are seeking large premium increases to offset the possible expiration of Affordable Care Act premium subsidies. In Washington, plans are seeking a 2026 average premium increase of 21.2 percent for individual plans. In Maryland, plans are seeking an average 17.1 percent increase. In New York, plans are seeking an average 13.5 percent increase. In Oregon, plans are seeking an average 9.2 percent increase.

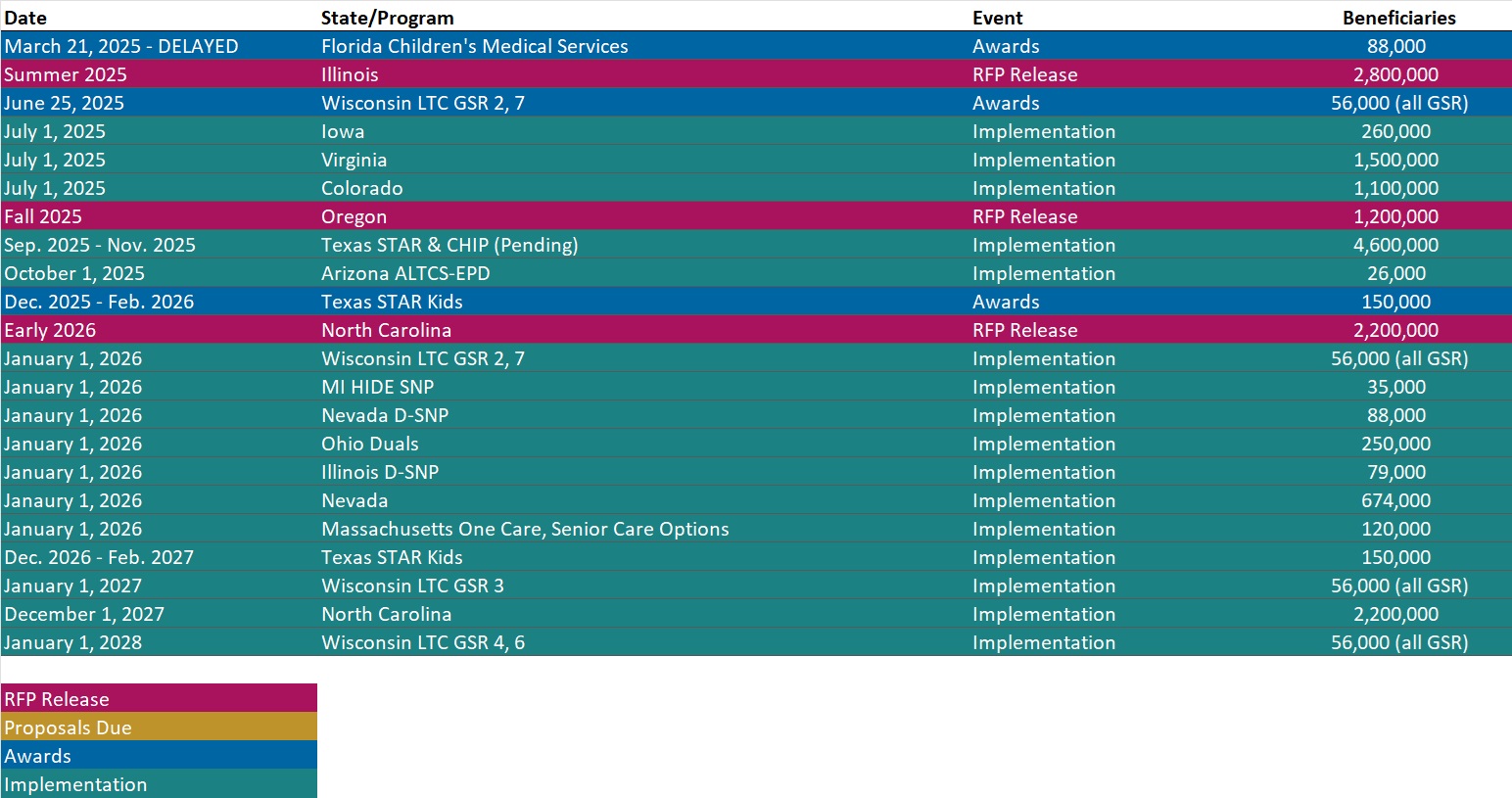

RFP Calendar

Actuaries Corner

Amazon Pharmacy’s PillPack Expands to Medicare Patients. Seniors on Medicare can now use PillPack from Amazon Pharmacy, a service that pre-sorts medication packets before sending them to consumers’ homes. Amazon also announced a new feature allowing customers to invite caregivers to manage medications on their behalf.

Discover other developments in the Wakely Wire here.

HMA News & Events

State of Reform Conference

2025 Maryland State of Reform Health Policy Conference. The 2025 Maryland State of Reform Health Policy Conference will once again be taking place in-person on June 12th, 2025 at the Baltimore Marriott Waterfront!

Managing constant change in healthcare takes more than just hard work. It takes a solid understanding of the legislative process and knowledge about intricacies of the healthcare system. That’s where State of Reform comes in.

State of Reform pulls together practitioners, thought leaders, and policymakers – each working to improve the healthcare system in their own way – into a unified conversation in a single place. It is sure to be one of the most diverse statewide gatherings of senior healthcare leaders, and one of the most important events in Maryland healthcare.

Join the conversation with other healthcare executives, and help shape reform on June 12th, 2025! If you have any questions, please feel free to drop us a line!

HMA Conference

Join the Plenary Conversations Moving Healthcare Forward. October 15, 2025

At a time of transformation across Medicaid, Medicare, and the healthcare ecosystem as a whole, the HMA Conference plenary sessions bring together leading voices from across the field to dig into the policies, innovations, and partnerships reshaping care.

From the opening keynote to the closing conversation, you’ll hear from state leaders, federal experts, provider executives, and cross-sector changemakers tackling the most pressing questions in healthcare today.

Early bird pricing ends July 31, 2025. We can’t wait to welcome you to New Orleans this October!

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Medicaid Market Overviews, Reports, and Data

- Updated HMA Federal Health Policy Snapshot

- New Medicaid enrollment, RFP documents, and other market intelligence resources for dozens of states.

- Updated North Carolina and Rhode Island Overviews

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services.

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].