This week our In Focus section reviews the Centers for Medicare & Medicaid Services’ (CMS) Innovation Center’s newly announced model – Accountable Care Organization Realizing Equity, Access, and Community Health (ACO REACH). CMS will accept applications from organizations interested in participating and is particularly interested in partnering with provider-led organizations and similar groups with direct patient care experience and a strong track record serving underserved populations that focus on primary care to better manage Medicare beneficiaries’ health. Applications are due by April 22, 2022.

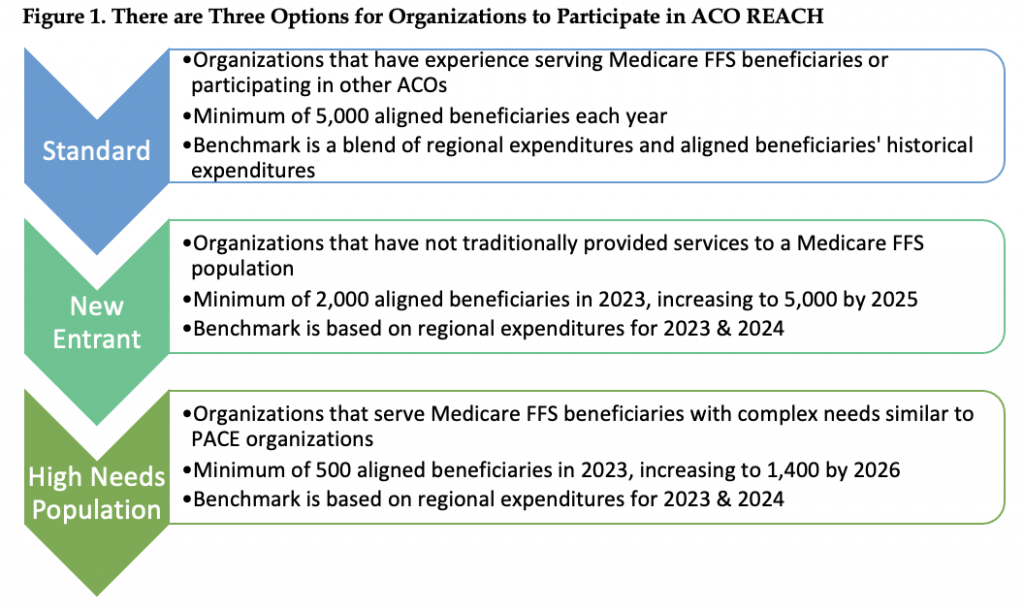

The ACO REACH model is a re-branding of the existing Global and Professional Direct Contracting (GPDC) model that began in 2021 and shares many of the same features of that model. It will continue to test a set of three voluntary payment model options aimed at reducing expenditures and preserving or enhancing quality of care for beneficiaries in traditional, fee-for-service (FFS) Medicare (Figure 1).

Note: ACO (accountable care organization), FFS (fee-for-service), PACE (Program of All Inclusive Care for the Elderly). Benchmark methodology is determined in part by the method used to align beneficiaries with ACOs.

The new cohort will begin participation in the ACO REACH Model on January 1, 2023, and may continue through December 31, 2026. Current GPDC Model participants must agree to meet all ACO REACH Model requirements to continue participating. This includes developing a health equity plan and ensuring that participating providers hold at least 75 percent of the governing board voting rights by January 1, 2023.

ACOs must make arrangements with Medicare-enrolled providers or suppliers to participate in the model and contribute to the ACO’s goals. In the REACH model, ACOs can form relationships with two groups of providers:

- Participant Providers

- Are used to align beneficiaries to the ACO

- Are required to accept payment from the ACO through their negotiated payment arrangement with the ACO

- Report quality

- Preferred Providers

- Are not used to align beneficiaries to the ACO

- Can elect to accept payment from the ACO through a negotiated payment arrangement with the ACO

- Both kinds of providers

- Continue to submit claims to Medicare and accept reduced claims payments

- Are eligible to receive shared savings

- Have the option to participate in benefit enhancements or patient engagement incentives

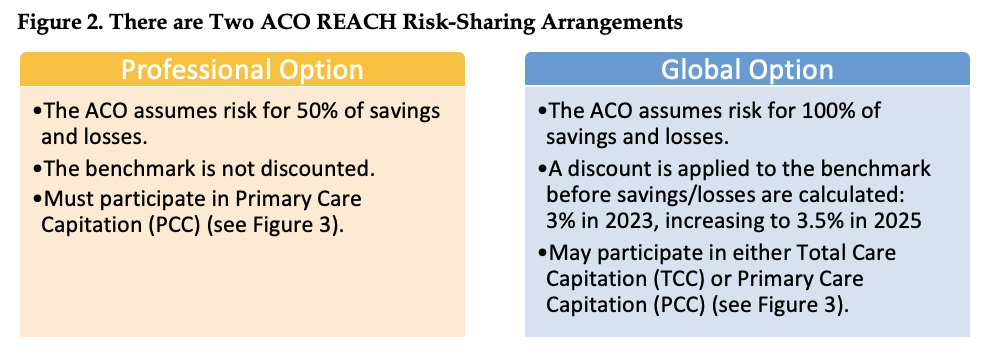

ACOs will have the choice of two risk-sharing arrangements—the Global Option and the Professional Option (Figure 2). In either option, participating providers accept Medicare reduced claims payment amounts and agree to receive at least some compensation from their ACO.

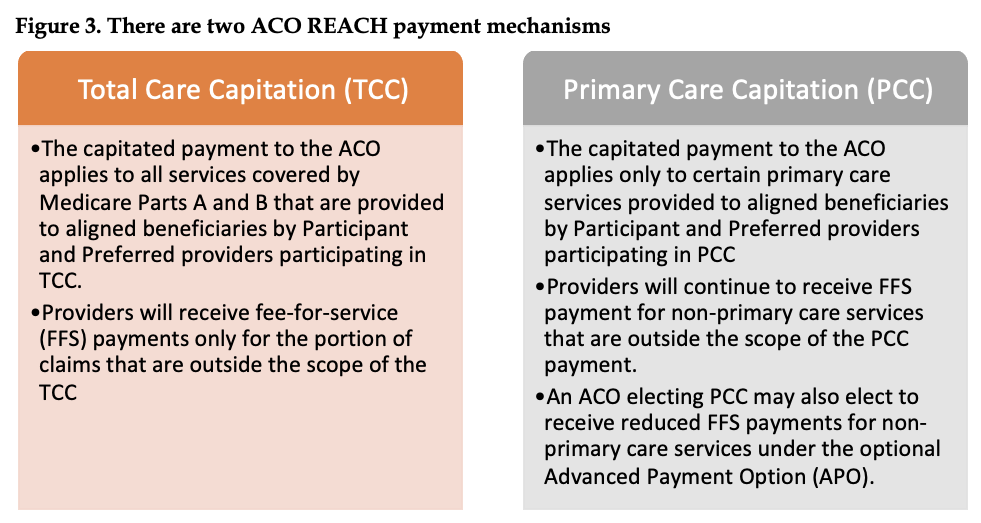

ACO REACH offers two payment mechanisms which pay participating organizations a monthly capitated amount based on reduced claims amounts. All ACOs in the REACH model must participate in one of the capitation payment mechanisms (Figure 3). An ACO electing Primary Care Capitation (PCC) may also elect to accept claims reduction through the optional Advanced Payment Option (APO). The APO is available only to Preferred and Participant Providers of a ACO electing PCC. It is up to each individual provider to decide whether they want to pursue claims reduction via the APO, and each provider may choose the desired percent reduction for relevant FFS claims (1 percent – 100 percent). Because APO applies to non-primary care services (i.e., services for which PCC does not apply), APO is complementary to PCC in that APO and PCC will never apply to the same service.

The impact of decisions made about TCC versus PCC vary depending on the performance year and whether providers have opted to be Participant or Preferred providers (Table 1).

The model design decisions potential ACO REACH participants make can have a substantial impact on their savings and loses. This includes decisions such as, type of ACO, selection of Participant and Preferred providers, risk-sharing arrangements, payment mechanisms, and other choices. More detail on these choices is included in a white paper available from actuaries Ivy Dong and Dani Cronick of Wakely, an HMA company. HMA staff and our family of companies have extensive experience in assessing the implications of these decisions for the ACO REACH model and other Innovation Center opportunities. If your organization is interested in assessing its ACO REACH opportunities, contact our experts below to learn how we can assist with a data-based consultation.