HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- In Focus: New HMA Report Analyzes the Expanded Landscape of Value-Based Entities and Market Growth Opportunities

- In Focus: Pennsylvania Releases Community HealthChoices (CHC) Medicaid Managed Care RFA

- HMA Press Release: Nine States to Participate in Children’s Behavioral Health Policy Lab

- California Plan Offers Medi-Cal Enrollees GED Services

- Colorado Legislative Committee Approves Increase in Medicaid Reimbursement for Pediatric Behavioral Care

- Indiana Intellectual, Developmental Disabilities Task Force Calls for Pause to Proposed Aged, Disabled Waiver Cuts

- Kentucky House Passes Bill Requiring Medicaid to Cover At-home Blood Test Kits

- Minnesota Releases Medicaid Dental Administrator RFI

- New Jersey Enacts Law to Expand Hospital at Home Services to Medicaid Beneficiaries

- New York Legislature Considers Bill to Transition Home Care Services From Managed Medicaid to Fee-For-Service

- Federal Government Issues Lawsuit to Block Novant Health’s Acquisition of North Carolina Hospitals

- South Dakota to Include Doula Services in New Medicaid Pregnancy Health Home

- Vermont Releases MMIS Procurement Assistance Vendor RFP

- Wisconsin Releases IRIS Self-Directed Personal Care Services RFP

- Medicaid Redetermination Updates: Louisiana, Ohio

- Medicare ACO Shared Savings Program Participation Increases in 2024

- CMS Cell and Gene Therapy Access Model to Focus on Sickle Cell Disease

- MACPAC Releases Medicaid Payment Policies Report for Home and Community-based Services

- Health Care Services Corporation to Acquire Cigna Medicare, CareAllies Businesses

In Focus

New HMA Report Analyzes the Expanded Landscape of Value-Based Entities and Market Growth Opportunities

This week, our In Focus section highlights a new report released on January 25, 2024, Analyzing the Expanded Landscape of Value-Based Entities: Implications and Opportunities of Enablers for the CMS Innovation Center and the Broader Value Movement. The analysis explores the growing ecosystem of new entities designed to assume accountability for the total cost and quality of care in order to understand the growth of this market and consider the role these entities play in advancing accountable care in Medicare, Medicaid, and the broader healthcare sector. The report combines the value-based payment (VBP) policy and market expertise of Health Management Associates (HMA) and Leavitt Partners, an HMA company, with support from Arnold Ventures.

At the start of the movement, value-based arrangements primarily involved traditional providers and payers engaging in relatively straight-forward and limited contractual arrangements. In recent years, the value-based care market has expanded to include a variety of risk-bearing healthcare delivery organizations and provider enablement entities, with capabilities and business models aligned with the functions and aims of accountable care. Despite their prevalence, little formal research has been conducted to determine the role, growth, and impact of these entities to date, and publicly available information is limited.

The report introduces a framework for classifying these entities and estimates the size of this market for the first time. Using insights from 60 interviews with entity leaders, providers, and policymakers, and extensive secondary research into approximately 120 organizations, the report details the common offerings, partnership models, and growth strategies of these entities. The research investigated primary care-focused entities as well as risk-bearing delivery organizations and VBP enablers focused on select specialty areas that align with total cost of care models (i.e., kidney care, oncology, cardiology, behavioral health, and palliative care). Authors examined providers’ experiences selecting and collaborating with enablement partners and the role of these entities within Medicare accountable care models, as well as the broader value movement, to inform a set of guiding principles that help providers and policymakers evaluate the attributes of ideal partners.

Market Landscape

For the past decade, the Centers for Medicare & Medicaid Services (CMS), through its Innovation Center (CMMI), has been leading the movement toward value. Going forward, the agency is focused on scaling accountable care adoption to achieve its 2030 goal, but also seeks to ensure that transformation is equitable and sustainable. These entities are helping providers to engage in accountable care, but our guiding principles and policy recommendations aim to support CMS in ensuring that their growth aligns with provider and patient priorities.

In assessing the value-based care market, the report divided the organizations into three main categories by their core business model: VBP enablers (which are not involved in the direct provision of care, but in assisting others to adopt VBP models); risk-bearing delivery organizations (entities designed to deliver value-based care and assume payment risk for the cost of care); and organizations that are a hybrid of the two (companies that own assets that enable other organizations and those that deliver care).

From risk-bearing delivery organizations with business models that hinge on effective population health management and longitudinal patient relationships, to VBP enablers that provide the population health functions needed to succeed in accountable care while sharing responsibility for those outcomes, these entities are creating more opportunities for clinicians to deliver the type of coordinated, proactive, whole-person care that is unsupported in a fee-for-service system.

A Growing Market

Fueling the growth of value enablers are signals from federal and state policymakers that value-based payment (VBP) is here to stay. The certainty of this approach is already leading to increased focus on underserved populations and safety net providers as CMS places greater focus on expanding VBP contracts in Medicaid and other public insurance programs.

As the market matures and pressure to participate in accountable care mounts, organizations will have several paths forward to implementation of alternative payment models. The growth and availability of enablement entities that are designed with the explicit purpose of helping providers overcome barriers to participation – and whose own financial success hinges on the success of their provider partners – could represent a promising gateway toward achieving accountable care.

The research found several similarities across most entities in this space, demonstrating a highly competitive market, with organizations focused on similar priorities in target providers, geographies, and key populations. Entities often use hybrid, high-touch clinical models to support physicians with patient navigators and other clinical extenders and support staff. They heavily rely on health information technology, and often develop homegrown, proprietary tech assets to better address provider pain points. Finally, most entities depend on outside capital and investment to fuel growth, and investor interest in the space seems to be robust and growing, along with the evolution of value-based care models.

Guiding Principles and Policy Recommendations

The report concludes by proposing a set of guiding principles to describe the optimal attributes of value-based enablement entities aligned with CMS, provider, and patient goals. Authors point to steps CMS can take to best engage with this expanded ecosystem in support of its efforts to scale accountable care while ensuring appropriate guardrails are in place to protect patients and providers.

As CMS works to accelerate adoption of accountable care to achieve its 2030 goal and beyond, the agency must find ways to bring in new providers who have yet to engage meaningfully in these models, while retaining current participants and advancing model designs for the next phase of VBP and delivery reform. The report makes policy recommendations to 1) drive new and sustained provider participation and 2) ensure high-quality partnerships for CMS and providers.

What’s Next

With its acquisition of Leavitt Partners and Wakely Consulting, along with its strong and growing Medicare policy practice, HMA is developing a diverse and robust set of solutions for entities engaging in value-based care and payment. On March 5 and 6, HMA will be devoting its spring event to the topic. The report authors will be featured prominently and will lead a session on the report’s implications. More information about the Spring Workshop, Getting Real about Transforming Healthcare Quality and Value, can be found here.

For details about this research, please contact report authors Kate de Lisle or Amy Bassano.

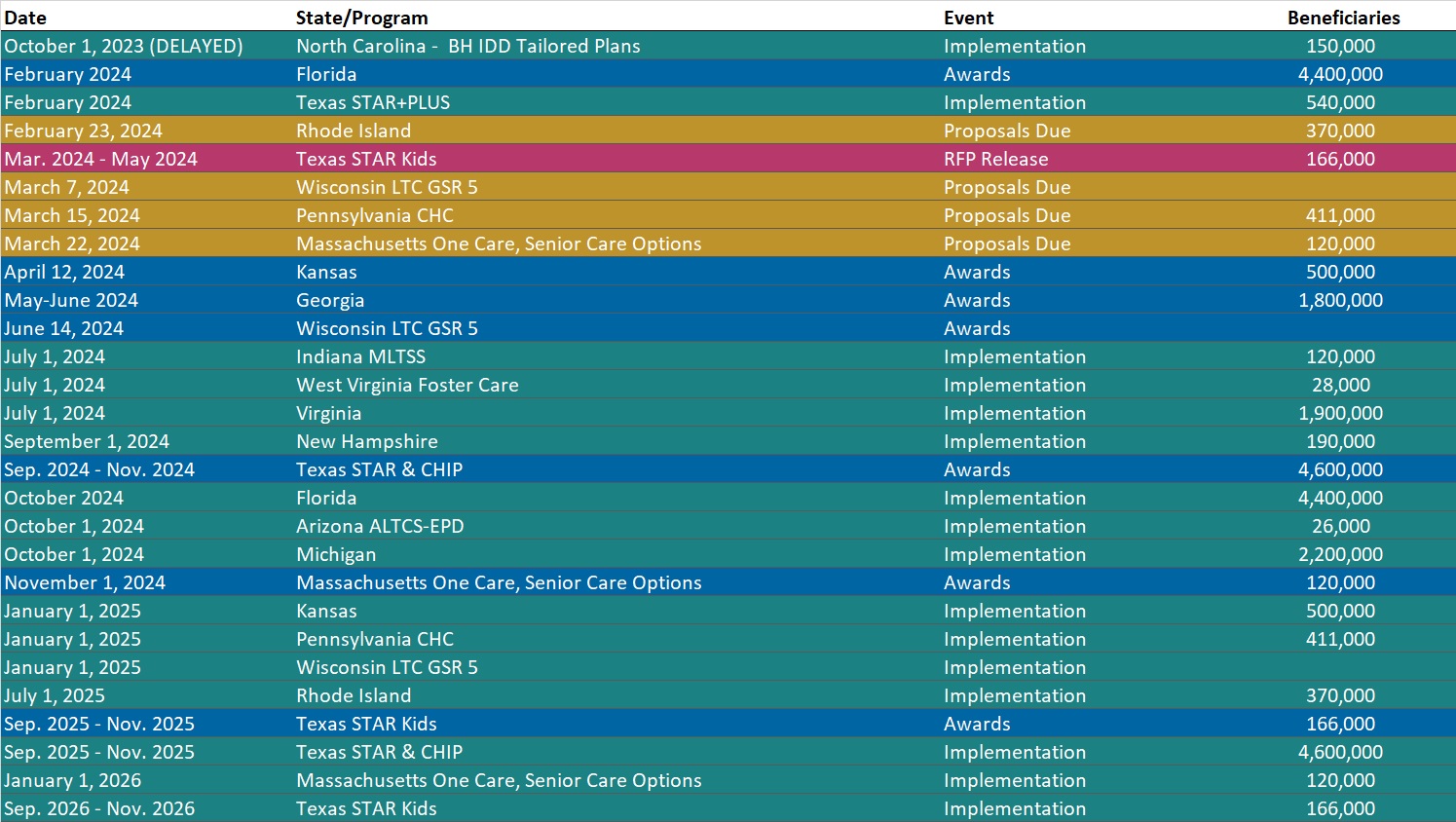

Pennsylvania Releases Community HealthChoices (CHC) Medicaid Managed Care RFA

This In Focus section reviews the request for applications (RFA) that the Commonwealth of Pennsylvania Department of Human Services (DHS) released January 30, for the Community HealthChoices (CHC) Program. CHC is the mandatory managed long-term services and supports (MLTSS) program, which serves five CHC zones that cover all 67 counties in the commonwealth.

Notably, this procurement, as compared to the original CHC procurement in 2018, has increased emphasis on innovative approaches to address health equity and the Social Determinates of Health (SDOH). The health equity focus goes beyond traditional health-related social needs such as access to housing, transportation, food, and employment, and addresses some SDOHs that have a particular impact on the CHC population, such as environmental conditions and addressing hazardous or unsafe living conditions.

Behavioral health remains carved-out to separate behavioral health managed care organizations (BH-MCOs). Instead, CHC applicants will need to articulate how they will coordinate with the BH-MCOs to ensure access to appropriate BH services, which continues to be an area of significant interest for state Medicaid officials.

Background

The CHC Program serves individuals who are dually eligible for Medicare and Medicaid and people with physical disabilities who receive home and community-based waiver services or nursing facility care.

Participants may receive LTSS in the community or in a nursing facility.

CHC is the sole program option for fully dual eligible beneficiaries and most nursing facility clinically eligible (NFCE) individuals who reside in the five zones. The regional CHC zones are as follows:

- Southwest zone: Allegheny, Armstrong, Beaver, Bedford, Blair, Butler, Cambria, Fayette, Green, Indiana, Lawrence, Somerset, Washington, and Westmoreland counties.

- Southeast zone: Bucks, Chester, Delaware, Montgomery, and Philadelphia Counties.

- Remaining zones and respective counties, including

- Lehigh/Capital zone: Adams, Berks, Cumberland, Dauphin, Fulton, Franklin, Huntingdon, Lancaster, Lebanon, Lehigh, Northampton, Perry, York

- Northeast zone: Bradford, Carbon, Centre, Clinton, Columbia, Juniata, Lackawanna, Luzerne, Lycoming, Mifflin, Monroe, Montour, Northumberland, Pike, Schuylkill, Snyder, Sullivan, Susquehanna, Tioga, Union, Wayne, Wyoming.

- Northwest zone: Cameron, Clarion, Clearfield, Crawford, Elk, Erie, Forest, Jefferson, McKean, Mercer, Potter, Venango, Warren

- Lehigh/Capital zone: Adams, Berks, Cumberland, Dauphin, Fulton, Franklin, Huntingdon, Lancaster, Lebanon, Lehigh, Northampton, Perry, York

RFA

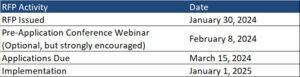

Medicaid managed care organizations (MCOs) may submit applications for one or more zones. Applications are due March 15, 2024. The department anticipates awarding agreements to three to five CHC-MCOs in each of the five CHC zones. Selected applicants must provide CHC services in all counties in the zone(s) for which they are selected to participate and improve the accessibility, continuity, and quality of services for participants in the CHC program. The contract will run for five years and will have three one-year renewal options.

DHS indicates that the awarded CHC-MCOs must have an aligned dual-eligible special needs plan (D-SNP) and a current Medicare Improvement for Patients and Providers Act (MIPPA) agreement with the department. The aligned D-SNP must be operational and the MIPPA agreement must be in place by the anticipated implementation date (January 1, 2025).

DHS indicates selected MCOs must be as flexible and adaptable as possible and demonstrate the ability to coordinate services for multiple populations and across multiple programs, including programs with a focus that is broader than the delivery of healthcare services and LTSS.

Other RFA highlights include the following:

- Does not require a cost submittal.

- Includes small diverse business (SDB) or veteran business enterprise (VBE) goals of 11 percent and 3 percent respectively. Applicants must include separate SDB and VBE submittals for each zone in its application.

- Includes a contractor partnership program (CPP) which requires entities that are awarded a contract or agreement with DHS to establish a hiring target to support Temporary Assistance for Needy Families (TANF) beneficiaries in obtaining employment with the contractor, grantee, or their subcontractors.

Notably, DHS has provided itself flexibility within the RFA to implement a pay-for-performance incentive to MCOs. Under this policy, DHS could make incentives available to MCOs that help participants successfully complete the financial eligibility redetermination process with their local County Assistance Offices (CAOs). The department may implement additional pay-for-performance incentives in later years.

Timeline

Evaluation

For an applicant to be considered responsible for this RFA and eligible for selection of best and final offers (BAFOs) and negotiations:

- The total score for the technical submittal of the application must be greater than or equal to 75 percent of the available raw technical points

- The applicant’s financial information must demonstrate that the organization possesses the financial capacity to fulfill the good faith performance of the agreement

The evaluation committee will evaluate technical submittals for each zone separately. For each zone, DHS must select for negotiations the applicants with the highest overall score. The weight for the technical criterion is 100 percent of the total available points. Technical evaluation will be based on soundness of approach, applicant qualifications, personnel qualifications, and understanding the project.

The final technical scores will be determined by giving the maximum number of technical points available to the application with the highest raw technical score. The remaining applications will be rated by applying the formula located at RFP Scoring Formula.

Financial information will not be scored as part of the technical submittal. It will be reviewed only to determine an applicant’s financial responsibility.

SDB and VBE participation submittals will not be scored, however, if an applicant fails to satisfy the SDB or VBE requirements described, and DHS will reject the application.

DHS will not score the CPP submittal. Once an applicant has been selected for negotiations, DHS will review the CPP submittal.

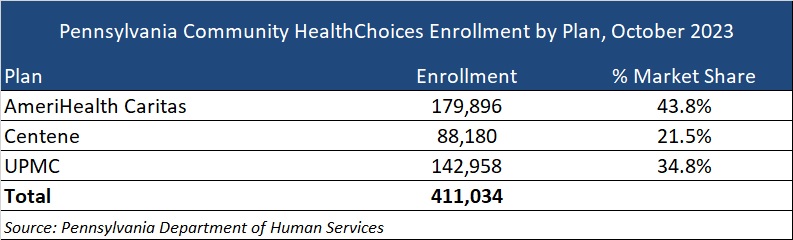

Current Market

The CHC incumbents are AmeriHealth Caritas, Centene, and University of Pittsburgh Medical Center (UPMC), serving 411,034 CHC members as of October 2023.

DHS has published a historical data summary for the CHC program along with other DHS reports at: Community HealthChoices Historical Data.

Link to solicitation: All files on PA eMarketplace

Want to know more about how the next phase of Community Health Choices will impact your organization?

HMA’s Pennsylvania-based teams can assist organizations seeking to understand the implications of this important procurement, key program changes and what the outcome may mean for providers, community base organizations, and other stakeholders. Please contact Dianne Bisacky with questions or if you are seeking more detailed analysis of this procurement or the Community Health Choices program generally.

Nine States to Participate in Children’s Behavioral Health Policy Lab

LANSING, MICH. – Health Management Associates (HMA), in partnership with the Annie E. Casey Foundation, Casey Family Programs, National Association of State Mental Health Program Directors (NASMHPD), the Child Welfare League of America (CWLA), the American Public Human Services Association (APHSA), National Association of Medicaid Directors (NAMD) and the Centene Foundation, will convene a Children’s Behavioral Health (CBH) State Policy Lab, Feb. 7-9 in Baltimore. HMA today announced that Georgia, Kansas, Kentucky, Maryland, Missouri, Pennsylvania, Texas, Utah, and Wisconsin will participate in the policy lab. MITRE, which previously hosted a related federal convening, will also take part in this state convening.

This pioneering effort, made possible by the partner organizations, aims to convene state interagency teams – including child welfare, juvenile justice, behavioral health, Medicaid, and K-12 public education – to collectively strategize, learn from innovators in the sector and promote cross-system alignment to drive outcomes for children, youth, and families.

COVID-19 has exacerbated long-standing system collaboration challenges across state child welfare, behavioral health, and Medicaid that lead to unsatisfactory outcomes for the most vulnerable children in our communities. Most worrisome is the worsening of behavioral and physical health challenges and trauma because of uncoordinated or fragmented care. This lack of coordinated strategy and policy leads to higher costs of treatment and also increasingly exposes states and local jurisdictions to threats or filings of class action lawsuits, and related settlements or those arising from Department of Justice investigations. Fortunately, federal and state efforts and investments to address the youth systems of care – including schools, community, delivery systems, and community-based child placing agencies – are in motion.

In November, a call for applications was released to U.S. states and territories for potential participation in the State Policy Lab. Applicants were required to identify demonstrated need, existing state agency governance structures focused on children and youth, technical assistance needs, and outcomes for attending the policy lab. The applications required demonstrated participation from Medicaid, child welfare and behavioral health agencies; a commitment to creating sustainable interagency solutions for children, youth, and their families and had to certify formal support from the Governor/Cabinet level.

An external independent panel reviewed applications for state agency participation using a standardized rubric that covered four domains:

- Gaps and opportunities analysis

- Intent of collaborative partnerships

- Approach to engagement of youth and adults with lived experience

- Imminent risks to public agency operations as a result of poor outcomes for children, youth, and their families

This convening is aimed at assisting child welfare, juvenile justice, behavioral health, Medicaid, and K-12 public education where possible to build upon existing efforts to improve outcomes for children, youth, and families, strategically layering on missing components and promoting alignment between them and with other agency priorities. Examples of what could be co-designed with state partners:

- Build a shared strategic vision for a comprehensive continuum of care that ensures access to the “right service, at the right time based on individual and family need.” This vision can strengthen prevention initiatives and ensure the full array of evidence-based community-based interventions including use of crisis response and stabilization models.

- Develop policies and strategies for improving the engagement of children, youth, and families with lived experiences to the “right part of the system for the right level of care,” agnostic of the door through which they enter any coordinated child serving system, while ensuring that all aspects of this system are anchored in equity.

Following the event, learnings and findings will be disseminated to help states and counties adopt innovative solutions to improve outcomes for children, youth, and their families.

For more information email: [email protected]

HMA Roundup

California

California Plan Offers Medi-Cal Enrollees GED Services. Fierce Healthcare reported on January 26, 2024, that Blue Shield of California Promise Health Plan, operating in Los Angeles and San Diego counties, will begin offering enrollees services to help earn a General Education Diploma (GED) beginning this month. The insurer is collaborating with GED Testing Service to offer access to GED study materials in English and Spanish, tutoring, practice tests, and personal advisors. Read More

Colorado

Colorado Legislative Committee Approves Increase in Medicaid Reimbursement for Pediatric Behavioral Care. CPR News reported on January 25, 2024, that the Colorado legislature’s Joint Budget Committee approved a bill sponsored by Senator Barbara Kirkmeyer (R-Brighton), which would allocate approximately $10 million to the Department of Healthcare Policy and Financing to raise Medicaid reimbursement rates for pediatric behavioral care by 25 percent. The rates could take effect beginning in mid-February if approved by the full state legislature and the Centers for Medicare & Medicaid Services. Read More

Florida

Florida Residents File Revised Lawsuit to Challenge Medicaid Redeterminations Process. Health News Florida reported on January 25, 2024, that Florida residents have filed a potential class action lawsuit alleging that the state did not provide sufficient notice prior to terminating Medicaid coverage amid eligibility redeterminations and therefore violated Medicaid beneficiaries’ due-process rights and federal Medicaid law. The lawsuit, previously filed in August, now includes two additional plaintiffs. The deadline for plaintiffs to file an amended motion seeking class action status is February 20. Read More

Indiana

Indiana Intellectual, Developmental Disabilities Task Force Calls for Pause to Proposed Aged, Disabled Waiver Cuts. The Indiana Capital Chronicle reported on January 29, 2024, that Indiana officials, including Lieutenant Governor Suzanne Crouch and three state legislators, called on the Family and Social Services Administration (FSSA) to halt program cuts that would remove compensation for family caregivers of children with complex medical needs during an Intellectual and Developmental Disabilities Task Force meeting. Task force members questioned the transparency of the proposed cuts, while FSSA Director Kelly Mitchell maintained that the agency is collecting feedback and is working to publicly release additional data. Read More

Kentucky

Kentucky House Passes Bill Requiring Medicaid to Cover At-home Blood Test Kits. The Kentucky Lantern reported on January 29, 2024, that the Kentucky House passed a bill requiring Medicaid to cover at-home blood test kits for anticoagulation management so patients do not need to travel to a medical facility for the blood draw. It is estimated that approximately 3,000 Kentuckians would benefit from the law. The bill now advances to the Senate. Read More

Louisiana

Louisiana Disenrolls Approximately 275,000 Medicaid Beneficiaries in 2023. The Louisiana Illuminator reported on January 30, 2024, that Louisiana disenrolled a total of approximately 275,000 Medicaid beneficiaries, nearly a quarter of which were children, in 2023. In December, the state disenrolled 54,391 enrollees, including 40,862 for procedural reasons and 13,529 for ineligibility. Read More

Minnesota

Minnesota Releases Medicaid Dental Administrator RFI. The Minnesota Department of Human Services (DHS) released on January 26, 2024, a request for information (RFI) about contracting a dental administrator to provide dental services for all recipients of Medical Assistance and MinnesotaCare. Minnesota enacted legislature requiring managed care and county-based purchasing plans to meet a 55 percent dental utilization rate performance benchmark for Minnesota Health Care Program enrolled members in 2024. If the benchmark is not met, DHS will be required to contract with a dental administrator beginning January 1, 2026. Questions must be submitted by February 26, and responses are due by March 15. Read More

Montana

Montana Close to Clearing Overdue State Contracts Causing Delayed Payments for Health Providers. KFF Health News reported on January 31, 2024, that Montana has completed nearly all of its overdue contracts with organizations providing public health services including county health departments and behavioral health providers, after more than 700 contracts due for review from June through December went uncompleted. Delayed contracts caused stalled services and lay offs. Read More

New Jersey

New Jersey Enacts Law to Expand Hospital at Home Services to Medicaid Beneficiaries. HealthLeaders Media reported on January 26, 2024, that New Jersey has enacted the Hospital at Home Act, which expands the state Hospital at Home program to those enrolled in Medicaid and private insurance. The program follows guidelines set by the Centers for Medicare & Medicaid Services Acute Hospital Care at Home program under a waiver that allows participating health systems to receive Medicare reimbursement for home-based care. The Medicare waiver is set to expire at the end of the year and proponents of the program are advocating to make the waiver policies permanent. Read More

New York

New York Legislature Considers Bill to Transition Home Care Services From Managed Medicaid to Fee-For-Service. Crain’s New York Business reported on January 30, 2024, that the New York legislature is considering a bill that would remove home care services from Medicaid managed care and transition payments to a fee-for-service model, aiming to save the state $3 billion a year. The proposal would shift home care management from the state’s 24 managed care plans to Health Homes, which are independent care managers operated by the state. Read More

North Carolina

Federal Government Issues Lawsuit to Block Novant Health’s Acquisition of North Carolina Hospitals. The Federal Trade Commission announced on January 25, 2024, that it has filed a lawsuit in federal court to block Novant Health’s $320 million acquisition of two hospitals in North Carolina from Community Health Systems. The commission also issued an administrative complaint alleging that the deal would allow Novant to control nearly 65 percent of the market for inpatient general acute care services in the Eastern Lake Norman Area of North Carolina. Read More

Ohio

Ohio Disenrolls 609,517 Medicaid Beneficiaries During 2023 Redeterminations. The Dayton Daily News reported on January 26, 2024, that Ohio disenrolled a total of approximately 609,517 Medicaid beneficiaries, including 448,433 due to procedural reasons and 161,074 due to eligibility in 2023. In December, the state disenrolled 47,063 enrollees, including 32,967 for procedural reasons and 14,096 for ineligibility. Read More

Oklahoma

Oklahoma Delays Inclusion of School-based, SoonerStart Program Services in SoonerSelect to July 2025. The Oklahoma Health Care Authority (OHCA) announced on January 30, 2024, that inclusion of school-based and SoonerStart program services in the state’s new Medicaid managed care program, SoonerSelect, will be delayed to July 1, 2025, 15 months after SoonerSelect’s implementation on April 1. School-based and SoonerStart services will be processed and reimbursed through OHCA and maintain current reimbursement practices prior to inclusion in SoonerSelect. Read More

Pennsylvania

Pennsylvania Releases Community HealthChoices RFA. The Pennsylvania Department of Health and Human Services released on January 30, 2024, a request for applications (RFA) for the Community HealthChoices (CHC) program, the state’s mandatory Medicaid managed long-term services and supports program. CHC serves individuals dually eligible for Medicare and Medicaid and individuals with physical disabilities receiving home and community-based care or nursing facility services. The CHC program serves enrollees in all 67 counties, which are divided into five regional zones. Medicaid managed care organizations can submit applications for one or more zones. Applications are due March 15, 2024. The contract will run for five years and will have three one-year renewal options. The incumbents are AmeriHealth Caritas, Centene, and UPMC, serving 411,034 CHC members, as of October 2023. Read More

South Dakota

South Dakota Senate Passes Medicaid Work Requirements Resolution. The Associated Press reported on January 25, 2024, that the South Dakota Senate passed a Medicaid work requirements joint resolution, led by Senator Crabtree (R-Madison), Representative Venhuizen (R-Sioux Falls), and others, that would allow the state to apply work requirements to certain individuals who are included in the Medicaid expansion population. The requirement would exclude certain beneficiaries who have not been diagnosed as physically or mentally disabled. The resolution will be included on state ballots for the November general election if passed by the state House. Read More

South Dakota to Include Doula Services in New Medicaid Pregnancy Health Home. South Dakota Searchlight reported on January 26, 2024, that South Dakota Department of Social Services Secretary Matt Althoff informed legislators that the state will provide doula services to Medicaid enrollees when it opens its Pregnancy Health Home Program in April. The program is aimed at providing improved prenatal, postpartum, and well-child care for Medicaid beneficiaries. In 2023, the Legislature approved $3.1 million for the initiative. Read More

Vermont

Vermont Releases MMIS Procurement Assistance Vendor RFP. The Department of Vermont Health Access released on January 29, 2024, a request for proposals (RFP) seeking a Procurement Assistance (PA) vendor to support Vermont’s efforts to reprocure a Medicaid Management Information System (MMIS) solution to address the state’s health care claims processing and fiscal agent service needs. The state will also eventually seek to procure a MMIS Core solution. The PA vendor will be responsible for coordinating relevant research and analysis, developing a plan to issue an MMIS RFP, and facilitating the evaluation of RFP bids and eventual vendor selection. Proposals are due April 17, 2024. The contract will run for three years beginning August 1, 2024, with two two-year renewal options.

Wisconsin

Wisconsin Releases IRIS Self-directed Personal Care Services RFP. The Wisconsin Department of Health Services released on January 30, 2024, a request for proposals (RFP) for a single agency to evaluate, authorize, and oversee services within the Include, Respect, I Self Direct (IRIS) Self-Directed Personal Care program for frail elders and adults with physical or developmental disabilities. The contract is anticipated to take effect on December 9, 2024, and will run for three years with four one-year renewal options. Proposals are due April 9, with awards expected on August 28, 2024. Read More

National

CMS Proposes MA Rate Increase of 3.7 Percent, Updates Medicare Part D Prescription Drug Payments. The Centers for Medicare & Medicaid Services (CMS) released on January 31, 2024, the Calendar Year (CY) 2025 Advance Notice for the Medicare Advantage (MA) and Medicare Part D Prescription Drug Programs, which would increase MA rates by 3.7 percent in 2025, providing plans an additional $16 billion. CMS also released the Draft CY 2025 Part D Redesign Program Instructions, which reduces costs for individuals with Medicare Part D prescription drug plans by capping out-of-pocket costs at $2,000 in 2025. The Advance Notice and the Draft CY 2025 Part D Redesign Program Instructions are open for public comment, through March 1 and official rates and Redesign Program Instructions will be released no later than April 1. Read More

Medicare ACO Shared Savings Program Participation Increases in 2024. Modern Healthcare reported on January 29, 2024, that accountable care organization’s (ACOs) are serving nearly half of individuals with traditional Medicare, or 13.7 million people, representing a 3 percent increase since 2023. The Medicare Shared Savings Program growth increase includes 71 renewals, 50 additional preexisting ACOs and 19 newly formed ACOs, bringing total participation to 480 ACOs. Additionally, 245 organizations will continue participation in ACO Realizing Equity, Access, and Community Health and the Kidney Care Choices models. Read More

Medicaid Enrollment Drops by Nearly 1.2 Million in October 2023, CMS Reports. The Centers for Medicare & Medicaid Services (CMS) reported on January 31, 2024, that enrollment in Medicaid and the Children’s Health Insurance Program (CHIP) was nearly 87.3 million in October 2023, reflecting a decrease in Medicaid enrollment of about 1.2 million from September 2023. Medicare enrollment was 66.6 million, up 142,432 from September 2023, including nearly 32.6 million in Medicare Advantage plans. More than 12 million Medicare-Medicaid dual eligible individuals are counted in both programs. Read More

Use of Medicaid Wraparound Services by Dual Eligible Individuals Varied in 2019, KFF Finds. KFF released on January 31, 2024, an issue brief discussing the utilization of Medicaid wraparound services among dual eligible individuals with full Medicaid by type of service, state, and demographic in 2019. The analysis focused on the 7.2 million dual eligible individuals who were enrolled in Medicaid for at least 10 months. Their use of services by type of service ranged from 27 percent and 26 percent for home and community-based services (HCBS) and vision care, respectively, to 12 percent for institutional long-term services and supports (LTSS). Twenty percent used dental services and 16 percent used non-emergency medical transportation. Use of at least one service, by state, ranged from 32 percent in Florida to 88 percent in Minnesota. Individuals identifying as Hispanic utilized wraparound services at a lower rate (approximately 50 percent) than other racial and ethnic groups (more than 60 percent), while individuals aged 65 and older utilized institutional LTSS at three times the rate of those under 65. Variation may be attributed to types of Medicare coverage among dual-eligible individuals, state coverage policies, and enrollees’ health status and awareness of Medicaid benefits. Read More

Medicaid Disenrollments Surpass 16 Million Following Redeterminations. KFF reported on January 30, 2024, that 31.2 million Medicaid beneficiaries have had their coverage renewed and 16.2 million individuals as of the end of January 2024, ten months after states resumed normal eligibility redetermination processes. KFF reported a large range in the share of renewals completed by states, ranging from 87 percent in Oregon to 22 percent in Wyoming. Similarly enrollment declines ranged from 32 percent in Idaho to one percent in Maine. KFF noted that these numbers are an undercount of the actual renewals completed because of the normal lag in reporting data. Read More

CMS Cell and Gene Therapy Access Model to Focus on Sickle Cell Disease. The Centers for Medicare & Medicaid Services (CMS) announced on January 30, 2024, that sickle cell disease (SCD) will be the first focus of the Cell and Gene Therapy Access Model, designed to improve health outcomes, increase access to cell and gene therapy, and reduce health care costs. The model, led by the CMS Innovation Center, will include partnerships with manufacturers to develop a framework to expand access to SCD gene therapies and negotiate outcomes-based agreements to ensure that treatment pricing is related to treatment effectiveness. States participating in the model can choose to enter into agreements with manufacturers based on negotiated terms and CMS will collect data, monitor results, and evaluate outcomes. The model will begin in January 2025 and states may begin participating between January 2025 and January 2026. Read More

MACPAC Makes Recommendations on Medicaid Denials, Appeals Processes. Fierce Healthcare reported on January 29, 2024, that the Medicaid and CHIP Payment and Access Commission (MACPAC) voted in favor of seven recommendations to alter Medicaid managed care beneficiaries’ appeals process and monitoring. MACPAC’s report to Congress will include recommendations requiring states to establish an independent, external medical review process; release federal guidance on improving denial notices and appeals; require managed care organizations to allow for beneficiary choice of electronic denial notices; extend the timeline for continuation of benefits; require the collection of data on denials, continuation of benefits, and appeal outcomes; require routine clinical audits of denials; publicly post all managed care program annual reports; and require states to incorporate denials and appeals data onto quality rating system websites. Read More

Exchange Plans Experienced Highest Increase in Complaints in 2023, NAIC Data Finds. Health Payer Specialist reported on January 29, 2024, that Exchange health plans experienced the highest increase in complaints in 2023 at 32.2 percent, while individual and group plans saw the lowest increases at 16.8 percent and 15.6 percent, respectively. Overall, health plan complaints increased by nearly 18 percent in 2023. The main reasons for complaints were delays in claim handling, denial of claims, and unsatisfactory settlement. Read More

CMS Releases Request for Feedback about Medicare Advantage Data. The Centers for Medicare & Medicaid Services (CMS) released on January 25, 2024, a Request for Information (RFI) to seek public input on recommendations related to several aspects of Medicare Advantage (MA) data. CMS intends to use the public feedback to help make MA data commensurate with data available for Traditional Medicare to advance transparency across the Medicare program, and to allow for analysis in the context of other health programs like accountable care organizations, the Marketplace, Medicaid managed care, integrated delivery systems, among others. Comments will be accepted through May 29. Read More

CMS Releases Memo Providing CY 2025 SMAC Submission Instructions, Medicare Managed Care Manual Updates. The Centers for Medicare & Medicaid Services (CMS) released on January 25, 2024, a memorandum providing the Contract Year (CY) 2025 State Medicaid Agency Contract (SMAC) Submission Instructions, as well as updates to Chapter 16-B of the Medicare Managed Care Manual, which include changes to Dual Eligible Special Needs Plans (D-SNPs) definitions and additional D-SNP requirements. Regulatory changes may impact plans’ qualification as a fully integrated D-SNP (FIDE SNP) or highly integrated D-SNP (HIDE SNP). Applications to offer FIDE or HIDE SNPs will be due February 14.

CMS Releases Request for Feedback about Medicare Advantage Data. The Centers for Medicare & Medicaid Services (CMS) released on January 25, 2024, a Request for Information (RFI) to seek public input on recommendations related to several aspects of Medicare Advantage (MA) data. CMS intends to use the public feedback to help make MA data commensurate with data available for Traditional Medicare to advance transparency across the Medicare program, and to allow for analysis in the context of other health programs like accountable care organizations, the Marketplace, Medicaid managed care, integrated delivery systems, among others. Comments will be accepted through May 29. Read More

U.S Senate Panel Examines Quality, Costs of Assisted Living Facilities. KFF Health News reported on January 25, 2024, that the U.S. Senate Special Committee On Aging held a hearing to address concerns about the cost, quality of care, and oversight around the assisted living sector. Committee members are asking residents of assisted living facilities and their families to submit stories and bills so the panel may assess the industry’s business practices. Additionally, Senator Robert Casey, Jr. (D-PA) and other Democratic senators sent a letter to the Government Accountability Office requesting it study how much Medicaid and other federal agencies pay for assisted living. Read More

MACPAC Releases Medicaid Payment Policies Report for Home and Community-based Services. The Medicaid and CHIP Payment and Access Commission (MACPAC) released in January 2024, a compendium showing Medicaid payment policies by state for home and community-based services (HCBS) under Section 1915c waivers, as of May 2023. Rate methodologies were reviewed for three major service categories accounting for the majority of HCBS spending including home-based services, day services, and round-the-clock care. Read More

Industry News

Health Care Services Corporation to Acquire Cigna Medicare, CareAllies Businesses. Health Care Services Corporation (HCSC) announced on January 31, 2024, that it has agreed to acquire Cigna’s Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. Cigna’s Medicare plans currently serve approximately 3.6 members. CareAllies, which serves approximately 450,000 individuals, supports independent physician associations, accountable care organizations, and value-based care via partnerships with providers. HCSC, a health insurer serving more than 22 million individuals across the country, will purchase Cigna’s businesses for $3.3 billion. The acquisition, subject to closing conditions and regulatory approval, is expected to close in early 2025. Read More

ProMedica to Sell Paramount Health to Medical Mutual. Modern Healthcare reported on January 29, 2024, that ProMedica plans to sell Paramount Health, its health insurance subsidiary consisting of 77,000 commercial and Medicare health plan members, to Medical Mutual. ProMedica stated that Paramount has struggled to stay competitive since its exit from Medicaid. The transaction is anticipated to close May 1, pending regulatory approval. Terms were not disclosed. Read More

BrightSpring Health Services Prices IPO Below Targeted Range. Reuters reported on January 25, 2024, that Kentucky-based BrightSpring Health Services, an independent provider of home and community-based services, has priced its initial public offering (IPO) at $13 per share and sold about 53.3 million shares, which is below its targeted range to raise $633 million. BrightSpring, was aiming to price its offering between $15 and $18 per share. The IPO values BrightSpring at $2.2 billion. Read More

RFP Calendar

HMA News & Events

Wakely, an HMA Company White Paper: