February 19, 2025

Healthcare Quality Goes Digital: Navigating Challenges and Opportunities

HMA Insights – including our new podcast – puts the vast depth of HMA’s expertise at your fingertips, helping you stay informed about the latest healthcare trends and topics. Below, you can easily search based on your topic of interest to find useful information from our podcast, blogs, webinars, case studies, reports and more.

Healthcare Quality Goes Digital: Navigating Challenges and Opportunities

Medicare’s fee-for-service (FFS) payment system includes payment policies that support providers’ use of innovative medical device technologies. The continued evolution of these policies is necessary to keep pace with current and future medical innovation. In this report, HMA summarizes models testing the implementation of a newly proposed policy for the hospital inpatient system which aims to eliminate systemic bias that may slow hospitals’ adoption of innovative technologies. HMA concludes that targeted policies that eliminate the use of the hospital wage index to standardize device costs can result in more accurate reimbursement for hospitals and increase beneficiary access to innovative technologies.

The healthcare industry is undergoing a seismic shift in how quality data are collected and reported, creating opportunities to use digital quality measures (dQM) to significantly improve health outcomes and efficiency. Starting in January 2027, new federal interoperability and prior authorization rules will promote widespread data exchange, enabling full digital quality measurement. Payers and providers must invest early to be well-positioned to undergo major strategic and operational changes to optimize healthcare data and transform their business processes.

This issue brief explains the federal policies and national changes that make digital quality measurement possible, explores challenges facing the health insurance industry, and highlights opportunities for payers and providers.

Our HMA dQM team helps health plans, providers, health & hospital systems, federal, state and local payers such as Medicare and Medicaid navigate the transformation to dQM and broader interoperability—from early planning through strategy development, implementation, and impact evaluation.

This week, our In Focus section highlights key insights from a new Health Management Associates (HMA), white paper, Concentration of Specialty Services in Medicaid. Experts from HMA and Wakely, an HMA company, used the national Transformed Medicaid Statistical Information System (T-MSIS) database to learn more about specialty provider networks and examine the provision of specialty services across various states.

The analysis, released in January 2025 with support from the Robert Wood Johnson Foundation, focuses on three representative services that are relatively common, potentially difficult for Medicaid beneficiaries to access, significantly affect quality of life, typically accessed as elective procedures, and unlikely to be provided by other clinicians, such as primary care or mid-level practitioners.

T-MSIS Analysis Overview

T-MSIS analytic files are a comprehensive resource for Medicaid encounter, beneficiary demographics, program enrollment, service utilization, and payment data. Individual states compile their Medicaid claims data and submit monthly files to the Centers for Medicare & Medicaid Services (CMS). As each state submits data individually, numerous state-specific variations occur in data availability and quality. Currently, T-MSIS data are available for 2016−2023. HMA data scientists have permission to use the T-MSIS files for healthcare services research.

This paper examines services in 10 states that met a threshold of data integrity in the T-MSIS dataset for 2022. Other important design aspects of the analysis are as follows:

Concentration of Specialty Providers

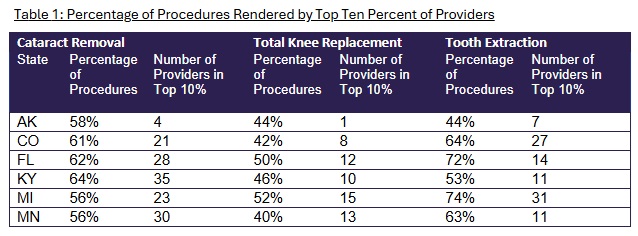

Table 1 summarizes findings about the concentration of specialty services.

The authors further analyzed the provision of services and, building on a previous study, examined network concentration. Findings were as follows:

These findings suggest that the specialty networks within each state are highly nuanced, and state policymakers need to look at individual specialty networks when considering health policy. State policymakers and managed care organizations (MCOs) need to examine each specialty individually to assess the distribution of services and access to care.

Looking Ahead

Timely access to healthcare services is critical for ensuring optimal health outcomes. The report authors’ analysis of T-MSIS data showed significant concentration of selected specialty services among providers, which may affect appropriate access to these services.

The analysis of concentration of specialty services among Medicaid specialty providers can guide MCOs and state policymakers in developing strategies to improve network adequacy, including clarifying the level of network adequacy and developing policies to assess and regulate access to specialty care. Addressing gaps in access to specialty care can contribute to better health outcomes for Medicaid beneficiaries and may be aligned with provisions in value-based contracts.

Connect with Us

Medicaid consumers, providers, MCOs, and states all have an interest in ensuring access to specialty care for Medicaid beneficiaries. The methodology applied in the analysis for the HMA white paper can be applied and adapted for future analysis to monitor network stability and to compare access among various payers.

For details about this analysis, its implications for state and local policies, and additional research using T-MSIS, contact our experts below.

In Focus: Highlights from HMA Analysis of Specialty Services in Medicaid

This webinar was held February 26, 2025.

During this webinar, our experts as discussed the latest developments in Medicaid financing and policy. With Congressional leaders and new U.S. Department of Health and Human Services officials focusing on Medicaid, significant changes are on the table during the budget reconciliation process. These changes create both risks and opportunities for Medicaid stakeholders. Learn what Congress and the Administration are considering and how it impacts Medicaid markets.

Learning Objectives:

New York healthcare providers and community-based organizations will have new opportunities to use state funding to strengthen reproductive healthcare infrastructure and improve the quality of maternity care. Governor Hochul’s proposed FY 2025 budget includes funding to increase access to comprehensive reproductive healthcare, and capital investment for renovations, equipment upgrades, planning, and construction, to help facilities modernize and secure their operations. The proposed budget also provides flexible funding streams for services and increased reimbursement for hospitals that meet new maternal health quality metrics.

Strategically seek funding to meet your goals and increase access to services

Develop successful grant applications that position your organization for long-term success and sustainability in New York’s transforming publicly financed healthcare environment

Implement new programs and services and measure their impact and value

Improve the quality and accessibility of services you offer.

Identify potential partners with whom to collaborate to expand new and existing services

| Proposed in Governor’s Budget | Opportunity Summary |

| Safety Net Transformation Program Funding | Would dedicate additional funding to support partnerships between safety-net hospitals and other healthcare organizations. |

| Reproductive Freedom and Equity Grant Funding | Would distribute $25 million in funding for the program with focus on strengthening access to comprehensive reproductive care. |

| Strengthening of Reproductive Healthcare Infrastructure | Would invest an additional $5 million in the Reproductive Freedom and Equity Grant Fund and security grant funding to expand capital investment support for providers; enables renovations, equipment upgrades, planning and construction to help facilities modernize and secure their operations. |

| Fair reimbursement for Abortion Services | Would invest an additional $20 million to enhance a new flexible funding stream to allow providers to better adapt to the impact of the incoming federal administration and ensure that providers are fairly reimbursed for providing abortions. |

| Safeguarding of Abortion as Emergency Medical Care | Codifies abortion as protected emergency medical care in New York State and requires hospitals to provide this stabilizing emergency medical care, reinforcing access to abortion services when medically necessary. |

| Increase in Hospital Reimbursement for High-quality Maternity Care | Increases Medicaid rates for hospitals that meet maternal healthcare quality metrics. |

| Expansion of Medicaid Coverage for Fertility Treatment | Extends coverage for fertility preservation services to Medicaid members undergoing medical treatments that may lead to infertility and expands eligibility for the Infertility Reimbursement Program. |

Former state directors of Title X, Title V Maternal and Child Health programs, and the Children’s Health Insurance Program (CHIP)

Former senior officials from the Centers for Medicare & Medicaid Services and the Health Resources and Services Administration

Advocates and former leaders of community-based organizations, foundations, and other programs that support reproductive health

Clinicians with experience providing a full range of reproductive health services

Social workers and behavioral health professionals working to integrate approaches that address social and behavioral health needs

Program development, strategic planning, and technical assistance experts working to implement innovative models of perinatal care and policy change to address social and economic drivers of maternal health

Experts in value-based payment and operations related to innovative models of perinatal care from the payer and provider perspectives

Researchers and evaluators with extensive experience examining the implementation and impact of policy and operational changes

HMA bring together experts from a full spectrum of reproductive health services including policy, clinical, operations, and research. We work with clients to reach shared goals of supporting maternal and child health, expanding access to the full spectrum of reproductive health services, reducing high rates of maternal and infant mortality and morbidity, and addressing deep and persistent racial disparities in birth outcomes and the inequities that drive them. We help clients stay ahead of the curve in publicly funded healthcare by providing technical assistance, resources, decision support and expertise.

As policymakers engage the state budget process, Medicaid continues to play a critical role. This role is programmatic, serving as the source of coverage for 1 in 4 Ohioans, including as the finance mechanism for half of all births in the state and the primary source of coverage for the elderly and disabled. However, a number of proposals are currently being discussed by the House, including changing how poverty programs are adjusted for inflation, reversing some Medicaid payment expansions, lowering the minimum federal funding rate for Medicaid, making the federal funding rate the same for all Medicaid expansion populations, limiting taxes on Medicaid providers, capping the amount spent per Medicaid enrollee, standardizing how administrative costs are matched, and other unspecified changes to Medicaid funding through Medicaid match. But these proposals can’t be viewed in isolation because the program is deeply intertwined with Ohio’s ability to have a balanced budget, serving a role in reducing direct state spending by enabling the draw down of federal dollars through “FMAP.” But what is FMAP and what happens if Congress fundamentally changes how it’s calculated?

The Federal Medical Assistance Percentage (FMAP) is a critical component of Medicaid funding, ensuring that states receive federal support to provide healthcare services to low-income individuals. FMAP is calculated based on a state’s per capita income relative to the national average. States with lower per capita incomes receive a higher FMAP, meaning the federal government covers a larger share of Medicaid costs, while states with higher per capita incomes receive a lower FMAP. The FMAP formula ensures that states with greater financial need, like Ohio, receive more federal assistance. For Federal Fiscal Year (FFY) 2025, Ohio’s FMAP is 64.6%, which means that for every dollar Ohio spends on most Medicaid services, 64.6 cents comes from the federal government. Even then, much of the state share is financed through fees on entities like hospitals, nursing facilities and health insurance companies.

Contextually, Ohio is a “recipient state,” indicating it receives more in federal tax revenue than it collects to finance the program. And, as was noted in the initial testimony offered in the Ohio House, Ohio continues to lag other states in terms of economic growth and has an aging population. As such, the availability and predictability of federal funding is a critical input in future years, particularly in long term care where most of the expense will continue to increase. With Congress deliberating all of these proposals, what could the impact be in Ohio? To illustrate, it may be good to focus on one area: the elimination of enhanced federal funding for those covered by the Medicaid expansion.

There has been some discussion during testimony that if the FMAP rate for the expansion population were to change, it could trigger an automatic end to the expansion itself. Importantly, there would be a disproportionate impact in Ohio’s rural counties where expansion coverage rates are higher. In fact, as of December 2024, 362,829 individuals in rural Ohio counties received their coverage through expansion, alone. These individuals, in addition to the 1.1 million others in these Ohio counties, rely on Medicaid for essential healthcare services, including addiction treatment.

In states with expansion, coverage for individuals with SUD has doubled highlighting the importance of maintaining robust funding for these programs. Expansion has also been the primary source of funding for addiction treatment in the state, with Medicaid covering half of all buprenorphine treatments. If expansion were eliminated due to the change in FMAP, the consequences for treatment may mean either a greater obligation on the state to finance those services directly, or, Ohio may exacerbate the opioid use disorder crisis, putting additional strain on our healthcare system, particularly for behavioral health providers.

As we consider the future of Ohio’s Medicaid expansion, it’s essential to recognize the critical role that FMAP plays in sustaining our healthcare system and supporting our state’s economy. Any changes to the FMAP rate must be carefully evaluated to ensure that we do not undermine the progress we have made in expanding access to care and addressing the opioid crisis.

Beyond the immediate impact on healthcare services, changes to FMAP could also have broader economic implications for Ohio. Medicaid represents about 4% of the state’s GDP, playing a vital role in supporting jobs and economic activity. If just 1% of that GDP were suddenly eliminated due to a cut in federal or state funding, the consequences could be severe. A sudden reduction in Medicaid funding could lead to job losses in the healthcare sector, reduced economic activity, reduced labor force participation, and increased financial strain on state and local governments. The ripple effects would be felt across the economy, impacting not only healthcare providers but also businesses and communities that rely on the stability and support provided by Medicaid as well as the budgetary stability it provides to Ohio’s process.

At the intersection of the federal 340B Drug Pricing program and the federal Medicaid Drug Rebate Program (MDRP), a potentially large set of Medicaid claims are generating duplicate discounts, which pharmaceutical manufacturers provide to eligible entities such as hospitals and health centers. These two complex federal programs were designed to reduce the costs of prescription drugs for providers that serve low-income patients, but both state Medicaid agencies and federal policymakers have been actively working to eliminate the unintended overlap of these two programs. To gain deeper insights into why duplicate discounts continue to occur, the scope of this concern, and to identify considerations of future policymaking, HMA conducted interviews with Medicaid officials and drug policy experts across several states.

Duplicate discounts occur when for a single sale a manufacturer is required to: (1) prospectively reduce the price of the product (a discount) they sell to a 340B covered entity in advance of the delivery of care to the patient; and (2) provide a retrospective payment (a rebate) to a state Medicaid program or managed care plan under the MDRP after care is delivered to a Medicaid enrollee. When duplicate discounts occur the manufacturer’s product is discounted twice for the same sale, contravening federal law, which prohibits duplicate discounts.

Despite the statutory prohibition, duplicate discounts remain a concern. Both state and federal policymakers have been actively addressing duplicate discounts but have been unable to identify clear and consistent policy solutions that neutralize this inefficiency. On the state level, Medicaid agencies and state legislatures have implemented policies to address duplicate discounts. On the federal level, the Health Resources and Services Administration (HRSA) and the Centers for Medicare & Medicaid Services (CMS) have conducted audits and published best practices for states to eliminate duplicate discounts. Nonetheless, duplicate discounts persist.

To gain deeper insights into how Medicaid agencies navigate duplicate discounts, Health Management Associates (HMA) conducted semi-structured interviews with former and current Medicaid directors and pharmaceutical policy experts in 14 states. Interviewees were asked about the frequency of duplicate discounts, the extent to which Medicaid agencies devote resources to tracking them, the policies states have implemented to address them, and the extent to which state or federal authorities are working to eliminate duplicate discounts.

Based on interviews, four key themes emerged:

Policymakers should consider that the environment for addressing duplicate discounts may become more complex in the future, which may increase the need for a federally coordinated policy solution. The complexity of the environment may deepen due to the increasing presence of contract pharmacies, the increasing presence of managed care in Medicaid programs, and the implementation of the drug pricing policies of the Inflation Reduction Act of 2022. Policy action coordinated across the various stakeholders (e.g., HRSA, CMS, state Medicaid agencies, covered entities, and manufacturers) may represent the best opportunity for success in eliminating duplicate discounts.

HMA partners with state, county, and local government entities nationwide to strategically allocate opioid settlement funds, driving impactful solutions for opioid use disorder (OUD) and overdose prevention. Through collaboration with policymakers, engaged stakeholders, and community members, we help clients develop funding priorities that enhance public health outcomes and improve quality of life. Our team has extensive experience working with counties across the U.S. to design and implement effective OUD programs. By fostering partnerships with clients, community advisory boards, and local organizations, we co-create community engagement strategies, tools, and plans that ensure meaningful participation in decision-making and sustainable program success.

We have a successful track record developing strategic expenditure plans for opioid abatement settlement funds that align with key funding priorities to drive measurable improvements in quality of life for individuals experiencing OUD and to implement effective overdose prevention initiatives.

Community-Driven Fund Allocation – Effective use of opioid settlement funds depends on robust community engagement and feedback, ensuring investments align with local needs and priorities.

Expert Facilitation of Consensus Building – HMA’s unique ability to navigate complex community dynamics enables us to diffuse tensions, validate diverse perspectives, and drive stakeholder alignment for impactful decision-making.

Data-Backed Strategic Planning – Our comprehensive data collection and analysis identify persistent challenges, best practices, and targeted actions across the continuum of care (prevention, intervention, and treatment), culminating in a final report that informs sustainable solutions.

Elevating Community Voices – We prioritize the insights of individuals with lived experience, healthcare providers, and tribal partners to ensure funding priorities reflect the real needs of those affected by OUD.

Blueprint for Sustainable Impact – The expenditure plan serves as a strategic manual for the effective use of opioid settlement funds, integrating state requirements with community-driven priorities to maximize long-term success.

With deep expertise in opioid settlement fund expenditure planning and a proven track record of success, HMA is uniquely positioned to help organizations nationwide design and implement effective OUD programs. Our team brings unparalleled experience in strategic planning, community engagement, and policy development, ensuring that funding is maximized for sustainable impact. We leverage strong partnerships and customized engagement strategies to drive data-driven, community-centered decision-making.

For recent examples of our work:

Contact our experts:

National Standards for Culturally and Linguistically Appropriate Services (CLAS) in Health and Healthcare frame how to improve healthcare quality and reduce disparities through a whole-person approach. Implementation of the CLAS standards demonstrates respect for individuals and responsiveness to their health needs, cultural beliefs and practices, preferred languages, and other communication needs. These standards guide the provision of high-quality care to people from all cultures and backgrounds, as well as persons with disabilities and rural populations. The 15 CLAS standards focus on governance, leadership, workforce, communication, language access, engagement, continuous improvement and accountability.

In 2022, Forbes reported that health inequities cost the US health system $320 billion now and could reach $1 trillion by 2040

Health Inequities Could Cost The U.S. Health System $1 Trillion By 2040, New Report Says

Our experts work with states, Certified Community Behavioral Health Clinics (CCBHC), behavioral health organizations, health systems and providers, health plans, and public health organizations to develop CLAS programs, assess gaps in the cultural and linguistic accessibility of services across a system, and provide tailored technical assistance and trainings. Adherence to CLAS standards is required by the Substance Abuse and Mental Health Services Administration (SAMHSA) for initiatives like the CCBHC model due to its positive impact on programming, outcomes, and disparity reduction.

Indiana Statewide Evaluation of Community Mental Health Center (CMHC) CLAS Compliance

HMA completed a comprehensive assessment of Indiana’s 24 CMHCs to evaluate the strengths and needs regarding CLAS standards. We provided coaching, technical assistance, and webinars to support the CMHCs to set goals, build action plans, operationalize CLAS standards, and align CCBHC demonstration preparation and CLAS efforts.

Delaware Division of Substance Abuse and Mental Health (DSAMH) CLAS Training & Mini-Grants

HMA collaborated with DSAMH to develop a strategy to increase cultural responsiveness of substance use disorder (SUD) services. This included implementing a CLAS mini-grant program to provide technical assistance and training for SUD services. We developed and delivered a CLAS “train-the trainer” curriculum for staff, focusing on culturally and linguistically responsive opioid use disorder (OUD) services for African American and Latine communities. We also created a CLAS standards assessment to frame community-based organization and provider improvement strategies.

CCBHC Transformation Projects Across the Country

Disparity reduction is key to the CCBHC model. Nationally, the HMA CLAS team offers technical assistance to states on how to embed CLAS standards into planning grant and demonstration grant applications. For states that have been awarded CCBHC funding, we can provide training on how to incorporate CLAS standards and disparity reduction strategies into various aspects of their operations. These include community needs assessments, advisory boards, policies and procedures, staff training, program operations, state administrative codes, quality improvement and assurance initiatives, as well as data collection and analysis processes.

HMA’s team tailors its support based on each client’s needs. HMA takes the following general approach to assess and implement CLAS standards:

Assess CLAS standard gaps at organization, system or state level focused on the three CLAS domains: Governance, Leadership and Workforce; Communication and Language Assistance; and Engagement, Continuous Improvement and Accountability

Provide tailored technical assistance and coaching to close gaps drawing on our team’s cultural and linguistic diversity and lived experiences with services that are inaccessible to persons with disabilities, as well as persons from racial, ethnic, linguistic, cultural, sexual, and gender minority groups

Design and facilitate training and webinars to address wide scale gaps. Webinar topics may include – using Continuous Quality Improvement (CQI) processes to reduce disparities; increasing language access through translation and interpretation best practices; how to use community needs assessments to identify disparities; and structuring advisory boards for maximum impact

Assist programs and states in developing a CQI strategy to monitor and adjust initiatives to ensure CLAS and disparity reduction initiatives are making demonstrable change