The transition of MyCare Ohio to the Next Generation of its program on January 1, 2026, marks a significant evolution in the way Ohio provides healthcare services to its dual-eligible population – those who qualify for both Medicaid and Medicare services. This evolution moves Ohio to a Fully Integrated Dual Eligible Special Needs Plan model (FIDE SNP) that aims to achieve several key goals through a population health approach, designed to address inequities and disparities in care for dual-eligible individuals. These goals include:

- Improved Care Coordination. Strengthening integration between Medicare and Medicaid services to provide seamless, holistic care for individuals, reducing fragmentation and ensuring comprehensive management of medical, behavioral, and social needs.

- Personalized Care. Utilizing data analytics and technology to create more tailored care plans, with a focus on proactive care to address the unique health needs of each individual, especially those with chronic conditions.

- Expanded Access to Services. Increasing accessibility, particularly through telehealth and digital tools, to reach underserved populations and improve convenience for patients, particularly those in rural or remote areas.

- Enhanced Quality of Care. Shifting focus from service volume to outcomes, encouraging providers to deliver high-quality care and improve patient satisfaction, while incentivizing preventive care to reduce hospital admissions and other high-cost interventions.

- Technology Integration. Leveraging advanced technologies like mobile apps, predictive analytics, and telemedicine to monitor patient health, improve communication between patients and providers, and enable more efficient care delivery.

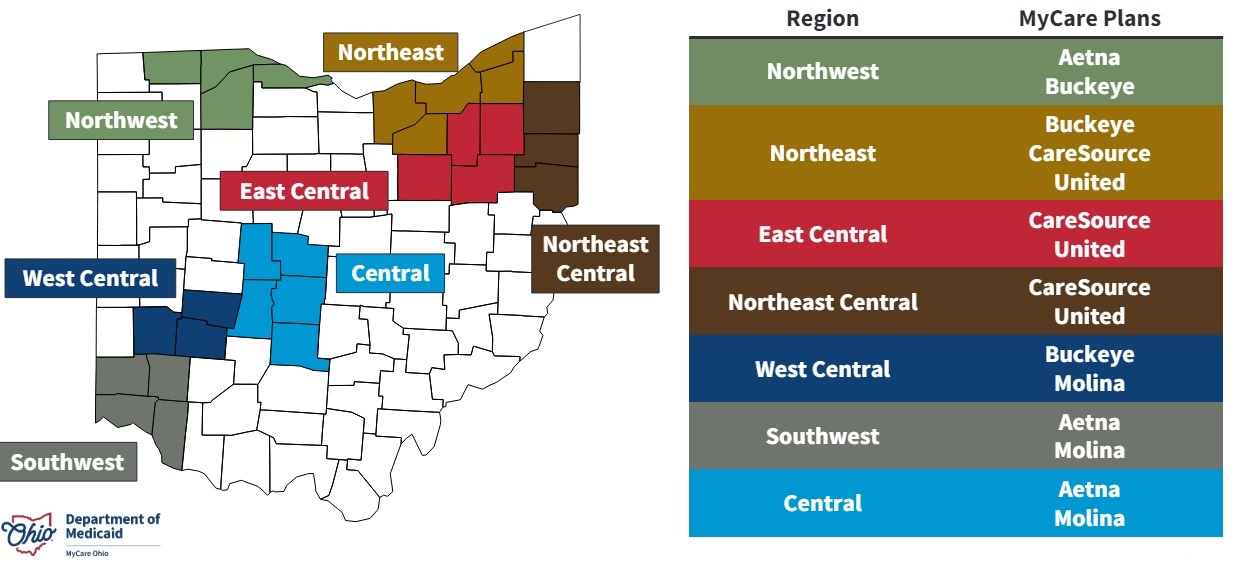

The current MyCare program is offered in 29 counties across Ohio but will transition to a statewide program as a part of the Next Generation changes. Additionally, Coordination Only Dual Eligible Special Needs Plans (CO DSNP) will no longer be permitted.

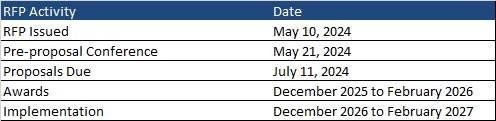

After the Ohio Department of Medicaid (ODM) publicly released the request for applications (RFA) and evaluated submitted proposals, they selected four Managed Care Organization (MCOs) that will become the Next Generation MyCare plans. The ODM awarded the following MCOs to serve MyCare members beginning in January 2026: Anthem Blue Cross and Blue Shield, Buckeye Health Plan, CareSource, and Molina HealthCare of Ohio.

The shift to the FIDE SNP model and selection of four participating health plans will have a considerable impact on the competitive landscape for Medicare and Medicaid managed care in Ohio. The resulting changes can affect both selected and non-selected participants in different ways, including:

- Increased competition among chosen MyCare MCOs. MCOs will need to focus on enhancing their care coordination systems, adopting new technologies, and developing personalized care plans to compete not just on the volume of services provided but also on the quality and effectiveness of care. Those who can best integrate services, offer proactive care management, and improve patient outcomes through value-based care and advanced technology initiatives will gain the competitive advantage, potentially attracting more beneficiaries.

- Strategic responses of nonparticipating MCOs to counter potential membership and financial losses. MCOs that lose membership by not being selected, or are unable to offer CO DSNPs moving forward, will likely strategize how to gain membership through other product lines or benefit design to offset losses. Strategies may vary but could include tactics such as enhancing benefits or decreasing member cost shares to entice member movement across carriers for non-DSNP plans; finding innovative ways to further reach different segments within the Medicare population, such as Value Based Insurance Design (VBID) packages or Chronic SNP plays; or shifting focus to product lines outside of Medicare Advantage and Medicaid.

Ohio is one of many states transitioning to a FIDE model beginning January 2026. Health Management Associates (HMA) has successfully supported participating and non-participating carriers throughout the transition process and continues to be a dedicated partner to organizations navigating Medicare and Medicaid changes across the country. Contact one of HMA’s many experts for more details on how to navigate this evolution in health care.