This week’s In Focus centers on the U.S. Department of Health and Human Services (HHS) August 29, 2023, announcement of the first 10 prescription medications that will be subject to price negotiation for Medicare coverage. This week, Health Management Association (HMA) experts offer their perspective on what this change means and what to expect next.

Background

Medicare was granted the authority to negotiate prescription drug prices through the Inflation Reduction Act (IRA), which the president signed into law on August 16, 2022. HHS, acting through the Centers for Medicare & Medicaid Services (CMS), will lead negotiations and enter into agreements with manufacturers for these products, negotiating a maximum fair price (MFP) for each selected drug in the Medicare program. HHS is required to negotiate on a certain number of drugs each year: 10 drugs in 2026, 15 drugs in 2027 and 2028, and 20 drugs in 2029 and subsequent years. Up to 60 drugs could be negotiated by 2029. Manufacturers that are noncompliant will face an excise tax that could far exceed the cost of drugs sold over time and civil monetary penalties.

Medicare Drug Negotiations: The Latest Development

Since passage of the IRA, CMS has been working to establish the regulatory infrastructure and policies to support implementation of Medicare’s new drug price negotiation authority on an expedited timeline. Guidance on the approach the agency will take in negotiating MFPs, along with other provisions of the act, has been issued.

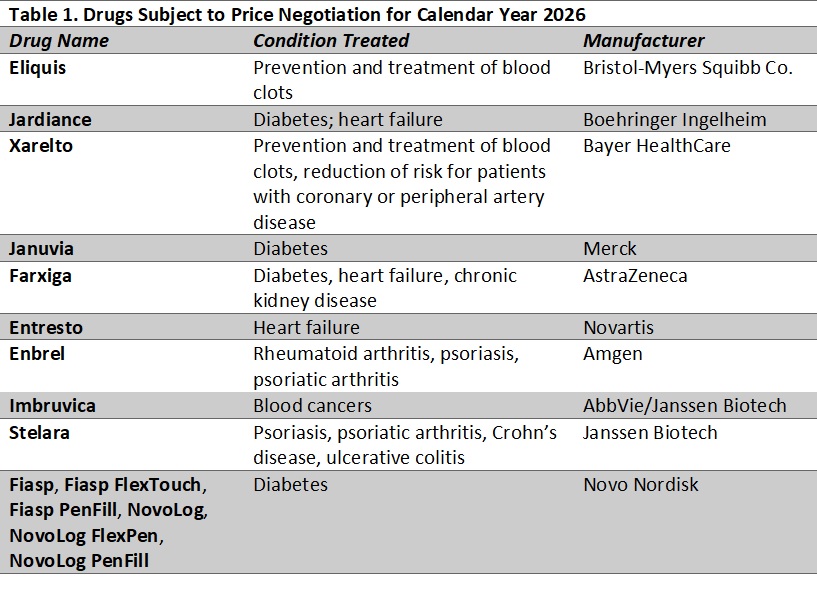

With this week’s action, CMS will begin the first round of negotiations. Table 1 lists the drugs CMS has identified for the first round of negotiations. Products selected for negotiation (with prices effective in 2026) are medications that represent the highest spending in the Part D drug benefit, excluding products with generic or biosimilar competition as well as certain orphan drugs and other products that qualify for a small biotechnology exemption.

Alongside CMS’s announcement, HHS’s Office of the Assistant Secretary for Planning and Evaluation (ASPE) released its analysis of prescription drug use and out-of-pocket spending for each of the 10 drugs for all Part D enrollees and separately by whether an enrollee receives the low-income subsidy (LIS). The report also examines demographic information about enrollees who use the selected products.

Takeaways

The products selected were largely in line with initial modeling that Moran Company analysts and others performed, but with some surprises. Variation from earlier projections could be expected for a number of reasons, including:

- The June 2022−May 2023 data CMS used were not generally available to outside analysts, and it is clear that several products had spending increases (whether because of volume or price increases) relative to prior years that moved them up the list.

- Some higher spending products have seen generic or biosimilar competitors launch, making them ineligible for selection for negotiation.

- For the top 30 products identified in previous dashboard data, at least 10 have evidence of generic or biosimilar competition.

- CMS’s decision to treat multiple products together for purposes of negotiations also affected the products included on the list.

- For a few other products, it is still unclear how CMS decisions were made.

What to Expect Next

The drug negotiation policy is highly controversial and is the subject of litigation that could delay the process. If litigation does not affect the timeline for implementation, manufacturers of selected drugs have until October 1 to agree to negotiate and provide initial information to CMS. If a manufacturer opts out of the negotiations, the company must pay either an excise tax or withdraw all its products from the Medicare and Medicaid programs. CMS and participating companies will then meet to discuss manufacturer submissions, and CMS will receive information from other stakeholders. Several listening sessions will take place.

CMS will make initial price offers by February 1, 2024. After a counteroffer process, negotiations may continue into the summer of 2024, but final determinations will be made by August 1, 2024. CMS plans to publish any agreed-upon negotiated prices for the selected drugs by September 1, 2024. Those prices take effect starting January 1, 2026.

In addition to the short-term impact on prices for specific drugs, several questions about the potential effects of the policy are worth monitoring over the long-term:

- How will research and development of new products and trends in the type of products prioritized change as a result of these policies?

- How will the policies affect pricing for competitor products and the launch prices of products in the future?

- Beyond the Medicare population, for whom the prices are directly applicable, how will MFPs affect negotiations on costs and supplemental rebates for other payers. including state Medicaid programs, state employee programs, drug purchasing pools, and commercial insurers?

- Will negotiations affect the design of standalone Prescription Drug Plans (PDPs) and Medicare Advantage PDPs.

The IRA included several other changes to the Medicare program, which we discussed in a previous In Focus.