This week's roundup:

- In Focus: CMS Finalizes 2026 Payment and Policy Updates for Medicare Advantage and Part D

- In Focus: Medicaid Managed Care Enrollment Update: Q4 2024

- Arkansas Governor Enacts Law Allowing Physician Assistants as Medicaid Primary Care Providers

- Indiana Legislators Pass Medicaid Expansion Work Requirement Bill

- Trump to Target Pharmaceutical Imports with New Tariffs

- Federal Judge Blocks Nursing Home Staffing Mandate

- CareSource to Acquire Commonwealth Care Alliance

- More News Here

In Focus

CMS Finalizes 2026 Payment and Policy Updates for Medicare Advantage and Part D

CMS approves average increase of 5.06 percent for MA plans while deferring major policy changes in MA and Part D programs

The Centers for Medicare & Medicaid Services (CMS) released the 2026 Medicare Advantage (MA) and Part D Rate Announcement on April 7, 2025, finalizing payment updates for calendar year (CY) 2026. This announcement came shortly after the release of the Contract Year 2026 MA, Part D, and PACE Policy and Technical Changes Final Rule, on April 4, 2025. Together, these updates mark the conclusion of CMS’s annual rulemaking cycle for Medicare Advantage, ahead of the June 2, 2025, deadline for 2026 MA plan bids.

Notably, because of the timing of the draft notices and proposed rule, Trump Administration officials ultimately had more input into policies omitted from the rate notice and final policy rule than on policies that were finalized. For example, the final rule is exclusive of proposals to expand coverage for anti-obesity medications, guardrails for artificial intelligence (AI), and new requirements related to utilization management and prior authorization procedures.

In his confirmation hearing, CMS Administrator Mehmet Oz, MD, cited Medicare Advantage prior authorization practices and health risk assessments that lead to upcoding as areas that deserve further consideration and scrutiny, raising the potential for future regulatory shifts and even legislative reform. With the possibility of Medicare, including MA, facing cuts as part of broader budget negotiations in Congress, the rate notice and policy rule offer program stability counterbalancing the political and fiscal pressures that may emerge this year.

CMS has sought to stabilize MA and Part D programs into 2026, and stakeholders can benefit from understanding the impact in markets for 2026 and the signals of potential regulatory changes to come. For more in-depth analysis and insights on the rate notice, look for our policy and actuarial experts’ brief due out next week.

The remainder of this In Focus article reviews CMS’s decisions on major payment and policy proposals in the Rate Announcement and Final Rule and examines key considerations for healthcare stakeholders.

Payment Impact on Medicare Advantage Organizations

In the CY 2026 Rate Announcement, CMS projects that federal payments to MA plans will increase by 5.06 percent from 2025 to 2026, which represents a $25 billion increase in expected payments to MA plans next year. According to CMS, this represents an increase of 2.83 percentage points compared with the CY 2026 Advance Notice that is largely attributable to an increase in the effective growth rate. The increase in the effective growth rate—increasing to 9.04 percent in the Rate Announcement from 5.93 percent in the Advance Notice—is primarily the result of the inclusion of additional data on Medicare fee-for-service (FFS) expenditures, including payment data through the fourth quarter of 2024.

The Rate Announcement estimates represent the average increase in payments to MA plans and actual payments will vary from plan to plan. Below, Table 1 provides CMS estimates of the impact of finalized payment changes on net MA plan payments.

MA Risk Adjustment Changes

As expected, CMS finalized the last year of the three-year phase-in of the MA risk adjustment model, which requires calculating 100 percent of the risk scores using only the 2024 CMS-HCC (Hierarchical Condition Category) model in 2026. CMS also addressed stakeholder concerns with the planned transition toward a risk adjustment model based on MA encounter data, as previewed in the CMS CY 2026 Advance Notice. CMS pledged to engage stakeholders in this model development process while continuing to evaluate the feasibility, transparency, and timing of a future transition to an encounter-based risk adjustment model.

CMS also finalized the MA coding pattern adjustment factor of 5.9 percent for CY 2026, which is the statutory minimum adjustment factor to account for differences in coding patterns between MA plans and providers under Medicare FFS Parts A and B.

Part D Risk Adjustment

For CY 2026, CMS finalized the revised 2026 RxHCC model with adjustments for maximum fair price drugs. Importantly, CMS also finalized using separate FFS normalization factors for MA-Prescription Drug (MA-PD) plans and Prescription Drug Plans (PDPs), making 2026 the second year CMS will vary normalization for these two markets. The calculation of the factors for CY 2026 is different, however, and will have substantially greater impact than the method used previously. It also will reduce Part D risk scores significantly for MA-PD plans while increasing scores for PDPs.

MA Star Ratings

CMS continues to solicit feedback from stakeholders on ways to simplify and refocus MA Star Ratings measures to focus more on clinical care, outcomes, and patient experience of care measures. Also included in the CY 2026 Rate Announcement are non-substantive measure specification updates and a list of measures included in the Part C and Part D improvement measures and categorical adjustment index for the 2026 Star Ratings.

Separately, in the policy and technical changes rule, CMS finalized new regulatory requirements designed to enhance MA beneficiary protections in an inpatient setting, provisions related to allowable special supplemental benefits for the chronically ill (SSBCI), and the care experience for dually eligible beneficiaries enrolled in MA special needs plans.

Enhancing MA Beneficiary Appeal Rights and Notification Requirements

CMS is finalizing provisions that limit the ability of MA plans to reopen and modify a previously approved inpatient hospital decision on the basis of information gathered after the approval. Under the final rule, MA plans will be able to reopen an approved hospital admission only due to error or fraud. In addition, CMS finalized several provisions to enhance beneficiary appeal rights and new reporting and notice requirements, including:

- Ensuring that MA appeals rules apply to adverse plan decisions, regardless of whether the decision was made before, during, or after the receipt of such services

- Codifying existing guidance that requires plans to give a provider notice of a coverage decision

- Ensuring enrollees have a right to appeal MA plan coverage denials that affect their ongoing source of treatment

Non-Allowable Special Supplemental Benefits for the Chronically Ill

The final rule establishes guardrails for SSBCI benefits by codifying a list of non-allowable examples (e.g., unhealthy food, alcohol, tobacco, life insurance). CMS did not finalize proposals that were designed to improve administration of supplemental benefits and enhance transparency of the availability of such benefits.

Improving Care Experience for Dual Eligibles

CMS finalized new requirements for dual eligible special needs plans (D-SNPS) that are applicable integrated plans (AIPs) as follows:

- D-SNPs will be required to have integrated member ID cards for their Medicare and Medicaid plans

- D-SNPs will be required to conduct an integrated health risk assessment for Medicare and Medicaid, rather than separate ones for each program.

These provisions affecting certain D-SNPS plans will be effective for the 2027 plan year.

Provisions Pertaining to the Medicare Part D Inflation Reduction Act

CMS is finalizing proposals to codify existing requirements related to key provisions of the Inflation Reduction Act, including no cost sharing for adult vaccines and capping monthly copayments for insulin at $35. In addition, CMS is codifying existing guidance related to the implementation of the Medicare Prescription Payment Plan, which is also part of the Inflation Reduction Act.

Key Proposals CMS Has Yet to Finalize

As noted earlier, CMS finalized a streamlined rule that excluded several regulatory changes identified in the November 2024 proposed rule. In addition to provisions related to coverage of anti-obesity medications, guardrails for AI, and mandatory analysis of the health equity impact of MA plans utilization management practices, the following proposals were not finalized. CMS notes that these proposals might be finalized in future rulemaking.

- Expanding Medicare Part D Medication Therapy Management (MTM) eligibility criteria

- Ensuring equitable access to behavioral health services by applying MA cost-sharing limits

- Enhancing the Medicare Plan Finder to include information on plan provider directories

- Promoting informed choice by enhancing CMS review of MA marketing and communication materials

- Enhancing rules on MA plans’ use of internal coverage criteria

Key Considerations

The policies finalized in the CY 2026 Rate Announcement are projected to increase average Part C payments to MA plans by 5.06 percent in CY 2026—a significant uptick from the payment updates originally proposed in the CY 2026 Advance Notice. Nonetheless, the final rate increase will have varying effects across MA plans, with some experiencing larger or smaller impacts in CY 2026. MA plans should assess these outcomes as they prepare their bid submissions for 2026.

According to the CY 2026 Rate Announcement, CMS expects that the 5.06 percent increase will provide continued stability for the MA program and its beneficiaries while ensuring accurate and appropriate payments to Medicare Advantage organizations.

In the CY 2026 MA and Part D Final Rule, CMS adopted a significantly scaled-back final rule, which omitted some of the more far-reaching proposals for MA and Part D that were originally proposed in November 2024. CMS, however, could potentially revisit and finalize some of these proposals in future rulemaking. Moreover, new regulatory requirements that enhance enrollee protections in inpatient care settings and improving the care experience for dual eligibles signal CMS’s continued interest in improving program oversight and enhancing consumer protections for MA beneficiaries.

Connect With Us

MA stakeholders need to undertake scenario planning and be prepared to adapt to a rapidly evolving federal policy environment. From modeling and impact assessments of specific policy changes to strategy development and implementation, HMA is home to experts with diverse skill sets. Our team can help stakeholders assess and prepare for potential changes to prior authorization, looking holistically at their organization’s operations, patient care models, and reimbursement strategies. Our team also provides detailed modeling and assessments to ensure health plans are prepared for changes in risk adjustment and coding policies, supplemental benefits, and other key issues affecting capitation payment, bids, and care delivery models.

For details about the finalized payment and policy rules contact our featured experts Julie Faulhaber, Greg Gierer, and Tim Courtney.

Medicaid Managed Care Enrollment Update: Q4 2024

Our second In Focus section reviews the most recent Medicaid enrollment trends in capitated risk-based managed care programs in 29 states.[1] Health Management Associates Information Services (HMAIS) collected and analyzed monthly Medicaid enrollment data from the fourth quarter (Q4) of 2024.

The data offer a timely overview of trends in Medicaid managed care enrollment and valuable insights into state-level and managed care organization (MCO)-specific enrollment patterns. This information allows state governments, their partners, and other organizations interested in Medicaid to track enrollment shifts. Understanding the underlying drivers of enrollment shifts is critical for shaping future Medicaid policies and adjusting program strategies amid a dynamic healthcare landscape.

Overview of the Data

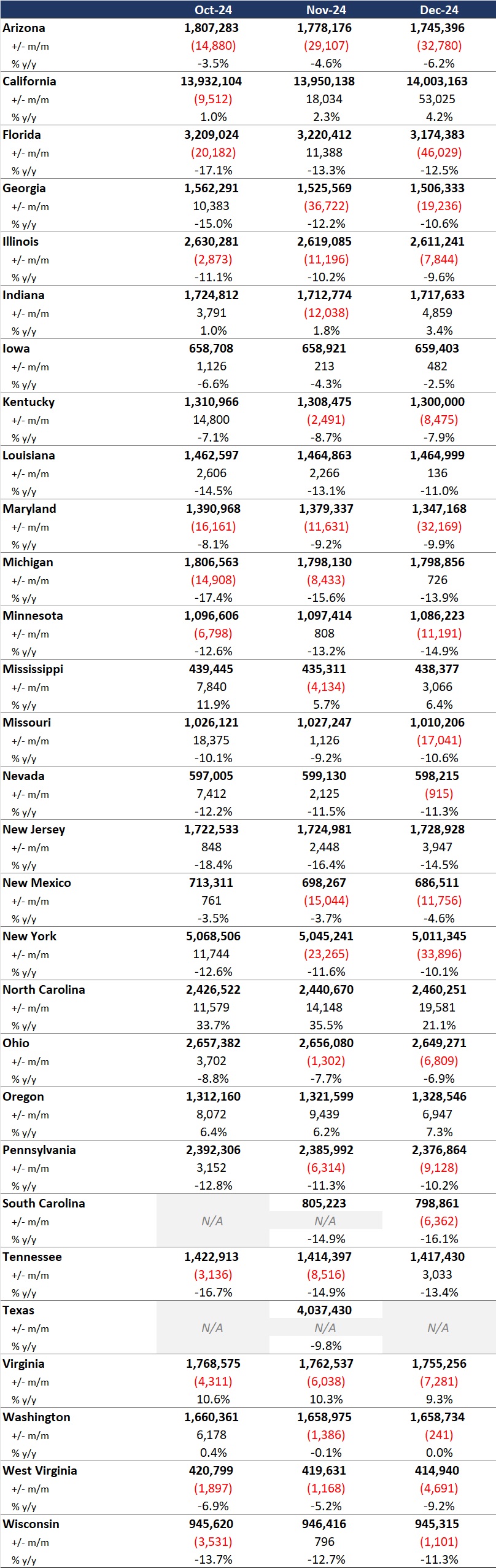

The 29 states included in our review have released monthly Medicaid managed care enrollment data via a public website or in response to a public records request from Health Management Associates (HMA). This report reflects the most recent data posted or obtained. HMA has made the following observations related to the enrollment data (see Table 1):

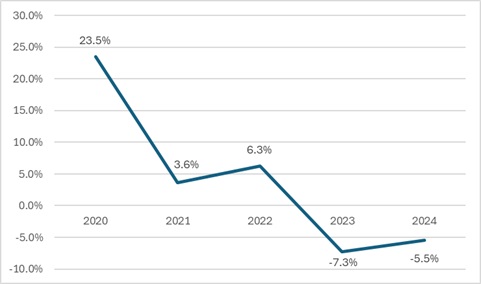

- As of December 2024, across the 29 states tracked in this report, Medicaid managed care enrollment was 61.7 million, down by 3.6 million (-5.5%) year-over-year.

- Though most states experienced declines in enrollment, six states saw enrollment increases as of December 2024—double the number of states from the previous year.

Figure 1. Year-Over-Year Medicaid Managed Care Enrollment Percent Change in Select States, 2020−24

- Among the 22 expansion states included in this report, net Medicaid managed care enrollment has decreased by 2.1 million (-4%) to 49.5 million members at the end of Q4 2024, compared with the same period in 2023.[2]

- Among the seven states included in this report that had not expanded Medicaid as of December 2024, net Medicaid managed care enrollment decreased by 1.5 million, or 1 percent, to 12.3 million members at the end of Q4 2024 compared with to the same period in 2023.

Table 1. Monthly MCO Enrollment by State—October through December 2024

It is important to note the limitations of the data presented. First, not all states report the data at the same time during the month. Some of these figures reflect beginning of the month totals, whereas others reflect an end of the month snapshot. Second, in some cases the data are comprehensive in that they cover all state-sponsored health programs that offer managed care options; in other cases, the data reflect only a subset of the broader managed Medicaid population. This limitation complicates comparison of the data described above with figures reported by publicly traded Medicaid MCOs. Hence, the data in Table 1 should be viewed as a sampling of enrollment trends across these states rather than as a comprehensive comparison, which cannot be established based solely on publicly available monthly enrollment data.

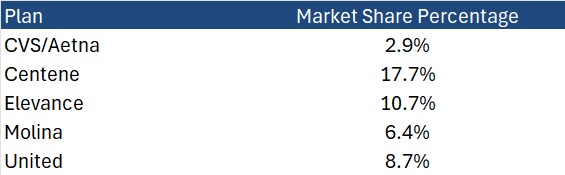

HMAIS also compiles a more detailed quarterly Medicaid managed care enrollment report representing nearly 300 health plans in 41 states. The report provides by plan enrollment plus corporate ownership, program inclusion, and for-profit vs. not-for-profit status, with breakout tabs for publicly traded plans. Table 2 shows a sampling of plans and their national market share of Medicaid managed care beneficiaries based on a total of 66.3 million enrollees. These data too should be viewed as a broader representation of enrollment trends rather than as a comprehensive comparison.

Table 2. National Medicaid Managed Care Market Share by Number of Beneficiaries for Sample of Publicly Traded Plans, 2024

What to Watch

Enrollment in Medicaid MCOs has experienced significant fluctuations recently, influenced both by policy changes and economic factors. Since April 2023, Medicaid enrollment has been on a downward trajectory as states complete eligibility redeterminations after the end of the COVID-19 public health emergency. This trend, coupled with financial and political challenges, necessitates strategic planning for stakeholders to navigate the evolving Medicaid landscape effectively.

Potential changes that may affect enrollment and require scenario and readiness planning include:

- Federal requirement, or a new state option, to implement Medicaid work requirements for at least some categories of enrollees

- Changes to the federal financial match policy, which may cause some states to make different decisions about their Affordable Care Act expansion program for adults

- Modifications in requirements and expectations for more efficient eligibility processes to improve the accuracy of determinations and assignment to eligibility categories

Connect with Us

HMA is home to experts who know the Medicaid managed care landscape at the federal and state levels. The HMAIS subscription provides point-in-time and longitudinal Medicaid enrollment data, health plan financials, and additional actionable information about eligibility expansions, demonstration and waiver initiatives, as well as population- and service-specific information. HMAIS also includes a comprehensive public documents library containing Medicaid requests for proposals and responses, model contracts, scoring sheets, and protests.

For detail about the HMAIS enrollment report and subscription service, contact Andrea Maresca and Alona Nenko.

[1] Arizona, California, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin.

[2] Health Management Associates, Inc. Medicaid Managed Care Enrollment Update—Q4 2023. HMA Weekly Roundup. April 17, 2024.

HMA Roundup

Alabama

Alabama Legislature Passes Prenatal Presumptive Eligibility Bill. The Associated Press reported on April 8, 2025, that the Alabama Senate approved Senate Bill 102, which would require Alabama Medicaid to provide prenatal presumptive Medicaid eligibility for up to 60 days. The bill, sponsored by Senator Linda Coleman-Madison (D-Birmingham), has a provision that will repeal the law on October 1, 2028. The legislation now heads to Governor Kay Ivey for signature.

Alabama Legislature Passes Pharmacy Benefit Manager Regulation Bill. The Associated Press reported on April 8, 2025, that the Alabama House voted 102-0 to pass a bill that would impose regulations on pharmacy benefit managers (PBMs). Senate Bill 252, sponsored by Senator Billy Beasly (D-Clayton), aims to protect independent pharmacies by requiring PBMs to reimburse the businesses at the state Medicaid agency’s reimbursement rate for prescription drugs. The bill now heads to Governor Kay Ivey for signature.

Alabama Senate Committee Advances Medicaid, SNAP Eligibility Bills. The Alabama Political Reporter reported on April 3, 2025, that the Senate Finance and Taxation Committee advanced two Medicaid and Supplemental Nutrition Assistance Program (SNAP) eligibility requirement bills, introduced by Senator Arthur Orr (R-Decatur). Senate Bill 245 would bar the Alabama Medicaid Agency from accepting certain self attestations for eligibility determination and require the Department of Human Resources (DHR) to enter into data-matching agreements for SNAP eligibility cross-checking. It would also require the agency and department to regularly publish reports relating to fraud and noncompliance investigations. Senate Bill 246 would prohibit DHR from using broad-based categorical eligibility for SNAP benefits.

Arkansas

Arkansas Governor Enacts Law Allowing Physician Assistants as Medicaid Primary Care Providers. KATV reported on April 7, 2025, Arkansas Governor Sarah Huckabee Sanders signed several healthcare-related bills into law, including SB 100 to allow physician assistants to serve as primary care providers under Medicaid. Separately, SB 264 establishes the Arkansas Primary Care Payment Improvement Working Group to enhance the primary care payment system, and HB 1549, the Arkansas Cybersecurity Act of 2025, which addresses digital protections in healthcare.

Florida

Florida Lawsuit Over Medicaid Managed Care Oversight Dismissed by Federal Judge. Health News Florida reported on April 7, 2025, that a federal judge has dismissed a lawsuit alleging that Florida failed to provide sufficient oversight of Medicaid managed care organizations (MCOs) that provide home and community-based services (HCBS). The lawsuit claims that MCOs have not provided adequate reasons when denying coverage and that the Florida Agency for Health Care Administration’s hearing process does not hold the plans accountable. The judge dismissed the case because the plaintiffs did not allege that they failed to receive care. The plaintiffs have three weeks to file an amended complaint.

Indiana

Indiana Legislators Pass Medicaid Expansion Work Requirement Bill. The Indiana Capital Chronicle reported on April 8, 2025 that the Indiana House voted 66-28 to pass Senate Bill 2, sponsored by Senator Ryan Mishler (R-Mishawaka), which would require the state Family and Social Services Administration (FSSA) to seek federal approval to add work requirements for the Healthy Indiana Plan (HIP). The bill would require most HIP beneficiaries, the Medicaid expansion population, to work or volunteer 20 hours per week in order to stay enrolled. The Senate must concur with the legislation due to multiple House amendments before it can head to Governor Mike Braun for signature.

Indiana Replaces Medicaid Actuarial Services Contractor. Louisville Public Media reported on April 5, 2025, that the Indiana Family and Social Services Administration (FSSA) has selected Deloitte as its new Medicaid actuarial services contractor after going through a procurement process, replacing incumbent Milliman. The change comes after the state discovered a $1 billion Medicaid forecasting error in late 2023. FSSA has entered into negotiations with Deloitte and will issue a final Notice of Award after contract finalization.

Indiana House Committee Advances Medicaid Bills. The Indiana Capital Chronicle reported on April 3, 2025, that the Indiana House Ways and Means Committee advanced House Bill 1689, which would require FSSA to work with the Division of Disability and Rehabilitative Services Advisory Council to plan how it will serve individuals requiring extraordinary care, add an FSSA ombudsman position for individuals receiving disability services, and require FSSA to create an annual report on Medicaid home and community-based waiver services. Another House committee advanced House Bill 1391, which would allow certain services providers in the home and community-based CHOICE program to not be Medicaid-approved and allow for a study to possibly realign coverage areas for Area Agencies on Aging.

Nevada

Nevada Lawmakers Advance Bill to Increase Mental Health Medicaid Reimbursement in University Clinics. The Nevada Current reported on April 4, 2025, that the state Senate Committee on Commerce and Labor advanced a bill that aims to increase Medicaid reimbursement rates at university-based training clinics that provide mental health services to the public. Senate Bill 353, sponsored by Senator Marilyn Dondero Loop, (D-Las Vegas), would create a reimbursement category for these clinics and two per diem reimbursement rates; one for psychiatric residents and one for non-medical trainees. The bill now heads to a financial Senate committee for consideration.

New York

New York CDPAP Rate Changes to Undergo Federal Review. Crain’s New York Business reported on April 7, 2025, that the Centers for Medicare & Medicaid Services will be conducting a 90 day review of changes the state plans to make within the Consumer Directed Personal Assistance Program (CDPAP). According to US Department of Health and Human Services Secretary Robert F. Kennedy, Jr., the review will examine “how the changes will affect access to care and evaluate the appropriate use of federal funding.” The state requested to change payment rates in late March 2025. The final transition to a single fiscal intermediary, Public Partnerships LLC, was originally scheduled to take effect April 1, 2025, but has been delayed due to ongoing litigation. Governor Kathy Hochul indicated the review of rate changes will not affect the transition. As of the start of April, 60,000 people have transitioned out of CDPAP to receive care through alternative programs.

South Dakota

South Dakota Medicaid Expansion Enrollment Expected to Decline. South Dakota Public Broadcasting reported on April 7, 2025, that South Dakota’s Medicaid expansion program is expected to cover approximately 30,000 individuals, approximately 10,000 less than last year, according to the state Department of Social Services. This projection has led lawmakers to reduce state Medicaid funding by $4.5 million for fiscal 2026. In addition, South Dakotans will be voting in November 2026 on whether to repeal Medicaid expansion if the federal medical assistance percentage drops below 90 percent.

Wisconsin

Wisconsin Governor Proposes Ending Medicaid Birth Cost Recovery. The Wisconsin Examiner reported on April 3, 2025, that Wisconsin Governor Tony Evers is proposing to end the state’s Medicaid birth cost recovery policy, which allows counties to seek repayment from noncustodial fathers when Medicaid covers childbirth. Evers’ 2025-27 biennium budget includes $3.8 million to offset lost county revenue. Dane and Milwaukee counties have already ended the practice.

National

Trump to Target Pharmaceutical Imports with New Tariffs. Politico reported on April 8, 2025, that President Donald Trump announced plans to impose tariffs on pharmaceutical imports. Speaking at the National Republican Congressional Committee dinner, Trump stated that these tariffs would prompt companies to relocate production from countries like China back to the United States. He did not provide specific details about the forthcoming tariffs.

Federal Judge Blocks Nursing Home Staffing Mandate. Modern Healthcare reported on April 7, 2025, that a federal judge in Texas has blocked the Biden administration’s nursing home staffing mandate following a lawsuit filed in May 2024 from the American Health Care Association (AHCA). The judge ruled that CMS exceeded its authority and that the mandate must align with Congressional statutes. The mandate would have required nursing homes to provide a registered nurse on-site 24/7 and a minimum of 3.48 hours of nursing care per resident each day.

Senate Passes Budget Resolution. The Hill reported on April 5, 2025, that the Senate passed their budget resolution with a 51-48 vote following debate on numerous amendments. Senator Dan Sullivan (R-AK) proposed an amendment that included language about “strengthening and improving” Medicaid for vulnerable populations. The amendment was adopted, 51-48. The budget resolution includes separate instructions for Senate committees while retaining the budget instructions previously passed by the House, including directing the House Energy and Commerce Committee to identify policies to reduce the deficit by not less than $880 billion. The House and Senate must agree to an identical budget resolution to allow the Senate to use the reconciliation process to advance its policy priorities.

Senate Confirms Dr. Mehmet Oz for CMS Administrator. The New York Times reported on April 4, 2025, that the U.S. Senate confirmed Dr. Mehmet Oz as the administrator of the Centers for Medicare & Medicaid Services (CMS) with a 53-45 vote. Dr. Oz, a former heart surgeon and television personality, will oversee programs providing health coverage to approximately 160 million Americans.

MedPAC Meeting Is Scheduled for April 10-11. The Medicare Payment Advisory Commission (MedPAC) announced on April 4, 2025, that its next meeting will be held on April 10-11. The meeting will discuss physician fee schedule reforms and relative payment rates; structural differences between the fee-for-service part D program and Medicare Advantage (MA) Part D markets; the utilization and delivery of MA supplemental benefits; how rural hospitals are affected by MA; paying for Medicare software technologies; access to certain hospice services for beneficiaries with end-stage renal disease; and Medicare policies meant to improve nursing home quality.

MACPAC Meeting Is Scheduled for April 10-11. The Medicaid and CHIP Payment and Access Commission (MACPAC) announced on April 3, 2025, that its next meeting will be held on April 10-11. The meeting will feature a special panel discussion on automation and artificial intelligence in prior authorization. Other discussion topics include a vote on recommendations to improve care transitions for children with special health needs; review of draft chapters for the June report to Congress on PACE, self-direction in HCBS, access to medications for opioid use disorder, and residential services for youth with behavioral health needs; healthcare access for children in foster care; and the transition of Medicare-Medicaid Plans.

Federal Judge Issues Temporary Injunction Blocking $11 Billion Public Health Funding Cuts. CBS News reported on April 3, 2025, that U.S. District Judge Mary McElroy in Rhode Island issued a temporary injunction blocking the Trump administration’s plan to cut $11 billion in public health funding after 23 states and D.C. sued to stop the move. The states argue the funding supports critical programs like disease tracking, vaccination access, and mental health services, and claim the cuts were abrupt and unjustified. The administration justified the cuts by stating that the pandemic is over, and the funds are no longer necessary. Judge McElroy plans to issue a written order following her bench ruling after a hearing.

HHS Reorganization Lays Off Duals Office, FOIA Staff Amid Broader Workforce Cuts. Modern Healthcare reported on April 2, 2025, that as part of ongoing reorganization efforts, the Department of Health and Human Services (HHS) has laid off staff managing programs for Medicare and Medicaid dually eligible enrollees, including those supporting the Financial Alignment Initiative and the Program of All-Inclusive Care for the Elderly (PACE). The Medicare-Medicaid Coordination Office will move under the Center for Medicare and Medicaid Innovation (CMMI). In addition, Freedom of Information Act (FOIA) teams at agencies such as the Centers for Disease Control and Prevention (CDC), Food and Drug Administration (FDA), and National Institutes of Health (NIH) were downsized or eliminated, raising concerns about delays in public access to health records amid broader HHS staff reductions.

Industry News

CareSource to Acquire Commonwealth Care Alliance. CareSource announced on April 9, 2025, that it has acquired Commonwealth Care Alliance (CCA) following a $217 million reserve shortfall that led Massachusetts to suspend enrollment in CCA’s two dual eligible plans, One Care and Senior Care Options. The Ohio-based nonprofit will invest $400 million to restore solvency, assume operations—including primary care practices—and support enrollment reopening. The state agreed to limit CareSource’s losses for two years, with any profits above a 2 percent margin used to repay MassHealth. CCA chief executive Chris Palmieri and the board resigned, and all employees will transition to CareSource, which now serves over 2 million members in 13 states.

CVS Health Names Brian Newman CFO. CVS Health announced on April 8, 2025, that Brian Newman has been named executive vice president and chief financial officer designate, effective April 21. Newman will succeed current CFO Tom Cowhey on May 12, when Cowhey transitions to a strategic advisor role. Dr. Amy Compton-Phillips will join as executive vice president and chief medical officer on May 19.

Differential Coding in Medicare Advantage Drove $33 Billion in Excess Payments in 2021. The American Journal of Managed Care reported on April 7, 2025, that differential coding in Medicare Advantage (MA) plans significantly inflated risk scores and payments compared to traditional Medicare, with wide variation across insurers, according to a study from the Annals of Internal Medicine. In 2021, MA risk scores were 0.19 higher on average, resulting in $33 billion in additional payments, largely driven by more persistent and frequent diagnoses in MA.

DOJ Requests Judge Move Forward with UnitedHealth Group Medicare Advantage Fraud Case. STAT News reported on April 3, 2025, that the U.S. Department of Justice (DOJ) has requested that a federal judge move forward with its lawsuit against UnitedHealth Group over alleged Medicare Advantage fraud after a special master previously recommended the judge dismiss the case. The lawsuit claims the payer withheld approximately $2 billion in overpayments from taxpayers, and the special master claimed the DOJ did not provide sufficient evidence regarding the overpayments. United has until May 2, 2025, to respond to the DOJ, and the department will have a chance to reply to the company’s filing by May 19, 2025. A final decision will be made in summer 2025.

RFP Calendar

The Actuaries' Corner

Trump Healthcare Price Transparency Order may not Bring Intended Relief to Patients. President Donald Trump first told hospitals to put prices online in 2019 during his first administration and transparency rules for insurers soon followed, as the government sought to lower U.S. healthcare spending, the highest in the world. But not all prices were posted and consumers struggled to find and analyze the scattered data.

Discover other developments in the Wakely Wire here.

HMA News & Events

Leavitt Partners Webinar

Digital Health & Interoperability Policy: New Ideas to Drive Federal Government Efficiency. Thursday, April 24, 2025, 12 PM ET. Building on previous successes across multiple administrations, we have an opportunity to continue to advance patient data exchange by taking an innovative approach to federal health care technology policy. How can we more effectively advance Fast Healthcare Interoperability Resources Application Programming Interface (FHIR API)-based data exchange between payers, providers, patients, and pharmacies? What should the role of The Centers for Medicare & Medicaid Services (CMS) and Office of the National Coordinator for Health IT (ONC) be over the next decade? What federal technology policies are needed (or not needed any longer) to truly create a patient-centered health care system? How does Certified Electronic Health Record Technology (CEHRT) need to evolve to support a modern, API-based, interoperable ecosystem? Join us to explore how top payers and providers, in collaboration with Leavitt Partners, an HMA Company, crafted bold, innovative federal technology and interoperability policy recommendations for the Trump administration.

HMA Webinar

Survey Readiness: Prepare, Respond, Succeed, a 5-part Virtual Series. Every Wednesday in April 1:00 PM to 2:30 PM ET.

In today’s complex healthcare environment, navigating the scrutiny of regulatory and accreditation bodies like The Centers for Medicare & Medicaid Services (CMS), Department of Health (DOH), The Joint Commission, and Det Norske Veritas (DNV) Healthcare is critical for the success of every hospital and health system. Unexpected surveys, triggered by recertification, validations or even complaints, can occur at any time.

HMA has partnered with the Healthcare Association of New York State (HANYS) to develop the content for Survey Readiness: Prepare, Respond, Succeed, a 5-part virtual series on Wednesdays in April from 1- 2:30pm ET. HMA’s expert faculty will also co-teach the sessions. Attendees will dive deep into organizational strategies and tactics to prepare, manage and respond to surveyors effectively – and get the essential skills to excel in survey readiness.

While some examples in the program will address issues from the New York state perspective, attendees from organizations nationwide should attend. Hospital and long-term care executive team and leaders in quality and compliance, survey coordinators, and risk management will benefit from attending.

Survey Readiness: Prepare, Respond, Succeed

Virtual Series | April 2 – 30

- April 2: Survey readiness 101: Overview and getting started

- April 9: Preparation: How to mitigate risk and prepare for upcoming surveys

- April 16: They’re here: Establishing a survey response and management protocol

- April 23: Responding to survey findings: How to develop a strong correction plan and knowing your options

- April 30: What’s next: Leveraging survey findings and strengthening organizational quality and compliance

The cost to attend this series is $475.

State hospital associations and their members can enjoy $50 off when using this code when registering: SHADISCOUNT25

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Reports

- Updated Medicaid Managed Behavioral Carve-Out Calendar

- Updated Medicaid Managed Care Rate Certifications Inventory

- Updated Federal Regulatory Tracker

- HMA Federal Health Policy Snapshot

- Updated Idaho, Oregon, and Texas State Overviews

Medicaid Data

Medicaid Enrollment and Financial data from Florida, Iowa, Kentucky, Maryland, Nevada, New Jersey, Ohio, Pennsylvania, and Texas.

Public Documents:

Medicaid RFP documents from Indiana, Rhode Island, and Washington.

Medicaid Managed Care Rate Certifications, Medicaid Quality Strategy Reports, Medicaid Committee Meeting Materials, and other key documents from the following states: California, Colorado, Illinois, New Mexico, North Carolina, Ohio, Texas, and Wisconsin

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].