This week, our In Focus section reviews the policy changes that the Centers for Medicare & Medicaid Services (CMS) finalized on August 1, 2024, in the fiscal year (FY) 2025 Medicare Hospital Inpatient Prospective Payment System (IPPS) and Long-Term Acute Care Hospital (LTCH) Final Rule (CMS-1808-F). This year’s IPPS final rule will impact hospital margins and administrative processes beginning October 1, 2024.

The remainder of our article delves into five of the key policy changes included in the final rule.

Key provisions in the FY 2025 Hospital IPPS and LTCH Final Rule

For FY 2025, CMS will modify several hospital inpatient payment policies. We highlight five of these policies because they will have the most significant impact on Medicare beneficiaries, hospitals and health systems, payors, and manufacturers:

- The annual inpatient market basket update and changes to the standardized payment amount

- New technology add-on payment (NTAP) policy changes

- Implementation of the Transforming Episode Accountability Model (TEAM) bundled payment model in 2026

- Hospital wage index changes and labor market adjustments

- Severity of illness increase for housing insecurity social determinants of health (SDOH) codes

Several of these and other policy changes for FY 2025 will become effective October 1, 2024.

Market basket update

Final rule: Overall CMS’s Medicare 2025 Hospital IPPS Rule will increase hospital inpatient payments to acute care hospitals by 2.9 percent from 2024 to 2025, an estimated increase of approximately $2.9 billion after other policy changes are included.

Health Management Associates (HMA) analysis: CMS’s 2.9 percent increase is largely based on an estimate of the rate of increase in the cost of a standard basket of hospital goods—the hospital market basket. For beneficiaries, this payment rate increase will lead to a higher standard Medicare inpatient deductible and increase out-of-pocket costs. The finalized payment increase (2.9 percent) is larger than the increase included in CMS’s IPPS Proposed Rule (2.6 percent) but continues to fall below economy-wide inflation over the past year (3.5 percent).1,2 Importantly, after accounting for the various policy changes made within the final rule (e.g., wage index reclassifications) we anticipate individual cases will experience an average payment increase of 1.7 percent.

Transforming Episode Accountability Model

Final rule: CMS finalized the creation of a new mandatory episode-based CMS Innovation Center methodology—TEAM. Under TEAM, selected acute care hospitals will coordinate care for people with traditional Medicare who undergo one of the following surgical procedures:

- Lower extremity joint replacement

- Surgical hip femur fracture treatment

- Spinal fusion

- Coronary artery bypass graft

- Major bowel procedure

Hospitals in the model will assume responsibility for the cost and quality of surgical care through the first 30 days after a Medicare beneficiary leaves the hospital. Hospitals also must refer patients to primary care services to support optimal long-term health outcomes. Hospitals will be assigned to different risk tracks to allow a graduated path to ease in to full-risk participation.

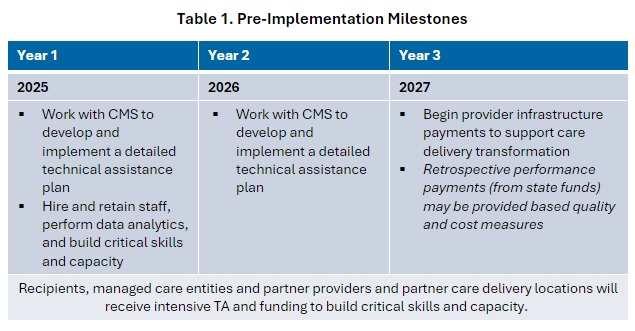

HMA analysis: The mandatory nature of this model requires hospitals in the selected geographic areas to begin to prepare for implementation of the model requirements in 2026. TEAM builds on and combines previous models such as the bundled payment for care improvement (BPCI) and the comprehensive care for joint replacement (CJR) models. Hospitals in roughly 23 percent (188 of 925) of the nation’s core-based statistical areas (CBSAs) are required to participate in this advanced payment model, with some exceptions, such as hospitals in Maryland and Sole Community Hospitals. Participating hospitals will be required to report various quality measures, and payment will be based on spending targets and include retroactive reconciliation. Reimbursement under the model will follow four different tracks, which vary by the level of upside and downside risk that the hospital accepts and with a specific track for safety net hospitals.

Hospital Wage Index Adjustments and Labor Market Changes

Final rule: CMS finalized two wage index policies for FY 2025. First, CMS extended the temporary policy finalized in the FY 2020 IPPS/LTCH PPS final rule for three additional years to address wage index disparities affecting low wage index hospitals, which includes many rural hospitals. Second, as required by law, CMS revised the labor market areas used for the wage index based on the most recent CBSA delineations issued by the OMB based on 2020 Census data.

HMA analysis: The two wage index policy changes for FY 2025 will have important positive and potentially negative consequences on hospital payment. The policy to extend the low wage index policy for three more years will allow many hospitals with low wage indexes to increase their wage index and their payment rates across all Medicare severity diagnosis-related groups (MS-DRGs).

Specifically, the roughly 800 hospitals with wage indexes below 0.9007 (the 25th percentile across all hospitals) will automatically receive an increase in their wage index and payment rates for all inpatient cases. This policy will bring additional millions of dollars to individual rural hospitals in FY 2025. The second policy is a statutorily required update to the labor markets used to establish CMS’s hospital wage indexes. To implement this policy, CMS will use US Census Bureau data to redefine urban and rural markets. As a result, CMS will redefine 53 urban counties as rural and will newly redefine 42 rural counties containing a hospital as urban. These changes will disrupt various hospital payment policies for hospitals in these counties. The overall impact of both geographic policy changes for FY 2025 will be to increase inpatient payment rates to rural hospitals.

Revision to Social Determinants of Health Housing Insecurity Diagnosis Coding

Final rule: CMS finalized a change in the severity designation of the seven ICD-10-CM diagnosis codes that describe inadequate housing and housing instability. Under the final rule, these codes are changing from non-complication or comorbidity (non-CC) to complication or comorbidity (CC) based on the higher average resource costs of cases compared with similar cases without these codes.

HMA analysis: This new policy will enable hospitals to receive higher inpatient payment rates when they provide care for patients with inadequate housing or housing instability are served. Specifically, this policy change will result in assigning cases involving patients with one of these codes to a higher-level MS-DRG. Hospital staff will want to ask patients about their housing upon admission and discharge to accurately document this critical SDOH characteristic.

New technology add-on payments

Final rule: CMS finalized three changes to the NTAP program and approved several products for NTAPs in FY 2025.

HMA analysis: CMS seems willing to increase NTAP payments in certain limited situations to boost selected policy goals but rejects comments seeking to increase the percentage for sickle cell products or expand the higher payments to other medical conditions. In addition, portions of the final rule indicate that CMS is applying some of the criteria for NTAPs more strictly than in recent years. If this trend continues, it may be more difficult for future new technologies to be approved for NTAPs.

Connect with Us

HMA’s Medicare Practice Group works to monitor legislative and regulatory developments in the inpatient hospital space and assess the impact of inpatient payment, quality, and policy changes on the hospital sector. We will continue to follow these and other changes happening to hospitals and are available to provide additional detail on these or other policies in the final rule. If you have any questions, please contact our featured experts below.