HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- In Focus: Leavitt Center for Alliances, an HMA Initiative, Drives Collaboration and Solutions

- In Focus: CMS Finalizes 2023 Landscape for Medicare Payment and Policy

- Alabama Releases Medicaid Modernization Program System Integration Services RFP

- Arkansas Receives Approval to Expand Community-Based Care for Certain High-Risk Individuals

- District of Columbia Mayor Calls for Investigation Into Awarded Medicaid Managed Contracts

- Michigan Medicaid Plan Meridian Appoints Patricia Graham as CEO

- Mississippi Submits 1115 Waiver Extension Application for Aged, Blind, Disabled Individuals

- New Hampshire to Award Adult Medicaid Dental Contract to Delta Dental

- South Dakota Seeks Five-Year Extension of Former Foster Care Youth Medicaid 1115 Waiver

- Tennessee Seeks to Extend Enhanced HCBS Supports

- Vermont Releases Medicaid IV&V RFP

- Wisconsin Receives Federal Approval to Use CHIP Funds For Housing Support

- HHS Bolsters Medicare Behavioral, Dental, Cancer Care in Physician Fee Schedule Final Rule

- HHS Focuses on Rural Health Equity in Hospital, Surgical Center Payment System Final Rule

- Walgreens’ VillageMD Reportedly Explores Merger With Summit Health

In Focus

Leavitt Center for Alliances, an HMA Initiative, Drives Collaboration and Solutions

Today, Health Management Associates (HMA) launched the Leavitt Center for Alliances, an HMA Initiative, which aims to elevate the national discourse on healthcare and help healthcare organizations solve their most complex challenges through consensus-based alliances.

The Leavitt Center for Alliances (Leavitt Center) is home to expert conveners who have decades of experience in the private sector and government. They have spent years fine tuning the process for building successful alliances that bring multi-sector stakeholders to the table with a commitment to reaching consensus, real-world solutions. Governor Mike Leavitt served as Secretary of the United States Department of Health and Human Services (HHS). Rich McKeown, served as Chief of Staff at HHS. The two of them founded Leavitt Partners, where they advanced the science of alliance building. Their book “Finding Allies, Building Alliances” mapped out eight crucial elements of successful alliances, providing a framework for the work and resources that now serve as the foundation for the Leavitt Center.

“Now more than ever, alliances offer a proven way forward, beyond the divisiveness, partisanship and uncivil discourse that too often stagnates momentum toward tangible progress,” said Leavitt, HMA co-chairman and Leavitt Partners chairman, Board of Managers. “Our approach to multi-sector consensus-based alliances, rooted in collaboration, has consistently helped organizations identify and develop solutions to some of the most complicated issues. It is a roadmap for bridging divides and realizing results.”

The Leavitt Center guides stakeholders through each step of the process to form alliances, develop consensus within those alliances, and then put a strategic plan into action that drives results. Expertly convened alliances solve the tough problems that are too big for individual organizations to tackle alone, leverage shared resources and expertise, and provide for “strength in numbers.”

“The expertise our Leavitt Center colleagues have when it comes to both the art and the science of creating and deploying alliances to develop innovative solutions is unmatched,” said Jay Rosen, founder, president, and co-chairman of HMA. “I see great potential for combining that know-how with our on-the-ground experts throughout all of HMA to expand this proven alliance approach beyond the federal landscape and into communities across the country.”

Leavitt Center experts have helped more than 50 alliances achieve impactful outcomes, including the Dual Eligible Coalition founded in 2017 to develop actionable, long-term policy and programmatic solutions to improve the delivery of care and outcomes for the dual eligible population. Other alliances include the CARIN Alliance, focused on improving access to digital health information, the Pharmaceutical Distribution Security Alliance (PDSA), and the COVID Patient Recovery Alliance. Other examples of alliances in action can be found here. Currently Leavitt Center experts are drawing from their past decade of alliance work to share insights in a new book, scheduled for release in 2023.

Founded in 1985, HMA is an independent, national research and consulting firm specializing in publicly funded healthcare and human services policy, programs, financing, and evaluation. Clients include government, public and private providers, health systems, health plans, community-based organizations, institutional investors, foundations, and associations. With offices in more than 20 locations across the country and over 500 multidisciplinary consultants coast to coast, HMA’s expertise, services, and team are always within client reach.

Leavitt Center for Alliances: https://leavittcenterforalliances.com/

CMS Finalizes 2023 Landscape for Medicare Payment and Policy

This week, our In Focus section reviews the remaining Medicare payment and policy rules, finalized over the last several days by the Centers for Medicare & Medicaid Services (CMS), that will shape the landscape for the Medicare program in 2023 and beyond. These include the Physician Fee Schedule (PFS), the Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) Payment System, the Home Health Prospective Payment System and Home Infusion Therapy Services updates, and the End Stage Renal Disease (ESRD) payment rules.

The final Medicare rules are directionally aligned with the agency’s policy priorities, including improving health equity and addressing the health and health-related needs of rural and underserved communities, promoting value-based, whole-person care, and removing barriers to behavioral health services, among other issues.

Across these rules, CMS took some steps where they have authority to mitigate reductions in payment rates for some provider types. Final payment and policy changes, however, will inform stakeholders’ federal advocacy efforts with Congress. Specifically, as part of an end of year legislative package lawmakers are considering legislative proposals to address the 2023 payment levels and their relationship to general inflation and the scheduled payment cuts for physicians. These issues and Medicare program solvency are expected to remain hot topics throughout 2023.

For today’s blog our HMA experts highlight a few of the finalized policy changes contained in the aforementioned regulations that will take effect on or after January 1, 2023. The HMA Medicare team will continue to analyze these policies for their immediate implications. Additionally, final policies and CMS’ response to commenters offer important insights that providers, vendors, and other stakeholders will want to incorporate in their future policy, financial, and operational strategies.

Medicare Physician Fee Schedule Final Rule

On November 1, 2022, CMS released final updates and policy changes for Medicare payments under the PFS, and other Medicare Part B issues. This rule largely finalizes many of the policies described in HMA’s earlier summary of the PFS proposed rule. Notably, CMS finalized updates to the Medicare Shared Savings Program (MSSP) largely as proposed. The agency expects these changes will renew and broaden provider interest in participating in the Medicare Shared Savings Program (MSSP). The new MSSP opportunities will support CMS’ work towards its goal that by 2030 100 percent of Medicare beneficiaries will be in a care relationship with accountability for quality and total cost of care. As expected, CMS also finalized proposals intended to enhance access to behavioral health services and strengthen the behavioral health model within the Medicare program. The changes represent a major shift in traditional Medicare’s coverage of services to identify and treat mental health conditions and substance used disorders. CMS plans to address payment for new codes that describe caregiver behavioral management training in CY 2024 rulemaking.

Notable policies that will be of interest to Medicare stakeholders include:

- Payment Rates and Inflation: The conversion factor used to determine payments to physicians through the PFS will be $33.06 in 2023, a decrease of $1.55 from the 2022 conversion factor. The final payment update reflects the following dynamics:

- Expiration of a statutory one-year 3 percent increase in payments,

- A statutory 0 percent payment update for CY 2023, and

- A budget neutrality adjustment across all billing codes resulting from modifications to PFS weights which increased the relative value of primary care billing codes.

This cut to the conversion factor is driven by statutory requirements. The physician community is actively advocating to Congress that they need an update to their payments given the high levels of inflation and the lack of automatic updates built in to the PFS.

CMS also updated the information under the PFS to account for current trends in the delivery of health care, especially concerning independent versus facility-based practices. CMS indicated the updates and improved public use files respond to requests the agency has received to provide more granular information that separates the specialty-specific impacts by site of service. According to CMS, stakeholders are seeking to better understand how Medicare payment policies are directly responsible for the consolidation of privately-owned physician practices and freestanding supplier facilities into larger health systems.

- Medicare Shared Savings Program: CMS finalized significant updates to MSSP that are aligned with the agency’s overall value-based care strategy of growth, alignment, and equity. These policies include paying advance shared savings to certain new ACOs that can be used to support their participation in the Shared Savings Program, a health equity adjustment to an ACO’s quality score, a revised benchmarking methodology, and allowing longer periods of time for ACOs to transition to downside risk. This package of changes are intended to increase participation in MSSP and in particular participation in rural and underserved areas.

- Behavioral health: The final rule expands the types of behavioral health providers eligible for reimbursement under Medicare Part B. Marriage and family therapists, licensed professional counselors, addiction counselors, certified peer recovery specialists, and others will be able to provide behavioral health services while being under general supervision rather than “direct” supervision. Psychologists and social workers that are part of a primary care team will also be eligible for payment to help manage behavioral health needs. Additionally, CMS confirmed that Opioid Treatment Programs may bill Medicare for services performed by mobile units without obtaining a separate registration and increasing payment rates to Opioid Treatment Programs.

- Telehealth: CMS finalized several policies related to Medicare telehealth services, reflecting statutory requirements of the Consolidated Appropriations Act (CAA) of 2022 and the agency’s ongoing evaluation of temporarily available services. The changes related to the CAA of 2022 include extending for 151 days beyond the end of the Public Health Emergency (PHE) the following coverage provisions: allowing telehealth services to be furnished in any geographic area and in any originating site setting (including the beneficiary’s home); allowing certain services to be furnished via audio-only telecommunications systems; allowing physical therapists, occupational therapists, speech-language pathologists, and audiologists to furnish telehealth services; delaying the onset of the in-person visit requirements for mental health services furnished during the PHE; and making policy changes consistent with those named above under the payment systems for Federally Qualified Health Centers (FQHCs) and Rural Health Clinics (RHC).

- Ground Ambulance: CMS affirmed that its expanded list of covered destinations for ground ambulance transports was for the duration of the COVID-19 PHE only. The regulation also finalized changes to the long awaited Medicare Ground Ambulance Data Collection Instrument, including clarifying to process for requesting exemption from reporting cost data through this collection device.

Outpatient Prospective Payment System and Ambulatory Surgical Care Payment System Final Rule

Also on November 1, 2022, CMS published the calendar year 2023 Hospital Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center (ASC) Payment System final rule. The rule presents new opportunities to address access to emergency services in rural communities and updates other outpatient and ASC policies.

- Payment rates and Inflation: CMS increased hospital outpatient and ambulatory surgical center payments by 3.8 percent in 2023 above 2022 rates. This reflects a 4.1 percent hospital market basket increase plus a 0.3 percentage point reduction for productivity and is consistent with Medicare’s 2023 hospital inpatient payment increase. The hospital industry has expressed deep concern to Congress and CMS that although the 4.1 percent market basket increase is as high as it has been in many previous years, it lags behind the measure of general inflation (October 2022 consumer price Index = 8.2 percent)

- Remote Behavioral health: CMS finalized its proposal to cover as an outpatient service remote behavioral health services provided by clinical staff of hospital outpatient departments, including critical access hospitals (CAHs), to beneficiaries in their homes. This policy was initially permitted under CMS’ COVID-19 PHE emergency rulemaking but this is now covered on a more permanent basis.

- In 2023 beneficiaries would need to receive an in-person service within the 6 months prior to the first time hospital clinical staff provide the remote behavioral health services. CMS also is requiring an in-person service without the use of communications technology within 12 months of each behavioral health service furnished remotely.

- The agency also finalized coverage of audio-only telehealth services in instances where the beneficiary is unable to use, does not wish to use, or does not have access to two-way, audio/video technology.

- Algorithm driven services: CMS finalized policy to pay separately (rather than bundle payment) for Algorithm-driven services that assist practitioners in making clinical assessments. This includes clinical decision support software, clinical risk modeling, and computer aided detection (CAD).

- Rural Emergency Hospitals (REH) : CMS finalized conditions of participation, payment rates, and Medicare enrollment procedures for the new REH provider type largely as proposed. The new REH program will be effective January 1, 2023. Federal policymakers believe the REH provider type could provide a more sustainable option for rural hospitals facing closure and to support access to care in rural and underserved communities. A previous HMA blog explains the payment and service parameters for the REH option.

- Hospitals and health systems and the rural communities they serve will want to analyze the final requirements for health and safety standards, staffing, and physical environment and emergency preparedness and other expectations and balance these with community perspectives to determine the feasibility of this pathway.

- Site neutral payment policy: CMS finalized its proposal to exempt Rural Sole Community Hospitals (SCHs) from the Medicare policy which pays clinic visit services 40 percent of the OPPS payment rate when provided at hospital outpatient departments. Instead, CMS will pay these providers full OPPS rates for clinic visits.

- 340B Drug Program: CMS finalized a payment rate of Average Sales Price plus 6 percent under the 340B program.

Home Health Prospective Payment System Rate Update and Home Infusion Therapy Services Requirements

On October 31, 2022, CMS finalized the calendar year 2023 Home Health Prospective Payment System (HH PPS) payment rates. CMS projects that aggregate spending for home health agencies in 2023 will increase by 0.7 percent, compared to 2022. This is a significant update as compared to the 4.2 percent decrease the agency proposed earlier this year. The originally proposed payment cut was in part due to CMS’s requirement to implement at statutory budget neutrality requirement for the Patient-Driven Groupings Model. While there was fervent industry pushback and advocacy to eliminate the proposed payment adjustments, CMS instead used its discretionary authority to implement a phased approach to payment reductions. The first half will be effective in 2023, and the remaining permanent adjustment and any other potential adjustments needed to account for behavior change will be proposed in future rulemaking. CMS’ payment approach is expected to factor heavily in the overall stability and market dynamics within the home health agency industry in the months ahead.

Other notable final rule Home Health policies include:

- CMS finalized a permanent cap on wage index decreases to promote predictability in payments and smooth year-to-year changes. This was also implemented within the Inpatient Prospective Payment System.

- CMS finalized the Expanded Home Health Value-Based Purchasing (HHVBP) Model home health agency baseline year to CY 2022 and the Model baseline year to CY 2023.

- CMS will begin collecting data on the use of telecommunications technology on home health claims voluntarily starting on January 1, 2023, and on a mandatory basis beginning on July 1, 2023. Further details are expected to be issued in January 2023.

ESRD Prospective Payment System Final Rule

Also on October 31, 2022, CMS released the calendar year 2023 ESRD Prospective Payment System Final Rule. In addition to updating the payment rates, the rule updates requirements for the ESRD Quality Incentive Program (QIP). Looking ahead CMS plans to consider comments in response to several requests for information as it updates the ESRD QIP, works to align resource use with payment, ensure equitable access to technologies that improve health and quality of life.

Additional impactful policies for providers and stakeholders include:

- CMS did not approve any of the three new technologies which applied for pass-through payment. While CMS has created a payment mechanism to promote innovation, it has proved challenging to actually access this payment mechanism. That may slow investment in the space if CMS continues to set such a high bar.

- As laid out in the final rule, CMS remains on track to fold all oral drugs including phosphate binders into the bundle when the statutory ban expires in 2025.

- CMS received many comments for its RFI regarding TDAPA, the new drug pass-through payment program in ESRD. It is likely that CMS will dedicate significant attention to this topic in the next rulemaking cycle. In particular, the RFI focused on how CMS might add new money to the ESRD bundle when new drugs exit pass-through, including the potential for accounting for other drugs which are replaced by the new products.

While providers and stakeholders must analyze the immediate impact of the final rules, it is also essential to consider the broader context of CMS’ reimbursement and policy decisions.

Notably, there is more urgency for the provider community, Medicare Advantage plans, and the broader Medicare stakeholder community to prepare for the imminent end of the federal COVID-19 Public Health Emergency (PHE) declaration. Congress and the Administration have already begun to identify and make permanent certain flexibilities afforded during the COVID-19 PHE. Other flexibilities will be phased out or ended. Looking ahead to this transition, thoughtful preparation and consideration of the Medicare policy context and opportunities will be critical.

For additional information, please contact Amy Bassano, Mark Desmarais, Zach Gaumer, Andrea Maresca, and Aaron Tripp.

HMA Roundup

Alabama

Alabama Releases Medicaid Modernization Program System Integration Services RFP. The Alabama Medicaid Agency released on November 1, 2022, a request for proposals for a system integration contractor to provide data integration, identity management, and centralized incident and change management services for the Alabama Medicaid Modernization Program. The contract, which will run for eight years, will be implemented on December 1, 2023. Proposals are due by March 17, 2023. Read More

Arkansas

Arkansas Receives Federal Approval to Expand Community-Based Care for Certain High-Risk Individuals. The U.S. Department of Health and Human Services announced on November 1, 2022, federal approval for the Arkansas Life360 HOME initiative, which is aimed at increasing community-based services to certain high risk populations. The initiative, which is offered through an amendment to the ARHOME Medicaid expansion program, includes home visits for women with high-risk pregnancies (Maternal Life360 Homes); care coordination services for individuals with serious mental illness or substance use disorders in rural areas (Rural Life360 Homes); and help with life skills and social-related health needs for young adults (Success Life360 Homes). Read More

District of Columbia

The District of Columbia Mayor Calls for Ethics Investigation Into Recently Awarded Medicaid Managed Contracts. The Washington Post reported on October 26, 2022, that District of Columbia Mayor Muriel Bowser called for an ethics investigation into recently awarded Medicaid managed care contracts, after learning that a District official had accepted a job at Elevance Health/Amerigroup, one of the contract winners, just one week after the award announcement. Bowser also said that she had fired the official, Bryan Hum, who was serving as interim director of the DC Office of Policy and Legislative Affairs. CareFirst, which was not awarded a contract, is urging DC to pause the contracting process until the extent of Hum’s involvement in the awards is understood. Read More

Michigan

Michigan Medicaid Plan Meridian Appoints Patricia Graham as CEO. Meridian announced on October 27, 2022, the appointment of Patricia Graham as its new chief executive, effective October 20, 2022. Previously, Graham served as chief operating officer at Meridian, which serves Medicaid, Medicare, dual, and Exchange members in Michigan. Read More

Michigan Proposes Rate Increases for Medicaid Dental Services in Outpatient Hospitals, Ambulatory Surgery Centers. The Michigan Department of Health and Human Services proposed on October 28, 2022, an increase in Medicaid payment rates to $2,300 for dental services provided at outpatient hospitals and $1,495 for dental services provided in an ambulatory surgical center. Under the proposal, the services would move from the current outpatient prospective payment system to a Medicaid fee schedule. If approved by the Centers for Medicare & Medicaid Services, the new rates would be effective October 1, 2022. Hospitals can submit comments until November 23. Read More

Missouri

Missouri Processes Medicaid Expansion Applications in 41 Days in September. The Missouri Independent reported on October 31, 2022, that Missouri processed Medicaid expansion applications in 41 days on average in September, down from a peak processing time of 115 days in June. Federal rules require the applications to be processed in 45 days or fewer. Read More

Mississippi

Mississippi Submits 1115 Healthier Mississippi Waiver Extension Application for Aged, Blind, Disabled Individuals. The Centers for Medicare & Medicaid Services announced on October 31, 2022, that Mississippi submitted a five-year extension request for the state’s current Section 1115 Heathier Mississippi demonstration, which offers Medicaid coverage of primary and preventative care to aged, blind, or disabled individuals who are not enrolled in Medicare or otherwise eligible for Medicaid. The demonstration would be effective from October 1, 2023, through September 30, 2028. The federal comment period will be open until November 30. Read More

New Hampshire

New Hampshire to Award Adult Medicaid Dental Contract to Delta Dental. The New Hampshire Bulletin reported on October 31, 2022, that the New Hampshire Department of Health and Human Services intends to award a contract to Delta Dental Plan of New Hampshire to provide adult Medicaid dental benefits. The New Hampshire Council will meet to approve the contract, which is worth $33.5 million. The contract is expected to begin on April 1, 2023 and run for 15 months with the option to renew for up to two additional years. The new coverage will not have a cap on benefits or copays for preventative services, while other care will be capped at $1,500 per year with a 10 percent copay. Read More

New York

New York Advocates Discuss Health Equity for Medicaid Beneficiaries With HHS Secretary. The U.S. Department of Health and Human Services (HHS) announced on November 1, 2022, that HHS Secretary Xavier Becerra had a virtual meeting with New York advocates to discuss equitable care in New York and statewide efforts to close equity gaps, lower costs, and deliver quality. Topics included Section 1115 Medicaid demonstration initiatives, mental and behavioral health, investments in health centers, homelessness and housing, and environmental justice and health. The state recently submitted a Section 1115 waiver amendment to address health equity for Medicaid beneficiaries. Read More

Oregon

Oregon Ballot Measure Would Declare Affordable Health Care a Human Right. The Associated Press reported on October 27, 2022, that Oregon will vote on a ballot measure next month to become the first state to amend its constitution to explicitly declare that affordable health care is a fundamental human right. The amendment states, “It is the obligation of the state to ensure that every resident of Oregon has access to cost-effective, clinically appropriate and affordable health care.” However, it does not provide for additional funding and adds that the state’s obligation “must be balanced against the public interest in funding public schools and other essential public services.” Read More

South Dakota

South Dakota Seeks Five-Year Extension of Former Foster Care Youth Medicaid Section 1115 Waiver. The Centers for Medicare & Medicaid Services (CMS) announced on November 2, 2022, that South Dakota requested a five year extension of the state’s Former Foster Care Youth Section 1115 waiver demonstration through April 30, 2028. The waiver provides Medicaid benefits to youth under age 26 who were formerly in foster care. Public comments will be accepted through December 2, 2022. Read More

Tennessee

Tennessee Seeks to Extend Enhanced HCBS Supports. The Centers for Medicare & Medicaid Services (CMS) announced on October 27, 2022, that Tennessee submitted an 1115 waiver amendment request to extend enhanced home and community-based services (HCBS) programs for seniors and individuals with disabilities authorized during the public health emergency (PHE). The state is seeking to increase the expenditure caps currently specified for these programs and to add enabling technology as a covered benefit. Public comments will be accepted through November 26, 2022. Read More

Texas

Texas Incorrectly Claims Nearly $19 Million in Uncompensated Care Payments From 2011-16, State OIG Finds. King & Spalding reported on October 31, 2022, that Texas incorrectly claimed $18.9 million in uncompensated care (UC) payments from 2011 to 2016, according to a September 2022 report from the state Office of Inspector General (OIG). Another $33.78 million in UC costs may have also been improper, the report says. The report reviewed $16.95 billion in UC payments from December 12, 2011, through September 30, 2016. Read More

Vermont

Vermont Releases Medicaid IV&V RFP. The Vermont Department of Health Access released on October 27, 2022, a request for proposals (RFP) for Independent Verification and Validation (IV&V) services during the design, development, and implementation phase of the state’s Medicaid management information system modernization efforts. The awarded contracts, worth up to $2.4 million annually, will be implemented on May 15, 2023, and run for five years with two, one-year renewal options. Proposals are due by December 20, 2022. Read More

Wisconsin

Wisconsin Receives Federal Approval to Use CHIP Funds For Housing Support. The Wisconsin Department of Health Services announced on October 27, 2022, federal approval to provide housing support for low-income families with children age 18 and younger and pregnant individuals through a Children’s Health Insurance Program (CHIP) Health Services Initiative. Services will include housing consultations, transition supports, relocation supports, and other support to help families sustain housing after moving. Read More

National

HHS Aims to Bolster Medicare Behavioral, Dental, Cancer Care in 2023 Physician Fee Schedule Final Rule. The U.S. Department of Health and Human Services (HHS) released on November 1, 2022, the Centers for Medicare & Medicaid Services (CMS) 2023 Physician Fee Schedule final rule, which is aimed at expanding access to behavioral health services for Medicare beneficiaries, expanding and enhancing accountable care organizations, expanding coverage for colon cancer screening, and codifying policies where Medicare Parts A and B pay for dental services when that service is integral to treating a beneficiary’s medical condition. Read More

HHS Focuses on Rural Health Equity in Outpatient Hospital, Surgical Center Payment System Final Rule. The U.S. Department of Health and Human Services (HHS) announced on November 1, 2022, that the Centers for Medicare & Medicaid Services (CMS) released the 2023 Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System final rule, with a focus on rural health equity. The rule allows Critical Access Hospitals and small rural hospitals to convert to Rural Emergency Hospitals, provides options for rural hospitals facing closure, and supports access to care in rural and underserved communities. Medicare will also pay hospital outpatient departments to provide remote behavioral health services to individuals at home. Read More

CMS Increases Home Health Provider Reimbursements by 0.7 Percent for 2023. Modern Healthcare reported on October 31, 2022, that the Centers for Medicare & Medicaid Services (CMS) published a final rule setting Medicare fees for 2023 home health services, which will give providers a 0.7 percent pay increase. CMS backed off plans to reduce home health reimbursements by $810 million following stakeholder objections. CMS will instead phase in certain payment reductions to anticipate home health providers billing for the highest-paying codes under the Patient-Driven Groupings Model. Read More

CMS Issues Final Rule to Increase ESRD Payments by 3.1 Percent. Modern Healthcare reported on October 31, 2022, that the Centers for Medicare & Medicaid Services (CMS) issued a final rule increasing payments for hospital-based end-stage renal disease (ESRD) providers by 3.1 percent and for freestanding facilities by three percent. In 2023, CMS will also bar ESRD providers from decreasing employee wages by more than five percent annually. Read More

Federal Exchange Open Enrollment Period Begins. The Centers for Medicare & Medicaid Services announced on October 31, 2022, that the HealthCare.gov open enrollment season begins on November 1 and goes through January 15, 2023. For a full year of coverage, individuals must enroll by December 15, 2022. Eighty percent of enrollees will have access to plans with premiums of $10 or less per month, after premium tax credits are applied. Read More

CMS Implements Additional Medicare Special Enrollment Periods in Final Rule. The Centers for Medicare & Medicaid Services (CMS) announced on October 28, 2022, a final rule allowing Medicare coverage to begin the month after enrollment and expanding special enrollment periods (SEPs). Changes would help individuals enroll in Part B coverage after the initial enrollment period, along with providing SEPs for individuals who missed an enrollment period due to a disaster or government-declared emergency, misrepresentations from their employer or health plan, incarceration, or loss of Medicaid coverage at the end of the public health emergency. The rule implements changes made in the Consolidated Appropriated Act, 2021. Read More

Medicaid, Medicare Enrollment Approaches 143 Million in July 2022. The Centers for Medicare & Medicaid Services (CMS) announced on October 28, 2022, that Medicaid and the Children’s Health Insurance Program (CHIP) enrollment approached 90 million in July 2022, an increase of nearly 0.6 percent from June. Medicare enrollment was nearly 65 million, up 0.2 percent. More than 12 million Medicare-Medicaid dual eligibles are counted in both programs. Read More

MACPAC Calls for States to Publicly Release Monthly Reports Related to PHE Unwinding. Fierce Healthcare reported on October 27, 2022, that the Medicaid and CHIP Payment and Access Commission (MACPAC) called for states to publicly release monthly reports they will be submitting to the Centers for Medicare & Medicaid Services containing data related to the public health emergency (PHE) unwinding. MACPAC is specifically interested in call center data and the tracking of those who lose coverage inappropriately. Read More

CMS Approves Extension of Postpartum Coverage to 12 Months in Georgia, Pennsylvania. The Centers for Medicare & Medicaid Services (CMS) announced on October 27, 2022, that Georgia and Pennsylvania have been approved to extend Medicaid postpartum coverage to 12 months. Up to 57,000 individuals will become eligible for coverage across the two states. Additionally, CMS released data on hospital participation in state or national programs to improve maternal and child health. Read More

Industry News

Carle Health to Become Parent of UnityPoint Health – Central IL. Carle Health announced on November 1, 2022, an agreement to replace UnityPoint Health as the parent organization of UnityPoint Health – Central Illinois, which includes Methodist, Proctor, and Pekin Hospitals, affiliated clinics, UnityPlace, and Methodist College. The change is being made through a strategic affiliation agreement. The anticipated closing date is April 1, 2023. Read More

The Ensign Group Acquires Lila Doyle Post Acute. The Ensign Group announced on November 2, 2022, its acquisition of Lila Doyle Post Acute, a 120-bed skilled nursing facility in South Carolina. Ensign now operates 269 healthcare operations across 13 states. Read More

Walgreens’ VillageMD Reportedly Explores Merger With Summit Health. Bloomberg reported on October 31, 2022, that VillageMD, which is majority owned by Walgreens Boots Alliance, is reportedly exploring a merger with Warburg Pincus-backed Summit Health. The deal would value the combined entity between $5 billion and $10 billion. Read More

Blackstone Considers Selling 50 Percent Stake in HealthEdge. Bloomberg reported on October 28, 2022, that Blackstone is considering the sale of a 50 percent stake in HealthEdge, which provides plan design, enrollment and claims adjudication software to health insurers. Read More

Lee Equity Partners Acquires Majority Stake in Bradford Health Services. Lee Equity Partners announced on October 28, 2022, the acquisition of a majority stake in Bradford Health Services, a substance use disorder treatment provider in the southeast. Bradford was previously owned by Centre Partners, which is maintaining a minority stake. Read More

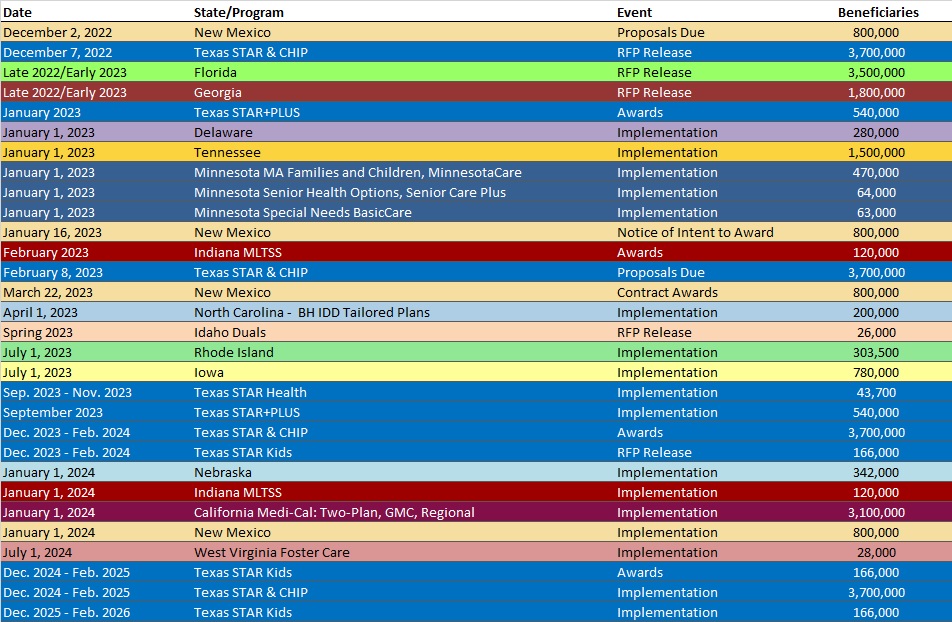

RFP Calendar

HMA News & Events

HMA WELCOMES

Carter Kimble, Principal – Austin, TX

Carter Kimble, MPH, is a thoughtful and strategic leader working at the intersection of systems and policy in health. He possesses expertise in solving complex issues regardless of project or program maturity. Specifically, he has held leadership level positions working on Medicaid, delivery system reform, health information exchange, public health, safety net health systems and graduate medical education.

Before joining HMA, he served as Deputy Secretary for Health and Mental Health for the state of Oklahoma. In this role he managed and facilitated numerous initiatives that included strategic development of a Medicaid reform plan surrounding Medicaid expansion and the implementation of managed care as well as establishment of Oklahoma’s statewide Health Information Exchange. He also served as the governor’s lead policy advisor on health and liaison to over 30 agencies, boards, and commissions in the Health and Mental Health Cabinet including Medicaid, public health and mental health and substance abuse.

During the COVID-19 pandemic, Carter led a team coordinating CARES Act expenditures targeted at health programs for the state of Oklahoma which resulted in more than $300 million in projects focusing on areas such as modernization of technology systems, communicable disease preparedness grants to local municipalities, and behavioral health crisis supports. On numerous occasions during his career, he has successfully developed impactful statutory changes to Medicaid, public health, health information technology and provider reimbursement including development and stakeholder engagement surrounding the issues.

He earned a Master of Public Health in health management and policy from the University of North Texas Health Sciences Center in Fort Worth. He also has a bachelor’s degree in public relations and management from Texas Tech University.

Vince McGowen, Principal – Chicago, IL

Vince McGowen has more than 20 years of strategic planning and healthcare management experience and has helped guide skilled nursing facilities with operational and financial consulting services.

Prior to joining HMA Vince was chief administrative officer and executive vice president of Villa Healthcare in Skokie, Illinois. In this role he led the revenue cycle team, supervised corporate support office operations, and helped develop budgets for corporate and divisional operations.

During his career Vince has served as senior vice president of operations at two different companies, where he led multi-facility regional managers and oversaw daily operations of 13 skilled facilities in Illinois and Missouri and 27 skilled nursing facilities across Kansas, Missouri, Indiana and Southern Illinois, respectively. He handled overall regulatory compliance, financial management, and establishment of strategic plans for the region.

Vince also spent seven years as vice president of Economic and Legislative Affairs for the Indiana Health Care Association. He helped design, implement, and refine a $1 billion Medicaid reimbursement system for long-term care facilities and served as the liaison to Indiana’s Office of Medicaid Policy and Planning and its subcontractors and Medicare fiscal intermediaries.

He earned a bachelor’s degree in humanities from Indiana University.

Dianne Neufville, Senior Consultant – Albany, NY

Dianne Neufville is an innovative leader with experience in strategic planning, program management, marketing research, communications and brand research. She has a proven track record of cultivating long-term, positive relationships with key stakeholders, overseeing a wide range of projects spanning the nonprofit, consumer goods, healthcare, and manufacturing industries.

She has extensive experience collaborating with executive teams to develop, communicate, and monitor an organization’s strategy and influence the decision-making process. She is skilled in operations management, cultural competence marketing management and branding strategy.

Prior to joining HMA, Dianne was regional director for Health Homes of Upstate New York (HHUNY). She developed, implemented, and directed Health Home care management practices across a network of 1,200 care managers and 60 agencies throughout 26 counties in the state of New York. In this role she established indicators for monitoring and evaluating continuous improvement, member satisfaction, utilization, performance management, and care management services across the continuum of care. She also orchestrated administrative and operations management for the HHUNY Management Services Organization (MSO) to ensure that operating practices complied with New York state Health Home standards.

Dianne previously was manager of marketing and strategic initiatives for the New York Care Coordination Program (NYCCP). In this role she collaborated with executives to develop, communicate, and track implementation of NYCCP and HHUNY’s strategy and led NYCCP and HHUNY’s annual strategic planning process.

She received a Master of Business Administration from the City University of New York, Zicklin School of Business and a bachelor’s degree in economics and management from the University of the West Indies. Dianne completed a Healthcare Business Academy Fellowship with Northstar Network and has Non-Profit Management Certification from St. John Fisher College and Marketing Research Certification from the University of Georgia.

NEW THIS WEEK ON HMA INFORMATION SERVICES (HMAIS):

Medicaid Data

Medicaid Enrollment:

- Colorado RAE Enrollment is Up 4.6%, Jul-22 Data

- Iowa Medicaid Managed Care Enrollment is Up 4.2%, Aug-22 Data

- Kansas Medicaid Managed Care Enrollment is Up 4.6%, Sep-22 Data

- Maine Medicaid Expansion Enrollment by County, Jun-22 Data

- Missouri Medicaid Managed Care Enrollment is Up 15.8%, Jul-22 Data

- North Dakota Medicaid Expansion Enrollment is Up 8.4%, May-22 Data

- North Dakota Medicaid Expansion Enrollment is Up 9.9%, Jun-22 Data

- North Dakota Medicaid Expansion Enrollment is Up 10%, Jul-22 Data

- Oklahoma Medicaid Enrollment is Up 7.1%, Jun-22 Data

- Pennsylvania Medicaid Managed Care Enrollment is Up 4.5%, Aug-22 Data

- Puerto Rico Medicaid Managed Care Enrollment is Up 2.2%, Sep-22 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- Alabama Medicaid Modernization Program System Integration Services RFP

- Missouri HealthNet Managed Care RFP, Proposals, Awards, and Evaluation, 2021-22

- Vermont Independent Verification and Validation for MMIS Modernization RFP, Oct-22

Medicaid Program Reports, Data, and Updates:

- Iowa Medicaid HITECH Implementation Advanced Planning Documents, 2018-23

- New York Medicaid Global Spending Cap Reports, 2019-22

- New York Medicaid Pharmacy Managed Care to FFS Transition Presentations, Oct-22

- Ohio JMOC Medicaid Medical Inflation Biennial Report, 2018-25

- Ohio Medicaid Budget Variance Reports, 2022

- Ohio Medicaid HITECH Implementation Advanced Planning Documents, FY 2023

- Oregon Medicaid Capitation Rate Certifications, CY 2020-23

- Pennsylvania Community HealthChoices Databook, CY 2023

- Pennsylvania Medical Assistance Advisory Committee (MAAC) Meeting Materials, Oct-22

- South Dakota Department of Social Services Medicaid Annual Reports, 2012-22

- Texas Medicaid CHIP Data Analytics Unit Quarterly Reports, 2018-22

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Carl Mercurio.