This week, our In Focus summarizes the findings of an HMA Information Services analysis of Medicaid managed care plan profitabilty, based on data from annual statutory filings made with the National Association of Insurance Commissioners (NAIC). For information on how to subscribe to HMA Information Resources, contact Carl Mercurio.

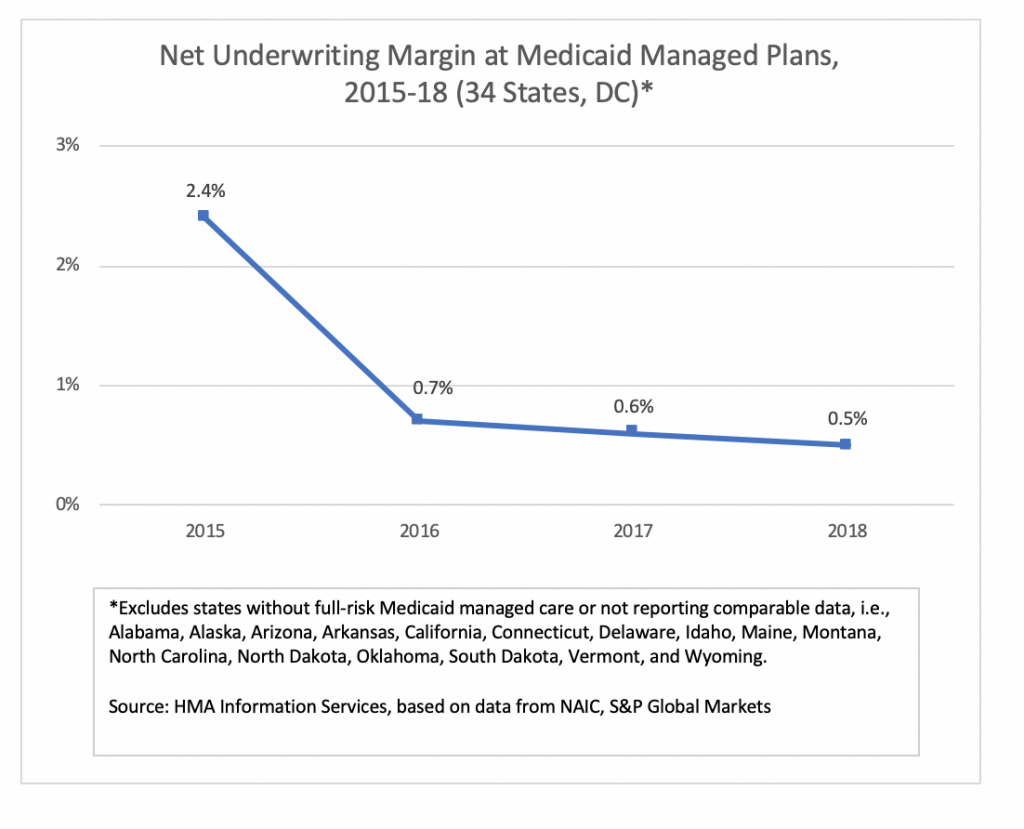

Underwriting Margin

An analysis by HMA Information Services, a division of Health Management Associates, shows that Medicaid managed care plans in 34 states and Washington, DC, posted a net underwriting margin of 0.5 percent in 2018, down 10 basis points from 0.6 percent in 2017. For-profit plans posted higher underwriting margins than not-for-profit plans.

Overall, margins have fallen consistently since hitting a four-year high of 2.4 percent in 2015. The data include financial information for about 210 Medicaid managed care plans, with total membership of 37 million in 2018 and revenues of about $188 billion. Net underwriting profit in 2018 was about $911 million, compared to more than $990 million in 2017.

States in which the aggregate Medicaid managed care margin was below the national average in 2018 (based on plans reporting NAIC statutory filings) included Florida, Hawaii, Louisiana, Massachusetts, Mississippi, New Jersey, New Mexico, Rhode Island, Texas, and Virginia.

Not included in the tally are most Medicaid plans in California and Arizona, which don’t report financial information through NAIC. In addition, some of the largest plans in New York don’t report financial information through NAIC.

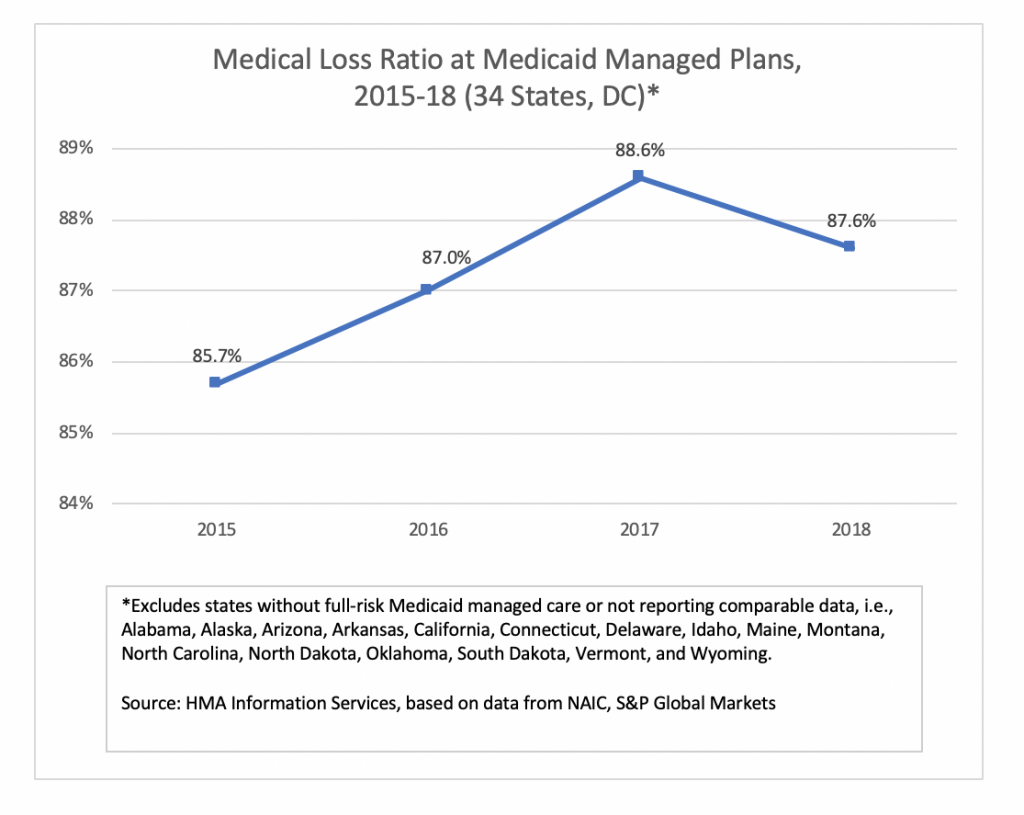

Medical Loss Ratio

Medical loss ratio (MLR) among Medicaid managed care plans in 34 states and Washington, DC, was 87.6 percent in 2018, down about 100 basis points from 2017. The MLRs calculated by HMAIS are blended and may include traditional Medicaid, expansion, and aged, blind and disabled populations, depending on the state. The improvement in average MLR was offset by an increase in administrative costs, resulting in the drop in underwriting margin.