HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- In Focus: CMS Releases Medicare Advantage and Part D Payment Policies for CY 2025

- Arkansas Releases Medicaid Sustainability Review Aimed at Containing Costs

- Idaho Re-enrolls 22 Percent of Medicaid Beneficiaries Disenrolled During Redeterminations

- Iowa Cancels Dental RFP for Iowa Dental Wellness Plan, Hawki

- Molina, Cityblock Offer SDOH Resources to Dual Eligibles in Massachusetts

- Mississippi Senate Passes Medicaid Expansion Bill with Work Requirements

- Nebraska Governor Signs Bill to Increase Medicaid Payment Rates for Hospitals

- New Mexico Open Enrollment Begins for Turquoise Care Managed Care Program

- Oklahoma Launches SoonerSelect Medicaid Managed Care Program

- Rhode Island Medicaid Managed Care Procurement Attracts Four Bidders

- Virginia Reissues Notice of Intent to Award Medicaid Managed Care Contracts

- CMS Marketplace Final Rule Adjusts Network Standards, Enrollment Period, Access to Dental Care

- Kaiser Permanente Acquires Geisinger Health

- FTC Issues Injunction to Block Novant Health’s Acquisition of North Carolina Hospitals

In Focus

CMS Releases Medicare Advantage and Part D Payment Policies for CY 2025

This week, our In Focus section reviews the recently announced policy and payment updates from the Centers for Medicare & Medicaid Services (CMS) that will affect Medicare Advantage (MA) and Medicare Part D programs in calendar year (CY) 2025. We also take a look at the CY 2025 Part D Redesign Program Instructions.

Both the rate announcement and program instructions include important technical updates and payment policy changes that will affect MA and Part D plans. CMS previously released a proposed rule in November 2023 that included proposed policy changes to MA and Part D. Health Management Associates, Inc., colleagues are closely monitoring how the final Rate Notice will shape the industry’s approach to the separately proposed policies for supplemental benefits, integrated dual eligible special needs plans (D-SNPs), and encounter data policies among others.

The following are highlights from the CY 2025 Rate Announcement and significant changes CMS made from the Advance Notice released earlier this year.

Payment Impact on MA

CMS estimates that the final ate announcement will lead to a 3.70 percent increase in average payments to MA plans in CY 2025. This reflects the net payment impact of policy changes and updates to MA plan payments relative to 2024 and is the same amount as proposed in the CY 2025 Advance Notice released on January 31, 2024. As a result, MA plans will receive an estimated $16 billion increase in payments for CY 2025, and according to CMS, the federal government is expected to make $500−$600 billion in payments to MA plans in 2025. This reimbursement increase—which include all the various elements affecting MA plan payments, including the MA risk score trend—represents the average payment increase across all MA plans, although the actual impact on each plan will vary.

Effective Growth Rate

The effective growth rate finalized in the CY 2025 rate announcement is 2.33 percent, down slightly from 2.44 percent in the advance notice. The effective growth rate is driven largely by growth in Medicare fee-for-service expenditures, and the CY 2025 Rate Announcement was updated to include program payments during the fourth quarter of 2023. In addition, the technical medical education adjustment has declined from 67 percent in the Advance Notice to 52 percent in the Rate Announcement.

Medicare Advantage Risk Adjustment and Coding

The rate announcement continues to phase in the updated risk adjustment model by blending 67 percent of the risk score calculated using the updated 2024 MA risk adjustment model with 33 percent of the risk score calculated using the 2020 MA risk adjustment model. These revisions to the MA risk adjustment model, which include important technical updates to improve the model’s predictive accuracy, were finalized last year under the CY 2024 Rate Announcement with a three-year phase-in. The Rate Announcement also finalizes that CMS will adopt a new methodology for normalizing risk scores to more accurately address the effects of the COVID-19 pandemic.

Consistent with what the agency proposed in the Advance Notice, in CY 2025, CMS will apply the statutory minimum 5.90 percent MA coding pattern difference adjustment.

Star Ratings

CMS continues work toward implementing the “Universal Foundation” of quality measures—a subset of metrics aligned across public programs. CMS invites stakeholder feedback as it continues to explore adding measures to the Star Ratings, which are components of the Universal Foundation.

For the CY 2025 rate announcement, Star Ratings changes include the types disasters that are included in the adjustment, updates to the non-substantive measure specification, and the list of metrics for inclusion in the MA and Part D improvement measures and Categorical Adjustment Index for 2025 Star Ratings.

Part D Design and Part D Risk Adjustment Changes

The Rate Announcement details several important changes to the standard Part D drug benefit for CY 2025 as required by the Inflation Reduction Act (IRA). These adjustments include eliminating the coverage gap phase from a three-phase benefit (deductible, initial coverage, and catastrophic) and setting the annual cap on patient out-of-pocket prescription drug costs at $2,000. The changes in Part D coverage design will have a significant impact on liability for Medicare beneficiaries, Part D plans, drug manufacturers, and CMS.

CMS also finalized updates to the Part D risk-adjustment model to reflect Part D design changes included in the IRA and to ensure Part D plan sponsors can develop accurate bids for CY 2025. These changes include calibrating the Part D risk model using more recent data years and updating the normalization factor to reflect differences between MA-PD plan and standalone Part D plan risk score trends.

Key Considerations

Overall the final rate notice maintains stability and the opportunity for beneficiary choices in the MA program even as it continues to implement noteworthy changes in risk adjustment. The payment policies finalized in the CY 2025 Rate Announcement will have varying effects across MA plans, with some experiencing larger or smaller impacts in CY 2025. Plans should assess these effects as they prepare their bid submissions for 2025.

In the CY 2025 rate announcement, CMS indicates that the 3.70 percent increase will provide continued stability in beneficiary access, choice, and benefits while ensuring accurate, appropriate payments to Medicare Advantage organizations.

Looking ahead, CMS also has proposed policy and technical changes to the MA and Part D programs, which are expected to be finalized in the coming days. HMA’s summary analysis homes in on key issues that likely will be included in the final rule. CMS continues to solicit feedback from stakeholders on ways to reinforce and improve transparency in the MA program through the CMS Request for Information on MA data collection. Comments are due May 29, 2024.

The HMA team will continue to analyze the important payment and technical changes finalized in the CY 2025 rate announcement. We have the depth, experience, and subject matter expertise to assist with tailored analysis and the modeling capabilities to assess the policy impacts across the multiple rules and guidance.

If you have questions about the comments of the CY 2025 Rate Announcement and payment policies that impact MA plans, providers, and beneficiaries, contact Julie Faulhaber ([email protected]), Amy Bassano ([email protected]), Andrea Maresca ([email protected]), or Greg Gierer ([email protected]).

HMA Roundup

Arkansas

Arkansas Releases Medicaid Sustainability Review Aimed at Containing Costs. The Arkansas Department of Human Services released on March 29, 2024, a Medicaid sustainability review that outlines strategic options to control spending while still improving Medicaid services. The review found that the annual Medicaid program cost increased by 41 percent between fiscal years 2018 and 2023. The report also considers an upcoming decrease in the federal match rate, which will fall from 72 percent to 71.1 percent on October 1. Read More

Florida

Florida Submits Section 1115 Demonstration Waiver Request to Expand CHIP Eligibility. The Centers for Medicare & Medicaid Services (CMS) announced on March 29, 2024, that Florida submitted a request for a new Section 1115 demonstration waiver, titled the “Children’s Health Insurance Program Eligibility Extension,” to extend eligibility for the state’s Children’s Health Insurance Program (CHIP), called KidCare, to children in households with income up to 300 percent of the federal poverty level. The five-year waiver has a proposed effective date of April 2024. The public comment period will be open through April 28. Read More

Florida Files Lawsuit Against Premiums Provision in Continuous CHIP Coverage Federal Mandate. The Tampa Bay Times reported on March 28, 2024, that Florida filed a lawsuit against a provision within the new federal regulations that guarantees a minimum of 12 months of continuous Children’s Health Insurance Program (CHIP) coverage for eligible individuals. The provision, which prevents states from terminating coverage for children whose parents fail to pay monthly premiums, has halted the passage of a bill that would expand CHIP coverage. A hearing for the suit is scheduled for April 18. Read More

Idaho

Idaho Senate Passes Fiscal 2025 Medicaid Budget Bill Requesting Additional Funding for New Staff, Provider Rate Increases. The Idaho Capital Sun reported on April 2, 2024, that the Idaho Senate has passed a bill, drafted by the Joint Finance-Appropriations Committee, that requests additional funding for new staff and pay increases for current medical providers in the state’s fiscal 2025 Medicaid budget. The proposed budget would provide a total of $253 million in additional funding and return $278 million in unspent funds from the current fiscal year. The budget totals $4.7 billion, or $4.4 billion after the reversion. The bill now heads to the House. Read More

Idaho Receives Federal Approval to Reimburse Spouses, Parents for Personal Care Services. The Centers for Medicare & Medicaid Services approved on March 29, 2024, Idaho’s request to amend its Behavioral Health Transformation Medicaid Section 1115 demonstration waiver to reimburse spouses and parents of minor children for providing personal care services to eligible individuals. The waiver amendment will be effective through March 31, 2025. Read More

Idaho Re-enrolls 22 Percent of Medicaid Beneficiaries Disenrolled During Redeterminations. The Idaho Capital Sun reported on April 1, 2024, that more than 22 percent of the approximately 185,000 Medicaid beneficiaries disenrolled during Idaho’s Medicaid eligibility redeterminations process have re-enrolled in the program. Approximately 44 percent of those who regained coverage re-enrolled within 30 days of losing coverage. The state also offers retroactive coverage extending back 90 days. Idaho disenrolled 4,745 beneficiaries in February, including 885 due to ineligibility and 3,860 due to procedural reasons. Read More

Illinois

Illinois House Committee Advances Bill Aiming to Further Regulate PBMs. Health News Illinois reported on April 3, 2024, that the Illinois House Health Care Availability and Accessibility Committee has advanced a bill which would expand regulations for pharmacy benefit managers (PBMs). The proposed bill would ban PBMs from steering patients to certain pharmacies and mandating the use of specific mail-order pharmacies. It also aims to have 100 percent of rebates go back to either the plan sponsor, employer, or consumer. Read More

Illinois Medical Professionals Sign Letter in Support of Prescription Drug Affordability Board. Health News Illinois reported on March 28, 2024, that more than 200 medical professionals in Illinois have written a letter to the General Assembly in support of a bill that would establish a five-member board to evaluate and set price limits on costly prescription drugs. Additionally, the bill would allow a 15-member council of legislators and stakeholders to further examine and address drug prices. A hearing on the legislation is scheduled for April 2 with the House Health Care Availability and Accessibility Committee. Read More

Iowa

Iowa Cancels Dental RFP for Iowa Dental Wellness Plan, Hawki. The Iowa Department of Health and Human Services announced on April 1, 2024, that it has cancelled the request for proposals (RFP) for pre-paid ambulatory health plans to provide dental services in the Iowa Dental Wellness Plan and Healthy and Well Kids in Iowa (Hawki) programs. The RFP may be reissued in the future. Read More

Massachusetts

Molina, Cityblock Offer SDOH Resources to Dual Eligibles in Massachusetts. Fierce Healthcare reported on April 2, 2024, that Massachusetts based plan Senior Whole Health, a subsidiary of Molina, is partnering with Cityblock Health to enhance services provided to Medicare-Medicaid dually eligible members. Cityblock will use its integrated care model to address members’ health-related social needs, including by connecting them to community-based organizations for support with obtaining housing, healthy foods, and utility reimbursements. Read More

Michigan

Michigan Disenrolls 14,688 Medicaid Beneficiaries During February Redeterminations. The Detroit News reported on March 29, 2024, that Michigan has disenrolled 14,688 Medicaid beneficiaries during redeterminations in February, bringing the total number of residents who lost coverage to 701,589 since June 2023. The state renewed coverage for 142,296 beneficiaries in February, for a total of 1.4 million. The state has also extended renewals to May 2024 for beneficiaries undergoing life-saving treatments, extended automatic enrollment into a Medicaid managed care plan up to 120 days, and is providing beneficiaries an extra month to submit their paperwork. Read More

Mississippi

Mississippi Senate Passes Medicaid Expansion Bill with Work Requirements. Mississippi Today reported on March 28, 2024, that the Mississippi Senate has passed a Medicaid expansion bill, which expands coverage for adults with incomes up to 100 percent of the federal poverty level and includes a 30 hour per week work requirement. The bill now heads to the House. Read More

Nebraska

Nebraska Governor Signs Bill to Increase Medicaid Payment Rates for Hospitals. Nebraska Public Media reported on March 29, 2024, that Nebraska Governor Jim Pillen has signed a bill, sponsored by Senator Mike Jacobson (R-North Platte) and 19 co-sponsors, that will garner more than $1 billion in federal funding through a hospital assessment of up to 6 percent of patient revenue to raise Medicaid payment rates for inpatient and outpatient hospital care beginning July 1. The bill is intended to reduce hospital closures and improve quality of care. Read More

New Jersey

New Jersey Legislators Consider Cuts to Charity Care Program in Lieu of New Medicaid Reimbursement Program. The New Jersey Monitor reported on April 2, 2024, that New Jersey legislators are considering a $204.8 million cut to the state’s charity care program and would implement a new program eligible for federal funding. The shift, which could garner $345 million in matching dollars to pay reimbursements under Medicaid, would also change charity care reimbursement rates to 40 percent for hospitals where charity care is most frequent, or 50 percent for hospitals that operate at a loss of 15 percent or more, and 30 percent for hospitals in the state’s poorest regions. Current program reimbursements range from nearly 100 percent to 43 percent of charity care cost. Read More

New Jersey Owes More than $113 Million to Federal Government Due to Improper Medical Claims, OIG Finds. The U.S. Office of the Inspector General (OIG) released in March 2024 an audit that found that New Jersey has not refunded $94.8 million in federal Medicaid funds after previously claiming Medicaid reimbursement for adult partial care services that did not comply with federal and state requirements. In a previous audit, OIG had found that 44 of the 100 claims examined were non-compliant with requirements and recommended the $94.8 million refund. The current audit noted that the state implemented procedural recommendations from the previous report, and recommends that it refund the $94.8 million as well as $18.8 million associated with telehealth non-compliance found in the current audit. Read More

New Mexico

New Mexico Open Enrollment Begins for Turquoise Care Managed Care Program. The Santa Fe New Mexican/AOL reported on April 2, 2024, that open enrollment has begun for New Mexico’s revamped Medicaid managed care program, dubbed Turquoise Care, and will remain open through May 31. The program, which will include food and housing initiatives, will replace the Centennial Care program beginning July 1, 2024. The four managed-care organizations under Turquoise Care will be Blue Cross and Blue Shield of New Mexico, Molina Healthcare of New Mexico, Presbyterian Turquoise Care, and United Healthcare Community Plan of New Mexico. Read More

New York

New York City Council Seeks $225 Million in Funding for Mental Health Services in Fiscal 2025 Budget. Crain’s New York Business reported on April 2, 2024, that the New York City Council is asking Mayor Eric Adams to include an additional $225 million in funding to support preventive mental healthcare in the city’s final fiscal 2025 budget. The request seeks to restore Adams’ previous cuts to mental health programs last year and proposes $77 million to support mental health care in the city’s Community Schools, $15 million for a youth peer support program, and $5 million to provide in-person and virtual mental health care for youth. The proposal also includes efforts to add $20 million for the 15/15 Supportive Housing Program, which provides housing and mental health services. The council and the mayor will next begin negotiations and must reach a final budget by June 30. Read More

Medicaid Providers Push for Bill to Reform Medicaid Audit Process. Crain’s New York Business reported on March 28, 2024, that 50 Medicaid providers have sent a letter to New York Governor Kathy Hochul and the legislature to push for the inclusion of a bill that would reform the state’s Medicaid auditing process in the final budget, due April 1. The bill, sponsored by Assemblywoman Amy Paulin (D-Scarsdale), cites unfair punitive processes as justification for the reform and would prevent the inspector general from extrapolating fines for technical or human errors and give providers more time to appeal audits. Read More

North Carolina

North Carolina Medicaid Expansion Enrollment Surpasses 400,000. ABC11 reported on April 2, 2024, that enrollment in the North Carolina Medicaid expansion program has surpassed 400,000 since launching in December. The state enrollment dashboard shows 96,318 enrollees live in rural communities and 30,741 enrollees are young adults as of March. Read More

Oklahoma

Oklahoma Launches SoonerSelect Medicaid Managed Care Program. Fox 25 reported on April 1, 2024, that the Oklahoma Health Care Authority launched its new Medicaid managed care program, SoonerSelect, April 1. Approximately 80 percent of SoonerCare members have switched to the new program, which is served by Centene/Oklahoma Complete Health, CVS/Aetna, and Humana. Members were autoenrolled into a plan and have until June 30 to switch plans. Read More

Rhode Island

Rhode Island Medicaid Managed Care Procurement Attracts Four Bidders. The Rhode Island Current reported on March 28, 2024, that the Rhode Island Department of Administration has confirmed that four plans have submitted proposals for the state’s Medicaid managed care reprocurement: incumbents Neighborhood Health Plan of Rhode Island, Tufts Health Public Plans, and United Healthcare of New England, along with new entrant Blue Cross Blue Shield of Rhode Island. The state will award no more than three contracts. The five-year contracts are expected to begin July 1, 2025, with a five-year renewal option. Read More

Rhode Island Medicaid Paid $38 Million For Out-of-state Residents, Audit Finds. WPRI reported on March 28, 2024, that the Rhode Island Medicaid program paid $38 million to Medicaid managed care organizations to cover individuals living in nine other states and Puerto Rico between 2019 and 2021, according to an audit conducted by the Rhode Island Office of the Auditor General. The audit recommends that the state improve its system for tracking recipients’ residency, develop monthly reporting to determine eligibility, and utilize databases to determine when beneficiaries leave the state. State officials noted that the pandemic complicated their ability to track beneficiaries’ residency, but indicated that they will review current systems and implement modifications if necessary. Read More

Vermont

Vermont House Approves Bill to Expand Medicaid Eligibility for Pregnant Individuals. The Vermont Digger reported on March 27, 2024, that the Vermont House gave preliminary approval to a bill, sponsored by Representative Lori Houghton (D-Chittenden), that would expand eligibility for the state’s Medicaid and Medicare programs. Specifically, the bill would expand Dr. Dynasaur coverage, a Medicaid-funded program for pregnant children and teens, to age 26, and increase the current Medicaid income limit for pregnant individuals from 213 percent to 317 percent of the federal poverty level by 2030. Additionally, the bill would increase the income limits for Medicare payment subsidies to reduce costs for more than 19,000 Medicare beneficiaries. The legislation, if enacted, would take effect in January 2026. Read More

Virginia

Virginia Reissues Notice of Intent to Award Medicaid Managed Care Contracts. The Virginia Department of Medical Assistance Services (DMAS) reissued on April 1, 2024, a new notice of intent to award Cardinal Care Medicaid managed care program contracts to five health plans: incumbents CVS/Aetna, Elevance/Anthem, Sentara/Optima Health, and United Healthcare, and non-incumbent Humana. A separate foster care specialty plan contract was awarded to Elevance/Anthem. The state previously rescinded its original notice of intent to the same plans. The contract is set to begin on July 1, 2024, and will run for six-years with two two-year renewal options. Read More

National

CMS Marketplace Final Rule Adjusts Network Standards, Enrollment Period, Increases Access to Dental Care. Modern Healthcare reported on April 2, 2024, that the Centers for Medicare & Medicaid Services (CMS) released the 2025 Notice of Benefit and Payment Parameters final rule, which establishes network adequacy standards based on the time and distance patients must travel for in-network care beginning in 2026 and aligns the annual open enrollment period for state-based Marketplaces with the federal sign-up campaign. Specifically, the rule requires state-based Marketplaces to begin open enrollment November 1 and accept sign-ups until January 15, permits some individuals to enroll in Marketplace policies year-round, promotes coverage for individuals with chronic or costly conditions, allows states to cover routine adult dental services as a routine benefit, and allows earlier access to benefits upon switching plans. Read More

Biden Administration Responds to Medicare Prescription Drug Price Negotiation Offers. Reuters reported on April 2, 2024, that the Biden administration has responded to offers from manufacturers of 10 drugs selected for the Medicare drug price negotiations. No details have been provided, although each company can meet with the Centers for Medicare & Medicaid Services up to three times for further negotiations before a final price is announced on August 1. The negotiated prices will go into effect in 2026. Read More

CMS Proposes Medicare Rate Increases, Strengthened Oversight for Facilities. Modern Healthcare reported on March 28, 2024, that the Centers for Medicare & Medicaid Services (CMS) has issued separate proposed rules which would increase Medicare reimbursements for nursing homes, hospices and inpatient psychiatric hospitals in fiscal 2025. Under the rules, skilled nursing facilities would get an increase of 4.1 percent in Medicare reimbursements; inpatient psychiatric hospitals would receive a 2.7 percent increase; and hospices would receive a 2.6 percent increase in the statutory aggregate cap that CMS pays per patient. CMS would also increase oversight of those facilities, specifically by imposing financial penalties to ensure compliance with health and safety mandates. Read More

CMS Proposes 2.8 Percent Increase for Inpatient Rehabilitation Facilities; Releases RFI to Develop Star Rating System. Modern Healthcare reported on March 27, 2024, that the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule to increase the prospective payment system by 2.8 percent for inpatient rehabilitation facilities (IRFs) in fiscal 2025. CMS has also released a request for information (RFI) seeking feedback on the development of a five-star rating system for IRFs, which aims to help consumers comparatively shop and promote competition. The RFI seeks public input regarding criteria that could be used for a star rating system and how the ratings should be presented to consumers. Read More

HHS Extends Temporary Special Enrollment Period to November 30. The U.S. Department of Health and Human Services (HHS) announced on March 28, 2024, that the Centers for Medicare & Medicaid Services (CMS) will extend a temporary special enrollment period from July 31 to November 30 to ensure that people maintain Medicaid and Children’s Health Insurance Program coverage while transitioning to Marketplace coverage. CMS additionally released guidance and tools for states regarding federal renewal requirements, guidance to Medicaid managed care plans to streamline coverage renewal, and resources to families to help navigate their respective state Medicaid fair-hearing process. Read More

CMS Releases Final Rules Aimed At Non-ACA Compliant ‘Junk’ Plans. The Centers for Medicare & Medicaid Services (CMS) released on March 28, 2024, the Short-Term, Limited-Duration Insurance (STLDI) and Independent, Noncoordinated Excepted Benefits Coverage, or “Junk Insurance”, Final Rules, intended to reduce health care costs and protect consumers from purchasing lower quality insurance. The rules will limit STLDI plans, which are not subject to the Affordable Care Act’s critical consumer protections, to four months rather than three years and require insurance companies to increase transparency regarding plans. Read More

Medicaid, CHIP Enrollment Drops More than 785,000 in December 2023, CMS Reports. The Centers for Medicare & Medicaid Services (CMS) released on March 28, 2024, that enrollment in Medicaid and the Children’s Health Insurance Program (CHIP) was approximately 85.1 million in December 2023, a decrease of 785,863 since November 2023. Medicare enrollment was 66.9 million, down 105,241 from November 2023, including 32.6 million in Medicare Advantage plans. More than 12 million Medicare-Medicaid dual eligibles are counted in both programs. Read More

ACA Marketplace Unauthorized Plan Switching Poses Challenge to Beneficiaries. KFF Health News reported on April 2, 2024, that some Affordable Care Act Marketplace beneficiaries are being switched to different plans without their permission. Unauthorized plan-switching has become an issue in the 32 states served by the federal marketplace, in which some agents have been able to access recipients’ accounts. Federal regulators have indicated they are undertaking efforts to combat plan-switching, but have not revealed the number of complaints that they have received. Read More

MACPAC Issue Brief Analyzes Medicaid School-based Services. The Medicaid and CHIP Payment and Access Commission (MACPAC) released in March 2024 an issue brief that found that although new Centers for Medicare & Medicaid Services (CMS) guidance regarding school-based Medicaid services and administrative claiming has addressed barriers and burdens facing the expansion of services, some challenges remain. Specifically, officials have raised concerns that Medicaid agencies and managed care organizations may deny coverage of services outside of school to students because of services received in school. Medicaid providers may also be less likely to provide services in school given the complicated process that school-based providers must undergo to offer services. Read More

Industry News

Kaiser Permanente Closes Geisinger Health Acquisition. Modern Healthcare reported on April 2, 2024, that Kaiser Permanente has acquired Geisinger Health and incorporated it into the new nonprofit, Risant Health, established to create a national value-based care network. Geisinger’s president and chief executive, Jaewon Ryu, will transition to chief executive of Risant Health. Read More

Aetna, Elevance, Kaiser to Offer Weight-loss Drug Wegovy for Medicare Beneficiaries with Cardiovascular Conditions. Health Payer Specialist reported on April 1, 2024, that Aetna, Elevance Health, and Kaiser Permanente will be the first U.S. health insurers to cover the weight-loss drug Wegovy for Medicare beneficiaries with heart conditions. The insurers’ announcements follow new guidelines released by the Centers for Medicare & Medicaid Services that permit Medicare Part D plans to cover anti-obesity drugs when used to treat cardiovascular conditions. Kaiser Permanente will offer the drug effective immediately while Elevance will offer the drug in the coming weeks. Read More

FTC Issues Injunction to Block Novant Health’s Acquisition of North Carolina Hospitals. Modern Healthcare reported on April 1, 2024, that the Federal Trade Commission (FTC) is seeking a preliminary injunction to block Novant Health’s $320 million acquisition of two hospitals in North Carolina from Community Health Systems. The preliminary injunction, filed in U.S. District Court for the Western District of North Carolina, alleges that the purchase would be anticompetitive and would allow Novant to control nearly 65 percent of the market for hospital services in the Eastern Lake Norman Area. Read More

Adventist Health Acquires Two California Hospitals from Tenet Healthcare. Modern Healthcare reported on March 29, 2024, that Adventist Health acquired two California hospitals, Sierra Vista Regional Medical Center and Twin Cities Community Hospital, from Tenet Healthcare in a $550 million transaction. Read More

University of California Irvine Acquires Four Tenet Healthcare Facilities in $800 Million Deal. Modern Healthcare reported on March 27, 2024, that University of California Irvine health system has acquired four of Tenet Healthcare’s hospitals and their affiliated outpatient locations in Southern California. The $800 million deal includes Lakewood Regional Medical Center, Los Alamitos Medical Center, Fountain Valley Regional Hospital and Medical Center, and Placentia-Linda Hospital. The facilities acquired generated an estimated $1 billion in revenue in 2023. Read More

UnitedHealth Group Pays Out $3.3 Billion in Loans to Providers Affected by Cyberattack. Reuters reported on March 28, 2024, that UnitedHealth Group has paid out more than $3.3 billion in loans to providers impacted by the cyberattack on Change Healthcare, 40 percent of which has gone to safety net hospitals and federally qualified health centers serving high-risk patients and communities. Providers will have 45 business days to pay back the loan. UnitedHealth Group has begun processing more than $14 billion of medical claims as it resumes partial software services. The U.S State Department has offered a bounty of up to $10 million for information on the hacking group responsible for the cyberattack.Read More

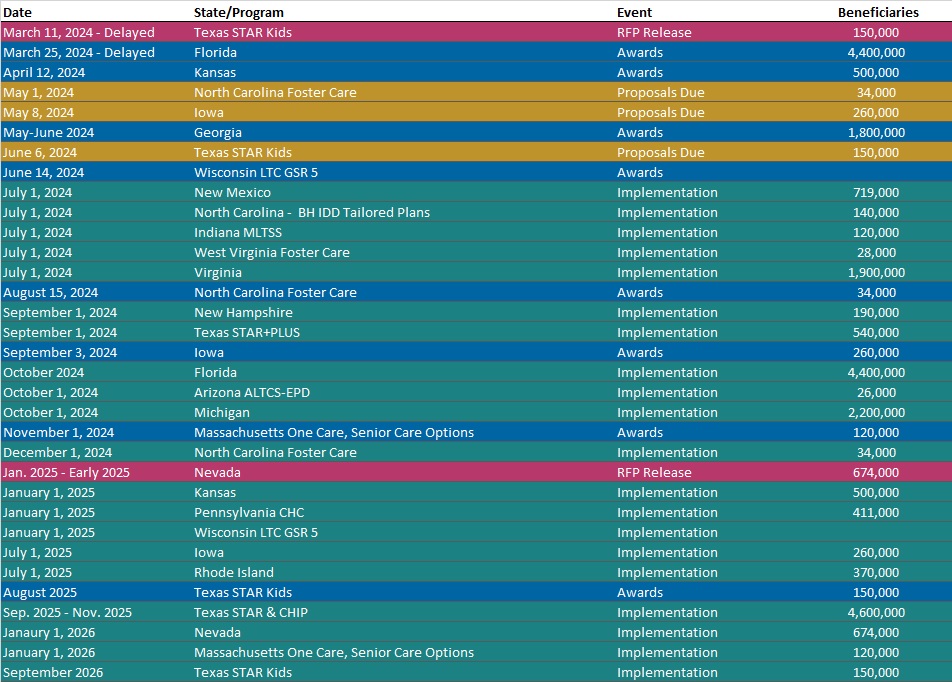

RFP Calendar

HMA News & Events

HMA Webinar:

Substance Use Disorder (SUD) Ecosystem of Care: Empowering Change in the SUD Ecosystem. Wednesday, April 10, 2024, 12 PM ET. Join us for part 2 in our webinar series “Substance Use Disorder Ecosystem of Care: Pivoting to Save Lives.” As covered in the first webinar, we have an imperative to think and act differently to change the trajectory of not just the long-standing opioid epidemic, but other existing and emerging harmful substance use and addiction. Grounded in equity, empowering change in the SUD ecosystem requires person-centered and community driven approaches to respond to individual wants and needs. We must meet each person where they are as well as consider how the ecosystem of each community can be leveraged to drive change. Register Here

Leavitt Partners, an HMA company, Webinar:

The Future of Medicare Advantage Supplemental Benefits. Thursday, April 4, 2024, 12 PM ET. More than 30 million Americans are enrolled in MA plans and more than half of Medicare-eligible beneficiaries participate in the program—a number that was less than 30 percent just a decade ago. One reason Medicare beneficiaries opt to participate in MA plans is the ability to offer supplemental benefits, including dental, vision, hearing, transportation services, OTC items, an in-home support services. Initially limited to a core set of offerings, over the years, MA supplemental benefits have undergone significant changes that have led to a broader range of allowable benefits, an expansion of how benefits can be targeted, and, growth in the number of plans offering such benefits. Register Here

Wakely, an HMA company, Webinar:

How the New MA/PD Risk Models & Post-IRA Part D Benefit are Changing the View of Medicare Profitability. Monday, April 22, 2024, 3 PM ET. Medicare risk scores continue to evolve, with increasing weight given to the MA’s 2024 v28 HCC risk score model and the introduction of a new post-IRA RxHCC risk score model for payment year 2025. In addition, basic Part D benefit costs are expected to change dramatically due to the overhaul of the Part D defined standard benefit in 2025 as part of the Inflation Reduction Act. These key changes to the Medicare Advantage and Part D programs have the potential to cause material shifts in the revenue, claims, and the drivers of profit/loss for MA/PD plans. This raises the question: how will the profiles for historically profitable/unprofitable members change in 2025 & beyond? Wakely has conducted in-depth analyses to explore the impact of risk score model changes and 2025 Part D defined standard benefit changes has on the overall profitability of certain MA-PD cohorts. In this webinar, we will share an overview of some of the results and discuss how plans can potentially use this analysis to inform strategies. Register Here