September 18, 2024

New HMA Analysis: Options for Improving California’s Substance Use Disorder Treatment System

HMA Insights – including our new podcast – puts the vast depth of HMA’s expertise at your fingertips, helping you stay informed about the latest healthcare trends and topics. Below, you can easily search based on your topic of interest to find useful information from our podcast, blogs, webinars, case studies, reports and more.

New HMA Analysis: Options for Improving California’s Substance Use Disorder Treatment System

Community Health Centers (CHCs), also known as Federally Qualified Health Centers (FQHCs), are community-based health care providers that are vital lifelines in medically underserved areas.

Funded by the Health Resources and Services Administration (HRSA), they provide comprehensive primary and preventative care, dental services, mental health and substance use services, and supportive services like transportation and translation, for patients to access health care. In addition, we have supported more than 20 states to write their CCBHC planning grant applications to initiate a state-run CCBHC model. Most recently, we had 100% success rate for our FY23 planning grant applications, resulting in four states receiving one year planning grants to build a state-run CCBHC model.

FQHCs partner with HMA for expert guidance in strategic planning, board development, finance and operations, clinical improvement, understanding federal and state policy, advancing health equity, grant writing, community health needs assessment, expanding practice scopes, and executive coaching. HMA’s consultants bring extensive real-world and leadership experience and expertise working with FQHCs prior to joining HMA, offering FQHCs a range of services and support with:

In addition to working with FQHCs, HMA works collaboratively with multiple Primary Care Associations (PCAs) to leverage our expertise benefiting multiple FQHCs.

HMA’s FQHC value-based payment team has extensive experience working with PCAs, Health Center Controlled Networks, and FQHCs to form integrated delivery systems focused on the Medicaid and Medicare populations to help them progress along the CMS Framework for Value‐based Payments commensurate with their readiness. Current and recent projects have included PCAs and FQHCs in New York, Illinois, Rhode Island, Oklahoma, Wisconsin, Missouri, North Carolina, Montana, and Indiana.

HMA Principal Art Jones, MD, MPH, was the architect of the first FQHC APM in the country that transitioned payment from fee-for-service to capitation. It was adopted by the FQHC he led as CEO and four other Chicago-area FQHCs in 2001. In 2017, HMA helped the Washington Health Care Authority, the Washington Primacy Care Association, and its FQHC members develop a capitated FQHC APM. Since then, HMA has worked with PCAs and FQHCs in New York, Illinois, Rhode Island, Oklahoma, Wisconsin, Missouri, North Carolina, Montana, and Indiana to develop their own capitated FQHC APMs.

HMA Principal Art Jones, MD, MPH, partnered with five Chicago area FQHCs and five hospitals to establish Medical Home Network in 2011, the prototype clinically integrated network focused on underserved communities. Driven to solve social drivers of health and seeking to demonstrate that in the safety net, technology can be deployed to deliver superior outcomes, the network has grown to include 14 FQHCs and three health systems with more than 180,000 Medicaid beneficiaries with delegated responsibility for care management and global risk. It supports 80 FQHCs in eight states in Medicare ACOs. Another HMA principal was CEO of one of the founding FQHCs at the network’s inception. This model has been replicated in other states to benefit communities of need.

FQHCs in some states receive general revenue funding to support operations. HMA has extensive experience with federal-directed payment program rules that can secure matching federal funds that at least double and sometimes as much triple total funding depending on the state’s federal match rate for Medicaid. Directed payment programs require a value-based payment component. HMA has worked with three state PCAs to develop their programs.

HMA consultants assist FQHCs and their clinically integrated networks in assessing the value-based payment arrangements being offered by managed care plans and proactively designing proposals to take to payers. In many cases, HMA joins in active negotiations with the payer.

HMA has several clinically licensed consultants with experience working at and with FQHCs in their pursuit of value-based care. This includes assisting in NCQA Patient-Centered Medical Home certification, implementing care management programs, and designing and implementing new clinical models of care made uniquely financially feasible under APMs.

HMA has several experienced consultants helping individual FQHCs, State PCAs, and FQHC-led clinically integrated networks with their strategic planning process.

HMA has consultants focused on helping providers, including FQHCs, improve their billing and collections systems to improve cash flow and revenue.

HMA experts are uniquely positioned to help FQHCs and other organizations develop strategies and write for New Access Point and Service Area Competitions.

We believe in a data-driven approach to drive actionable insights. We start with an efficient assessment of your current state and prepare a roadmap for success. After our thorough and rapid assessment, our consultants work with your organization on any aspect of implementation to ensure a sustainable, high-performing empanelment environment that drives operational quality and optimizes

current and future revenue streams. A high-performing empanelment environment leads to optimized PCP continuity of care, accountable PCP and care teams driving clinical quality improvement, readily available appointment slots, and patient retention and productivity goals.

No matter the size, HMA empowers FQHCs to thrive in an ever-changing healthcare landscape. With deep expertise at every level, HMA teams partner with FQHCs nationally to address a wide range of operational challenges, including designing innovative school-based care, and expanding community health centers, optimizing scheduling and empanelment, integrating behavioral health care and strategically adopting telehealth solutions, we help FQHCs seize opportunities. Our experience extends to selecting and implementing cutting-edge IT systems for population health management, optimizing participation in the 340B program, and maximizing workforce capacity. HMA is dedicated to ensuring that FQHCs deliver exceptional care to those who need it most.

State PCAs frequently ask HMA to speak on various value-based payment-related topics at annual conferences.

Project Spotlight

Community Health Center, New York

HMA assisted the community health center in creating its strategic approach to value-based care. The project included analysis of current clinical and financial performance under managed care arrangements, workforce optimization, and opportunities to identify shared savings on total cost of care.

Health Center Strategic Planning, California

HMA worked with the board of directors, community stakeholders, clinicians, and staff to create a theory of change and then identify internal and external opportunities for expansion, quality improvement, and financial growth.

Community Health Center Service Area Competition (SAC) Grant, Ohio

HMA supported a CHC in completing its needs assessment and writing its SAC grant.

PACE readiness, Illinois

HMA consulted with an FQHC in Illinois to analyze, plan for, and apply to open a Program for All-Inclusive Care for the Elderly (PACE) focused on the Latinx population.

Learn more about our work

Contact our experts:

For many Americans, housing costs are out of reach, as 13 of the 20 largest occupations in the U.S. pay less than the housing wage. This housing crisis is impacting overall health and well-being and utilization of healthcare. Individuals and families struggling with homelessness often experience lower infant birthweights, mental health challenges, chronic disease, and higher mortality.

HMA works at the intersection of housing and healthcare in a variety of ways, including policy, programs, financing, and evaluation. A safe and secure place to live is fundamental to all of the healthcare and human services work we do at HMA. Our experts have developed and worked within programs in public housing authorities, hospital housing partnerships, shelters and transitional housing, post-incarceration transition and 1115 waiver supports, rural housing, and other housing supports.

HMA experts are former state and local public health leaders, directors of community-based organizations, and former senior officers from key federal agencies, setting us apart from other consulting companies.

We understand the complexity of designing and implementing change beyond the theoretical level – we have walked in the shoes of our clients and understand how to provide insight that is meaningful, actionable, and realistic.

Organizations we support

Federal, state and local government agencies

Managed Care Organizations

Public Housing Authorities

Community-based health/behavioral health and human service organizations

Provider organizations (FQHCs, CCBHCs)

Schools and universities

Departments of behavioral and public health

Healthcare systems and providers

Philanthropic organizations

Jails and correctional facilities

We Help Our Clients

Transform their community’s response to homelessness

Improve local housing delivery systems

Facilitate new or expanded community partnerships

Address systemic barriers

Build capacity of local partners and resources

Help with targeted impact improvements

Scale interventions to match resources and need

Increasing system capacity

Provide management tools for improved decision making

Planning and implementation support for continuum of homeless services

Affordable housing needs assessment

Consultation on shelter and outreach team best practices

Project Spotlight

The problem:

With new funding available and a homelessness crisis growing more acute, the JOHS requested an evaluation of the department’s effectiveness and barriers, as well as the governance model over all homelessness response functions.

How we helped:

HMA conducted a discovery process consisting of 40 stakeholder interviews with local elected officials, County and department staff, and contracted service providers. We also reviewed key contracts, policies and procedures, and other foundational documents; and completed a summary of national best practices to inform future program development. This resulted in a summary of gaps, opportunities and recommendations that HMA presented to a joint meeting of County and City Commissioners, and HMA continues to assist in implementation

The outcome:

HMA presented leaders with findings and recommendations, including reforms to provider payment, system governance, inter-agency partnerships and more). Subsequent contracted initiatives to support implementation include the renegotiation of an Inter-Governmental Agreement and action plans to improve to the shelter system and street outreach systems.

The problem:

Tens of thousands of residents of HUD assisted senior housing in California are dually eligible for Medicaid and Medicare and have complex medical, behavioral health, and health-related social needs. Affordable housing developers, owners and operators do not have financing to enhance resident supports to prevent homelessness, avoidable hospitalizations, or institutional care transitions. While evidence shows that Medicaid, Medicare and D-SNP plans and healthcare providers would reduce avoidable inpatient and urgent care costs from enhanced resident services, mechanisms to partner with housing organizations have been elusive due to different incentive structures, infrastructure, and cultures in each sector.

How we helped:

Through contracts with LeadingAge California, HMA supported California housing organizations to develop a compelling value proposition for strategic discussions with payers, providers, and foundations. HMA is developing a financing plan and gap analysis to braid and blend Medicaid, Medicare, D-SNP, workforce, behavioral health, and other funding streams to sustainably support enhanced services provided by trusted, culturally and linguistically responsive on-site service coordinators.

The outcome:

California DHHS and Department of Aging leadership endorsed the goals of the CICH model and are guiding next steps to develop the infrastructure and braided/blended financing plans. Two health plans in southern California are interested to partner in piloting the model.

The problem:

Housing and community development organizations are trusted resources in low-income rural and urban communities across the US; and they were instrumental during COVID in engaging high-risk communities in prevention activities. While housing and community development organizations are a natural place for successful CHW programs, most CHW models and training programs have been developed for healthcare organization environments.

How we helped:

HMA co-led a cohort of NeighborWorks network organizations to co-design three housing and community-development organization-centered CHW program models and a toolkit covering every element of standing up and sustaining a CHW program within housing and community development structures, values, and resources. We provided coaching and technical assistance to learning cohort participants to test toolkit components.

The outcome:

Web-based toolkit Community Health Workers: A Promising Program Model to Advance Health & Well-Being in Affordable Housing and Community Development – NeighborWorks America

The problem:

The organization has requested assistance with establishing healthcare partnerships, designing health care services to meet resident health needs in each affordable housing development, and identifying opportunities to expand health and wellness services.

How we are helping:

HMA is providing guidance in service planning, partnerships, resources, budgeting, and strategies. This may include identification of potential health care partners, design of the health care model, assistance with budgeting for health care service costs, and other consultation as requested.

The outcome:

HMA presented leadership with insight on how to expand embedded health services to optimize resident health across their housing portfolio, assisted with the design of health care services, and helped to build healthcare partnerships.

Our HMA experts are ready to help your organization support your communities.

Contact our experts:

This week’s second In Focus continues the conversation on drug policies and trends, providing updates and insights into the current landscape of Medicare’s drug price negotiations.

The Centers for Medicare & Medicaid Services (CMS) recently released the negotiated prices for the first 10 Medicare Part D drugs under the Inflation Reduction Act’s (IRA’s) negotiation authority. CMS plans to add more drugs to the negotiation list, including 15 additional Part D drugs in 2027 and 15 more products from both Part D (pharmacy benefit drugs) and Part B (mostly physician administered drugs). In 2029 and later years, another 20 drugs from either Part B or Part D will be chosen.

Negotiated Prices for First 10 Drugs Leave Unanswered Questions

CMS estimates the negotiated prices for 30-day supplies of each medication will result in savings ranging from 38 percent to 79 percent compared with list prices when they take effect in 2026. This comparison, however, does not account for several factors that could affect the actual savings for the Medicare program and beneficiaries, including:

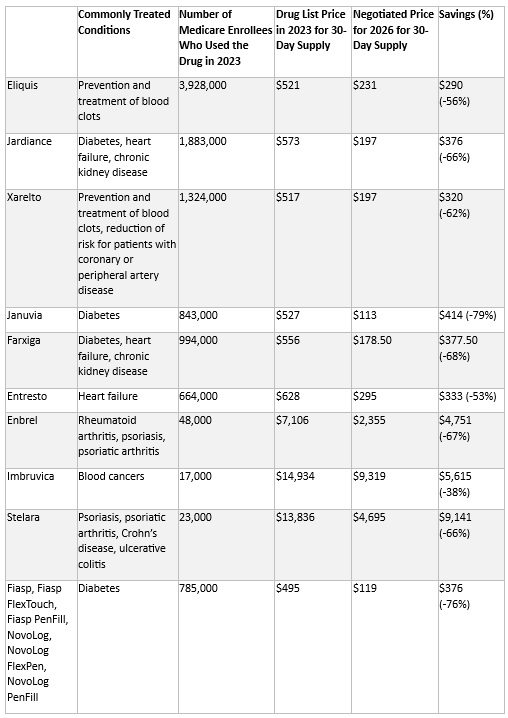

CMS is required to provide a detailed explanation of how negotiated prices were determined by March 1. The price comparisons with privately negotiated prices, however, will remain unclear and the effects on other payers and longer-term investments in new products may not be fully understood for some time. The table below lists the negotiated discounts for the first 10 drugs, which CMS selected from the top 50 Part D drugs by spending, which lacked generic or biosimilar alternatives and met other IRA criteria.

Negotiated Drug Prices Applicable in 2026

Looking Ahead

Age of Products and Role of Generic and Biosimilar Competition: Drugs eligible for negotiation are typically the highest expenditure drugs that have been on the market for at least seven years or 11 years in the case of biologics. Importantly, products with generic or biosimilar competition are exempt from negotiation. This exemption may increase the speed at which biosimilar or generic competition comes to market, as the IRA requires competitors to engage in bona fide marketing to exempt an innovator from negotiation. Despite approval, biosimilars for some of the drugs will remain subject to negotiated prices until their marketing efforts begin.1

Impact on Medicaid and Other Payers: The IRA’s negotiated discounts are not required to be available outside of the Medicare program. It remains uncertain whether other payers will use Medicare-negotiated prices as leverage in their own negotiations. For Medicaid, the direct impact of negotiations themselves is expected to be negligible; however, the IRA’s inflation penalties could encourage more manufacturers to moderate price increases over time, potentially leading to reduced inflation penalty rebates to state Medicaid programs.

Connect with Us

To explore these topics further, join Health Management Associates at the upcoming event, Unlocking Solutions in Medicaid, Medicare, and Marketplace. Engage with our Medicare experts below who will lead a small group discussion on trends in prescription drug policies during the pre-conference workshop.

For details on IRA pricing issues or other Medicare health policy developments, contact our featured experts below. HMA’s Wakely Actuaries also are available to discuss the IRA’s role in Medicare Part D.

This week’s In Focus covers key takeaways and insights from a recently released HMA report, State Approaches to Managing the Medicaid Pharmacy Benefit: Insights from a National Survey for State Fiscal Years 2023 and 2024.

The report, released in August 2024 with support from Arnold Ventures, includes survey responses from 47 states (including DC) for state fiscal years (SFYs) 2023 and 2024. The survey instrument builds on questions posed in the 2019 Medicaid Pharmacy Study of all 50 states and the District of Columbia, which HMA and the Kaiser Family Foundation conducted.

The report discusses state trends for how Medicaid pharmacy benefits are administered across the country, including planned priorities and anticipated challenges in SFY 2025 and beyond. The findings are based on information provided by the nation’s state Medicaid Directors, Medicaid Pharmacy Directors, and other Medicaid agency experts.

Pharmacy Benefit Administration

In many states, managed care delivery systems play a pivotal role in administering Medicaid benefits, including prescription drugs. As of July 1, 2023, survey results found that:

MCO states were surveyed about their use of carve outs for certain drug products/classes, inclusive of physician-administered drugs covered under the medical benefit.

Pharmacy Benefit Managers

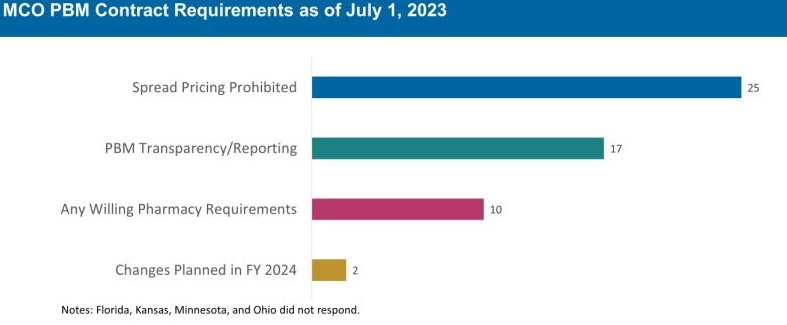

The significant role and market power of PBMs have prompted many state legislatures to enact greater transparency practices and require health plans to accept more responsibility for monitoring the PBMs they contract with, which reflect notable changes since the 2019 survey. More specifically:

The 30 MCO states that carve in pharmacy benefits responded to survey questions about PBM transparency and spread pricing requirements. Of these states:

The Role of PDLs, Prior Authorization, and Step Therapy in Controlling Drug Costs and Utilization

HMA’s experts also sought information on state payment strategies and utilization management protocols that are used to manage pharmacy expenditures. Nearly all responding states (44) have a preferred drug list (PDL) in place for fee-for-service prescriptions, which allow states to drive the use of lower cost drugs by encouraging providers to prescribe preferred drugs. Further, nearly two-thirds of responding MCO states (19 of 30 states) that do not carve out the pharmacy benefit reported having a uniform PDL for some or all drug classes, requiring all MCOs to cover the same drugs.

Many states have implemented step therapy and prior authorization (PA) guardrails in their Medicaid programs through legislation. However, 85.1 percent of responding states (40 of 47) report utilization controls like PA or step therapy applied to drugs that are reimbursed through the medical benefit to control utilization and costs. States also play an active role in managing MCO clinical protocols or medical necessity criteria, with 22 out of 30 MCO pharmacy carve-in states reporting that they require uniform clinical protocols for some or all drugs with clinical criteria. Approximately one-half of responding MCO carve-in states also require review and approval of MCOs’ PA criteria (15 of 30 states) and step therapy criteria (14 of 30 states).

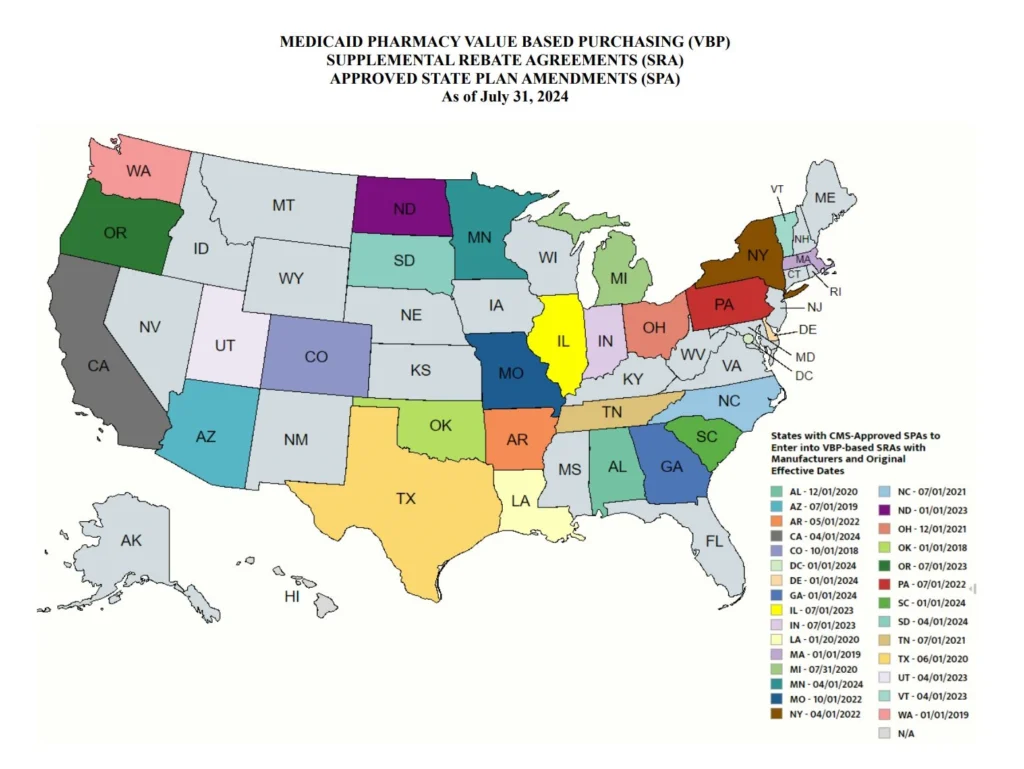

State Adoption of VBAs: Improving Patient Access to Cell and Gene Therapies

A growing number of states are actively considering entering into value-based arrangements (VBAs) with manufacturers, as pressure to improve patient access to cell and gene therapies increases. Nine states have at least one VBA in place, and 23 states reported that VBAs are among their future solutions for addressing coverage of new high-cost therapies. States will need to address common barriers to VBA implementation, which involves more upfront costs and operational challenges to implement than traditional contracts.

Subsequent to the submission of survey responses, the Centers for Medicare & Medicaid Services (CMS) released a Cell and Gene Therapy (CGT) Access Model, which begins with a focus on sickle cell disease, anticipated to go live on January 1, 2025. Under the model, CMS will negotiate outcomes-based agreements with manufacturers on behalf of the state to ensure that treatment pricing is related to treatment effectiveness. In the coming years, experiences with this model will help determine whether a CMS-led approach to developing and administering VBAs for CGTs improves Medicaid member access to innovative treatment and their impact on expenditures, if any.

Looking Ahead

Managing the Medicaid pharmacy benefit has never been more challenging. In FY 2025 and beyond, most states will be focused on managing their Medicaid pharmacy budgets, especially the development of VBAs and other policies and strategies for managing new high-cost therapies. Other top priorities and challenges cited by multiple states include management of PBM arrangements and considering coverage of the new generation of GLP-1 anti-obesity medications. States also must react to changing drug marketplace conditions driven, in part, by federal policy changes to the Medicaid drug rebate formula and changes designed to lower Medicare drug costs. Drug manufacturer responses to these changes have implications for Medicaid state budgets, but also for state PDL management decisions and beneficiary access to needed medications.

Connect with Us

The upcoming event, Unlocking Solutions in Medicaid, Medicare, and Marketplace, hosted by HMA, will offer more opportunities to engage with report author Kathy Gifford at the pre-conference workshop Paying for Innovative Pharmaceuticals: State and Federal Trends Shaping Public Programs. Leaders from various sectors will join Kathy to discuss trends in prescription drug policies in public and commercial insurance programs.

For details about the report, contact our featured experts below.

Countdown to the HMA Conference: Unlocking Solutions in Medicaid, Medicare, and Marketplace

Watch a replay of our webinar Mastering Star Performance: Strategies from the HMA Stars Accelerator Program.

Star Ratings have been on a steady decline over the last two years resulting in large reductions in quality bonus and rebate payments, potentially impacting opportunities to improve member health outcomes.

We have developed a playbook that captures The HMA Stars Accelerator Solution with proven strategies for Stars improvement based on our diverse and extensive expertise in managed care plan (MCP) operations, MCP strategy, performance improvement, actuarial science, data analytics, risk adjustment, and federal and state policy.

Using our vast experience in the Medicare and Medicaid space, HMA can help you maximize ratings in programs like Medicare Stars and Medicaid quality performance. Together with our actuarial colleagues from Wakely Consulting Group and federal policy expert colleagues from Leavitt Partners, both HMA companies, we can provide the assistance you need to move your organization to a higher Star rating level. With guidance from HMA experts, the Accelerator is scalable for both functional and matrix organizations.

Want a copy of HMA’s

Stars Accelerator Playbook?

Fill out this form and one of our consultants will get back to you.

Meaningful data analysis ensures plans can prioritize the most important areas for strategic focus. Improving performance in Stars requires a multi-pronged, multifactorial approach. The HMA Stars Accelerator Solution is consumer-oriented and customizable to meet the unique needs of your members’ needs. It facilitates understanding of the organization’s current state, identifies opportunities for improvement, provides best practices for design of meaningful solutions to implement, and measures the effectiveness of improvements.

The Centers for Medicare & Medicaid Services (CMS) publishes the Medicare Advantage (Medicare Part C) and Medicare Part D Star ratings each year to measure the quality of health and drug services received by consumers enrolled in Medicare Advantage (MA) and Prescription Drug Plans (PDPs or Part D plans). Star ratings impact a managed care plan’s financial performance, competitiveness, growth, and member retention. They are based on measures of multiple aspects of plan performance including:

Member experience and satisfaction

Administrative performance

Medication safety and/or adherence

Hospital readmissions

Healthcare Effectiveness Data and Information Set (HEDIS) and Health Outcomes Survey (HOS), both of which measure performance improvement.

Contracts are rated on a scale of one to five stars (rounded to nearest half star) based on approximately 45 measures related to preventive care, member experience (health plan customer service, physician point of service care, and perceived health), prescription drug monitoring, health plan operations, etc.

The industry has meaningfully improved traditional quality metrics (e.g. preventative care and medication adherence rates). As performance peaks in those measures, CMS is placing increasing emphasis on the member experience with their health plan and their providers during care.

Plans with 5 stars can market year-round.

The marketing advantage is a distinction for a high rated plan.

Poor performers (under 3 Star rating for 3 years) receive a Poor Performance Icon and may not be able to renew with CMS.

In 2024 there were 29 Part C (Medicare Parts A & B) and 11 Part D (Pharmacy) measures, and they can change every year. CMS recently released plan preview Star performance data for health plans to review. Final scores and Star ratings will be released by CMS in early October 2024 for Star Year 2025 based upon 2023 dates of service.

CMS Star Ratings are a lagged pay-for-performance system. For 2026 Star Ratings, 2024 and early 2025 performance timeframes are critical to success, even though payments for this performance will not be received until 2027.

What plans do in 2024 and 2025 impacts your 2026 Star rating which will affect your plan’s revenues in 2027.

Is your plan building a strategy for next year based upon underperforming measures? Are you looking for ways to lean in on any remaining Consumer Assessment of Healthcare Providers and Systems (CAHPS) and HOS opportunities? Do you know where to start?

See our HMA Solutions page, Star Rating: We Can Help You Navigate to a Higher Level, for more information.

HMA is pleased to welcome new experts to our family of companies in the second quarter of 2024. This group of leaders has decades of experience in health policy, Medicaid, public health, and healthcare strategy. They have led initiatives to enhance access, operational efficiency, and equity and have expertise in areas such as behavioral health, data analysis, and serving underserved populations.

Learn more about our new HMA colleagues

APRIL

MAY

JUNE

This week, our In Focus section reviews state policies designed to increase insurer participation in Medicaid managed care and Marketplace programs. As states seek to address healthcare costs, affordability, and consumer experiences, they are exploring a range of initiatives—from the rise of prescription drug affordability boards to cost containment commissions, cost growth benchmarks, transparency, and examination of mergers and acquisitions.

A notable trend is the use of state policy and purchasing power to encourage or mandate that Medicaid managed care organizations (MCOs) offer Marketplace plans. Dual-market participation can help smooth coverage transitions, ensure continuity of care, and expand consumer choice. The remainder of this article addresses original research and analysis of this trend by our Health Management Associates, Inc. (HMA), featured experts.

Current Landscape

In 2024, enrollment in the Marketplace program has surged to more than 21 million, approximately a 30 percent increase from 2023. This growth was largely attributed to the temporary enhanced subsidies that allowed more people to access affordable coverage. Over the past several regulatory cycles, federal policymakers also have taken steps to further align the Marketplace framework with Medicaid on key issues, such as essential community provider access, eligibility and enrollment processes, and plan design standards. In response, states are innovating to meet federal requirements while pursuing their own healthcare goals related to coverage, affordability, access, and healthcare outcomes.

Value Proposition

A compelling value proposition for Medicaid MCOs to participate in the Marketplace (and vice versa) includes the ability to market to and retain people moving from one program to another as life circumstances change. Dual-market participation also supports diversification and growth strategies. In fact, enrollment in the Marketplace has nearly doubled since 2020. For Medicaid MCOs in particular, expanding product offerings to include Marketplace plans presents a unique opportunity to leverage existing provider networks and reimbursement arrangements to deliver more competitive rates.

Consumers benefit when the same organization participates in both markets. Families with parents and children who obtain coverage under different programs have an opportunity to work with a single organization and choose providers from the same or overlapping networks. Income fluctuations may result in disenrollment from one program (e.g., Medicaid) and eligibility for a new program (e.g., Marketplace subsidies). Continuity of care policies can smooth these transitions in areas such as prior authorization, care management, and provider network.

State Strategies to Increase Dual-Market Participation

The Affordable Care Act expanded access to affordable health insurance coverage for as many as 45 million individuals by giving states the option to expand Medicaid and provide federal subsidies to people who purchase Marketplace plans. States are now using various strategies to encourage or require insurer participation in both programs to ease transitions for individuals and families “churning” from one program to another, increase competition and choice of Marketplace plans, and reduce the risk of coverage gaps. For example:

The Centers for Medicaid & Medicare Services (CMS) collaborated with states to promote continuity of coverage following the end of the Medicaid continuous enrollment requirement established in the Families First Coronavirus Response Act of 2020, also known as the Medicaid public health emergency (PHE) unwinding. This support includes the clarification of permissible outreach activities by Medicaid MCOs that also offer a Marketplace plan, information sharing, and other assistance. Many states have incorporated the CMS guidanceiii into Medicaid MCO contracts. North Carolina, Utah, and West Virginia include additional contract terms supporting their Medicaid MCOs’ ability to co-market Medicaid and Marketplace plans, including when an individual is losing Medicaid eligibility.

What to Watch For

Coverage transition challenges throughout the Medicaid PHE unwinding have highlighted the real-life impact of coverage gaps and the importance of policies and practices that promote uninterrupted access to healthcare coverage. Historic Marketplace enrollment levels and recent CMS guidance clarifying the allowability of outreach to people who are losing Medicaid coverage about Marketplace plan available make the prospect of dual-market participation increasingly attractive for Medicaid MCOs. A greater focus on improving continuity of care and Marketplace plan choice may lead to more states encouraging or requiring Medicaid MCOs to participate in the Marketplace.

Connect with Us

The upcoming HMA event, Unlocking Solutions in Medicaid, Medicare, and Marketplace, will offer more opportunities to engage with leaders from various sectors who are advancing innovations in Medicaid managed care and Marketplace programs and the points at which these programs intersect. State Medicaid and insurance commissioners, health plan executives, and community leaders, among others, will share insights into their market success and initiatives designed to address healthcare costs and insurance affordability.

Experts from HMA and our family of companies have extensive experience in the policy, structure, and administration of healthcare markets and health plan contracting. For more information, contact our featured experts below.

How States Are Shaping Medicaid Managed Care and Marketplace Participation

HMA’s trusted experts have a wealth of harm reduction experience, from training volunteers for community outreach to managing state procurement processes for harm reduction tools, to policy analyses at all levels of government.

Our consultants have worked with stakeholders of all walks of life including people with lived and living experience of drug use, sex work, and homelessness. In fact, we believe in talking to them first to understand local needs and feasible solutions.

The term “harm reduction” is often used to describe:

provision of risk reduction tools, like condoms, naloxone, and sterile syringes;

approach of meeting people where they are and supporting them at their own pace, without judgement, to pursue self-determined goals; and,

philosophy that promotes equitable access to resources for people who use drugs and struggle to meet basic needs due to the impact of social structures.

The Substance Abuse and Mental Health Services Administration (SAMHSA) defines harm reduction as a practical and transformative approach that incorporates community-driven public health strategies — including prevention, risk reduction, and health promotion — to empower people who use drugs and their families with the choice to live healthier, self-directed, and purpose-filled lives.

The President’s National Drug Control Strategy is the first-ever to champion harm reduction to meet people where they are and engage them in care and services.

People are dying from drug overdose at an alarming rate in the U.S. For the fourth year in a row, we have lost over 100,000 people (enough to fill the University of Michigan stadium). Many of these deaths are preventable. Harm reduction interventions proven to stop overdose deaths include making the overdose reversal drug naloxone available to all at risk of overdose, reducing barriers to medications that treat opioid use disorder, and providing supervised drug consumption services for rapid overdose response. Moreover, successful harm reduction programs rely on reducing the stigma of drug use and people who have an addiction.

Harm reduction is more than handing out naloxone or syringes; it’s a nonjudgemental approach that affirms participant autonomy and engages people in care over the long term.

Here are just a few services HMA can offer to help clients establish, expand, or improve services for people who use drugs, respond to overdose and infectious disease syndemics (combinations of two or more diseases or health conditions that interact within a population, often due to social and structural factors and inequities), and prevent the next drug crisis.

HMA provides training and technical assistance to a range of clients – from community-based organizations conducting outreach, to medical providers wishing to better serve their patients, to large hospital systems wishing to incorporate drug user health into their systems. HMA can:

A quality improvement (QI) strategy is vital for healthcare organizations to maximize patient outcomes and satisfaction, achieve efficiency, and ensure compliance with regulations. HMA can:

Many funding opportunities require (or can benefit from) a detailed assessment of the community’s need for the services being funded. Our experts can help gather both quantitative data and qualitative stakeholder input to ensure that the client’s proposed plan targets the populations, communities, and gaps in service for which resources will be most impactful. HMA can:

The legal landscape related to drug use varies across communities and does not always facilitate a public health approach. HMA can:

Multi-sector collaboration is essential to develop sustainable, impactful solutions to reduce physical and structural harms related to drug use. HMA can:

HMA consultants work with clients to review program efficacy and cost efficiency based on process, outcomes, costs and more, considering quantitative and qualitative data sources and using data-driven tools to assess and measure impact. HMA can:

Project Spotlight

Contact our experts: