HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- In Focus: CMS Picks Up the Pace on Transforming the Medicare Landscape

- California Governor Signs Bill to Establish No-Bid Contract with Medicaid Plan

- Colorado Policy Restricts Use of Behavioral Health Interns, Unlicensed Therapists

- Florida Considers Denying Medicaid Coverage for Gender-Affirming Care for Transgender Youth

- Georgia Receives Federal Renewal of 1915 HCBS Waiver for Five Years

- Idaho Releases Medicaid Dual Programs RFI

- Illinois Accepting Medicaid Applications for Individuals 42 and Up, Regardless of Immigration Status

- Massachusetts Releases Request for Responses for Behavioral Health, LTSS Community Partners

- New York HCBS Children’s Waiver Providers to Receive Temporary 25 Percent Rate Increase

- Oregon Medicaid CCO Program ‘Helped Slow Cost Growth,’ State Says

- Pennsylvania Physical HealthChoices Beneficiaries Must Choose New Plan Before August 16

- Tennessee Drafts Amendment to TennCare Block Grant Waiver

- Washington Seeks 5-Year Renewal of Medicaid Transformation 1115 Waiver

- COVID-19 Is Associated with Increased Incidence of Future Medicaid Conditions, Costs, Wakely Study Finds

- CMS Awards $49 Million in Grants to Boost Medicaid, CHIP Enrollment of Children

- CMS Proposes 2.7 Percent Increase in Medicare Reimbursement Rate for Outpatient, Ambulatory Surgical Center Services

- Pediatric Home Service Acquires Craig HomeCare, Cherub Medical Supply

- Health Plan Joins Hospital Systems as Co-Owner of Delaware Regional Medicare ACO

In Focus

CMS Picks Up the Pace on Transforming the Medicare Landscape

Over the course of three weeks CMS has made a series of Medicare announcements that arguably contain the most sweeping changes to the Medicare program proposed thus far by the Biden Administration. With final Medicare payment rules on the horizon, CMS is poised to further the Biden Administration’s directional imprint on the Medicare program. The recent releases include:

- A new opportunity focused on rural hospitals designed to preserve –and likely expand – access to services in rural communities;

- A proposed payment and policy rule for outpatient and ambulatory care services also lays the groundwork for new transparency and competition initiatives;

- Significant updates to most aspects of Medicare’s accountable care organizations; and

- New opportunities to support oncology providers in moving towards a whole person approach to services through the Enhancing Oncology Model.

For this In Focus, our HMA experts focus on the 2,000+ page Calendar Year (CY) 2023 Medicare Physician Fee Schedule (PFS) proposed rule released to the public on July 7, 2022. The Medicare Physician Fee Schedule and its accompanying proposed policy changes is a significant tool CMS uses to advance annual updates in reimbursement policy and to consider other policy changes in traditional Medicare that have implications for the program writ large.

Generally, in the CY 2023 proposed rule the Administration is continuing to broaden and deepen the way it applies its health equity framework to the entirety of the proposals, strengthens access to behavioral health services, and reinvigorates value-based care through the Medicare Shared Savings Program’s (MSSP) Accountable Care Organizations (ACOs) structure.

The rule includes a myriad of other policy proposals. We highlight a few of the key ones below. For example, CMS must make updates to the physician fee schedule conversion factor which has ripple effects throughout the Medicare program. The agency is also proposing updates to reimbursement for certain telehealth services and coverage enhancements for hearing and dental services, among many others proposals.

Key Action Items for Stakeholders

All comments to the rule are due to CMS by September 6, 2022. CMS plans to publish the final rule in late fall 2022.

The public comment opportunity is essential for CMS to deepen its understanding of the impact of the proposals. The agency considers stakeholders’ concerns, questions, and other feedback as it makes decisions on which proposals to finalize, modifications to the proposals, or to defer implementation.

This is also an important window of opportunity during which stakeholders can analyze the impact of the proposals and the business decisions these may require, plan advocacy around the proposed changes, and prepare for implementation which generally will occur on January 1, 2023.

Many leading national provider organizations are making their concerns with the annual payment update a central piece of their advocacy agenda in Congress. These concerns will add to the long list of structural issues that Congress is expected to debate leading up to and well after this year’s mid-term elections. However, providers still need to weigh the inflation pressures and uncertainty surrounding Congress’ ability to intervene with new opportunities in the Medicare program and Medicare Advantage market.

Medicare Shared Savings Program

CMS proposes significant changes to the Medicare Shared Savings Program (MSSP), which aredesigned to accelerate provider and Medicare beneficiary participation in accountable relationships. Last year, CMS established a goal of all Medicare beneficiaries will be in a care relationship with accountability for quality and total cost of care by 2030. These proposals are designed to make further progress on achieving that goal. First, CMS proposes several changes to MSSP which respond to criticisms that the program is not sufficiently flexible to support Medicare providers who may have different levels of sophistication with respect to risk-sharing and available capital for practice transformation. Additionally, it reflects federal officials understanding of the impact social care services can have on Medicare beneficiary health and well-being.

Proposed changes to the MSSP include the following:

- Investment in New Accountable Care Organizations (ACOs): CMS proposes to provide a one-time fixed payment of $250,000 and quarterly payments for the first two years of the 5-year agreement period for certain ACOs. Eligible ACOs are those that are low revenue ACOs, inexperienced with performance-based risk Medicare ACO initiatives, new to MSSP and that serve underserved populations.

- The initial application cycle to apply for advance investment payments will occur during CY 2023 for a January 1, 2024, start date.

- The advance investment payments would increase when more beneficiaries who are dually eligible for Medicare and Medicaid or who live in areas with high deprivation or both, are assigned to the ACO.

- The advance investment payments would be recouped once the ACO begins to achieve shared savings in their current agreement period and in their next agreement period, if a balance persists. If the ACO doesn’t achieve shared savings, CMS would not recoup the funding.

- Funds would be available to address the social and other needs of people with Medicare.

- CMS would also provide greater flexibility in the progression to performance-based risk for new ACOs to ease the transition to and likelihood of success under risk arrangements. Specifically, for ACOs with agreement periods beginning on January 1, 2024, and in subsequent years, ACOs inexperienced with performance-based risk could participate a one-side risk model for up to 7 years.

- Current ACO Participants: For performance years beginning January 1, 2023, and in subsequent years, CMS may allow certain currently participating ACOs to elect to continue in their glide path agreement.

- CMS intends to incorporate an adjustment for prior savings that would apply in the establishment of benchmarks for renewing ACOs and re-entering ACOs

- CMS also is proposing several changes to the benchmark methodology to better support long term participation in MSSP and less capitalized ACOs for agreement periods beginning January 1, 2024. This includes adjusting the benchmark for prior savings and reducing the impact of the negative regional adjustment.

- CMS also plans to include a fixed, prospectively projected administrative growth factor (referred to in this proposed rule as the Accountable Care Prospective Trend (ACPT)), into a three-way blend with national and regional growth rates to update an ACO’s historical benchmark for each performance year (PY) in the ACO’s agreement period.

- CMS requested comments on alternative benchmarking policies: a) exclude the ACO’s own assigned beneficiaries from the assignable beneficiary population used in regional expenditure calculations, b) expand the definition of the ACO regional service area to use a larger geographic area to determine regional FFS expenditures, or c) both.

- Beginning on January 1, 2023, and subsequent years, CMS is planning to change the all-or-nothing approach to determining an ACO’s eligibility for shared savings based on quality performance to allow for scaling of shared savings rates for ACOs that fall below the 30th/40th percentile quality standard threshold required to share in savings at the maximum sharing rate. To be eligible ACOs must meet minimum quality reporting and performance requirements.

- CMS also plans to update MSSP quality-measurement policies, including a new health equity adjustment that would award bonus points for high quality measure performance and serving higher proportions of underserved or dually eligible beneficiaries.

Behavioral Health Changes

The CY2023 MPFS also seeks to enhance access to behavioral health services and strengthen the behavioral health model within the Medicare program. The proposals include:

- Creating an exception to supervision requirements, allowing marriage and family therapists, licensed professional counselors, addiction counselors, certified peer recovery specialists, and others to provide behavioral health services while being under general supervision rather than “direct” supervision.

- Paying psychologists and social workers to help manage behavioral health needs as part of the primary care team.

- Establishing new payments for team-based, comprehensive management and treatment of chronic pain.

- Enhancing the ability of ACOs to address social, behavioral, and physical health care needs, by making advanced shared savings payments to new, smaller ACOs. CMS states these funds could be used to hire behavioral health practitioners and address the social needs, such as food and housing.

- Clarifying Opioid Treatment Programs may bill Medicare for services performed by mobile units without obtaining a separate registration and increasing payment rates to Opioid Treatment Programs.

These proposed changes represent a major shift in traditional Medicare’s coverage of behavioral health services. If finalized and in combination with changes to coverage for telehealth services, these could have a meaningful impact for Medicare beneficiaries including those in rural communities. ACOs, health systems, and other providers may have greater opportunities to include behavioral health practitioners in their model of care.

Payment Issues

Payments to physicians through the PFS are proposed to decline by roughly 4 percent from CY 2022 to CY 2023. The bulk of this decline stems from CMS’s proposal to reduce the PFS conversion factor (CF) by nearly 4.5 percent. In dollar terms the proposed 2023 CF would be $33.08, which is $1.53 lower than the 2022 CF. This policy change to the CF reflects three dynamics, two of which are changes directly mandated by the U.S. Congress:

- Expiration of a statutory one-year 3 percent increase in payments,

- A statutory 0 percent payment update for CY 2023, and

- A budget neutrality adjustment across all billing codes resulting from modifications to PFS weights which increased the relative value of primary care billing codes.

Payment changes contained within the CY 2023 proposed rule result in differential impacts for individual physician service codes and physician specialties. While payment rates for many codes are proposed to decline uniformly by roughly 4 percent, payment rates for some services codes may decline more, such as for some physician inpatient hospital care codes that may decline more than 10 percent. In the context of physician specialty type, CMS estimates 5 percent payment increases on average for infectious disease and a 3 percent increases on average for internal medicine and geriatrics. By contrast, CMS estimates a 2 percent decline on average for clinical psychology and a 3 percent decline on average for radiology.

Notable Issues for Stakeholder Consideration

In addition to the major structural and financing issues discussed above, the wide-ranging rule contains numerous other policy proposals with direct and indirect implications on Medicare providers, and beneficiaries, and other stakeholders. Table 1 provides a snapshot of some of the issues that warrant further consideration.

Table 1. Other Notable Proposed Changes Impacting Health Care Providers and Stakeholders

| Topic | Summary |

| Telehealth | The Proposed Rule makes a number of potential changes to telehealth policies: Implements several of the policies mandated by the Consolidated Appropriations Act (CAA) of 2022, which extended telehealth flexibilities CMS adopted during the public health emergency (PHE) for 151 days after the end of the PHE. The rule also confirms Medicare telehealth services performed with dates of service occurring on or after the 152nd day after the end of the PHE will revert to pre-PHE rules and the appropriate place of service (POS) indicator will be required to be included on the claim.Permanently adds three new services to the list of reimbursable telehealth services: prolonged inpatient hospital, prolonged skilled nursing, and prolonged home services. Adds several additional services to the Medicare Telehealth Temporarily (through the end of CY 2023) adds several telehealth services: new therapy services, audiology, and new behavior assessment/treatment services. Temporarily (during PHE plus 151 days) requires practitioners to use billing modifier code ‘95’ and either provider of service code ‘02’ (not in home) or ‘10’ (home) for all telehealth services. At the end of the PHE-plus-151 days, billing requirements will revert to pre-PHE methods. Permanently (beginning in 2023) requires practitioners to use billing modifier ‘93’ for all audio-only services, and requires RHCs, FQHCs, and OTPs to use modifier ‘93’ for eligible mental health services furnished via audio-only services. However, CMS specifically did not propose to extend audio-only evaluation and management visits beyond the 151 days after the PHE. |

| Dental | Medicare pays for a limited number of dental services when the dental care is an integral part of a beneficiary’s medical treatment. CMS is proposing to add to the list of conditions where that may be appropriate such as dental exams and necessary treatments prior to organ transplants, cardiac valve replacements, and valvuloplasty procedures. CMS is also seeking feedback on other clinical conditions where the dental services are linked to the clinical success of the medical services. |

| Hearing | CMS is proposing to allow audiologists to perform and bill for certain diagnostic hearing tests for patients with non-acute conditions without a physician order. |

| Wound Care | CMS is proposing several policies to update payment, coding and billing for skin substitutes which are commonly used in the treatment of diabetic foot ulcers and venous leg ulcers. CMS is proposing to change the terminology of skin substitutes to ‘wound care management products’ in order to reflect how clinicians use these products, to provide a more consistent approach to coding for these products, and to treat and pay for these products as a physician supply instead of a separately paid product under the Average Sales Price methodology beginning on January 1, 2024. |

| MIPS | CMS continues to update and refine the quality measures used in the different aspects of the programs under MIPS including the addition of certain health equity related measures. CMS also is proposing five additional MIPS Value Pathways (MVPs) (Advancing Cancer Care, Optimal Care for Kidney Health, Optimal Care for Patients with Episodic Neurological Conditions, Supportive Care for Neurodegenerative Conditions, and Promoting Wellness) CMS also proposed several ways to reduce the burden for physicians participating in advanced alternative payment models (AAPMs) including permanently establishing the 8% minimally Generally Applicable Risk Standard for AAPM qualification and proposing to apply the eligible clinician limit to the entity participating in the medical home model rather than the parent organization. |

The HMA Medicare team will continue to analyze these proposed changes. We have the depth and breadth of expertise to assist with tailored analysis, to model policy impacts, and to support the drafting of comment letters to this rule.

HMA Roundup

California

Governor Signs Bill to Establish No-Bid Contract with Medicaid Plan. Kaiser Health News reported on July 19, 2022, that California Governor Gavin Newsom signed legislation to create a no-bid statewide Medi-Cal contract for Kaiser Permanente outside of the state’s upcoming procurement. Kaiser serves nearly 900,000 Medicaid members, largely through subcontractors. Under the new contract, which will run five years effective January 1, 2024, Kaiser would enroll Medicaid members directly. Read More

Colorado

Colorado Policy Restricts Use of Behavioral Health Interns, Unlicensed Therapists to Serve Medicaid Beneficiaries. The Colorado Sun reported on July 14, 2022, that the Colorado Department of Health Care Policy and Financing approved a policy that restricts the use of behavioral health interns and unlicensed therapists to help treat Medicaid members. The policy impacts interns still working toward their graduate degrees and post-graduate therapists who have yet to receive their licenses, who can see patients but must have a licensed counselor sign off on diagnoses and progress notes. Under the new rule, only counselors licensed for at least two years can sign off. Read More

Colorado Exchange Plan Premiums Could Rise 11.3 Percent in 2023. The Colorado Sun reported on July 13, 2022, that Colorado Exchange plan premiums are set to rise 11.3 percent in 2023, according to preliminary rate filings released by the state Division of Insurance. The planned increases come as the state prepares to launch the Colorado Option in 2023, a standardized Exchange plan that health insurers will be mandated to offer at premiums that are 5 percent below what they charged in 2021, after adjusting for inflation. Read More

Florida

Florida Considers Rule to Deny Medicaid Coverage for Gender-Affirming Care for Transgender Youth. Advocate reported on July 12, 2022, that the Florida Agency for Health Care Administration is considering a proposed rule that would deny Medicaid coverage of gender-affirming care for transgender youth, including puberty blockers, hormones, hormone antagonists, gender-affirmation surgeries, and other procedures. Read More

Georgia

Georgia Receives Federal Renewal of 1915 HCBS Waiver for Five Years. The Georgia Department of Community Health announced on July 18, 2022, federal renewal of its Section 1915(c) Comprehensive Supports Waiver for individuals with intellectual and/or developmental disabilities for five years effective April 1, 2021. The waiver provides home and community-based services (HCBS), including community living support, adult dental, adult occupational and physical therapy, adult speech and language therapy, and nursing services. Read More

Idaho

Idaho Releases Medicaid Dual Programs RFI. The Idaho Division of Purchasing released on July 18, 2022, a request for information (RFI) concerning managed care services for dual-eligible Medicare Medicaid members. The state currently administers two managed care programs for duals, with combined membership of 26,000. The Medicare Medicaid Coordinated Plan constitutes Fully Integrated Dual Eligible Special Needs Plans (FIDE-SNPs), and Idaho Medicaid Plus is a wraparound managed long term services and supports program. The state intends to competitively bid both programs for the first time by Spring 2023.

Illinois

Illinois Begins Accepting Medicaid Applications for Low-Income Individuals 42 and Up, Regardless of Immigration Status. NPR Illinois reported on July 14, 2022, that the Illinois Department of Healthcare and Family Services is now accepting Medicaid applications for non-citizens age 42 and up, regardless of immigration status. The coverage, which is available through the Health Benefits for Immigrant Adults program, has previously been limited individuals 55 and up. Maximum household income for eligibility is $18,754 annually per individual and $25,268 for a two-person household. Read More

Massachusetts

Massachusetts Releases Request for Responses for Behavioral Health, LTSS Community Partners. The Massachusetts Executive Office of Health and Human Services released on July 18, 2022, a request for responses for the state’s Behavioral Health (BH) and Long Term Services and Supports (LTSS) Community Partners program. Responses are due on September 16, 2022, with contracts effective April 1, 2023. Contracts will run through 2027, with five additional option years. Under the program, Medicaid Accountable Care Organizations and Medicaid managed care plans will be required to contract with community partners selected by the state for care coordination for beneficiaries that have predominant BH and/or LTSS needs. Read More

Montana

Montana Seeks Five-Year Extension of 1115 Waiver for Individuals With Severe Disabling Mental Illness. The Center for Medicaid and CHIP Services announced on July 14, 2022, that the Montana Department of Public Health and Human Services is seeking a five-year extension of its 1115 demonstration Waiver for Additional Service and Populations, which provides 12 months of continuous eligibility and health care services for individuals with a severe disabling mental illness who are not otherwise eligible for Medicaid. If approved, the waiver would expire December 31, 2027. Public comments will be accepted through August 13, 2022. Read More

New York

New York Medicaid HCBS Children’s Waiver Providers to Receive Temporary 25 Percent Rate Increase. The New York State Department of Health announced on July 13, 2022, that the Centers for Medicare & Medicaid Services approved the state’s 1915(c) Home and Community Based Medicaid Children’s Waiver Renewal request, which includes a temporary 25 percent rate increase for providers. The renewal also broadens the definition of caregivers eligible for training, updates performance metrics, and clarifies the definition of reportable incidents from Health Homes. The waiver is retroactively effective from April 1, 2022 through March 31, 2027.

New York Medicaid Failed to Claw Back $292 Million from Third-Party Insurers for Pharmacy Claims, Audit Finds. Spectrum News reported on July 13, 2022, that New York Department of Health and Office of Medicaid failed to claw back $292 million in overpayments for pharmacy claims between October 2015 and May 2020, according to an audit released by Comptroller Tom DiNapoli. The audit found that a lack of oversight resulted in failure to charge third-party insurers for the claims. Read More

Oregon

Oregon Medicaid CCO Program ‘Helped Slow Cost Growth,’ State Says. 1190 KEX reported on July 19, 2022, that costs in the Oregon Medicaid Coordinated Care Organization (CCO) program rose a total of 31 percent per capita from 2013 to 2019, less than the rate of growth in costs for commercial and Medicare members in the state, according to a report from the Oregon Health Authority. The report concluded that “Oregon’s CCO model helped slow cost growth in the Medicaid sector.” Overall, healthcare costs in Oregon rose 40 percent from 2013 to 2019, outpacing the national average, the report said. Read More

Oregon CCOs Have Operating Margin of 2.1 Percent in 2021, Report Finds. The Oregon Health Authority reported on July 14, 2022, that the state’s 16 contracted Medicaid coordinated care organizations (CCOs) posted an average operating margin of 2.1 percent in 2021, up from 1.5 percent in 2020. CCOs spent 90.4 percent of premiums on benefits and 7.5 percent on administrative services. CCOs provide coordinated medical, behavioral, and dental benefits to more than 1.1 million members. Read More

Pennsylvania

Pennsylvania Physical HealthChoices Beneficiaries Must Choose New Plan Before August 16. The Philadelphia Business Journal reported on July 14, 2022, that approximately 500,000 Pennsylvania Medicaid beneficiaries have until August 16 to enroll in a new Medicaid Physical HealthChoices managed care plan or they will be assigned one. Re-enrollment is necessary because the state is implementing new HealthChoices contracts on September 1. The new contracts come after six years of delays from litigation challenging the state’s process for awarding Medicaid plan contracts. Read More

Tennessee

Tennessee Drafts Amendment to TennCare Block Grant Waiver. The Tennessee Division of TennCare announced on July 19, 2022, it will submit another amendment to its TennCare III block grant Medicaid waiver, addressing changes requested by federal regulators. The Centers for Medicare & Medicaid Services (CMS) asked TennCare to submit a new budget based on a traditional per member per month cap, remove the waiver’s closed formulary for pharmaceuticals, and modify its Medicaid terms and conditions to ensure benefits and coverage will not be cut. Tennessee is accepting public comments on the amendment through August 19. Read More

Washington

Washington Seeks 5-Year Renewal of Medicaid Transformation 1115 Waiver. State of Reform reported on July 19, 2022, that the Washington Health Care Authority has asked federal regulators for a five-year renewal of the state’s Section 1115 Medicaid Transformation Project waiver, with the goal of expanding existing programs and adding new ones. The existing waiver is currently set to expire on December 31, 2022. New programs would include community-based hubs for health-related services, continuous Medicaid enrollment for children through five years old, re-entry coverage for individuals exiting a correctional treatment facility, 12 months of postpartum coverage, and an integrated care assessment for physical and behavioral health care. Current waiver programs include a long-term services and supports program, a housing and employment supports program, a substance use disorder program, and a mental health program for institutions of mental disease. Read More

National

COVID-19 Is Associated with Increased Incidence of Future Medicaid Conditions, Costs, Wakely Study Finds. Wakely, an HMA Company, released on July 15, 2022, a report on the impact of “long COVID,” which found that individuals diagnosed with COVID-19 are more likely to have additional medical conditions and are costlier in months following the initial diagnosis, according to a study of more than 10 million commercial members. The findings were consistent when controlling for age, prior conditions, and severity of COVID-19. Read More

CMS Awards $49 Million in Grants to Boost Medicaid, CHIP Enrollment of Children. NPR reported on July 19, 2022, that the Centers for Medicare & Medicaid Services (CMS) awarded $49 million in grants aimed at boosting enrollment of families and children in Medicaid and the Children’s Health Insurance Program (CHIP). The Connecting Kids to Coverage grants will go to community organizations for outreach enrollment assistance. Read More

About 3 Percent of Individuals Disenrolled from Medicaid, CHIP Transition to Exchange, MACPAC Finds. The Medicaid and CHIP Payment and Access Commission (MACPAC) reported in July 2022, that only about three percent of individuals who were disenrolled from Medicaid or the Children’s Health Insurance Program (CHIP) were enrolled in an Exchange plan within 12 months, according to a study of 2017-19 enrollment data. Furthermore, most of the three percent had a gap in coverage, with the gap longer for minorities. Read More

Medicaid, CHIP Churn Is Associated with Avoidable Hospitalizations, MACPAC Finds. The Medicaid and CHIP Payment and Access Commission (MACPAC) reported in July 2022, that member churn in the Medicaid and Children’s Health Insurance Program (CHIP) is associated with avoidable hospitalizations, according to a study of data from 2017 to 2019. MACPAC found that rates of emergency department visits and hospitalizations related to diabetes, heart failure, asthma, and chronic obstructive pulmonary disease more than doubled in the first month after an individual was disenrolled and subsequently reenrolled in Medicaid or CHIP. Read More

Biden Urges Congress to Pass Legislation to Allow Medicare to Negotiate Drug Prices, Extend Enhanced Exchange Subsidies. The Associated Press reported on July 15, 2022, that President Biden is urging Congress to pass a budget reconciliation bill that would allow Medicare to negotiate drug prices and extend enhanced Exchange subsidies. Senate Democrats have agreed to extend subsidies for two years through 2024. Previously, Congress was considering a more extensive bill that would also address climate change and raise taxes on large companies, but those provisions have stalled. The President has asked Congress to pass the legislation before the August recess. Read More

HHS Extends Public Health Emergency Through October 2022. Fierce Healthcare reported on July 15, 2022, that the U.S. Department of Health and Human Services extended the public health emergency (PHE) by 90 days through October 2022. The Centers for Medicare & Medicaid Services will give 60 days warning before the end of the PHE. Read More

Democrats Address HCBS Funding, Exchange Subsidies in Budget Talks, But Not Medicaid Coverage Gap. Roll Call reported on July 14, 2022, that Congressional Democrats have largely excluded provisions to address the Medicaid coverage gap in non-expansion states from budget reconciliation talks. Instead, the focus has been on extending premium tax credits for Exchange plans and $150 billion to increase access to home and community-based services (HCBS). Read More

CMS Proposes 2.7 Percent Increase in Medicare Reimbursement Rate for Outpatient, Ambulatory Surgical Center Services. Modern Healthcare reported on July 15, 2022, that Medicare will increase payment rates by 2.7 percent for outpatient and ambulatory surgical center services in 2023, under a proposed rule issued by the Centers for Medicare & Medicaid Services (CMS). The proposed rule also extends reimbursements for behavioral telehealth services beyond the COVID-19 pandemic. CMS also intends to reverse 340B drug payment cuts following a Supreme Court ruling that the agency acted improperly. Read More

Industry News

Pediatric Home Service Acquires Craig HomeCare, Cherub Medical Supply. InTandem Capital Partners and its portfolio company Pediatric Home Service (PHS) announced on July 18, 2022, the acquisitions of Craig HomeCare, a pediatric nursing services provider, and Cherub Medical Supply, a respiratory and durable medical equipment provider focused on pediatrics. The acquisitions will expand PHS into Kansas, Missouri, and Nebraska. Read More

WindRose Health Investors Completes Acquisition of Ganse Apothecary. WindRose Health Investors announced on July 14, 2022, the completed acquisition of Ganse Apothecary, a long-term care and specialty pharmacy for individuals with severe and persistent mental illness and intellectual and developmental disabilities. The acquisition was made through a merger with Terrapin Pharmacy, an existing WindRose portfolio company. Read More

Centene Completes Divestiture of Pharmacy Business. Centene Corporation announced on July 14, 2022, the completed divesture of its pharmacy business, PANTHERx, to Vistria Group, General Atlantic, and Nautic Partners. Centene, which acquired PANTHERx in 2020, will use the proceeds to repurchase stock and reduce debt. Read More

Health Plan Joins Hospital Systems as Co-Owner of Delaware Regional Medicare ACO. Philadelphia Business Journal reported on July 12, 2022, that Humana has joined Main Line Health and Jefferson Health as third co-owner of Delaware Valley Accountable Care Organization (ACO), a Medicare ACO serving 90,000 beneficiaries. Read More

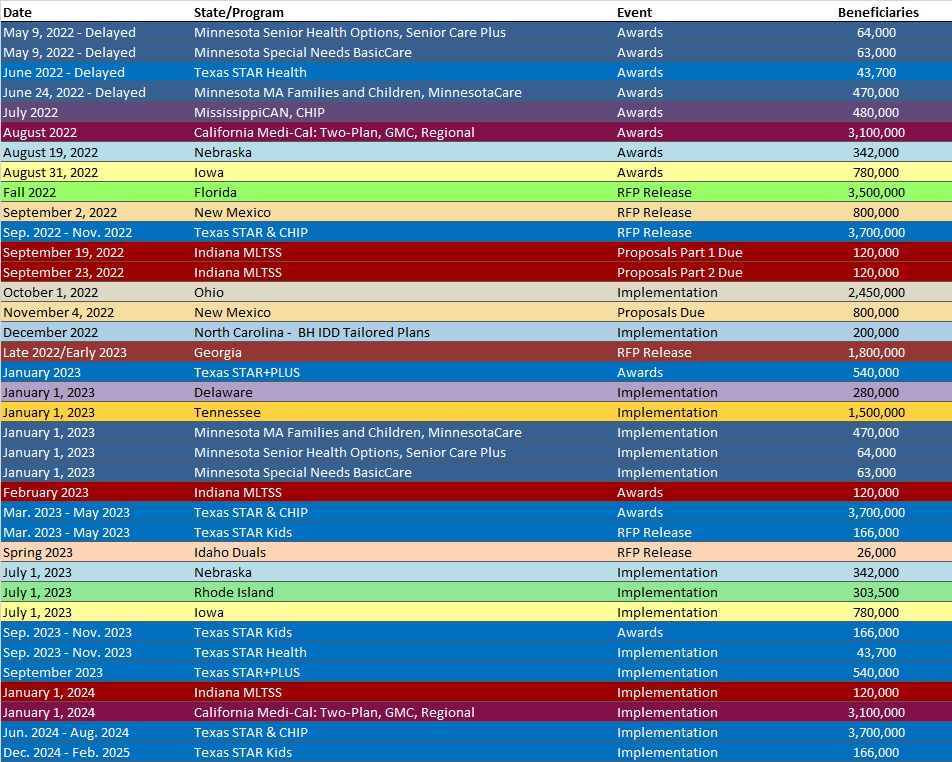

RFP Calendar

HMA News & Events

NEW THIS WEEK ON HMA INFORMATION SERVICES (HMAIS):

Medicaid Data

- District of Columbia Medicaid Managed Care Enrollment is Up 2.5%, May-22 Data

- Iowa Medicaid Managed Care Enrollment is Up 3%, Apr-22 Data

- Mississippi Medicaid Managed Care Enrollment is Down 11%, Jun-22 Data

- Nebraska Medicaid Managed Care Enrollment Is Up 4.1%, Apr-22 Data

- Oregon Medicaid Managed Care Enrollment is Up 11%, 2021 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- Idaho Medicaid Dual Programs RFI, Jul-22

- Massachusetts Community Partners Program Behavioral Health, Long Term Services and Supports Vendors RFR, Jul-22

- Maryland Behavioral Administrative Services Organization (ASO) RFP, Proposals, and Contract, 2018-19

- Virginia Medicaid Dental Benefits Analysis RFP, Jul-22

Medicaid Program Reports, Data and Updates:

- Pennsylvania MLTSS Subcommittee Meeting Materials, 2021-22

- Ohio Joint Medicaid Oversight Committee Meeting Materials, 2017-22

- Tennessee TennCare III 1115 Waiver Documents, 2020-22

- Texas Behavioral Health Presentations to Legislature, Jul-22

- Texas COVID-19 Federal Funds Presentation to Legislature, Jul-22

- Texas Medicaid Information Technology Presentation to Legislature, Jul-22

- Washington 1115 Medicaid Transformation Waiver Documents, 2015-22

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Carl Mercurio.